Which firms tend to have low forward-looking price-earnings (PE) ratios? Only consider firms with positive PE ratios.

Which of the following is NOT a valid method to estimate future revenues or costs in a pro-forma income statement when trying to value a company?

The boss of WorkingForTheManCorp has a wicked (and unethical) idea. He plans to pay his poor workers one week late so that he can get more interest on his cash in the bank.

Every week he is supposed to pay his 1,000 employees $1,000 each. So $1 million is paid to employees every week.

The boss was just about to pay his employees today, until he thought of this idea so he will actually pay them one week (7 days) later for the work they did last week and every week in the future, forever.

Bank interest rates are 10% pa, given as a real effective annual rate. So ##r_\text{eff annual, real} = 0.1## and the real effective weekly rate is therefore ##r_\text{eff weekly, real} = (1+0.1)^{1/52}-1 = 0.001834569##

All rates and cash flows are real, the inflation rate is 3% pa and there are 52 weeks per year. The boss will always pay wages one week late. The business will operate forever with constant real wages and the same number of employees.

What is the net present value (NPV) of the boss's decision to pay later?

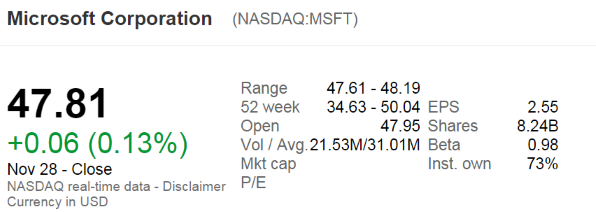

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's approximate payout ratio over the last year?

Note that MSFT's past four quarterly dividends were $0.31, $0.28, $0.28 and $0.28.

Find the cash flow from assets (CFFA) of the following project.

| Project Data | ||

| Project life | 2 years | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year for tax purposes | $1m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $3 | |

| Fixed costs per year, paid at the end of each year | $1.5m | |

| Tax rate | 30% | |

Note 1: The equipment will have a book value of $4m at the end of the project for tax purposes. However, the equipment is expected to fetch $0.9 million when it is sold at t=2.

Note 2: Due to the project, the firm will have to purchase $0.8m of inventory initially, which it will sell at t=1. The firm will buy another $0.8m at t=1 and sell it all again at t=2 with zero inventory left. The project will have no effect on the firm's current liabilities.

Find the project's CFFA at time zero, one and two. Answers are given in millions of dollars ($m).

If trader A has sold the right that allows counterparty B to buy the underlying asset from him at maturity if counterparty B wants then trader A is:

Question 598 future, tailing the hedge, cross hedging

The standard deviation of monthly changes in the spot price of lamb is $0.015 per pound. The standard deviation of monthly changes in the futures price of live cattle is $0.012 per pound. The correlation between the spot price of lamb and the futures price of cattle is 0.4.

It is now January. A lamb producer is committed to selling 1,000,000 pounds of lamb in May. The spot price of live cattle is $0.30 per pound and the June futures price is $0.32 per pound. The spot price of lamb is $0.60 per pound.

The producer wants to use the June live cattle futures contracts to hedge his risk. Each futures contract is for the delivery of 50,000 pounds of cattle.

How many live cattle futures should the lamb farmer sell to hedge his risk? Round your answer to the nearest whole number of contracts.

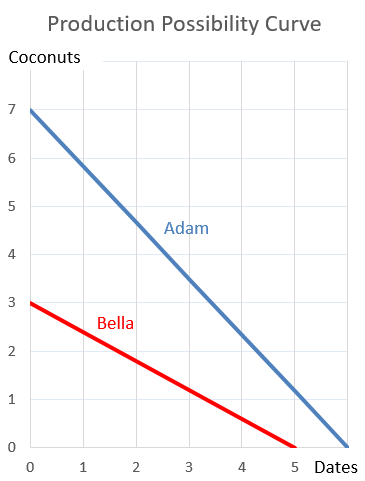

Question 895 comparative advantage in trade, production possibilities curve

Adam and Bella are the only people on a remote island.

Luckily there are Coconut and Date palm trees on the island that grow delicious fruit. The problem is that harvesting the fruit takes a lot of work.

Adam can pick 7 coconuts per hour, 6 dates per hour or any linear combination of coconuts and dates. For example, he could pick 3.5 coconuts and 3 dates per hour.

Bella can pick 3 coconuts per hour, 5 dates per hour or any linear combination. For example, she could pick 1.5 coconuts and 2.5 dates per hour.

This information is summarised in the table and graph:

| Harvest Rates Per Hour | ||

| Coconuts | Dates | |

| Adam | 7 | 6 |

| Bella | 3 | 5 |

Which of the following statements is NOT correct?

Question 922 Stutzer portfolio performance indicator, Sharpe ratio, no explanation

Stutzer’s Portfolio Performance Indicator (PPI) ranks portfolios similarly to what other performance metric, assuming that the portfolios’ continuously compounded returns (LGDR’s) are normally distributed?