For a price of $100, Andrea will sell you a 2 year bond paying annual coupons of 10% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 6% pa.

What is the Internal Rate of Return (IRR) of the project detailed in the table below?

Assume that the cash flows shown in the table are paid all at once at the given point in time. All answers are given as effective annual rates.

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

A share pays annual dividends. It just paid a dividend of $2. The growth rate in the dividend is 3% pa. You estimate that the stock's required return is 8% pa. Both the discount rate and growth rate are given as effective annual rates.

Using the dividend discount model, what is the share price?

Find World Bar's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| World Bar | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 300 | |

| COGS | 150 | |

| Operating expense | 50 | |

| Depreciation | 40 | |

| Interest expense | 10 | |

| Taxable income | 50 | |

| Tax at 30% | 15 | |

| Net income | 35 | |

| World Bar | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 200 | 230 |

| PPE | ||

| Cost | 400 | 400 |

| Accumul. depr. | 75 | 35 |

| Carrying amount | 325 | 365 |

| Total assets | 525 | 595 |

| Liabilities | ||

| Current liabilities | 150 | 205 |

| Non-current liabilities | 235 | 250 |

| Owners' equity | ||

| Retained earnings | 100 | 100 |

| Contributed equity | 40 | 40 |

| Total L and OE | 525 | 595 |

Note: all figures above and below are given in millions of dollars ($m).

On his 20th birthday, a man makes a resolution. He will deposit $30 into a bank account at the end of every month starting from now, which is the start of the month. So the first payment will be in one month. He will write in his will that when he dies the money in the account should be given to charity.

The bank account pays interest at 6% pa compounding monthly, which is not expected to change.

If the man lives for another 60 years, how much money will be in the bank account if he dies just after making his last (720th) payment?

In general, stock prices tend to rise. What does this mean for futures on equity?

Question 923 omitted variable bias, CAPM, single factor model, single index model, no explanation

Capital Asset Pricing Model (CAPM) and the Single Index Model (SIM) are single factor models whose only risk factor is the market portfolio’s return. Say a Taxi company and an Umbrella company are influenced by two factors, the market portfolio return and rainfall. When it rains, both the Taxi and Umbrella companies’ stock prices do well. When there’s no rain, both do poorly. Assume that rainfall risk is a systematic risk that cannot be diversified and that rainfall has zero correlation with the market portfolio’s returns.

Which of the following statements about these two stocks is NOT correct?

The CAPM and SIM:

Question 980 balance of payments, current account, no explanation

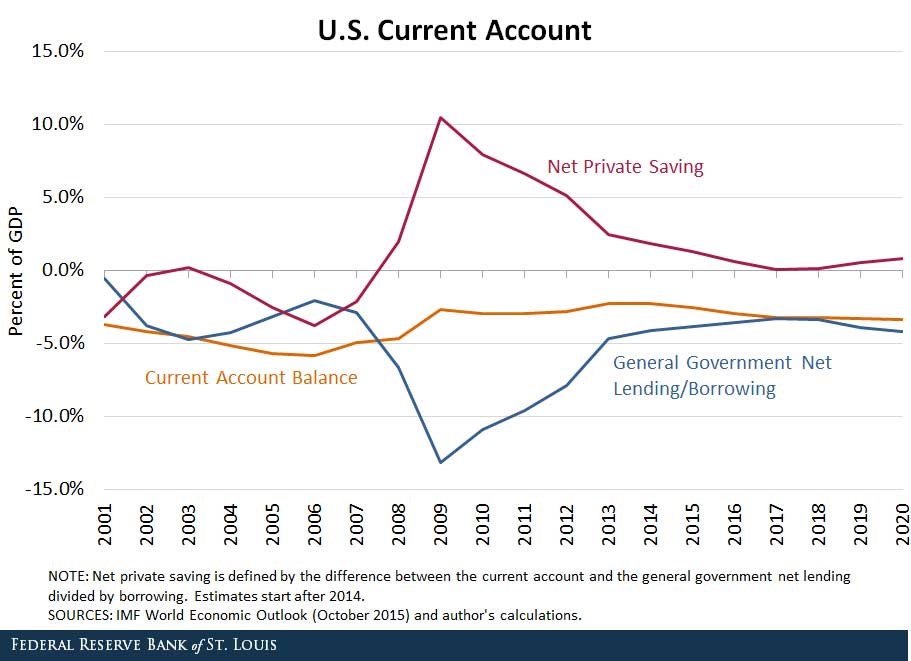

Observe the below graph of the US current account surplus as a proportion of GDP.

Define lending as buying (or saving or investing in) debt and equity assets.

The sum of US ‘net private saving’ plus ‘net general government lending’ equals the US: