Currently, a mining company has a share price of $6 and pays constant annual dividends of $0.50. The next dividend will be paid in 1 year. Suddenly and unexpectedly the mining company announces that due to higher than expected profits, all of these windfall profits will be paid as a special dividend of $0.30 in 1 year.

If investors believe that the windfall profits and dividend is a one-off event, what will be the new share price? If investors believe that the additional dividend is actually permanent and will continue to be paid, what will be the new share price? Assume that the required return on equity is unchanged. Choose from the following, where the first share price includes the one-off increase in earnings and dividends for the first year only ##(P_\text{0 one-off})## , and the second assumes that the increase is permanent ##(P_\text{0 permanent})##:

Note: When a firm makes excess profits they sometimes pay them out as special dividends. Special dividends are just like ordinary dividends but they are one-off and investors do not expect them to continue, unlike ordinary dividends which are expected to persist.

Estimate Microsoft's (MSFT) share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- Apple, Google and Microsoft are comparable companies,

- Apple's (AAPL) share price is $526.24 and historical EPS is $40.32.

- Google's (GOOG) share price is $1,215.65 and historical EPS is $36.23.

- Micrsoft's (MSFT) historical earnings per share (EPS) is $2.71.

Source: Google Finance 28 Feb 2014.

A man is thinking about taking a day off from his casual painting job to relax.

He just woke up early in the morning and he's about to call his boss to say that he won't be coming in to work.

But he's thinking about the hours that he could work today (in the future) which are:

What is the covariance of a variable X with itself?

The cov(X, X) or ##\sigma_{X,X}## equals:

A trader buys one crude oil European style put option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

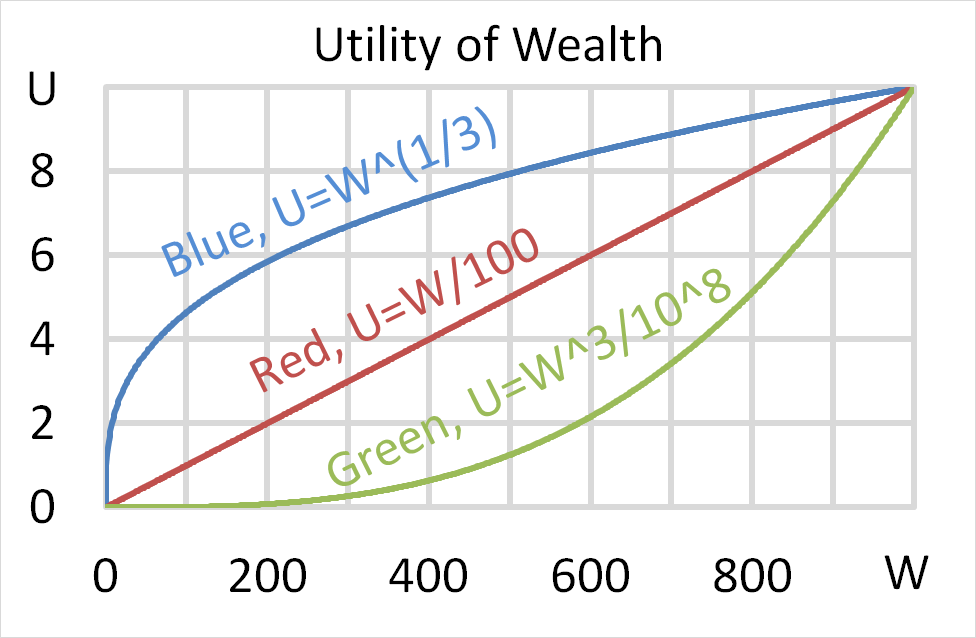

Question 703 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $500 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $500. Each player can flip a coin and if they flip heads, they receive $500. If they flip tails then they will lose $500. Which of the following statements is NOT correct?

A firm is about to conduct a 2-for-7 rights issue with a subscription price of $10 per share. They haven’t announced the capital raising to the market yet and the share price is currently $13 per share. Assume that every shareholder will exercise their rights, the cash raised will simply be put in the bank, and the rights issue is completed so quickly that the time value of money can be ignored. Disregard signalling, taxes and agency-related effects.

Which of the following statements about the rights issue is NOT correct? After the rights issue is completed:

Question 851 labour force, no explanation

Below is a table showing some figures about the Australian labour force.

| Australian Labour Force and Employment Data | |

| April 2017 Seasonally Adjusted figures | |

| Employed persons ('000) | 12 061.9 |

| Unemployed persons ('000) | 751.4 |

| Unemployment rate (%) | 5.9 |

| Participation rate (%) | 64.8 |

Source: ABS 6202.0 Labour Force, Australia, Apr 2017

What do you estimate is the size of working age population in thousands (‘000)?

Question 905 market capitalisation of equity, PE ratio, payout ratio

The below graph shows the computer software company Microsoft's stock price (MSFT) at the market close on the NASDAQ on Friday 1 June 2018.

Based on the screenshot above, which of the following statements about MSFT is NOT correct? MSFT's:

Question 908 effective rate, return types, gross discrete return, return distribution, price gains and returns over time

For an asset's price to double from say $1 to $2 in one year, what must its gross discrete return (GDR) be? If the price now is ##P_0## and the price in one year is ##P_1## then the gross discrete return over the next year is:

###\text{GDR}_\text{annual} = \dfrac{P_1}{P_0}###