A project to build a toll road will take 3 years to complete, costing three payments of $50 million, paid at the start of each year (at times 0, 1, and 2).

After completion, the toll road will yield a constant $10 million at the end of each year forever with no costs. So the first payment will be at t=4.

The required return of the project is 10% pa given as an effective nominal rate. All cash flows are nominal.

What is the payback period?

The security market line (SML) shows the relationship between beta and expected return.

Buying investment projects that plot above the SML would lead to:

Question 433 Merton model of corporate debt, real option, option, no explanation

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

What is the payoff to equity holders at maturity, assuming that they keep their shares until maturity?

Question 488 income and capital returns, payout policy, payout ratio, DDM

Two companies BigDiv and ZeroDiv are exactly the same except for their dividend payouts.

BigDiv pays large dividends and ZeroDiv doesn't pay any dividends.

Currently the two firms have the same earnings, assets, number of shares, share price, expected total return and risk.

Assume a perfect world with no taxes, no transaction costs, no asymmetric information and that all assets including business projects are fairly priced and therefore zero-NPV.

All things remaining equal, which of the following statements is NOT correct?

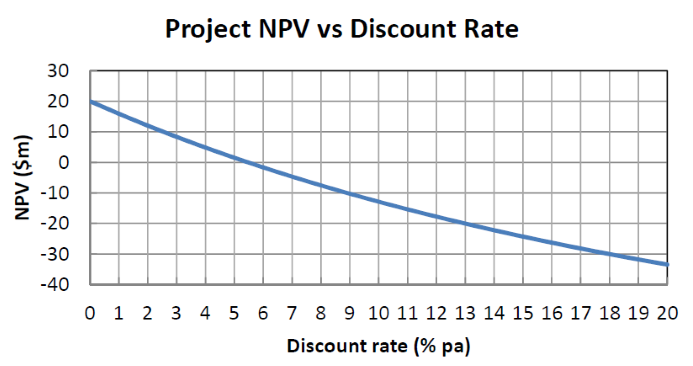

The below graph shows a project's net present value (NPV) against its annual discount rate.

For what discount rate or range of discount rates would you accept and commence the project?

All answer choices are given as approximations from reading off the graph.

The price of gold is currently $700 per ounce. The forward price for delivery in 1 year is $800. An arbitrageur can borrow money at 10% per annum given as an effective discrete annual rate. Assume that gold is fairly priced and the cost of storing gold is zero.

What is the best way to conduct an arbitrage in this situation? The best arbitrage strategy requires zero capital, has zero risk and makes money straight away. An arbitrageur should sell 1 forward on gold and:

Question 662 APR, effective rate, effective rate conversion, no explanation

Which of the following interest rate labels does NOT make sense?

A stock's returns are normally distributed with a mean of 10% pa and a standard deviation of 20 percentage points pa. What is the 95% confidence interval of returns over the next year? Note that the Z-statistic corresponding to a one-tail:

- 90% normal probability density function is 1.282.

- 95% normal probability density function is 1.645.

- 97.5% normal probability density function is 1.960.

The 95% confidence interval of annual returns is between: