A stock pays annual dividends which are expected to continue forever. It just paid a dividend of $10. The growth rate in the dividend is 2% pa. You estimate that the stock's required return is 10% pa. Both the discount rate and growth rate are given as effective annual rates. Using the dividend discount model, what will be the share price?

The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Net Present Value (NPV) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 11 |

| 2 | 121 |

Stock A and B's returns have a correlation of 0.3. Which statement is NOT correct?

A 30-day Bank Accepted Bill has a face value of $1,000,000. The interest rate is 2.5% pa and there are 365 days in the year. What is its price now?

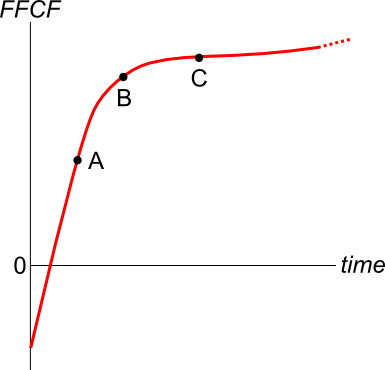

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

Two years ago Fred bought a house for $300,000.

Now it's worth $500,000, based on recent similar sales in the area.

Fred's residential property has an expected total return of 8% pa.

He rents his house out for $2,000 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $23,173.86.

The future value of 12 months of rental payments one year ahead is $25,027.77.

What is the expected annual growth rate of the rental payments? In other words, by what percentage increase will Fred have to raise the monthly rent by each year to sustain the expected annual total return of 8%?

Question 381 Merton model of corporate debt, option, real option

In the Merton model of corporate debt, buying a levered company's debt is equivalent to buying risk free government bonds and:

The standard deviation and variance of a stock's annual returns are calculated over a number of years. The units of the returns are percent per annum ##(\% pa)##.

What are the units of the standard deviation ##(\sigma)## and variance ##(\sigma^2)## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

To value a business's assets, the free cash flow of the firm (FCFF, also called CFFA) needs to be calculated. This requires figures from the firm's income statement and balance sheet. For what figures is the balance sheet needed? Note that the balance sheet is sometimes also called the statement of financial position.

RBA analyst Adam Hamilton wrote in the December 2018 Bulletin article ‘Understanding Exchange Rates and Why They Are Important’ the following passage about bilateral exchange rates:

A bilateral exchange rate refers to the value of one currency relative to another. It is the most commonly referenced type of exchange rate. Most bilateral exchange rates are quoted against the US dollar (USD), as it is the most traded currency globally. Looking at the Australian dollar (AUD), the AUD/USD exchange rate gives you the amount of US dollars that you will receive for each Australian dollar that you convert (or sell). For example, an AUD/USD exchange rate of 0.75 means that you will get US75 cents for every 1 AUD.

An appreciation of the Australian dollar is an increase in its value compared with a foreign currency. This means that each Australian dollar buys you more foreign currency than before. Equivalently, if you are buying an item that is priced in foreign currency it will now cost you less in Australian dollars than before. If there is a depreciation of the Australian dollar, the opposite is true.

Based on this information, which of the following statements is NOT correct?