For a price of $13, Carla will sell you a share paying a dividend of $1 in one year and every year after that forever. The required return of the stock is 10% pa.

A firm can issue 3 year annual coupon bonds at a yield of 10% pa and a coupon rate of 8% pa.

The beta of its levered equity is 2. The market's expected return is 10% pa and 3 year government bonds yield 6% pa with a coupon rate of 4% pa.

The market value of equity is $1 million and the market value of debt is $1 million. The corporate tax rate is 30%.

What is the firm's after-tax WACC? Assume a classical tax system.

A share pays annual dividends. It just paid a dividend of $2. The growth rate in the dividend is 3% pa. You estimate that the stock's required return is 8% pa. Both the discount rate and growth rate are given as effective annual rates.

Using the dividend discount model, what is the share price?

Question 271 CAPM, option, risk, systematic risk, systematic and idiosyncratic risk

All things remaining equal, according to the capital asset pricing model, if the systematic variance of an asset increases, its required return will increase and its price will decrease.

If the idiosyncratic variance of an asset increases, its price will be unchanged.

What is the relationship between the price of a call or put option and the total, systematic and idiosyncratic variance of the underlying asset that the option is based on? Select the most correct answer.

Call and put option prices increase when the:

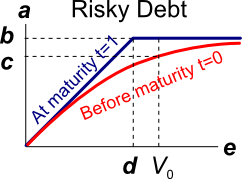

Question 386 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

The risky corporate debt graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's approximate payout ratio over the last year?

Note that MSFT's past four quarterly dividends were $0.31, $0.28, $0.28 and $0.28.

The average weekly earnings of an Australian adult worker before tax was $1,542.40 per week in November 2014 according to the Australian Bureau of Statistics. Therefore average annual earnings before tax were $80,204.80 assuming 52 weeks per year. Personal income tax rates published by the Australian Tax Office are reproduced for the 2014-2015 financial year in the table below:

| Taxable income | Tax on this income |

|---|---|

| 0 – $18,200 | Nil |

| $18,201 – $37,000 | 19c for each $1 over $18,200 |

| $37,001 – $80,000 | $3,572 plus 32.5c for each $1 over $37,000 |

| $80,001 – $180,000 | $17,547 plus 37c for each $1 over $80,000 |

| $180,001 and over | $54,547 plus 45c for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2%. Exclude the Medicare levy from your calculations

How much personal income tax would you have to pay per year if you earned $80,204.80 per annum before-tax?

A credit card company advertises an interest rate of 18% pa, payable monthly. Which of the following statements about the interest rate is NOT correct? All rates are given to four decimal places.

Question 854 speculation motive for keeping money, no explanation

What is the speculation motive for keeping money? The speculation motive encourages people to keep money available: