Question 452 limited liability, expected and historical returns

What is the lowest and highest expected share price and expected return from owning shares in a company over a finite period of time?

Let the current share price be ##p_0##, the expected future share price be ##p_1##, the expected future dividend be ##d_1## and the expected return be ##r##. Define the expected return as:

##r=\dfrac{p_1-p_0+d_1}{p_0} ##

The answer choices are stated using inequalities. As an example, the first answer choice "(a) ##0≤p<∞## and ##0≤r< 1##", states that the share price must be larger than or equal to zero and less than positive infinity, and that the return must be larger than or equal to zero and less than one.

For a price of $102, Andrea will sell you a share which just paid a dividend of $10 yesterday, and is expected to pay dividends every year forever, growing at a rate of 5% pa.

So the next dividend will be ##10(1+0.05)^1=$10.50## in one year from now, and the year after it will be ##10(1+0.05)^2=11.025## and so on.

The required return of the stock is 15% pa.

In the 'Austin Powers' series of movies, the character Dr. Evil threatens to destroy the world unless the United Nations pays him a ransom (video 1, video 2). Dr. Evil makes the threat on two separate occasions:

- In 1969 he demands a ransom of $1 million (=10^6), and again;

- In 1997 he demands a ransom of $100 billion (=10^11).

If Dr. Evil's demands are equivalent in real terms, in other words $1 million will buy the same basket of goods in 1969 as $100 billion would in 1997, what was the implied inflation rate over the 28 years from 1969 to 1997?

The answer choices below are given as effective annual rates:

Question 363 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 8% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

Question 407 income and capital returns, inflation, real and nominal returns and cash flows

A stock has a real expected total return of 7% pa and a real expected capital return of 2% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What is the nominal expected total return, capital return and dividend yield? The answers below are given in the same order.

A newly floated farming company is financed with senior bonds, junior bonds, cumulative non-voting preferred stock and common stock. The new company has no retained profits and due to floods it was unable to record any revenues this year, leading to a loss. The firm is not bankrupt yet since it still has substantial contributed equity (same as paid-up capital).

On which securities must it pay interest or dividend payments in this terrible financial year?

Question 461 book and market values, ROE, ROA, market efficiency

One year ago a pharmaceutical firm floated by selling its 1 million shares for $100 each. Its book and market values of equity were both $100m. Its debt totalled $50m. The required return on the firm's assets was 15%, equity 20% and debt 5% pa.

In the year since then, the firm:

- Earned net income of $29m.

- Paid dividends totaling $10m.

- Discovered a valuable new drug that will lead to a massive 1,000 times increase in the firm's net income in 10 years after the research is commercialised. News of the discovery was publicly announced. The firm's systematic risk remains unchanged.

Which of the following statements is NOT correct? All statements are about current figures, not figures one year ago.

Hint: Book return on assets (ROA) and book return on equity (ROE) are ratios that accountants like to use to measure a business's past performance.

###\text{ROA}= \dfrac{\text{Net income}}{\text{Book value of assets}}###

###\text{ROE}= \dfrac{\text{Net income}}{\text{Book value of equity}}###

The required return on assets ##r_V## is a return that financiers like to use to estimate a business's future required performance which compensates them for the firm's assets' risks. If the business were to achieve realised historical returns equal to its required returns, then investment into the business's assets would have been a zero-NPV decision, which is neither good nor bad but fair.

###r_\text{V, 0 to 1}= \dfrac{\text{Cash flow from assets}_\text{1}}{\text{Market value of assets}_\text{0}} = \dfrac{CFFA_\text{1}}{V_\text{0}}###

Similarly for equity and debt.

One and a half years ago Frank bought a house for $600,000. Now it's worth only $500,000, based on recent similar sales in the area.

The expected total return on Frank's residential property is 7% pa.

He rents his house out for $1,600 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $18,617.27.

The future value of 12 months of rental payments one year in the future is $19,920.48.

What is the expected annual rental yield of the property? Ignore the costs of renting such as maintenance, real estate agent fees and so on.

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

Question 524 risk, expected and historical returns, bankruptcy or insolvency, capital structure, corporate financial decision theory, limited liability

Which of the following statements is NOT correct?

Question 576 inflation, real and nominal returns and cash flows

What is the present value of a nominal payment of $1,000 in 4 years? The nominal discount rate is 8% pa and the inflation rate is 2% pa.

Question 155 inflation, real and nominal returns and cash flows, Loan, effective rate conversion

You are a banker about to grant a 2 year loan to a customer. The loan's principal and interest will be repaid in a single payment at maturity, sometimes called a zero-coupon loan, discount loan or bullet loan.

You require a real return of 6% pa over the two years, given as an effective annual rate. Inflation is expected to be 2% this year and 4% next year, both given as effective annual rates.

You judge that the customer can afford to pay back $1,000,000 in 2 years, given as a nominal cash flow. How much should you lend to her right now?

Question 526 real and nominal returns and cash flows, inflation, no explanation

How can a nominal cash flow be precisely converted into a real cash flow?

Question 554 inflation, real and nominal returns and cash flows

On his 20th birthday, a man makes a resolution. He will put $30 cash under his bed at the end of every month starting from today. His birthday today is the first day of the month. So the first addition to his cash stash will be in one month. He will write in his will that when he dies the cash under the bed should be given to charity.

If the man lives for another 60 years, how much money will be under his bed if he dies just after making his last (720th) addition?

Also, what will be the real value of that cash in today's prices if inflation is expected to 2.5% pa? Assume that the inflation rate is an effective annual rate and is not expected to change.

The answers are given in the same order, the amount of money under his bed in 60 years, and the real value of that money in today's prices.

Question 575 inflation, real and nominal returns and cash flows

You expect a nominal payment of $100 in 5 years. The real discount rate is 10% pa and the inflation rate is 3% pa. Which of the following statements is NOT correct?

A project to build a toll road will take 3 years to complete, costing three payments of $50 million, paid at the start of each year (at times 0, 1, and 2).

After completion, the toll road will yield a constant $10 million at the end of each year forever with no costs. So the first payment will be at t=4.

The required return of the project is 10% pa given as an effective nominal rate. All cash flows are nominal.

What is the payback period?

A firm is considering a business project which costs $10m now and is expected to pay a single cash flow of $12.1m in two years.

Assume that the initial $10m cost is funded using the firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

Question 218 NPV, IRR, profitability index, average accounting return

Which of the following statements is NOT correct?

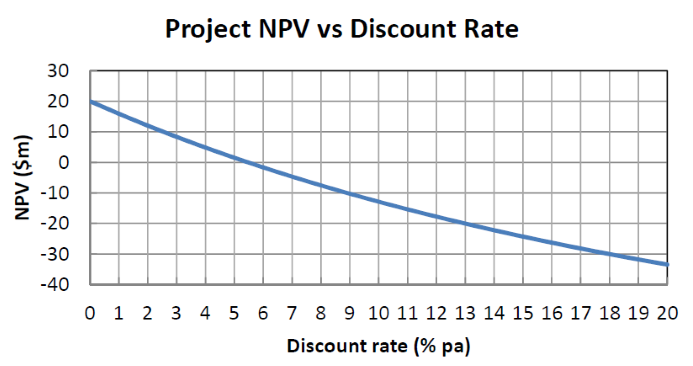

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

Your friend wants to borrow $1,000 and offers to pay you back $100 in 6 months, with more $100 payments at the end of every month for another 11 months. So there will be twelve $100 payments in total. She says that 12 payments of $100 equals $1,200 so she's being generous.

If interest rates are 12% pa, given as an APR compounding monthly, what is the Net Present Value (NPV) of your friend's deal?

The following cash flows are expected:

- 10 yearly payments of $60, with the first payment in 3 years from now (first payment at t=3 and last at t=12).

- 1 payment of $400 in 5 years and 6 months (t=5.5) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

Some countries' interest rates are so low that they're zero.

If interest rates are 0% pa and are expected to stay at that level for the foreseeable future, what is the most that you would be prepared to pay a bank now if it offered to pay you $10 at the end of every year for the next 5 years?

In other words, what is the present value of five $10 payments at time 1, 2, 3, 4 and 5 if interest rates are 0% pa?

A stock pays annual dividends which are expected to continue forever. It just paid a dividend of $10. The growth rate in the dividend is 2% pa. You estimate that the stock's required return is 10% pa. Both the discount rate and growth rate are given as effective annual rates. Using the dividend discount model, what will be the share price?

Question 498 NPV, Annuity, perpetuity with growth, multi stage growth model

A business project is expected to cost $100 now (t=0), then pay $10 at the end of the third (t=3), fourth, fifth and sixth years, and then grow by 5% pa every year forever. So the cash flow will be $10.5 at the end of the seventh year (t=7), then $11.025 at the end of the eighth year (t=8) and so on perpetually. The total required return is 10℅ pa.

Which of the following formulas will NOT give the correct net present value of the project?

Question 180 equivalent annual cash flow, inflation, real and nominal returns and cash flows

Details of two different types of light bulbs are given below:

- Low-energy light bulbs cost $3.50, have a life of nine years, and use about $1.60 of electricity a year, paid at the end of each year.

- Conventional light bulbs cost only $0.50, but last only about a year and use about $6.60 of energy a year, paid at the end of each year.

The real discount rate is 5%, given as an effective annual rate. Assume that all cash flows are real. The inflation rate is 3% given as an effective annual rate.

Find the Equivalent Annual Cost (EAC) of the low-energy and conventional light bulbs. The below choices are listed in that order.

A European bond paying annual coupons of 6% offers a yield of 10% pa.

Convert the yield into an effective monthly rate, an effective annual rate and an effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff, monthly} , r_\text{eff, yearly} , r_\text{eff, daily} ###

On his 20th birthday, a man makes a resolution. He will deposit $30 into a bank account at the end of every month starting from now, which is the start of the month. So the first payment will be in one month. He will write in his will that when he dies the money in the account should be given to charity.

The bank account pays interest at 6% pa compounding monthly, which is not expected to change.

If the man lives for another 60 years, how much money will be in the bank account if he dies just after making his last (720th) payment?

You want to buy an apartment priced at $300,000. You have saved a deposit of $30,000. The bank has agreed to lend you the $270,000 as an interest only loan with a term of 25 years. The interest rate is 12% pa and is not expected to change.

What will be your monthly payments? Remember that mortgage payments are paid in arrears (at the end of the month).

Question 56 income and capital returns, bond pricing, premium par and discount bonds

Which of the following statements about risk free government bonds is NOT correct?

Hint: Total return can be broken into income and capital returns as follows:

###\begin{aligned} r_\text{total} &= \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0} \\ &= r_\text{income} + r_\text{capital} \end{aligned} ###

The capital return is the growth rate of the price.

The income return is the periodic cash flow. For a bond this is the coupon payment.

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

Bonds X and Y are issued by different companies, but they both pay a semi-annual coupon of 10% pa and they have the same face value ($100) and maturity (3 years).

The only difference is that bond X and Y's yields are 8 and 12% pa respectively. Which of the following statements is true?

Bonds X and Y are issued by the same US company. Both bonds yield 6% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X pays coupons of 8% pa and bond Y pays coupons of 12% pa. Which of the following statements is true?

An investor bought a 10 year 2.5% pa fixed coupon government bond priced at par. The face value is $100. Coupons are paid semi-annually and the next one is in 6 months.

Six months later, just after the coupon at that time was paid, yields suddenly and unexpectedly fell to 2% pa. Note that all yields above are given as APR's compounding semi-annually.

What was the bond investors' historical total return over that first 6 month period, given as an effective semi-annual rate?

A stock just paid its annual dividend of $9. The share price is $60. The required return of the stock is 10% pa as an effective annual rate.

What is the implied growth rate of the dividend per year?

Question 497 income and capital returns, DDM, ex dividend date

A stock will pay you a dividend of $10 tonight if you buy it today. Thereafter the annual dividend is expected to grow by 5% pa, so the next dividend after the $10 one tonight will be $10.50 in one year, then in two years it will be $11.025 and so on. The stock's required return is 10% pa.

What is the stock price today and what do you expect the stock price to be tomorrow, approximately?

"Buy low, sell high" is a phrase commonly heard in financial markets. It states that traders should try to buy assets at low prices and sell at high prices.

Traders in the fixed-coupon bond markets often quote promised bond yields rather than prices. Fixed-coupon bond traders should try to:

A person is thinking about borrowing $100 from the bank at 7% pa and investing it in shares with an expected return of 10% pa. One year later the person intends to sell the shares and pay back the loan in full. Both the loan and the shares are fairly priced.

What is the Net Present Value (NPV) of this one year investment? Note that you are asked to find the present value (##V_0##), not the value in one year (##V_1##).

A stock's required total return will increase when its:

A firm is considering a business project which costs $11m now and is expected to pay a constant $1m at the end of every year forever.

Assume that the initial $11m cost is funded using the firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

Your neighbour asks you for a loan of $100 and offers to pay you back $120 in one year.

You don't actually have any money right now, but you can borrow and lend from the bank at a rate of 10% pa. Rates are given as effective annual rates.

Assume that your neighbour will definitely pay you back. Ignore interest tax shields and transaction costs.

The Net Present Value (NPV) of lending to your neighbour is $9.09. Describe what you would do to actually receive a $9.09 cash flow right now with zero net cash flows in the future.

This annuity formula ##\dfrac{C_1}{r}\left(1-\dfrac{1}{(1+r)^3} \right)## is equivalent to which of the following formulas? Note the 3.

In the below formulas, ##C_t## is a cash flow at time t. All of the cash flows are equal, but paid at different times.

Discounted cash flow (DCF) valuation prices assets by finding the present value of the asset's future cash flows. The single cash flow, annuity, and perpetuity equations are very useful for this.

Which of the following equations is the 'perpetuity with growth' equation?

A stock is expected to pay its next dividend of $1 in one year. Future annual dividends are expected to grow by 2% pa. So the first dividend of $1 will be in one year, the year after that $1.02 (=1*(1+0.02)^1), and a year later $1.0404 (=1*(1+0.02)^2) and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

A stock is just about to pay a dividend of $1 tonight. Future annual dividends are expected to grow by 2% pa. The next dividend of $1 will be paid tonight, and the year after that the dividend will be $1.02 (=1*(1+0.02)^1), and a year later 1.0404 (=1*(1+0.04)^2) and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

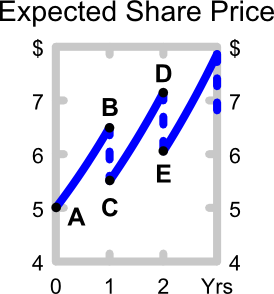

The perpetuity with growth formula, also known as the dividend discount model (DDM) or Gordon growth model, is appropriate for valuing a company's shares. ##P_0## is the current share price, ##C_1## is next year's expected dividend, ##r## is the total required return and ##g## is the expected growth rate of the dividend.

###P_0=\dfrac{C_1}{r-g}###

The below graph shows the expected future price path of the company's shares. Which of the following statements about the graph is NOT correct?

A semi-annual coupon bond has a yield of 3% pa. Which of the following statements about the yield is NOT correct? All rates are given to four decimal places.

You just agreed to a 30 year fully amortising mortgage loan with monthly payments of $2,500. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 10 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change. The below choices are given in the same order.

In these tough economic times, central banks around the world have cut interest rates so low that they are practically zero. In some countries, government bond yields are also very close to zero.

A three year government bond with a face value of $100 and a coupon rate of 2% pa paid semi-annually was just issued at a yield of 0%. What is the price of the bond?

Find Sidebar Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Sidebar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 405 | |

| COGS | 100 | |

| Depreciation | 34 | |

| Rent expense | 22 | |

| Interest expense | 39 | |

| Taxable Income | 210 | |

| Taxes at 30% | 63 | |

| Net income | 147 | |

| Sidebar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Cash | 0 | 0 |

| Inventory | 70 | 50 |

| Trade debtors | 11 | 16 |

| Rent paid in advance | 4 | 3 |

| PPE | 700 | 680 |

| Total assets | 785 | 749 |

| Trade creditors | 11 | 19 |

| Bond liabilities | 400 | 390 |

| Contributed equity | 220 | 220 |

| Retained profits | 154 | 120 |

| Total L and OE | 785 | 749 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

Over the next year, the management of an unlevered company plans to:

- Achieve firm free cash flow (FFCF or CFFA) of $1m.

- Pay dividends of $1.8m

- Complete a $1.3m share buy-back.

- Spend $0.8m on new buildings without buying or selling any other fixed assets. This capital expenditure is included in the CFFA figure quoted above.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

An economy has only two investable assets: stocks and cash.

Stocks had a historical nominal average total return of negative two percent per annum (-2% pa) over the last 20 years. Stocks are liquid and actively traded. Stock returns are variable, they have risk.

Cash is riskless and has a nominal constant return of zero percent per annum (0% pa), which it had in the past and will have in the future. Cash can be kept safely at zero cost. Cash can be converted into shares and vice versa at zero cost.

The nominal total return of the shares over the next year is expected to be:

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

Let the 'income return' of a bond be the coupon at the end of the period divided by the market price now at the start of the period ##(C_1/P_0)##. The expected income return of a premium fixed coupon bond is:

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Of the 15% pa total expected return, the dividend yield is expected to always be 7% pa and rest is the capital yield.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% total return lasts for the next 100 years (t=0 to 100), then reverts to 10% after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant, the dividends can only be re-invested at 10% pa and all returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

The efficient markets hypothesis (EMH) and no-arbitrage pricing theory are most closely related to which of the following concepts?

Question 626 cross currency interest rate parity, foreign exchange rate, forward foreign exchange rate

The Australian cash rate is expected to be 2% pa over the next one year, while the Japanese cash rate is expected to be 0% pa, both given as nominal effective annual rates. The current exchange rate is 100 JPY per AUD.

What is the implied 1 year forward foreign exchange rate?