A fairly priced stock has a beta that is the same as the market portfolio's beta. Treasury bonds yield 5% pa and the market portfolio's expected return is 10% pa. What is the expected return of the stock?

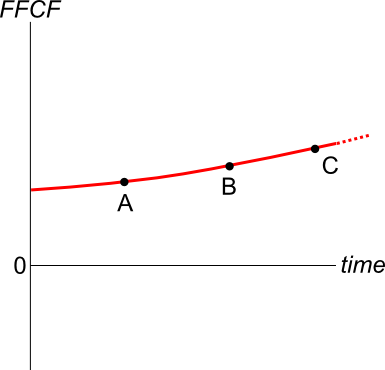

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

One year ago you bought $100,000 of shares partly funded using a margin loan. The margin loan size was $70,000 and the other $30,000 was your own wealth or 'equity' in the share assets.

The interest rate on the margin loan was 7.84% pa.

Over the year, the shares produced a dividend yield of 4% pa and a capital gain of 5% pa.

What was the total return on your wealth? Ignore taxes, assume that all cash flows (interest payments and dividends) were paid and received at the end of the year, and all rates above are effective annual rates.

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

A mining firm has just discovered a new mine. So far the news has been kept a secret.

The net present value of digging the mine and selling the minerals is $250 million, but $500 million of new equity and $300 million of new bonds will need to be issued to fund the project and buy the necessary plant and equipment.

The firm will release the news of the discovery and equity and bond raising to shareholders simultaneously in the same announcement. The shares and bonds will be issued shortly after.

Once the announcement is made and the new shares and bonds are issued, what is the expected increase in the value of the firm's assets ##(\Delta V)##, market capitalisation of debt ##(\Delta D)## and market cap of equity ##(\Delta E)##? Assume that markets are semi-strong form efficient.

The triangle symbol ##\Delta## is the Greek letter capital delta which means change or increase in mathematics.

Ignore the benefit of interest tax shields from having more debt.

Remember: ##\Delta V = \Delta D+ \Delta E##

Question 626 cross currency interest rate parity, foreign exchange rate, forward foreign exchange rate

The Australian cash rate is expected to be 2% pa over the next one year, while the Japanese cash rate is expected to be 0% pa, both given as nominal effective annual rates. The current exchange rate is 100 JPY per AUD.

What is the implied 1 year forward foreign exchange rate?

Question 831 option, American option, no explanation

Which of the following statements about American-style options is NOT correct? American-style:

A company has a 95% daily Value at Risk (VaR) of $1 million. The units of this VaR are in:

Question 948 VaR, expected shortfall

Below is a historical sample of returns on the S&P500 capital index.

| S&P500 Capital Index Daily Returns Ranked from Best to Worst |

||

| 10,000 trading days from 4th August 1977 to 24 March 2017 based on closing prices. |

||

| Rank | Date (DD-MM-YY) |

Continuously compounded daily return (% per day) |

| 1 | 21-10-87 | 9.23 |

| 2 | 08-03-83 | 8.97 |

| 3 | 13-11-08 | 8.3 |

| 4 | 30-09-08 | 8.09 |

| 5 | 28-10-08 | 8.01 |

| 6 | 29-10-87 | 7.28 |

| … | … | … |

| 9980 | 11-12-08 | -5.51 |

| 9981 | 22-10-08 | -5.51 |

| 9982 | 08-08-11 | -5.54 |

| 9983 | 22-09-08 | -5.64 |

| 9984 | 11-09-86 | -5.69 |

| 9985 | 30-11-87 | -5.88 |

| 9986 | 14-04-00 | -5.99 |

| 9987 | 07-10-98 | -6.06 |

| 9988 | 08-01-88 | -6.51 |

| 9989 | 27-10-97 | -6.55 |

| 9990 | 13-10-89 | -6.62 |

| 9991 | 15-10-08 | -6.71 |

| 9992 | 29-09-08 | -6.85 |

| 9993 | 07-10-08 | -6.91 |

| 9994 | 14-11-08 | -7.64 |

| 9995 | 01-12-08 | -7.79 |

| 9996 | 29-10-08 | -8.05 |

| 9997 | 26-10-87 | -8.4 |

| 9998 | 31-08-98 | -8.45 |

| 9999 | 09-10-08 | -12.9 |

| 10000 | 19-10-87 | -23.36 |

| Mean of all 10,000: | 0.0354 | |

| Sample standard deviation of all 10,000: | 1.2062 | |

| Sources: Bloomberg and S&P. | ||

Assume that the one-tail Z-statistic corresponding to a probability of 99.9% is exactly 3.09. Which of the following statements is NOT correct? Based on the historical data, the 99.9% daily: