A three year bond has a face value of $100, a yield of 10% and a fixed coupon rate of 5%, paid semi-annually. What is its price?

Bonds A and B are issued by the same company. They have the same face value, maturity, seniority and coupon payment frequency. The only difference is that bond A has a 5% coupon rate, while bond B has a 10% coupon rate. The yield curve is flat, which means that yields are expected to stay the same.

Which bond would have the higher current price?

The following cash flows are expected:

- 10 yearly payments of $80, with the first payment in 3 years from now (first payment at t=3).

- 1 payment of $600 in 5 years and 6 months (t=5.5) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

Bonds X and Y are issued by the same company. Both bonds yield 10% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X pays coupons of 6% pa and bond Y pays coupons of 8% pa. Which of the following statements is true?

Find Ching-A-Lings Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Ching-A-Lings Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 100 | |

| COGS | 20 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 30 | |

| Taxes at 30% | 9 | |

| Net income | 21 | |

| Ching-A-Lings Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 49 | 38 |

| Trade debtors | 14 | 2 |

| Rent paid in advance | 5 | 5 |

| PPE | 400 | 400 |

| Total assets | 468 | 445 |

| Trade creditors | 4 | 10 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 145 | 145 |

| Retained profits | 119 | 100 |

| Total L and OE | 468 | 445 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

You just entered into a fully amortising home loan with a principal of $600,000, a variable interest rate of 4.25% pa and a term of 25 years.

Immediately after settling the loan, the variable interest rate suddenly falls to 4% pa! You can't believe your luck. Despite this, you plan to continue paying the same home loan payments as you did before. How long will it now take to pay off your home loan?

Assume that the lower interest rate was granted immediately and that rates were and are now again expected to remain constant. Round your answer up to the nearest whole month.

The standard deviation and variance of a stock's annual returns are calculated over a number of years. The units of the returns are percent per annum ##(\% pa)##.

What are the units of the standard deviation ##(\sigma)## and variance ##(\sigma^2)## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

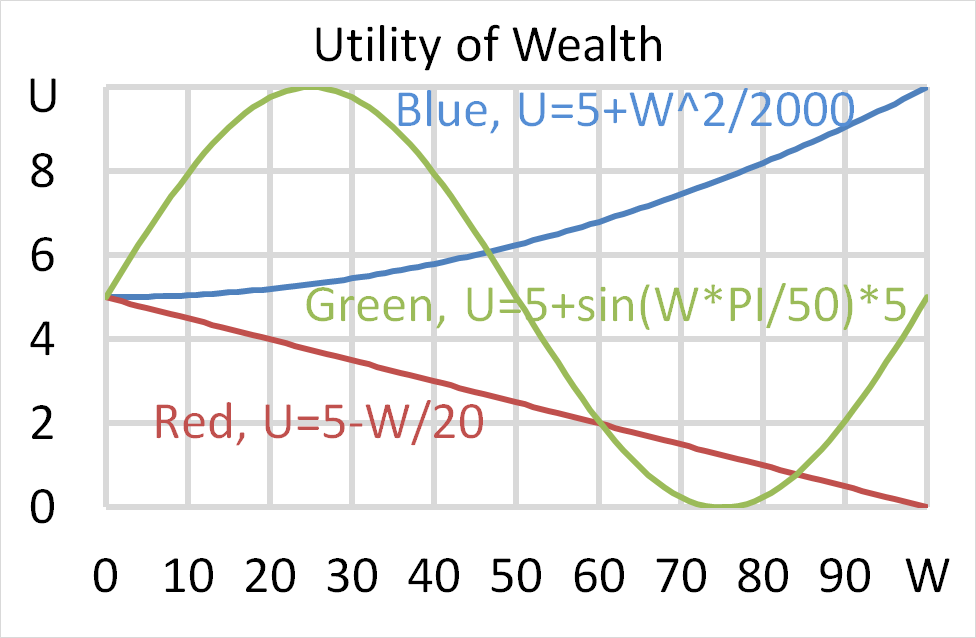

Mr Blue, Miss Red and Mrs Green are people with different utility functions. Which of the statements about the 3 utility functions is NOT correct?

Question 780 mispriced asset, NPV, DDM, market efficiency, no explanation

A company advertises an investment costing $1,000 which they say is under priced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Of the 15% pa total expected return, the dividend yield is expected to be 4% pa and the capital yield 11% pa. Assume that the company's statements are correct.

What is the NPV of buying the investment if the 15% total return lasts for the next 100 years (t=0 to 100), then reverts to 10% after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant, the dividends can only be re-invested at 10% pa and all returns are given as effective annual rates. The answer choices below are given in the same order (15% for 100 years, and 15% forever):

Question 861 open interest, closing out future contract, no explanation

Alice, Bob, Chris and Delta are traders in the futures market. The following trades occur over a single day in a newly-opened equity index future that matures in one year which the exchange just made available.

1. Alice buys 2 future from Bob.

2. Chris buys 5 futures from Delta.

3. Chris buys 9 futures from Bob.

These were the only trades made in this equity index future.

Which of the following statements is NOT correct?