Investment bank Canaccord's Think Childcare (TNK) initiation of coverage states: "What's the Differentiator? TNK are operators, not consolidators - Other listed childcare companies have led highly successful consolidation strategies involving multiple arbitrage combined with scale benefits and operating efficiencies. TNK’s focus is on operating the centres to the best of their individual potentials..." (Canaccord, 2016). Multiples arbitrage involves:

Question 1032 inflation, percent of sales forecasting, no explanation

Investment bank Canaccord's Think Childcare (TNK) initiation of coverage states: "Building lease costs – Rent expense is the second largest cost and TNK reported rent/sales of 12.1%, within the industry range that we typically see as 12-14% of sales. TNK lease all their properties and do not intend to own property. Leases are generally long term with 10-15 year terms and additional options. Although terms vary across properties and landlords, rental increases are generally tied to the consumer price index (CPI)" (Canaccord, 2016).

Assuming that sales grow faster than the CPI, when Canaccord forecast TNK's building lease costs using the 'percent of sales' method, that proportion should:

Question 1029 Buffett ratio

Tesla CEO Elon Musk asked a question to ARK Invest CEO Cathie Wood on 6 April 2021: "What do you think of the unusually high ratio of the S&P market cap to GDP?", to which Cathie Wood replied.

What are the units of this S&P500 market cap to GDP ratio, commonly known as the Buffett ratio?

Read these quotes from Adir Shiffman's 26 July 2021 article in the AFR 'Roll up, roll up and make a mint off Amazon sellers'.

"Amazon sellers outsource their warehousing and logistics to the tech giant in a model known as “fulfilled by Amazon”, or FBA. Joining FBA provides access to one of the world’s largest global warehousing operations and even a fleet of Boeing 747 cargo jets. Just as significantly, FBA sellers can much more easily qualify for Amazon’s Prime program, which guarantees free and fast shipping to members."

"Companies want to acquire and integrate a selection, or in business parlance, do a 'roll-up'."

"More than 100 companies are now racing to roll-up FBA sellers, and almost all have launched since 2017. At least a dozen of these boast war chests of more than $US100 million. The largest, Thrasio, was founded in 2018 and has raised more than $US1.7 billion. Thrasio targets businesses with high quality and differentiated products that generate $US1 to $US100 million in revenue annually" (Shiffman, 2021).

If Thrasio's total funds available to spend on the roll up is $1.7 billion, and it's buying targets at price-to-revenue multiples of 2, what's the largest number of firms with $50 million of annual revenue that it could buy?

Question 1022 inflation linked bond, breakeven inflation rate, inflation, real and nominal returns and cash flows

Below is a graph of 10-year US treasury fixed coupon bond yields (red), inflation-indexed bond yields (green) and the 'breakeven' inflation rate (blue). Note that inflation-indexed bonds are also called treasury inflation protected securities (TIPS) in the US. In other countries they're called inflation-linked bonds (ILB's). For more information, see PIMCO's great article about inflation linked bonds here.

The 10 year breakeven inflation rate (blue) equals the:

Question 1023 monetary policy, inflation, breakeven inflation rate

If the breakeven inflation rate was far above the US Fed's long term 2% average inflation target, the Fed would be expected to:

PIMCO gives the following example of an Inflation Linked Bond (ILB), called Treasury Inflation Protected Securities (TIPS) in the US.

How do ILBs work?

An ILB’s explicit link to a nationally-recognized inflation measure means that any increase in price levels directly translates into higher principal values. As a hypothetical example, consider a $1,000 20-year U.S. TIPS with a 2.5% coupon (1.25% on semiannual basis), and an inflation rate of 4%. The principal on the TIPS note will adjust upward on a daily basis to account for the 4% inflation rate. At maturity, the principal value will be $2,208 (4% per year, compounded semiannually). Additionally, while the coupon rate remains fixed at 2.5%, the dollar value of each interest payment will rise, as the coupon will be paid on the inflation-adjusted principal value. The first semiannual coupon of 1.25% paid on the inflation-adjusted principal of $1,020 is $12.75, while the final semiannual interest payment will be 1.25% of $2,208, which is $27.60.

Forecast the semi-annual coupon paid in 10 years based on the bond details given above. The 20th semi-annual coupon, paid in 10 years, is expected to be:

Meier and Tarhan (2006) conducted an interesting survey of corporate managers. The results are copied in Table 7 below. What proportion of managers are evaluating levered projects correctly?

| Table 7: Consistency between hurdle rate and the calculation of cash flows | |||||||

| Hurdle rate | Cash flow calculation (see below notes) | ||||||

|---|---|---|---|---|---|---|---|

| (i) | (ii) | (iii) | (iv) | (v) | Other | Total | |

| WACC | 11.3% | 34.8% | 1.7% | 3.5% | 18.3% | 1.7% | 71.3% |

| Equity levered | 0.0% | 2.6% | 0.9% | 0.0% | 0.9% | 0.9% | 6.1% |

| Equity unlevered | 1.7% | 1.7% | 0.9% | 0.9% | 1.7% | 0.9% | 7.8% |

| Other | 2.6% | 5.2% | 1.7% | 0.9% | 3.5% | 0.9% | 14.8% |

| Total | 16.5% | 44.4% | 5.2% | 5.2% | 24.4% | 4.4% | 100.0% |

The rows of the cross-tabulation indicate what the self-reported hurdle rate represents and the columns denote five different ways to calculate cash flows, (i) to (v), plus the “other” category. Each cell then displays the fraction of all 113 respondents for a given combination of what the hurdle rate represents and how the firm calculates its cash flows when evaluating a project.

The definitions of the cash flow calculations (i)-(v) are as follows:

(i) Earnings before interest and after taxes (EBIAT) + depreciation

(ii) Earnings before interest and after taxes (EBIAT) + depreciation – capital expenditures – net change in working capital

(iii) Earnings

(iv) Earnings + depreciation

(v) Earnings + depreciation – capital expenditures – net change in working capital

Assume that the WACC is after tax, the required return on unlevered equity is the WACC before tax, all projects are levered, the benefit of interest tax shields should be included in the valuation, earnings = net profit after tax (NPAT) and EBIAT = EBIT*(1-tc) which is often also called net operating profit after tax (NOPAT).

What proportion of managers are evaluating levered projects correctly?

Former Reserve Bank of Australia (RBA) Governor Phil Lowe says that the RBA cash rate is the interest rate in the Australian:

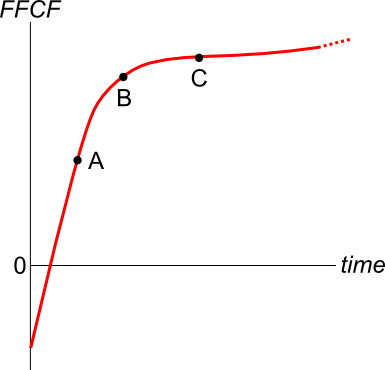

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

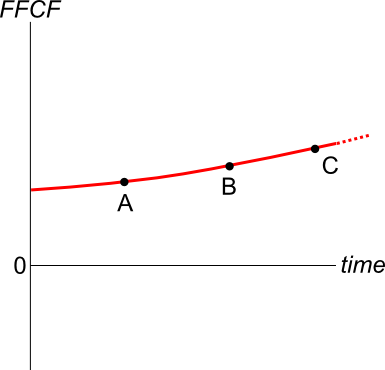

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

Find the Macaulay duration of a 2 year 5% pa annual fixed coupon bond which has a $100 face value and currently has a yield to maturity of 8% pa. The Macaulay duration is:

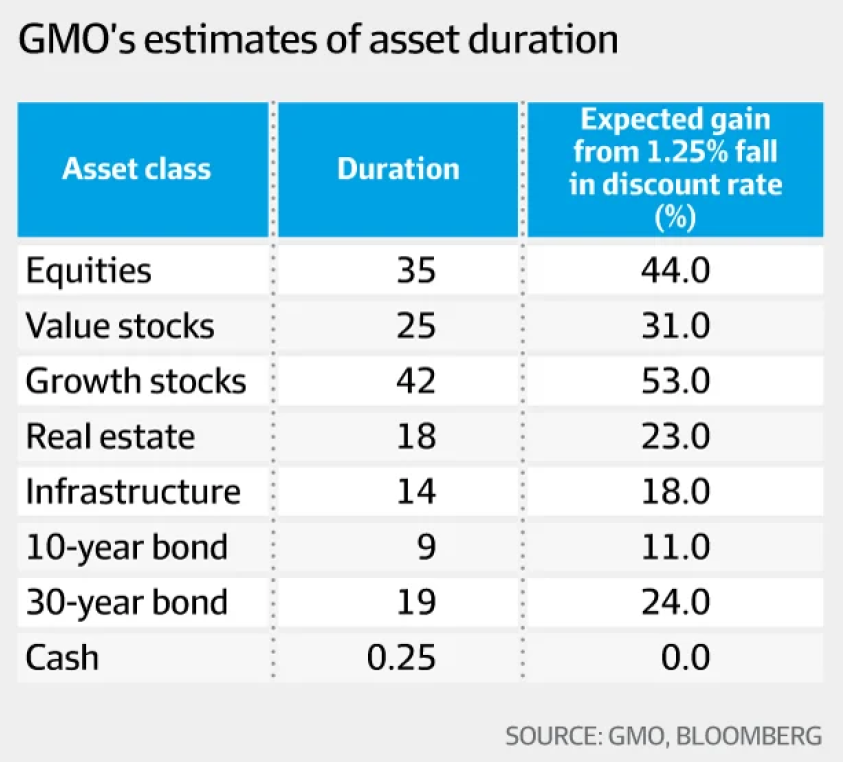

Below is a table showing GMO's 2016 estimates of different assets' durations, appearing in Slater (2017).

If you were certain that interest rates would fall more than the market expects, into what asset might you allocate more funds?

Which of the following statements about Macaulay duration is NOT correct? The Macaulay duration:

Find the Macaulay duration of a 2 year 5% pa semi-annual fixed coupon bond which has a $100 face value and currently has a yield to maturity of 8% pa. The Macaulay duration is:

Question 1039 gross domestic product, inflation, business cycle

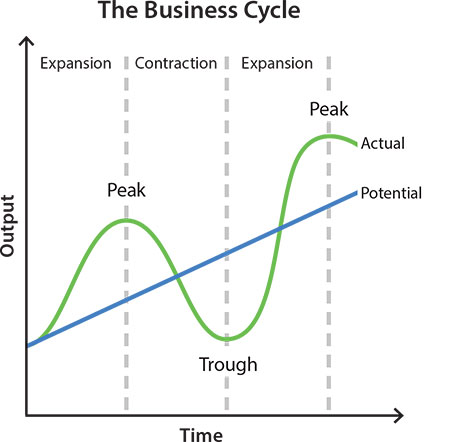

In this business cycle graph shown in the RBA's article explaining recessions, how might 'output' on the y-axis be measured?

The ‘output’ y-axis amount in the business cycle chart can be measured by:

Calculate Australia’s GDP over the 2016 calendar year using the below table:

| Australian Gross Domestic Product Components | ||||

| A$ billion, 2016 Calendar Year from 1 Jan 2016 to 31 Dec 2016 inclusive | ||||

| Consumption | Investment | Government spending | Exports | Imports |

| 971 | 421 | 320 | 328 | 344 |

Source: ABS 5206.0 Australian National Accounts: National Income, Expenditure and Product. Table 3. Expenditure on Gross Domestic Product (GDP), Current prices.

Over the 2016 calendar year, Australia’s GDP was:

Question 841 gross domestic product, government spending

The government spends money on:

- Goods and services such as defence, police, schools, hospitals and roads; and

- Transfer payments (also called welfare) such as the pension, dole, disability support and student support.

When calculating GDP (=C+I+G+X-M), the ‘government spending’ component (G) is supposed to include:

Question 850 gross domestic product, gross domestic product per capita

Below is a table showing some countries’ GDP, population and GDP per capita.

| Countries' GDP and Population | |||

| GDP | Population | GDP per capita | |

| USD million | millions of people | USD | |

| United States | 18,036,648 | 325 | 55,492 |

| China | 11,158,457 | 1,383 | 8,066 |

| Japan | 4,383,076 | 127 | 34,586 |

| Germany | 3,363,600 | 83 | 40,623 |

| Norway | 500,519 | 5 | 95,027 |

Source: "GDP and its breakdown at current prices in US Dollars" United Nations Statistics Division. December 2016.

Using this data only, which one of these countries’ citizens have the highest living standards?

Question 1036 Minsky financial instability hypothesis, leverage

Hyman Minsky, author of 'The Financial Instability Hypothesis' (1992), wrote:

In particular, over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. Consequently, units with cash flow shortfalls will be forced to try to make position by selling out position. This is likely to lead to a collapse of asset values.

Which of the below statements explaining this quote is NOT correct?

Here's an excerpt from an interview between Magellan fund co-founder Hamish Douglass and AFR reporter Vesna Poljak, which appeared in the Australian Financial Review article ‘It's all about interest rates: Hamish Douglass’, 19 July 2019:

Take a business growing at 4 per cent a year, with a cost of equity of 10 per cent based off a 5 per cent risk-free rate and a 5 per cent market risk premium: you would value that at around 16.6 times free cashflow.

Now take a business growing at the same rate, with a 4 per cent risk free rate. At a 9 per cent cost of equity that would command a 20 times multiple, he says.

At a 3 per cent risk-free rate, the cost of equity is 8 per cent, and the multiple is 25.

Finally at 2 per cent – 'which is where the world is at the moment' – the same business would be worth around 33 times free cashflow.

In August 2021, the RBA overnight cash rate and 3 year Australian government treasury bond yield were both 0.1% pa. If this low risk-free yield was expected to persist forever, what approximate equity price-to-cashflow multiple would that imply for a business expected to grow at 4% pa in perpetuity with a 5% equity risk premium?

Question 1013 book build, initial public offering, capital raising, demand schedule

A firm is floating its stock in an IPO and its underwriter has received the following bids, listed in order from highest to lowest share price:

| IPO Book Build Bids | ||

| Bidders | Share price | Number of shares |

| $/share | millions | |

| BidderA | 2.5 | 2 |

| BidderB | 2 | 1.5 |

| BidderC | 1.5 | 4 |

| BidderD | 1 | 3 |

| BidderE | 0.5 | 2 |

Suppose that the firm's owner wishes to sell all of their 8 million shares, so no new money will be raised and no money will re-invested back into the firm. Which of the following statements is NOT correct?

Use the below information to value a mature levered company with growing annual perpetual cash flows and a constant debt-to-assets ratio. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. The firm's debt funding comprises annual fixed coupon bonds that all have the same seniority and coupon rate. When these bonds mature, new bonds will be re-issued, and so on in perpetuity. The yield curve is flat.

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}_1## | $12.5m | Operating free cash flow at time 1 |

| ##\text{FFCF}_1 \text{ or }\text{CFFA}_1## | $14m | Firm free cash flow or cash flow from assets at time 1 |

| ##\text{EFCF}_1## | $11m | Equity free cash flow at time 1 |

| ##\text{BondCoupons}_1## | $1.2m | Bond coupons paid to debt holders at time 1 |

| ##g## | 2% pa | Growth rate of OFCF, FFCF, EFCF and Debt cash flow |

| ##\text{WACC}_\text{BeforeTax}## | 9% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 8.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Bond yield |

| ##r_\text{EL}## | 13% pa | Cost or required return of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##n_\text{shares}## | 1m | Number of shares |

| ##t_c## | 30% | Corporate tax rate |

Which of the following statements is NOT correct?

Question 990 Multiples valuation, EV to EBITDA ratio, enterprise value

A firm has:

2 million shares;

$200 million EBITDA expected over the next year;

$100 million in cash (not included in EV);

1/3 market debt-to-assets ratio is (market assets = EV + cash);

4% pa expected dividend yield over the next year, paid annually with the next dividend expected in one year;

2% pa expected dividend growth rate;

40% expected payout ratio over the next year;10 times EV/EBITDA ratio.

30% corporate tax rate.

The stock can be valued using the EV/EBITDA multiple, dividend discount model, Gordon growth model or PE multiple. Which of the below statements is NOT correct based on an EV/EBITDA multiple valuation?

Your friend just bought a house for $1,000,000. He financed it using a $900,000 mortgage loan and a deposit of $100,000.

In the context of residential housing and mortgages, the 'equity' or 'net wealth' tied up in a house is the value of the house less the value of the mortgage loan. Assuming that your friend's only asset is his house, his net wealth is $100,000.

If house prices suddenly fall by 15%, what would be your friend's percentage change in net wealth?

Assume that:

- No income (rent) was received from the house during the short time over which house prices fell.

- Your friend will not declare bankruptcy, he will always pay off his debts.

Question 566 capital structure, capital raising, rights issue, on market repurchase, dividend, stock split, bonus issue

A company's share price fell by 20% and its number of shares rose by 25%. Assume that there are no taxes, no signalling effects and no transaction costs.

Which one of the following corporate events may have happened?

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $48.5m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $50m | Firm free cash flow or cash flow from assets |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 10% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 9.7% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 11.25% pa | Cost of levered equity |

| ##D/V_L## | 20% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

One year ago you bought $100,000 of shares partly funded using a margin loan. The margin loan size was $70,000 and the other $30,000 was your own wealth or 'equity' in the share assets.

The interest rate on the margin loan was 7.84% pa.

Over the year, the shares produced a dividend yield of 4% pa and a capital gain of 5% pa.

What was the total return on your wealth? Ignore taxes, assume that all cash flows (interest payments and dividends) were paid and received at the end of the year, and all rates above are effective annual rates.

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

Question 408 leverage, portfolio beta, portfolio risk, real estate, CAPM

You just bought a house worth $1,000,000. You financed it with an $800,000 mortgage loan and a deposit of $200,000.

You estimate that:

- The house has a beta of 1;

- The mortgage loan has a beta of 0.2.

What is the beta of the equity (the $200,000 deposit) that you have in your house?

Also, if the risk free rate is 5% pa and the market portfolio's return is 10% pa, what is the expected return on equity in your house? Ignore taxes, assume that all cash flows (interest payments and rent) were paid and received at the end of the year, and all rates are effective annual rates.

Question 800 leverage, portfolio return, risk, portfolio risk, capital structure, no explanation

Which of the following assets would you expect to have the highest required rate of return? All values are current market values.

Question 989 PE ratio, Multiples valuation, leverage, accounting ratio

A firm has 20 million stocks, earnings (or net income) of $100 million per annum and a 60% debt-to-equity ratio where both the debt and asset values are market values rather than book values. Similar firms have a PE ratio of 12.

Which of the below statements is NOT correct based on a PE multiples valuation?

Question 852 gross domestic product, inflation, employment, no explanation

When the economy is booming (in an upswing), you tend to see:

Which form of production is included in the Gross Domestic Product (GDP) reported by the government statistics agency?

Question 882 Asian currency crisis, foreign exchange rate, original sin, no explanation

In the 1997 Asian currency crisis, the businesses most vulnerable to bankruptcy were those that:

In the 1997 Asian financial crisis many countries' exchange rates depreciated rapidly against the US dollar (USD). The Thai, Indonesian, Malaysian, Korean and Filipino currencies were severely affected. The below graph shows these Asian countries' currencies in USD per one unit of their currency, indexed to 100 in June 1997.

Of the statements below, which is NOT correct? The Asian countries':

Question 413 CFFA, interest tax shield, depreciation tax shield

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA).

One method is to use the following formulas to transform net income (NI) into FFCF including interest and depreciation tax shields:

###FFCF=NI + Depr - CapEx -ΔNWC + IntExp###

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )###

Another popular method is to use EBITDA rather than net income. EBITDA is defined as:

###EBITDA=Rev - COGS - FC###

One of the below formulas correctly calculates FFCF from EBITDA, including interest and depreciation tax shields, giving an identical answer to that above. Which formula is correct?

What effect is being referred to in the following quote from the MARTIN model description?

Economy-wide models also account for feedback between economic variables. For example, an increase in aggregate demand will encourage firms to hire more workers, which raises employment and lowers the unemployment rate. The tightening of the labour market is likely to lead to an increase in wages growth. The resulting increase in household incomes is likely to lead to an increase in consumption, further raising aggregate demand. (Ballantyne et al, 2019)

The name of the effect being referred to is:

Question 1038 fire sale, leverage, no explanation

Listen to 'Lessons and Questions from the GFC' on 6 December 2018 by RBA Deputy Governor Guy Debelle from 17:58 to 20:08 or read the below transcript:

Guy Debelle talks about the GFC and says that the Australian government’s guarantee of wholesale debt and deposits on 12 October 2008 was "introduced to facilitate the flow of credit to the real economy at a reasonable price and, in some cases, alleviate the need for asset fire sales, which have the capacity to tip markets and the economy into a worse equilibrium... The crisis very much demonstrated the critical importance of keeping the lending flowing. The lesson is that countries that did that fared better than countries that didn't. That lesson is relevant to the situation today in Australia, where there is a risk that a reduced appetite to lend will overly curtail borrowing with consequent effects for the Australian economy." (Debelle, 2019)

When assets are sold in a fire sale, there’s usually a large increase in the:

Four retail business people compete in the same city. They are all exactly the same except that they have different ways of funding or leasing the shop real estate needed to run their retail business.

The two main assets that retail stores need are:

- Inventory typically worth $1 million which has a beta of 2, and;

- Shopfront real estate worth $1 million which has a beta of 1. Shops can be bought or leased.

Lease contract prices are fixed for the term of the lease and based on expectations of the future state of the economy. When leases end, a new lease contract is negotiated and the lease cost may be higher or lower depending on the state of the economy and demand and supply if the economy is:

- Booming, shop real estate is worth more and lease costs are higher.

- In recession, shop real estate is worth less and lease costs are low.

Which retail business person will have the LOWEST beta of equity (or net wealth)?

Your friend just bought a house for $400,000. He financed it using a $320,000 mortgage loan and a deposit of $80,000.

In the context of residential housing and mortgages, the 'equity' tied up in the value of a person's house is the value of the house less the value of the mortgage. So the initial equity your friend has in his house is $80,000. Let this amount be E, let the value of the mortgage be D and the value of the house be V. So ##V=D+E##.

If house prices suddenly fall by 10%, what would be your friend's percentage change in equity (E)? Assume that the value of the mortgage is unchanged and that no income (rent) was received from the house during the short time over which house prices fell.

Remember:

### r_{0\rightarrow1}=\frac{p_1-p_0+c_1}{p_0} ###

where ##r_{0-1}## is the return (percentage change) of an asset with price ##p_0## initially, ##p_1## one period later, and paying a cash flow of ##c_1## at time ##t=1##.

A firm has a debt-to-assets ratio of 50%. The firm then issues a large amount of debt to raise money for new projects of similar market risk to the company's existing projects. Assume a classical tax system. Which statement is correct?

Question 568 rights issue, capital raising, capital structure

A company conducts a 1 for 5 rights issue at a subscription price of $7 when the pre-announcement stock price was $10. What is the percentage change in the stock price and the number of shares outstanding? The answers are given in the same order. Ignore all taxes, transaction costs and signalling effects.

A company conducts a 2 for 3 rights issue at a subscription price of $8 when the pre-announcement stock price was $9. Assume that all investors use their rights to buy those extra shares.

What is the percentage increase in the stock price and the number of shares outstanding? The answers are given in the same order.

A firm wishes to raise $50 million now. They will issue 7% pa semi-annual coupon bonds that will mature in 6 years and have a face value of $100 each. Bond yields are 5% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

A firm wishes to raise $100 million now. The firm's current market value of equity is $300m and the market price per share is $5. They estimate that they'll be able to issue shares in a rights issue at a subscription price of $4. All answers are rounded to 6 decimal places. Ignore the time value of money and assume that all shareholders exercise their rights. Which of the following statements is NOT correct?

A firm wishes to raise $30 million now. The firm's current market value of equity is $60m and the market price per share is $20. They estimate that they'll be able to issue shares in a rights issue at a subscription price of $15. Ignore the time value of money and assume that all shareholders exercise their rights. Which of the following statements is NOT correct?

Question 803 capital raising, rights issue, initial public offering, on market repurchase, no explanation

Which one of the following capital raisings or payouts involve the sale of shares to existing shareholders only?

A firm has a debt-to-equity ratio of 25%. What is its debt-to-assets ratio?

A firm has a debt-to-equity ratio of 60%. What is its debt-to-assets ratio?

A firm has a debt-to-assets ratio of 20%. What is its debt-to-equity ratio?

Question 536 idiom, bond pricing, capital structure, leverage

The expression 'my word is my bond' is often used in everyday language to make a serious promise.

Why do you think this expression uses the metaphor of a bond rather than a share?

Question 772 interest tax shield, capital structure, leverage

A firm issues debt and uses the funds to buy back equity. Assume that there are no costs of financial distress or transactions costs. Which of the following statements about interest tax shields is NOT correct?

One year ago you bought a $1,000,000 house partly funded using a mortgage loan. The loan size was $800,000 and the other $200,000 was your wealth or 'equity' in the house asset.

The interest rate on the home loan was 4% pa.

Over the year, the house produced a net rental yield of 2% pa and a capital gain of 2.5% pa.

Assuming that all cash flows (interest payments and net rental payments) were paid and received at the end of the year, and all rates are given as effective annual rates, what was the total return on your wealth over the past year?

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

In the home loan market, the acronym LVR stands for Loan to Valuation Ratio. If you bought a house worth one million dollars, partly funded by an $800,000 home loan, then your LVR was 80%. The LVR is equivalent to which of the following ratios?

Question 905 market capitalisation of equity, PE ratio, payout ratio

The below graph shows the computer software company Microsoft's stock price (MSFT) at the market close on the NASDAQ on Friday 1 June 2018.

Based on the screenshot above, which of the following statements about MSFT is NOT correct? MSFT's:

A one year European-style put option has a strike price of $4. The option's underlying stock pays no dividends and currently trades at $5. The risk-free interest rate is 10% pa continuously compounded. Use a single step binomial tree to calculate the option price, assuming that the price could rise to $8 ##(u = 1.6)## or fall to $3.125 ##(d = 1/1.6)## in one year. The put option price now is:

A one year European-style call option has a strike price of $4. The option's underlying stock pays no dividends and currently trades at $5. The risk-free interest rate is 10% pa continuously compounded. Use a single step binomial tree to calculate the option price, assuming that the price could rise to $8 ##(u = 1.6)## or fall to $3.125 ##(d = 1/1.6)## in one year. The call option price now is:

A 12 month European-style call option with a strike price of $11 is written on a dividend paying stock currently trading at $10. The dividend is paid annually and the next dividend is expected to be $0.40, paid in 9 months. The risk-free interest rate is 5% pa continuously compounded and the standard deviation of the stock’s continuously compounded returns is 30 percentage points pa. The stock's continuously compounded returns are normally distributed. Using the Black-Scholes-Merton option valuation model, determine which of the following statements is NOT correct.

A one year European-style put option has a strike price of $4.

The option's underlying stock currently trades at $5, pays no dividends and its standard deviation of continuously compounded returns is 47% pa.

The risk-free interest rate is 10% pa continuously compounded.

Use the Black-Scholes-Merton formula to calculate the option price. The put option price now is:

Question 794 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the Delta of a European call option?

Where:

###d_1=\dfrac{\ln[S_0/K]+(r+\sigma^2/2).T)}{\sigma.\sqrt{T}}### ###d_2=d_1-\sigma.\sqrt{T}=\dfrac{\ln[S_0/K]+(r-\sigma^2/2).T)}{\sigma.\sqrt{T}}###Question 795 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the Delta of a European put option?

Question 796 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the risk-neutral probability that a European call option will be exercised?

Question 797 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the risk-neutral probability that a European put option will be exercised?

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $105 million. A cash offer will be made that pays the fair price for the target's shares plus 75% of the total synergy value. The cash will be paid out of the firm's cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 6,000 | 700 |

| Debt ($m) | 4,800 | 400 |

| Share price ($) | 40 | 20 |

| Number of shares (m) | 30 | 15 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $105 million. A scrip offer will be made that pays the fair price for the target's shares plus 75% of the total synergy value.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 6,000 | 700 |

| Debt ($m) | 4,800 | 400 |

| Share price ($) | 40 | 20 |

| Number of shares (m) | 30 | 15 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The firms operate in different industries and the CEO's rationale for the merger is to increase diversification and thereby decrease risk. The deal is not expected to create any synergies. An 80% scrip and 20% cash offer will be made that pays the fair price for the target's shares. The cash will be paid out of the firms' cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 6,000 | 700 |

| Debt ($m) | 4,800 | 400 |

| Share price ($) | 40 | 20 |

| Number of shares (m) | 30 | 15 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $105 million. A 40% scrip and 60% cash offer will be made that pays the fair price for the target's shares plus 75% of the total synergy value. The cash will be paid out of the firm's cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 6,000 | 700 |

| Debt ($m) | 4,800 | 400 |

| Share price ($) | 40 | 20 |

| Number of shares (m) | 30 | 15 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $2 million. A cash offer will be made that pays the fair price for the target's shares plus 70% of the total synergy value. The cash will be paid out of the firm's cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 60 | 10 |

| Debt ($m) | 20 | 2 |

| Share price ($) | 10 | 8 |

| Number of shares (m) | 4 | 1 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $2 million. A scrip offer will be made that pays the fair price for the target's shares plus 70% of the total synergy value.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 60 | 10 |

| Debt ($m) | 20 | 2 |

| Share price ($) | 10 | 8 |

| Number of shares (m) | 4 | 1 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $0.5 million, but investment bank fees and integration costs with a present value of $1.5 million is expected. A 10% cash and 90% scrip offer will be made that pays the fair price for the target's shares only. Assume that the Target and Acquirer agree to the deal. The cash will be paid out of the firms' cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 60 | 10 |

| Debt ($m) | 20 | 2 |

| Share price ($) | 10 | 8 |

| Number of shares (m) | 4 | 1 |

Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $1 billion, corresponding to extra earnings of $0.05 billion per year.

A 70% scrip and 30% cash offer will be made that pays the fair price for the target's shares plus $0.4 billion of the available synergies, corresponding to extra earnings of $0.02 billion per year. The cash will be paid out of the firm's existing cash holdings, so no new debt or equity will be raised.

| Firms Involved in the Takeover | |||

| Acquirer | Target | Merged | |

| Assets ($b) | 12 | 5 | ? |

| Debt ($b) | 7 | 2 | (a) |

| Equity ($b) | 5 | 3 | ? |

| Share price ($/share) | 10 | 2 | (b) |

| Number of shares (b) | 0.5 | 1.5 | (c) |

| Earnings ($b/year) | 0.25 | 0.15 | (d) |

| EPS ($/share) | 0.5 | 0.1 | ? |

| PE ratio (years) | 20 | 20 | ? |

Assume that:

- The acquirer's cash holdings are in a liquid account paying zero interest;

- The cash will be paid out of the firm's cash holdings, so no new debt or equity will be raised;

- There are no transaction costs or fees;

- The firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant;

- The acquisition is planned to occur immediately, so ignore the time value of money.

Which of the following statements is NOT correct? The merged firm will have:

Question 383 Merton model of corporate debt, real option, option

In the Merton model of corporate debt, buying a levered company's debt is equivalent to buying the company's assets and:

Which of the following is the least useful method or model to calculate the value of a real option in a project?

Some financially minded people insist on a prenuptial agreement before committing to marry their partner. This agreement states how the couple's assets should be divided in case they divorce. Prenuptial agreements are designed to give the richer partner more of the couples' assets if they divorce, thus maximising the richer partner's:

A moped is a bicycle with pedals and a little motor that can be switched on to assist the rider. Mopeds are useful for quick transport using the motor, and for physical exercise when using the pedals unassisted. This offers the rider:

You're thinking of starting a new cafe business, but you're not sure if it will be profitable.

You have to decide what type of cups, mugs and glasses you wish to buy. You can pay to have your cafe's name printed on them, or just buy the plain un-marked ones. For marketing reasons it's better to have the cafe name printed. But the plain un-marked cups, mugs and glasses maximise your:

The cheapest mobile phones available tend to be those that are 'locked' into a cell phone operator's network. Locked phones can not be used with other cell phone operators' networks.

Locked mobile phones are cheaper than unlocked phones because the locked-in network operator helps create a monopoly by:

Question 398 financial distress, capital raising, leverage, capital structure, NPV

A levered firm has zero-coupon bonds which mature in one year and have a combined face value of $9.9m.

Investors are risk-neutral and therefore all debt and equity holders demand the same required return of 10% pa.

In one year the firm's assets will be worth:

- $13.2m with probability 0.5 in the good state of the world, or

- $6.6m with probability 0.5 in the bad state of the world.

A new project presents itself which requires an investment of $2m and will provide a certain cash flow of $3.3m in one year.

The firm doesn't have any excess cash to make the initial $2m investment, but the funds can be raised from shareholders through a fairly priced rights issue. Ignore all transaction costs.

Should shareholders vote to proceed with the project and equity raising? What will be the gain in shareholder wealth if they decide to proceed?

Question 434 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

What is the payoff to debt holders at maturity, assuming that they keep their debt until maturity?

Question 433 Merton model of corporate debt, real option, option, no explanation

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

What is the payoff to equity holders at maturity, assuming that they keep their shares until maturity?

Former RBA Governor Phil Lowe says that if the economy is growing very strongly, then prices might be growing too:

Question 1019 RBA cash rate, monetary policy, wealth effect

Former RBA Governor Phil Lowe says that when the RBA raise the cash rate, asset prices tend to:

A stock has a beta of 1.2. Its next dividend is expected to be $20, paid one year from now.

Dividends are expected to be paid annually and grow by 1.5% pa forever.

Treasury bonds yield 3% pa and the market portfolio's expected return is 7% pa. All returns are effective annual rates.

What is the price of the stock now?

Assume that the market portfolio has a duration of 15 years and an individual stock has a duration of 20 years.

What can you say about the stock's (single factor CAPM) beta with respect to the market portfolio? The stock's beta is likely to be:

A stock has a beta of 0.5. Its next dividend is expected to be $3, paid one year from now. Dividends are expected to be paid annually and grow by 2% pa forever. Treasury bonds yield 3% pa and the market risk premium (MRP) is 6% pa. All returns are effective annual rates.

Which of the following statements is NOT correct?

Question 871 duration, Macaulay duration, modified duration, portfolio duration

Which of the following statements about Macaulay duration is NOT correct? The Macaulay duration:

Question 872 duration, Macaulay duration, modified duration, portfolio duration

A fixed coupon bond’s modified duration is 20 years, and yields are currently 10% pa compounded annually. Which of the following statements about the bond is NOT correct?

Which of the following statements about bond convexity is NOT correct?

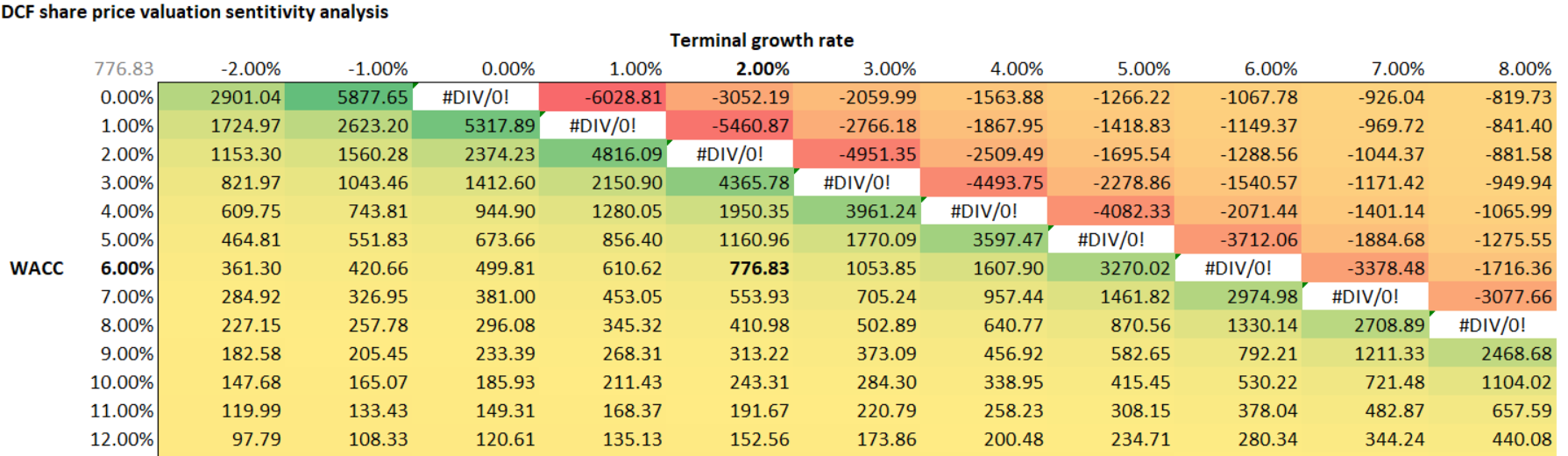

An analyst has prepared a discounted cash flow model to value a firm's share price. A sensitivity analysis data table with ‘conditional formatting’ shading is shown below. The table shows how changes in the weighted average cost of capital (WACC, left column) and terminal value growth rate (top row) affect the firm's model-estimated share price.

The base case estimates are shown in bold.

Which of the following statements is NOT correct? The model-estimated share price would normally be expected to:

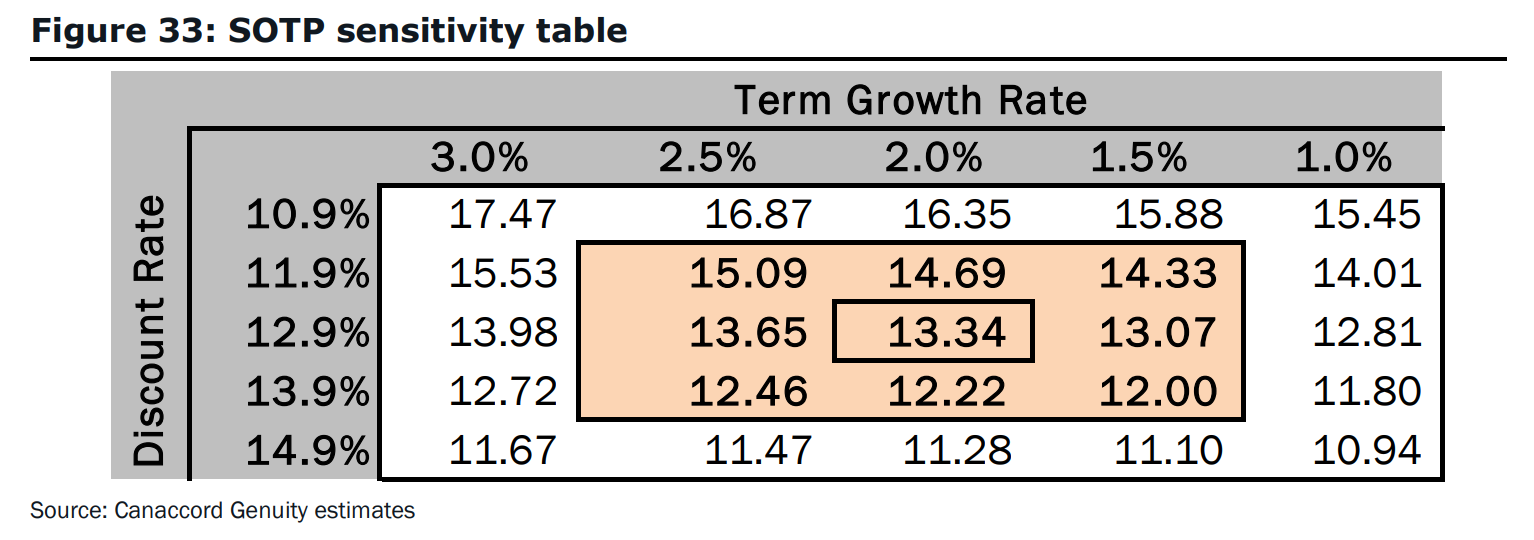

Canaccord conducts a sensitivity analysis of the Israeli pharmaceutical firm InterCure's (INCR) estimated share price in figure 33 on page 30:

Estimate the Macaulay duration of INCR's equity. The Macaulay duration is approximately:

A man just sold a call option to his counterparty, a lady. The man has just now:

A European call option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the call option?

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the put option?

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from having written (being short) the put option?

Which of the following statements about option contracts is NOT correct? For every:

A levered firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced.

| Balance Sheet Market Values and Betas | ||

| Balance sheet item | Market value ($m) | Beta |

| Cash asset | 0.5 | 0 |

| Truck assets | 0.5 | 2 |

| Loan liabilities | 0.25 | 0.1 |

| Equity funding | ? | ? |

Which of the following statements is NOT correct?

A levered firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced.

| Balance Sheet Market Values and Betas | ||

| Balance sheet item | Market value ($m) | Beta |

| Cash asset | 0.5 | 0 |

| Truck assets | 0.5 | 2 |

| Loan liabilities | 0.25 | 0.1 |

| Equity funding | ? | ? |

The firm then pays off (retires) all of its loan liabilities using its cash. Ignore interest tax shields.

Which of the following statements is NOT correct? All answers are given to 6 decimal places. This event led to a:

If trader A has sold the right that allows counterparty B to buy the underlying asset from him at maturity if counterparty B wants then trader A is: