Katya offers to pay you $10 at the end of every year for the next 5 years (t=1,2,3,4,5) if you pay her $50 now (t=0). You can borrow and lend from the bank at an interest rate of 10% pa, given as an effective annual rate. Ignore credit risk.

Which one of the following bonds is trading at par?

Find Scubar Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Scubar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 60 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 90 | |

| Taxes at 30% | 27 | |

| Net income | 63 | |

| Scubar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 60 | 50 |

| Trade debtors | 19 | 6 |

| Rent paid in advance | 3 | 2 |

| PPE | 420 | 400 |

| Total assets | 502 | 458 |

| Trade creditors | 10 | 8 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 130 | 130 |

| Retained profits | 162 | 130 |

| Total L and OE | 502 | 458 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid semi-annually. So there are two coupons per year, paid in arrears every six months.

A trader buys one crude oil futures contract on the CME expiring in one year with a locked-in futures price of $38.94 per barrel. If the trader doesn’t close out her contract before expiry then in one year she will have the:

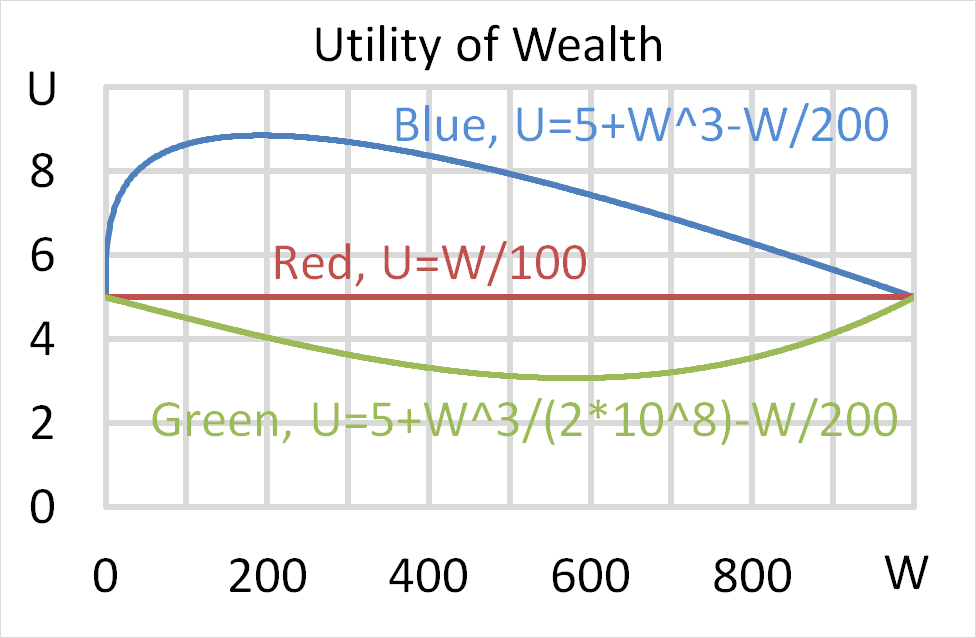

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Which of the following statements is NOT correct?

Question 730 DDM, income and capital returns, no explanation

A stock’s current price is $1. Its expected total return is 10% pa and its long term expected capital return is 4% pa. It pays an annual dividend and the next one will be paid in one year. All rates are given as effective annual rates. The dividend discount model is thought to be a suitable model for the stock. Ignore taxes. Which of the following statements about the stock is NOT correct?

Question 795 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the Delta of a European put option?

Question 950 future, backwardation