A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 200 |

| 2 | 250 |

What is the Profitability Index (PI) of the project? Assume that the cash flows shown in the table are paid all at once at the given point in time. The required return is 10% pa, given as an effective annual rate.

A method commonly seen in textbooks for calculating a levered firm's free cash flow (FFCF, or CFFA) is the following:

###\begin{aligned} FFCF &= (Rev - COGS - Depr - FC - IntExp)(1-t_c) + \\ &\space\space\space+ Depr - CapEx -\Delta NWC + IntExp(1-t_c) \\ \end{aligned}###

Which of the following is the least useful method or model to calculate the value of a real option in a project?

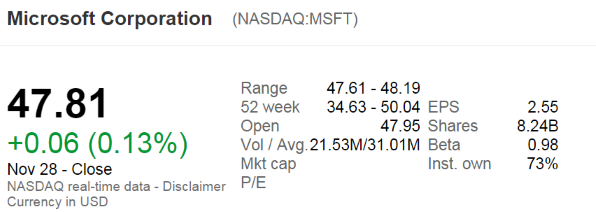

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's approximate payout ratio over the last year?

Note that MSFT's past four quarterly dividends were $0.31, $0.28, $0.28 and $0.28.

Find the cash flow from assets (CFFA) of the following project.

| Project Data | ||

| Project life | 2 years | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year for tax purposes | $1m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $3 | |

| Fixed costs per year, paid at the end of each year | $1.5m | |

| Tax rate | 30% | |

Note 1: The equipment will have a book value of $4m at the end of the project for tax purposes. However, the equipment is expected to fetch $0.9 million when it is sold at t=2.

Note 2: Due to the project, the firm will have to purchase $0.8m of inventory initially, which it will sell at t=1. The firm will buy another $0.8m at t=1 and sell it all again at t=2 with zero inventory left. The project will have no effect on the firm's current liabilities.

Find the project's CFFA at time zero, one and two. Answers are given in millions of dollars ($m).

Question 539 debt terminology, fully amortising loan, bond pricing

A 'fully amortising' loan can also be called a:

A trader sells a one year futures contract on crude oil. The contract is for the delivery of 1,000 barrels. The current futures price is $38.94 per barrel. The initial margin is $3,410 per contract, and the maintenance margin is $3,100 per contract.

What is the smallest price change that would lead to a margin call for the seller?

An effective semi-annual return of 5% ##(r_\text{eff 6mth})## is equivalent to an effective annual return ##(r_\text{eff annual})## of:

Question 722 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

Here is a table of stock prices and returns. Which of the statements below the table is NOT correct?

| Price and Return Population Statistics | ||||

| Time | Prices | LGDR | GDR | NDR |

| 0 | 100 | |||

| 1 | 50 | -0.6931 | 0.5 | -0.5 |

| 2 | 100 | 0.6931 | 2 | 1 |

| Arithmetic average | 0 | 1.25 | 0.25 | |

| Arithmetic standard deviation | 0.9802 | 1.0607 | 1.0607 | |

Question 874 utility, return distribution, log-normal distribution, arithmetic and geometric averages

Who was the first theorist to endorse the maximisiation of the geometric average gross discrete return for investors (not gamblers) since it gave a "...portfolio that has a greater probability of being as valuable or more valuable than any other significantly different portfolio at the end of n years, n being large"?