The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

A zero coupon bond that matures in 6 months has a face value of $1,000.

The firm that issued this bond is trying to forecast its income statement for the year. It needs to calculate the interest expense of the bond this year.

The bond is highly illiquid and hasn't traded on the market. But the finance department have assessed the bond's fair value to be $950 and this is its book value right now at the start of the year.

Assume that:

- the firm uses the 'effective interest method' to calculate interest expense.

- the market value of the bond is the same as the book value.

- the firm is only interested in this bond's interest expense. Do not include the interest expense for a new bond issued to refinance the current one, as would normally happen.

What will be the interest expense of the bond this year for the purpose of forecasting the income statement?

Currently, a mining company has a share price of $6 and pays constant annual dividends of $0.50. The next dividend will be paid in 1 year. Suddenly and unexpectedly the mining company announces that due to higher than expected profits, all of these windfall profits will be paid as a special dividend of $0.30 in 1 year.

If investors believe that the windfall profits and dividend is a one-off event, what will be the new share price? If investors believe that the additional dividend is actually permanent and will continue to be paid, what will be the new share price? Assume that the required return on equity is unchanged. Choose from the following, where the first share price includes the one-off increase in earnings and dividends for the first year only ##(P_\text{0 one-off})## , and the second assumes that the increase is permanent ##(P_\text{0 permanent})##:

Note: When a firm makes excess profits they sometimes pay them out as special dividends. Special dividends are just like ordinary dividends but they are one-off and investors do not expect them to continue, unlike ordinary dividends which are expected to persist.

Which of the following investable assets are NOT suitable for valuation using PE multiples techniques?

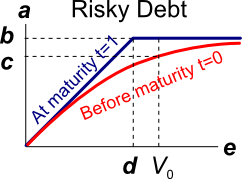

Question 386 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

The risky corporate debt graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

Question 536 idiom, bond pricing, capital structure, leverage

The expression 'my word is my bond' is often used in everyday language to make a serious promise.

Why do you think this expression uses the metaphor of a bond rather than a share?

In general, stock prices tend to rise. What does this mean for futures on equity?

Question 639 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being short a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Question 892 foreign exchange reserve, foreign exchange rate, no explanation

The Chinese central bank has the largest amount of foreign currency reserves.

What could the large amounts of foreign exchange reserves held by the Chinese government be used for in a currency crisis? China's currency is called the Renminbi (RMB) or Yuan (CNY). In a Chinese currency crisis the Chinese government is likely to use its FX reserves to: