Question 385 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

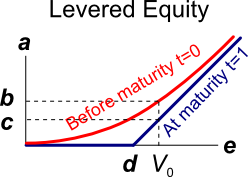

The levered equity graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

Question 386 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

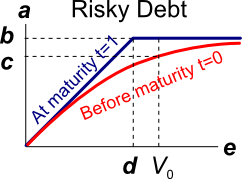

The risky corporate debt graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

Question 381 Merton model of corporate debt, option, real option

In the Merton model of corporate debt, buying a levered company's debt is equivalent to buying risk free government bonds and:

Some financially minded people insist on a prenuptial agreement before committing to marry their partner. This agreement states how the couple's assets should be divided in case they divorce. Prenuptial agreements are designed to give the richer partner more of the couples' assets if they divorce, thus maximising the richer partner's:

Your firm's research scientists can begin an exciting new project at a cost of $10m now, after which there’s a:

- 70% chance that cash flows will be $1m per year forever, starting in 5 years (t=5). This is the A state of the world.

- 20% chance that cash flows will be $3m per year forever, starting in 5 years (t=5). This is the B state of the world.

- 10% chance of a major break through in which case the cash flows will be $20m per year forever starting in 5 years (t=5), or instead, the project can be expanded by investing another $10m (at t=5) which is expected to give cash flows of $60m per year forever, starting at year 9 (t=9). Note that the perpetual cash flows are either the $20m from year 4 onwards, or the $60m from year 9 onwards after the additional $10m year 5 investment, but not both. This is the C state of the world.

The firm's cost of capital is 10% pa.

What's the present value (at t=0) of the option to expand in year 5?

Question 434 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

What is the payoff to debt holders at maturity, assuming that they keep their debt until maturity?

Question 397 financial distress, leverage, capital structure, NPV

A levered firm has a market value of assets of $10m. Its debt is all comprised of zero-coupon bonds which mature in one year and have a combined face value of $9.9m.

Investors are risk-neutral and therefore all debt and equity holders demand the same required return of 10% pa.

Therefore the current market capitalisation of debt ##(D_0)## is $9m and equity ##(E_0)## is $1m.

A new project presents itself which requires an investment of $2m and will provide a:

- $6.6m cash flow with probability 0.5 in the good state of the world, and a

- -$4.4m (notice the negative sign) cash flow with probability 0.5 in the bad state of the world.

The project can be funded using the company's excess cash, no debt or equity raisings are required.

What would be the new market capitalisation of equity ##(E_\text{0, with project})## if shareholders vote to proceed with the project, and therefore should shareholders proceed with the project?

Question 1010 lemons problem, asymmetric information, adverse selection, fungible

The ‘Lemons Problem’ is likely to more adversely affect the desirability of which type of investment?

Which of the below formulas gives the profit ##(\pi)## from being short a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

A trader buys one crude oil European style put option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

Which of the following statements about call options is NOT correct?

A trader just bought a European style put option on CBA stock. The current option premium is $2, the exercise price is $75, the option matures in one year and the spot CBA stock price is $74.

Which of the following statements is NOT correct?

Question 584 option, option payoff at maturity, option profit

Which of the following statements about European call options on non-dividend paying stocks is NOT correct?

A stock, a call, a put and a bond are available to trade. The call and put options' underlying asset is the stock they and have the same strike prices, ##K_T##.

You are currently long the stock. You want to hedge your long stock position without actually trading the stock. How would you do this?

Question 1036 Minsky financial instability hypothesis, leverage

Hyman Minsky, author of 'The Financial Instability Hypothesis' (1992), wrote:

In particular, over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. Consequently, units with cash flow shortfalls will be forced to try to make position by selling out position. This is likely to lead to a collapse of asset values.

Which of the below statements explaining this quote is NOT correct?

Question 1051 monetary policy, equilibrium real interest rate, inequality, marginal propensity to consume, gross domestic product, bond pricing

Read the below quote for background, or skip it to answer the question immediately.

In his 31 August 2021 article 'The rich get richer and rates get lower', Robert Armstrong states that:

"Atif Mian, Ludwig Straub and Amir Sufi agree with partisans of the demographic view, such as the economists Charles Goodhart and Manoj Pradhan, that a key contributor to falling rates is higher savings.

Mian, Straub and Sufi disagree, however, about why there are ever more savings sloshing around. It is not because the huge baby-boom generation is getting older and saving more (a trend that will change direction soon, when they are all retired). Rather, it’s because a larger and larger slice of national income is going to the top decile of earners. Because a person can only consume so much, the wealthy few tend to save much of this income rather than spend it. This pushes rates down directly, when those savings are invested, driving asset prices up and yields down; and indirectly, by sapping aggregate demand.

Why doesn’t all the cash that the rich push into markets get converted, ultimately, into productive investment, either at home or abroad? Tricky question. For present purposes it is enough to note that this is not happening — the savings of the American rich reappear, instead, as debt, owed by the government or by lower-income US households. (In another paper, MS&S have pointed out that this means the high share of income going to the rich hurts aggregate demand in two ways: the rich have a lower marginal propensity to consume, and governments and the non-rich are forced to shift dollars from consumption to debt service. Economically speaking, high inequality is a real buzzkill.)

MS&S prefer the inequality explanation for two reasons. Using data from the Fed’s Survey of Consumer Finances (which goes back to 1950) they show that differences in savings rates are much greater within any given age cohort than across age cohorts. That is, savings are building up faster because the rich are getting richer, not because the baby boomers are getting older."

Which of the following statements about this quote is NOT correct?

Question 871 duration, Macaulay duration, modified duration, portfolio duration

Which of the following statements about Macaulay duration is NOT correct? The Macaulay duration:

Question 1050 Miller debt and taxes, interest tax shields, Miller and Modigliani, no explanation

In Miller's 1977 article 'Debt and Taxes', he argues that interest tax shields are likely to benefit who? Note that this 1977 article is contrary to his past research findings with Modigliani (1958), modern textbooks and common practice by valuers.

Miller (1977) concludes that the benefits of interest tax shields are likely to benefit:

Which of the following formulas for 'contributed equity' from the balance sheet is correct? Assume that now is time 1 and last year is time 0. Assume that book equity consists of contributed equity, retained profits and reserves only (BookEquity = ContributedEquity + RetainedProfits + Reserves).

An analyst is valuing a levered company whose owners insist on keeping the dollar amount of debt funding fixed. So the company cannot issue or repay its debt, its dollar value must remain constant. Any funding gaps will be met with equity.

The analyst is wondering, as he changes inputs into his valuation, such as the forecast growth rate of sales, then asset values and other things will change. This makes it hard to figure out which values can be held constant and would therefore make good model inputs, rather than outputs which vary depending on the inputs. Assume that the cost of debt (yield) remains constant and the company’s asset beta will also remain constant since any expansion (or downsize) will involve buying (or selling) more of the same assets.

Which of the following values can be assumed to stay constant when projected sales growth increases?

An analyst is valuing a levered company whose owners insist on keeping a constant market debt to assets ratio into the future.

The analyst is wondering how asset values and other things in her model will change when she changes the forecast sales growth rate.

Which of the below values will increase as the forecast growth rate of sales increases, with the debt to assets ratio remaining constant?

Assume that the cost of debt (yield) remains constant and the company’s asset beta will also remain constant since any expansion (or downsize) will involve buying (or selling) more of the same assets.

The analyst should expect which value or ratio to increase when the forecast growth rate of sales increases and the debt to assets ratio remains unchanged? In other words, which of the following values will NOT remain constant?

Question 795 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the Delta of a European put option?

A one year European-style call option has a strike price of $4.

The option's underlying stock currently trades at $5, pays no dividends and its standard deviation of continuously compounded returns is 47% pa.

The risk-free interest rate is 10% pa continuously compounded.

Use the Black-Scholes-Merton formula to calculate the option price. The call option price now is: