By convention, money market securities' yields are always quoted as:

Question 327 bill pricing, simple interest rate, no explanation

On 27/09/13, three month Swiss government bills traded at a yield of -0.2%, given as a simple annual yield. That is, interest rates were negative.

If the face value of one of these 90 day bills is CHF1,000,000 (CHF represents Swiss Francs, the Swiss currency), what is the price of one of these bills?

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's market capitalisation of equity?

A stock is just about to pay a dividend of $1 tonight. Future annual dividends are expected to grow by 2% pa. The next dividend of $1 will be paid tonight, and the year after that the dividend will be $1.02 (=1*(1+0.02)^1), and a year later 1.0404 (=1*(1+0.04)^2) and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

A stock is expected to pay its first dividend of $20 in 3 years (t=3), which it will continue to pay for the next nine years, so there will be ten $20 payments altogether with the last payment in year 12 (t=12).

From the thirteenth year onward, the dividend is expected to be 4% more than the previous year, forever. So the dividend in the thirteenth year (t=13) will be $20.80, then $21.632 in year 14, and so on forever. The required return of the stock is 10% pa. All rates are effective annual rates. Calculate the current (t=0) stock price.

A stock is expected to pay a dividend of $15 in one year (t=1), then $25 for 9 years after that (payments at t=2 ,3,...10), and on the 11th year (t=11) the dividend will be 2% less than at t=10, and will continue to shrink at the same rate every year after that forever. The required return of the stock is 10%. All rates are effective annual rates.

What is the price of the stock now?

Question 488 income and capital returns, payout policy, payout ratio, DDM

Two companies BigDiv and ZeroDiv are exactly the same except for their dividend payouts.

BigDiv pays large dividends and ZeroDiv doesn't pay any dividends.

Currently the two firms have the same earnings, assets, number of shares, share price, expected total return and risk.

Assume a perfect world with no taxes, no transaction costs, no asymmetric information and that all assets including business projects are fairly priced and therefore zero-NPV.

All things remaining equal, which of the following statements is NOT correct?

When using the dividend discount model, care must be taken to avoid using a nominal dividend growth rate that exceeds the country's nominal GDP growth rate. Otherwise the firm is forecast to take over the country since it grows faster than the average business forever.

Suppose a firm's nominal dividend grows at 10% pa forever, and nominal GDP growth is 5% pa forever. The firm's total dividends are currently $1 billion (t=0). The country's GDP is currently $1,000 billion (t=0).

In approximately how many years will the company's total dividends be as large as the country's GDP?

Itau Unibanco is a major listed bank in Brazil with a market capitalisation of equity equal to BRL 85.744 billion, EPS of BRL 3.96 and 2.97 billion shares on issue.

Banco Bradesco is another major bank with total earnings of BRL 8.77 billion and 2.52 billion shares on issue.

Estimate Banco Bradesco's current share price using a price-earnings multiples approach assuming that Itau Unibanco is a comparable firm.

Note that BRL is the Brazilian Real, their currency. Figures sourced from Google Finance on the market close of the BVMF on 24 July 2015.

Question 535 DDM, real and nominal returns and cash flows, stock pricing

You are an equities analyst trying to value the equity of the Australian telecoms company Telstra, with ticker TLS. In Australia, listed companies like Telstra tend to pay dividends every 6 months. The payment around August is called the final dividend and the payment around February is called the interim dividend. Both occur annually.

- Today is mid-March 2015.

- TLS's last interim dividend of $0.15 was one month ago in mid-February 2015.

- TLS's last final dividend of $0.15 was seven months ago in mid-August 2014.

Judging by TLS's dividend history and prospects, you estimate that the nominal dividend growth rate will be 1% pa. Assume that TLS's total nominal cost of equity is 6% pa. The dividends are nominal cash flows and the inflation rate is 2.5% pa. All rates are quoted as nominal effective annual rates. Assume that each month is exactly one twelfth (1/12) of a year, so you can ignore the number of days in each month.

Calculate the current TLS share price.

The following table shows a sample of historical total returns of shares in two different companies A and B.

| Stock Returns | ||

| Total effective annual returns | ||

| Year | ##r_A## | ##r_B## |

| 2007 | 0.2 | 0.4 |

| 2008 | 0.04 | -0.2 |

| 2009 | -0.1 | -0.3 |

| 2010 | 0.18 | 0.5 |

What is the historical sample covariance (##\hat{\sigma}_{A,B}##) and correlation (##\rho_{A,B}##) of stock A and B's total effective annual returns?

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the expected return of the above portfolio?

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Covariance ##(\sigma_{A,B})## | Beta | Dollars invested |

|

| A | 0.2 | 0.4 | 0.12 | 0.5 | 40 | |

| B | 0.3 | 0.8 | 1.5 | 80 | ||

What is the standard deviation (not variance) of the above portfolio? Note that the stocks' covariance is given, not correlation.

The standard deviation and variance of a stock's annual returns are calculated over a number of years. The units of the returns are percent per annum ##(\% pa)##.

What are the units of the standard deviation ##(\sigma)## and variance ##(\sigma^2)## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

A stock's returns are normally distributed with a mean of 10% pa and a standard deviation of 20 percentage points pa. What is the 90% confidence interval of returns over the next year? Note that the Z-statistic corresponding to a one-tail:

- 90% normal probability density function is 1.282.

- 95% normal probability density function is 1.645.

- 97.5% normal probability density function is 1.960.

The 90% confidence interval of annual returns is between:

A stock has an expected return of 10% pa and you're 90% sure that over the next year, the return will be between -15% and 35%. The stock's returns are normally distributed. Note that the Z-statistic corresponding to a one-tail:

- 90% normal probability density function is 1.282.

- 95% normal probability density function is 1.645.

- 97.5% normal probability density function is 1.960.

What is the stock’s standard deviation of returns in percentage points per annum (pp pa)?

What is the covariance of a variable X with a constant C?

The cov(X, C) or ##\sigma_{X,C}## equals:

You just borrowed $400,000 in the form of a 25 year interest-only mortgage with monthly payments of $3,000 per month. The interest rate is 9% pa which is not expected to change.

You actually plan to pay more than the required interest payment. You plan to pay $3,300 in mortgage payments every month, which your mortgage lender allows. These extra payments will reduce the principal and the minimum interest payment required each month.

At the maturity of the mortgage, what will be the principal? That is, after the last (300th) interest payment of $3,300 in 25 years, how much will be owing on the mortgage?

You are promised 20 payments of $100, where the first payment is immediate (t=0) and the last is at the end of the 19th year (t=19). The effective annual discount rate is ##r##.

Which of the following equations does NOT give the correct present value of these 20 payments?

Some countries' interest rates are so low that they're zero.

If interest rates are 0% pa and are expected to stay at that level for the foreseeable future, what is the most that you would be prepared to pay a bank now if it offered to pay you $10 at the end of every year for the next 5 years?

In other words, what is the present value of five $10 payments at time 1, 2, 3, 4 and 5 if interest rates are 0% pa?

On his 20th birthday, a man makes a resolution. He will deposit $30 into a bank account at the end of every month starting from now, which is the start of the month. So the first payment will be in one month. He will write in his will that when he dies the money in the account should be given to charity.

The bank account pays interest at 6% pa compounding monthly, which is not expected to change.

If the man lives for another 60 years, how much money will be in the bank account if he dies just after making his last (720th) payment?

Bonds X and Y are issued by the same US company. Both bonds yield 10% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X and Y's coupon rates are 8 and 12% pa respectively. Which of the following statements is true?

Which one of the following bonds is trading at a discount?

Which one of the following bonds is trading at a premium?

An investor bought two fixed-coupon bonds issued by the same company, a zero-coupon bond and a 7% pa semi-annual coupon bond. Both bonds have a face value of $1,000, mature in 10 years, and had a yield at the time of purchase of 8% pa.

A few years later, yields fell to 6% pa. Which of the following statements is correct? Note that a capital gain is an increase in price.

In these tough economic times, central banks around the world have cut interest rates so low that they are practically zero. In some countries, government bond yields are also very close to zero.

A three year government bond with a face value of $100 and a coupon rate of 2% pa paid semi-annually was just issued at a yield of 0%. What is the price of the bond?

An investor bought a 20 year 5% pa fixed coupon government bond priced at par. The face value is $100. Coupons are paid semi-annually and the next one is in 6 months.

Six months later, just after the coupon at that time was paid, yields suddenly and unexpectedly rose to 5.5% pa. Note that all yields above are given as APR's compounding semi-annually.

What was the bond investors' historical total return over that first 6 month period, given as an effective semi-annual rate?

For a price of $100, Rad will sell you a 5 year bond paying semi-annual coupons of 16% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 6% pa.

For a price of $100, Vera will sell you a 2 year bond paying semi-annual coupons of 10% pa. The face value of the bond is $100. Other bonds with similar risk, maturity and coupon characteristics trade at a yield of 8% pa.

For a price of $95, Nicole will sell you a 10 year bond paying semi-annual coupons of 8% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 8% pa.

A firm wishes to raise $10 million now. They will issue 6% pa semi-annual coupon bonds that will mature in 8 years and have a face value of $1,000 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue? All numbers are rounded up.

Question 143 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds:

- A 6-month zero coupon bond at a yield of 6% pa, and

- A 12 month zero coupon bond at a yield of 7% pa.

What is the company's forward rate from 6 to 12 months? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

Question 572 bond pricing, zero coupon bond, term structure of interest rates, expectations hypothesis, forward interest rate, yield curve

In the below term structure of interest rates equation, all rates are effective annual yields and the numbers in subscript represent the years that the yields are measured over:

###(1+r_{0-3})^3 = (1+r_{0-1})(1+r_{1-2})(1+r_{2-3}) ###

Which of the following statements is NOT correct?

Question 573 bond pricing, zero coupon bond, term structure of interest rates, expectations hypothesis, liquidity premium theory, forward interest rate, yield curve

In the below term structure of interest rates equation, all rates are effective annual yields and the numbers in subscript represent the years that the yields are measured over:

###(1+r_{0-3})^3 = (1+r_{0-1})(1+r_{1-2})(1+r_{2-3}) ###

Which of the following statements is NOT correct?

Question 693 boot strapping zero coupon yield, forward interest rate, term structure of interest rates

Information about three risk free Government bonds is given in the table below.

| Federal Treasury Bond Data | ||||

| Maturity | Yield to maturity | Coupon rate | Face value | Price |

| (years) | (pa, compounding semi-annually) | (pa, paid semi-annually) | ($) | ($) |

| 0.5 | 3% | 4% | 100 | 100.4926 |

| 1 | 4% | 4% | 100 | 100.0000 |

| 1.5 | 5% | 4% | 100 | 98.5720 |

Based on the above government bonds' yields to maturity, which of the below statements about the spot zero rates and forward zero rates is NOT correct?

Question 784 boot strapping zero coupon yield, forward interest rate, term structure of interest rates

Information about three risk free Government bonds is given in the table below.

| Federal Treasury Bond Data | ||||

| Maturity | Yield to maturity | Coupon rate | Face value | Price |

| (years) | (pa, compounding annually) | (pa, paid annually) | ($) | ($) |

| 1 | 0% | 2% | 100 | 102 |

| 2 | 1% | 2% | 100 | 101.9703951 |

| 3 | 2% | 2% | 100 | 100 |

Based on the above government bonds' yields to maturity, which of the below statements about the spot zero rates and forward zero rates is NOT correct?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume an equal amount now (t=0) and in one year (t=1) and have nothing left in the bank at the end (t=1).

How much can you consume at each time?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume an equal amount now (t=0), in one year (t=1) and in two years (t=2), and still have $50,000 in the bank after that (t=2).

How much can you consume at each time?

A firm is considering a business project which costs $10m now and is expected to pay a single cash flow of $12.1m in two years.

Assume that the initial $10m cost is funded using the firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

Your neighbour asks you for a loan of $100 and offers to pay you back $120 in one year.

You don't actually have any money right now, but you can borrow and lend from the bank at a rate of 10% pa. Rates are given as effective annual rates.

Assume that your neighbour will definitely pay you back. Ignore interest tax shields and transaction costs.

The Net Present Value (NPV) of lending to your neighbour is $9.09. Describe what you would do to actually receive a $9.09 cash flow right now with zero net cash flows in the future.

A stock has a beta of 1.5. The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

In the last 5 minutes, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 1%. The risk free rate was unchanged.

What do you think was the stock's historical return over the last 5 minutes, given as an effective 5 minute rate?

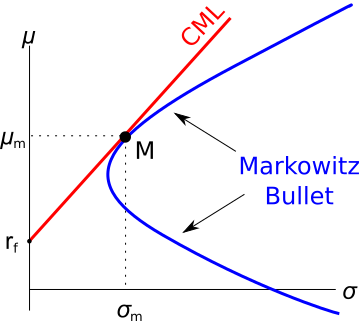

Question 778 CML, systematic and idiosyncratic risk, portfolio risk, CAPM

The capital market line (CML) is shown in the graph below. The total standard deviation is denoted by σ and the expected return is μ. Assume that markets are efficient so all assets are fairly priced.

Which of the below statements is NOT correct?

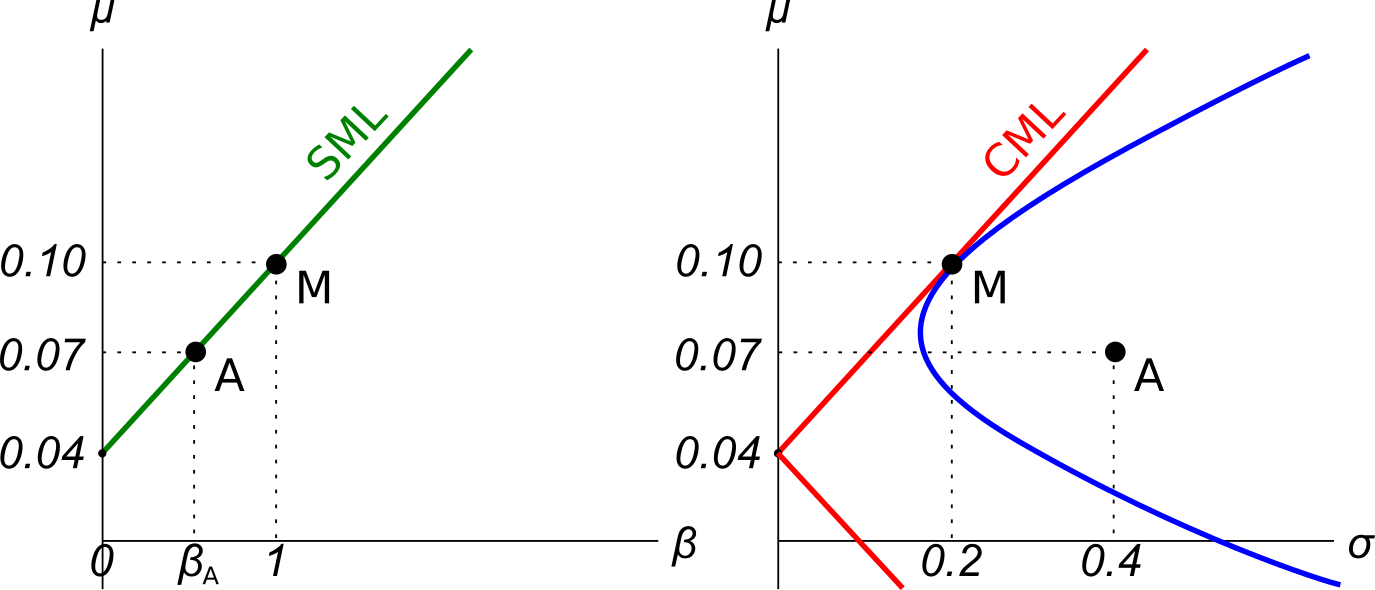

Question 810 CAPM, systematic and idiosyncratic risk, market efficiency

Examine the graphs below. Assume that asset A is a single stock. Which of the following statements is NOT correct? Asset A:

Stock A has a beta of 0.5 and stock B has a beta of 1. Which statement is NOT correct?

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

Your friend just bought a house for $1,000,000. He financed it using a $900,000 mortgage loan and a deposit of $100,000.

In the context of residential housing and mortgages, the 'equity' or 'net wealth' tied up in a house is the value of the house less the value of the mortgage loan. Assuming that your friend's only asset is his house, his net wealth is $100,000.

If house prices suddenly fall by 15%, what would be your friend's percentage change in net wealth?

Assume that:

- No income (rent) was received from the house during the short time over which house prices fell.

- Your friend will not declare bankruptcy, he will always pay off his debts.

Question 800 leverage, portfolio return, risk, portfolio risk, capital structure, no explanation

Which of the following assets would you expect to have the highest required rate of return? All values are current market values.

A firm has a debt-to-assets ratio of 20%. What is its debt-to-equity ratio?

A firm can issue 3 year annual coupon bonds at a yield of 10% pa and a coupon rate of 8% pa.

The beta of its levered equity is 2. The market's expected return is 10% pa and 3 year government bonds yield 6% pa with a coupon rate of 4% pa.

The market value of equity is $1 million and the market value of debt is $1 million. The corporate tax rate is 30%.

What is the firm's after-tax WACC? Assume a classical tax system.

The equations for Net Income (NI, also known as Earnings or Net Profit After Tax) and Cash Flow From Assets (CFFA, also known as Free Cash Flow to the Firm) per year are:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c)###

###CFFA=NI+Depr-CapEx - \varDelta NWC+IntExp###

For a firm with debt, what is the amount of the interest tax shield per year?

The equations for Net Income (NI, also known as Earnings or Net Profit After Tax) and Cash Flow From Assets (CFFA, also known as Free Cash Flow to the Firm) per year are:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c)###

###CFFA=NI+Depr-CapEx - \varDelta NWC+IntExp###

For a firm with debt, what is the formula for the present value of interest tax shields if the tax shields occur in perpetuity?

You may assume:

- the value of debt (D) is constant through time,

- The cost of debt and the yield on debt are equal and given by ##r_D##.

- the appropriate rate to discount interest tax shields is ##r_D##.

- ##\text{IntExp}=D.r_D##

Interest expense (IntExp) is an important part of a company's income statement (or 'profit and loss' or 'statement of financial performance').

How does an accountant calculate the annual interest expense of a fixed-coupon bond that has a liquid secondary market? Select the most correct answer:

Annual interest expense is equal to:

To receive the dividend you must own the stock when the market closes on which date?

A company conducts a 10 for 3 stock split. What is the percentage increase in the stock price and the number of shares outstanding? The answers are given in the same order.

A firm conducts a two-for-one stock split. Which of the following consequences would NOT be expected?

In the dividend discount model (DDM), share prices fall when dividends are paid. Let the high price before the fall be called the peak, and the low price after the fall be called the trough.

###P_0=\dfrac{C_1}{r-g}###

Which of the following statements about the DDM is NOT correct?

For certain shares, the forward-looking Price-Earnings Ratio (##P_0/EPS_1##) is equal to the inverse of the share's total expected return (##1/r_\text{total}##). For what shares is this true?

Use the general accounting definition of 'payout ratio' which is dividends per share (DPS) divided by earnings per share (EPS) and assume that all cash flows, earnings and rates are real rather than nominal.

A company's forward-looking PE ratio will be the inverse of its total expected return on equity when it has a:

A mature firm has constant expected future earnings and dividends. Both amounts are equal. So earnings and dividends are expected to be equal and unchanging.

Which of the following statements is NOT correct?

Which firms tend to have high forward-looking price-earnings (PE) ratios?

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Of the 15% pa total expected return, the dividend yield is expected to always be 7% pa and rest is the capital yield.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% total return lasts for the next 100 years (t=0 to 100), then reverts to 10% after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant, the dividends can only be re-invested at 10% pa and all returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):