A stock pays semi-annual dividends. It just paid a dividend of $10. The growth rate in the dividend is 1% every 6 months, given as an effective 6 month rate. You estimate that the stock's required return is 21% pa, as an effective annual rate.

Using the dividend discount model, what will be the share price?

A firm has forecast its Cash Flow From Assets (CFFA) for this year and management is worried that it is too low. Which one of the following actions will lead to a higher CFFA for this year (t=0 to 1)? Only consider cash flows this year. Do not consider cash flows after one year, or the change in the NPV of the firm. Consider each action in isolation.

Which firms tend to have low forward-looking price-earnings (PE) ratios? Only consider firms with positive PE ratios.

Which of the following is NOT a valid method to estimate future revenues or costs in a pro-forma income statement when trying to value a company?

What is the covariance of a variable X with itself?

The cov(X, X) or ##\sigma_{X,X}## equals:

A company conducts a 4 for 3 stock split. What is the percentage change in the stock price and the number of shares outstanding? The answers are given in the same order.

If a variable, say X, is normally distributed with mean ##\mu## and variance ##\sigma^2## then mathematicians write ##X \sim \mathcal{N}(\mu, \sigma^2)##.

If a variable, say Y, is log-normally distributed and the underlying normal distribution has mean ##\mu## and variance ##\sigma^2## then mathematicians write ## Y \sim \mathbf{ln} \mathcal{N}(\mu, \sigma^2)##.

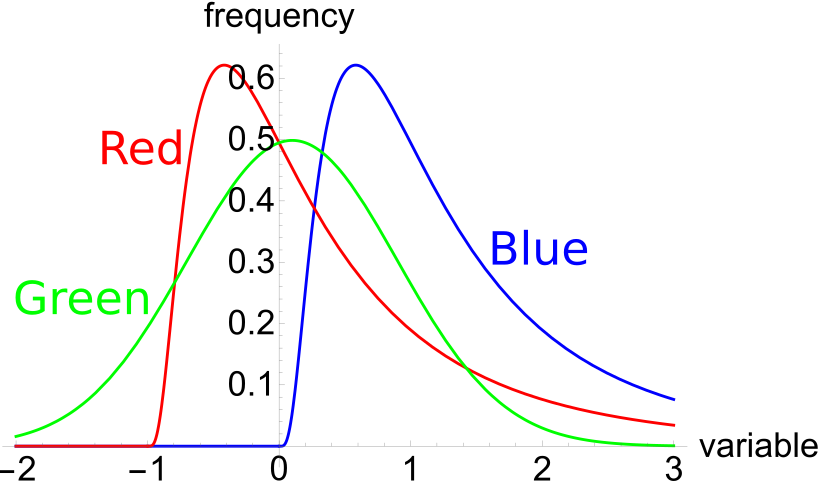

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue.

Select the most correct statement:

A stock is expected to pay a dividend of $1 in one year. Its future annual dividends are expected to grow by 10% pa. So the first dividend of $1 is in one year, and the year after that the dividend will be $1.1 (=1*(1+0.1)^1), and a year later $1.21 (=1*(1+0.1)^2) and so on forever.

Its required total return is 30% pa. The total required return and growth rate of dividends are given as effective annual rates. The stock is fairly priced.

Calculate the pay back period of buying the stock and holding onto it forever, assuming that the dividends are received as at each time, not smoothly over each year.

A firm wishes to raise $100 million now. The firm's current market value of equity is $300m and the market price per share is $5. They estimate that they'll be able to issue shares in a rights issue at a subscription price of $4. All answers are rounded to 6 decimal places. Ignore the time value of money and assume that all shareholders exercise their rights. Which of the following statements is NOT correct?

A stock, a call, a put and a bond are available to trade. The call and put options' underlying asset is the stock they and have the same strike prices, ##K_T##.

Being long the call and short the stock is equivalent to being: