Question 180 equivalent annual cash flow, inflation, real and nominal returns and cash flows

Details of two different types of light bulbs are given below:

- Low-energy light bulbs cost $3.50, have a life of nine years, and use about $1.60 of electricity a year, paid at the end of each year.

- Conventional light bulbs cost only $0.50, but last only about a year and use about $6.60 of energy a year, paid at the end of each year.

The real discount rate is 5%, given as an effective annual rate. Assume that all cash flows are real. The inflation rate is 3% given as an effective annual rate.

Find the Equivalent Annual Cost (EAC) of the low-energy and conventional light bulbs. The below choices are listed in that order.

Which one of the following bonds is trading at par?

A trader buys one crude oil futures contract on the CME expiring in one year with a locked-in futures price of $38.94 per barrel. If the trader doesn’t close out her contract before expiry then in one year she will have the:

Question 662 APR, effective rate, effective rate conversion, no explanation

Which of the following interest rate labels does NOT make sense?

A pig farmer in the US is worried about the price of hogs falling and wants to lock in a price now. In one year the pig farmer intends to sell 1,000,000 pounds of hogs. Luckily, one year CME lean hog futures expire on the exact day that he wishes to sell his pigs. The futures have a notional principal of 40,000 pounds (about 18 metric tons) and currently trade at a price of 63.85 cents per pound. The underlying lean hogs spot price is 77.15 cents per pound. The correlation between the futures price and the underlying hogs price is one and the standard deviations are both 4 cents per pound. The initial margin is USD1,500 and the maintenance margin is USD1,200 per futures contract.

Which of the below statements is NOT correct?

Question 693 boot strapping zero coupon yield, forward interest rate, term structure of interest rates

Information about three risk free Government bonds is given in the table below.

| Federal Treasury Bond Data | ||||

| Maturity | Yield to maturity | Coupon rate | Face value | Price |

| (years) | (pa, compounding semi-annually) | (pa, paid semi-annually) | ($) | ($) |

| 0.5 | 3% | 4% | 100 | 100.4926 |

| 1 | 4% | 4% | 100 | 100.0000 |

| 1.5 | 5% | 4% | 100 | 98.5720 |

Based on the above government bonds' yields to maturity, which of the below statements about the spot zero rates and forward zero rates is NOT correct?

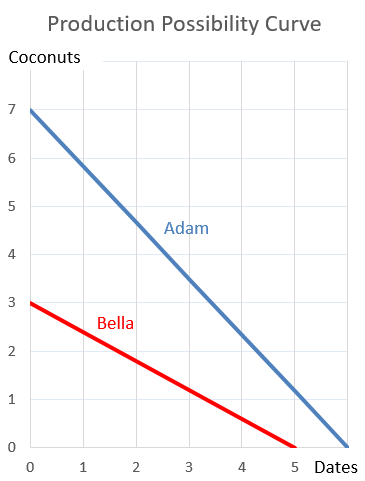

Question 895 comparative advantage in trade, production possibilities curve

Adam and Bella are the only people on a remote island.

Luckily there are Coconut and Date palm trees on the island that grow delicious fruit. The problem is that harvesting the fruit takes a lot of work.

Adam can pick 7 coconuts per hour, 6 dates per hour or any linear combination of coconuts and dates. For example, he could pick 3.5 coconuts and 3 dates per hour.

Bella can pick 3 coconuts per hour, 5 dates per hour or any linear combination. For example, she could pick 1.5 coconuts and 2.5 dates per hour.

This information is summarised in the table and graph:

| Harvest Rates Per Hour | ||

| Coconuts | Dates | |

| Adam | 7 | 6 |

| Bella | 3 | 5 |

Which of the following statements is NOT correct?

Which type of business organisation has the most checks and balances against the detrimental effects of the principal-agent problem since it's potentially the most exposed?

Question 1000 duration, duration of a perpetuity with growth, needs refinement

An unlevered firm cuts its dividends and re-invests in zero-NPV projects with the same risk as its existing projects. This decreases the dividend yield, but increases the firm's equity's dividend growth rate and duration, while its total required return on equity remains unchanged. The equity can be valued as a perpetuity and the duration of a perpetuity is given below:

###D_\text{Macaulay} = \dfrac{1+r}{r-g}###What will be the effect on the stock's CAPM beta? Assume that there's no change in the risk free rate or market risk premium. The company's equity beta will: