What is the Internal Rate of Return (IRR) of the project detailed in the table below?

Assume that the cash flows shown in the table are paid all at once at the given point in time. All answers are given as effective annual rates.

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume an equal amount now (t=0), in one year (t=1) and in two years (t=2), and still have $50,000 in the bank after that (t=2).

How much can you consume at each time?

Your neighbour asks you for a loan of $100 and offers to pay you back $120 in one year.

You don't actually have any money right now, but you can borrow and lend from the bank at a rate of 10% pa. Rates are given as effective annual rates.

Assume that your neighbour will definitely pay you back. Ignore interest tax shields and transaction costs.

The Net Present Value (NPV) of lending to your neighbour is $9.09. Describe what you would do to actually receive a $9.09 cash flow right now with zero net cash flows in the future.

An asset's total expected return over the next year is given by:

###r_\text{total} = \dfrac{c_1+p_1-p_0}{p_0} ###

Where ##p_0## is the current price, ##c_1## is the expected income in one year and ##p_1## is the expected price in one year. The total return can be split into the income return and the capital return.

Which of the following is the expected capital return?

One and a half years ago Frank bought a house for $600,000. Now it's worth only $500,000, based on recent similar sales in the area.

The expected total return on Frank's residential property is 7% pa.

He rents his house out for $1,600 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $18,617.27.

The future value of 12 months of rental payments one year in the future is $19,920.48.

What is the expected annual rental yield of the property? Ignore the costs of renting such as maintenance, real estate agent fees and so on.

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

Question 575 inflation, real and nominal returns and cash flows

You expect a nominal payment of $100 in 5 years. The real discount rate is 10% pa and the inflation rate is 3% pa. Which of the following statements is NOT correct?

A stock just paid a dividend of $1. Future annual dividends are expected to grow by 2% pa. The next dividend of $1.02 (=1*(1+0.02)^1) will be in one year, and the year after that the dividend will be $1.0404 (=1*(1+0.02)^2), and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

Question 50 DDM, stock pricing, inflation, real and nominal returns and cash flows

Most listed Australian companies pay dividends twice per year, the 'interim' and 'final' dividends, which are roughly 6 months apart.

You are an equities analyst trying to value the company BHP. You decide to use the Dividend Discount Model (DDM) as a starting point, so you study BHP's dividend history and you find that BHP tends to pay the same interim and final dividend each year, and that both grow by the same rate.

You expect BHP will pay a $0.55 interim dividend in six months and a $0.55 final dividend in one year. You expect each to grow by 4% next year and forever, so the interim and final dividends next year will be $0.572 each, and so on in perpetuity.

Assume BHP's cost of equity is 8% pa. All rates are quoted as nominal effective rates. The dividends are nominal cash flows and the inflation rate is 2.5% pa.

What is the current price of a BHP share?

Carlos and Edwin are brothers and they both love Holden Commodore cars.

Carlos likes to buy the latest Holden Commodore car for $40,000 every 4 years as soon as the new model is released. As soon as he buys the new car, he sells the old one on the second hand car market for $20,000. Carlos never has to bother with paying for repairs since his cars are brand new.

Edwin also likes Commodores, but prefers to buy 4-year old cars for $20,000 and keep them for 11 years until the end of their life (new ones last for 15 years in total but the 4-year old ones only last for another 11 years). Then he sells the old car for $2,000 and buys another 4-year old second hand car, and so on.

Every time Edwin buys a second hand 4 year old car he immediately has to spend $1,000 on repairs, and then $1,000 every year after that for the next 10 years. So there are 11 payments in total from when the second hand car is bought at t=0 to the last payment at t=10. One year later (t=11) the old car is at the end of its total 15 year life and can be scrapped for $2,000.

Assuming that Carlos and Edwin maintain their love of Commodores and keep up their habits of buying new ones and second hand ones respectively, how much larger is Carlos' equivalent annual cost of car ownership compared with Edwin's?

The real discount rate is 10% pa. All cash flows are real and are expected to remain constant. Inflation is forecast to be 3% pa. All rates are effective annual. Ignore capital gains tax and tax savings from depreciation since cars are tax-exempt for individuals.

You own a nice suit which you wear once per week on nights out. You bought it one year ago for $600. In your experience, suits used once per week last for 6 years. So you expect yours to last for another 5 years.

Your younger brother said that retro is back in style so he wants to wants to borrow your suit once a week when he goes out. With the increased use, your suit will only last for another 4 years rather than 5.

What is the present value of the cost of letting your brother use your current suit for the next 4 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new suit when your current one wears out and your brother will not use the new one; your brother will only use your current suit so he will only use it for the next four years; and the price of a new suit never changes.

You own some nice shoes which you use once per week on date nights. You bought them 2 years ago for $500. In your experience, shoes used once per week last for 6 years. So you expect yours to last for another 4 years.

Your younger sister said that she wants to borrow your shoes once per week. With the increased use, your shoes will only last for another 2 years rather than 4.

What is the present value of the cost of letting your sister use your current shoes for the next 2 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new pair of shoes when your current pair wears out and your sister will not use the new ones; your sister will only use your current shoes so she will only use it for the next 2 years; and the price of new shoes never changes.

You just bought a nice dress which you plan to wear once per month on nights out. You bought it a moment ago for $600 (at t=0). In your experience, dresses used once per month last for 6 years.

Your younger sister is a student with no money and wants to borrow your dress once a month when she hits the town. With the increased use, your dress will only last for another 3 years rather than 6.

What is the present value of the cost of letting your sister use your current dress for the next 3 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new dress when your current one wears out; your sister will only use the current dress, not the next one that you will buy; and the price of a new dress never changes.

A project's NPV is positive. Select the most correct statement:

Question 523 income and capital returns, real and nominal returns and cash flows, inflation

A low-growth mature stock has an expected nominal total return of 6% pa and nominal capital return of 2% pa. Inflation is expected to be 3% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the stock's expected real total, capital and income returns?

The answer choices below are given in the same order.

Question 498 NPV, Annuity, perpetuity with growth, multi stage growth model

A business project is expected to cost $100 now (t=0), then pay $10 at the end of the third (t=3), fourth, fifth and sixth years, and then grow by 5% pa every year forever. So the cash flow will be $10.5 at the end of the seventh year (t=7), then $11.025 at the end of the eighth year (t=8) and so on perpetually. The total required return is 10℅ pa.

Which of the following formulas will NOT give the correct net present value of the project?

Question 728 inflation, real and nominal returns and cash flows, income and capital returns, no explanation

Which of the following statements about gold is NOT correct? Assume that the gold price increases by inflation. Gold has a:

Question 729 book and market values, balance sheet, no explanation

If a firm makes a profit and pays no dividends, which of the firm’s accounts will increase?

Stocks in the United States usually pay quarterly dividends. For example, the software giant Microsoft paid a $0.23 dividend every quarter over the 2013 financial year and plans to pay a $0.28 dividend every quarter over the 2014 financial year.

Using the dividend discount model and net present value techniques, calculate the stock price of Microsoft assuming that:

- The time now is the beginning of July 2014. The next dividend of $0.28 will be received in 3 months (end of September 2014), with another 3 quarterly payments of $0.28 after this (end of December 2014, March 2015 and June 2015).

- The quarterly dividend will increase by 2.5% every year, but each quarterly dividend over the year will be equal. So each quarterly dividend paid in the financial year beginning in September 2015 will be $ 0.287 ##(=0.28×(1+0.025)^1)##, with the last at the end of June 2016. In the next financial year beginning in September 2016 each quarterly dividend will be $0.294175 ##(=0.28×(1+0.025)^2)##, with the last at the end of June 2017, and so on forever.

- The total required return on equity is 6% pa.

- The required return and growth rate are given as effective annual rates.

- Dividend payment dates and ex-dividend dates are at the same time.

- Remember that there are 4 quarters in a year and 3 months in a quarter.

What is the current stock price?

You just borrowed $400,000 in the form of a 25 year interest-only mortgage with monthly payments of $3,000 per month. The interest rate is 9% pa which is not expected to change.

You actually plan to pay more than the required interest payment. You plan to pay $3,300 in mortgage payments every month, which your mortgage lender allows. These extra payments will reduce the principal and the minimum interest payment required each month.

At the maturity of the mortgage, what will be the principal? That is, after the last (300th) interest payment of $3,300 in 25 years, how much will be owing on the mortgage?

You want to buy an apartment worth $300,000. You have saved a deposit of $60,000.

The bank has agreed to lend you $240,000 as an interest only mortgage loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

Question 239 income and capital returns, inflation, real and nominal returns and cash flows, interest only loan

A bank grants a borrower an interest-only residential mortgage loan with a very large 50% deposit and a nominal interest rate of 6% that is not expected to change. Assume that inflation is expected to be a constant 2% pa over the life of the loan. Ignore credit risk.

From the bank's point of view, what is the long term expected nominal capital return of the loan asset?

Let the 'income return' of a bond be the coupon at the end of the period divided by the market price now at the start of the period ##(C_1/P_0)##. The expected income return of a premium fixed coupon bond is:

In these tough economic times, central banks around the world have cut interest rates so low that they are practically zero. In some countries, government bond yields are also very close to zero.

A three year government bond with a face value of $100 and a coupon rate of 2% pa paid semi-annually was just issued at a yield of 0%. What is the price of the bond?

Your main expense is fuel for your car which costs $100 per month. You just refueled, so you won't need any more fuel for another month (first payment at t=1 month).

You have $2,500 in a bank account which pays interest at a rate of 6% pa, payable monthly. Interest rates are not expected to change.

Assuming that you have no income, in how many months time will you not have enough money to fully refuel your car?

What is the net present value (NPV) of undertaking a full-time Australian undergraduate business degree as an Australian citizen? Only include the cash flows over the duration of the degree, ignore any benefits or costs of the degree after it's completed.

Assume the following:

- The degree takes 3 years to complete and all students pass all subjects.

- There are 2 semesters per year and 4 subjects per semester.

- University fees per subject per semester are $1,277, paid at the start of each semester. Fees are expected to remain constant in real terms for the next 3 years.

- There are 52 weeks per year.

- The first semester is just about to start (t=0). The first semester lasts for 19 weeks (t=0 to 19).

- The second semester starts immediately afterwards (t=19) and lasts for another 19 weeks (t=19 to 38).

- The summer holidays begin after the second semester ends and last for 14 weeks (t=38 to 52). Then the first semester begins the next year, and so on.

- Working full time at the grocery store instead of studying full-time pays $20/hr and you can work 35 hours per week. Wages are paid at the end of each week and are expected to remain constant in real terms.

- Full-time students can work full-time during the summer holiday at the grocery store for the same rate of $20/hr for 35 hours per week.

- The discount rate is 9.8% pa. All rates and cash flows are real. Inflation is expected to be 3% pa. All rates are effective annual.

The NPV of costs from undertaking the university degree is:

Why is Capital Expenditure (CapEx) subtracted in the Cash Flow From Assets (CFFA) formula?

###CFFA=NI+Depr-CapEx - \Delta NWC+IntExp###

A firm has forecast its Cash Flow From Assets (CFFA) for this year and management is worried that it is too low. Which one of the following actions will lead to a higher CFFA for this year (t=0 to 1)? Only consider cash flows this year. Do not consider cash flows after one year, or the change in the NPV of the firm. Consider each action in isolation.

Over the next year, the management of an unlevered company plans to:

- Make $5m in sales, $1.9m in net income and $2m in equity free cash flow (EFCF).

- Pay dividends of $1m.

- Complete a $1.3m share buy-back.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to legally pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

Find the cash flow from assets (CFFA) of the following project.

| Project Data | ||

| Project life | 2 years | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year for tax purposes | $1m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $3 | |

| Fixed costs per year, paid at the end of each year | $1.5m | |

| Tax rate | 30% | |

Note 1: The equipment will have a book value of $4m at the end of the project for tax purposes. However, the equipment is expected to fetch $0.9 million when it is sold at t=2.

Note 2: Due to the project, the firm will have to purchase $0.8m of inventory initially, which it will sell at t=1. The firm will buy another $0.8m at t=1 and sell it all again at t=2 with zero inventory left. The project will have no effect on the firm's current liabilities.

Find the project's CFFA at time zero, one and two. Answers are given in millions of dollars ($m).

Value the following business project to manufacture a new product.

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year | $3m | |

| Expected sale price of equipment at end of project | $0.6m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $5 | |

| Fixed costs per year, paid at the end of each year | $1m | |

| Interest expense per year | 0 | |

| Tax rate | 30% | |

| Weighted average cost of capital after tax per annum | 10% | |

Notes

- The firm's current assets and current liabilities are $3m and $2m respectively right now. This net working capital will not be used in this project, it will be used in other unrelated projects.

Due to the project, current assets (mostly inventory) will grow by $2m initially (at t = 0), and then by $0.2m at the end of the first year (t=1).

Current liabilities (mostly trade creditors) will increase by $0.1m at the end of the first year (t=1).

At the end of the project, the net working capital accumulated due to the project can be sold for the same price that it was bought. - The project cost $0.5m to research which was incurred one year ago.

Assumptions

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 3% pa.

- All rates are given as effective annual rates.

- The business considering the project is run as a 'sole tradership' (run by an individual without a company) and is therefore eligible for a 50% capital gains tax discount when the equipment is sold, as permitted by the Australian Tax Office.

What is the expected net present value (NPV) of the project?

Interest expense (IntExp) is an important part of a company's income statement (or 'profit and loss' or 'statement of financial performance').

How does an accountant calculate the annual interest expense of a fixed-coupon bond that has a liquid secondary market? Select the most correct answer:

Annual interest expense is equal to:

A firm has a debt-to-equity ratio of 25%. What is its debt-to-assets ratio?

A manufacturing company is considering a new project in the more risky services industry. The cash flows from assets (CFFA) are estimated for the new project, with interest expense excluded from the calculations. To get the levered value of the project, what should these unlevered cash flows be discounted by?

Assume that the manufacturing firm has a target debt-to-assets ratio that it sticks to.

The US firm Google operates in the online advertising business. In 2011 Google bought Motorola Mobility which manufactures mobile phones.

Assume the following:

- Google had a 10% after-tax weighted average cost of capital (WACC) before it bought Motorola.

- Motorola had a 20% after-tax WACC before it merged with Google.

- Google and Motorola have the same level of gearing.

- Both companies operate in a classical tax system.

You are a manager at Motorola. You must value a project for making mobile phones. Which method(s) will give the correct valuation of the mobile phone manufacturing project? Select the most correct answer.

The mobile phone manufacturing project's:

A firm has a debt-to-assets ratio of 50%. The firm then issues a large amount of equity to raise money for new projects of similar systematic risk to the company's existing projects. Assume a classical tax system. Which statement is correct?

A firm has a debt-to-assets ratio of 50%. The firm then issues a large amount of debt to raise money for new projects of similar market risk to the company's existing projects. Assume a classical tax system. Which statement is correct?

Question 337 capital structure, interest tax shield, leverage, real and nominal returns and cash flows, multi stage growth model

A fast-growing firm is suitable for valuation using a multi-stage growth model.

It's nominal unlevered cash flow from assets (##CFFA_U##) at the end of this year (t=1) is expected to be $1 million. After that it is expected to grow at a rate of:

- 12% pa for the next two years (from t=1 to 3),

- 5% over the fourth year (from t=3 to 4), and

- -1% forever after that (from t=4 onwards). Note that this is a negative one percent growth rate.

Assume that:

- The nominal WACC after tax is 9.5% pa and is not expected to change.

- The nominal WACC before tax is 10% pa and is not expected to change.

- The firm has a target debt-to-equity ratio that it plans to maintain.

- The inflation rate is 3% pa.

- All rates are given as nominal effective annual rates.

What is the levered value of this fast growing firm's assets?

Question 370 capital budgeting, NPV, interest tax shield, WACC, CFFA

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $600k | |

| Depreciation of equipment per year | $250k | |

| Expected sale price of equipment at end of project | $200k | |

| Revenue per job | $12k | |

| Variable cost per job | $4k | |

| Quantity of jobs per year | 120 | |

| Fixed costs per year, paid at the end of each year | $100k | |

| Interest expense in first year (at t=1) | $16.091k | |

| Interest expense in second year (at t=2) | $9.711k | |

| Tax rate | 30% | |

| Government treasury bond yield | 5% | |

| Bank loan debt yield | 6% | |

| Levered cost of equity | 12.5% | |

| Market portfolio return | 10% | |

| Beta of assets | 1.24 | |

| Beta of levered equity | 1.5 | |

| Firm's and project's debt-to-equity ratio | 25% | |

Notes

- The project will require an immediate purchase of $50k of inventory, which will all be sold at cost when the project ends. Current liabilities are negligible so they can be ignored.

Assumptions

- The debt-to-equity ratio will be kept constant throughout the life of the project. The amount of interest expense at the end of each period has been correctly calculated to maintain this constant debt-to-equity ratio. Note that interest expense is different in each year.

- Thousands are represented by 'k' (kilo).

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are nominal. The inflation rate is 2% pa.

- All rates are given as effective annual rates.

- The 50% capital gains tax discount is not available since the project is undertaken by a firm, not an individual.

What is the net present value (NPV) of the project?

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

One method for calculating a firm's free cash flow (FFCF, or CFFA) is to ignore interest expense. That is, pretend that interest expense ##(IntExp)## is zero:

###\begin{aligned} FFCF &= (Rev - COGS - Depr - FC - IntExp)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp \\ &= (Rev - COGS - Depr - FC - 0)(1-t_c) + Depr - CapEx -\Delta NWC - 0\\ \end{aligned}###

Question 413 CFFA, interest tax shield, depreciation tax shield

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA).

One method is to use the following formulas to transform net income (NI) into FFCF including interest and depreciation tax shields:

###FFCF=NI + Depr - CapEx -ΔNWC + IntExp###

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )###

Another popular method is to use EBITDA rather than net income. EBITDA is defined as:

###EBITDA=Rev - COGS - FC###

One of the below formulas correctly calculates FFCF from EBITDA, including interest and depreciation tax shields, giving an identical answer to that above. Which formula is correct?

Question 69 interest tax shield, capital structure, leverage, WACC

Which statement about risk, required return and capital structure is the most correct?

Question 121 capital structure, leverage, financial distress, interest tax shield

Fill in the missing words in the following sentence:

All things remaining equal, as a firm's amount of debt funding falls, benefits of interest tax shields __________ and the costs of financial distress __________.

A firm plans to issue equity and use the cash raised to pay off its debt. No assets will be bought or sold. Ignore the costs of financial distress.

Which of the following statements is NOT correct, all things remaining equal?

Question 99 capital structure, interest tax shield, Miller and Modigliani, trade off theory of capital structure

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged.

Assume that:

- The firm and individual investors can borrow at the same rate and have the same tax rates.

- The firm's debt and shares are fairly priced and the shares are repurchased at the market price, not at a premium.

- There are no market frictions relating to debt such as asymmetric information or transaction costs.

- Shareholders wealth is measured in terms of utiliity. Shareholders are wealth-maximising and risk-averse. They have a preferred level of overall leverage. Before the firm's capital restructure all shareholders were optimally levered.

According to Miller and Modigliani's theory, which statement is correct?

You deposit money into a bank. Which of the following statements is NOT correct? You:

Question 738 financial statement, balance sheet, income statement

Where can a private firm's market value of equity be found? It can be sourced from the company's:

Question 418 capital budgeting, NPV, interest tax shield, WACC, CFFA, CAPM

| Project Data | ||

| Project life | 1 year | |

| Initial investment in equipment | $8m | |

| Depreciation of equipment per year | $8m | |

| Expected sale price of equipment at end of project | 0 | |

| Unit sales per year | 4m | |

| Sale price per unit | $10 | |

| Variable cost per unit | $5 | |

| Fixed costs per year, paid at the end of each year | $2m | |

| Interest expense in first year (at t=1) | $0.562m | |

| Corporate tax rate | 30% | |

| Government treasury bond yield | 5% | |

| Bank loan debt yield | 9% | |

| Market portfolio return | 10% | |

| Covariance of levered equity returns with market | 0.32 | |

| Variance of market portfolio returns | 0.16 | |

| Firm's and project's debt-to-equity ratio | 50% | |

Notes

- Due to the project, current assets will increase by $6m now (t=0) and fall by $6m at the end (t=1). Current liabilities will not be affected.

Assumptions

- The debt-to-equity ratio will be kept constant throughout the life of the project. The amount of interest expense at the end of each period has been correctly calculated to maintain this constant debt-to-equity ratio.

- Millions are represented by 'm'.

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 2% pa. All rates are given as effective annual rates.

- The project is undertaken by a firm, not an individual.

What is the net present value (NPV) of the project?

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation ##(\rho_{A,B})## | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the standard deviation (not variance) of returns of the above portfolio?

The covariance and correlation of two stocks X and Y's annual returns are calculated over a number of years. The units of the returns are in percent per annum ##(\% pa)##.

What are the units of the covariance ##(\sigma_{X,Y})## and correlation ##(\rho_{X,Y})## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

Let the standard deviation of returns for a share per month be ##\sigma_\text{monthly}##.

What is the formula for the standard deviation of the share's returns per year ##(\sigma_\text{yearly})##?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

Let the variance of returns for a share per month be ##\sigma_\text{monthly}^2##.

What is the formula for the variance of the share's returns per year ##(\sigma_\text{yearly}^2)##?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

The following table shows a sample of historical total returns of shares in two different companies A and B.

| Stock Returns | ||

| Total effective annual returns | ||

| Year | ##r_A## | ##r_B## |

| 2007 | 0.2 | 0.4 |

| 2008 | 0.04 | -0.2 |

| 2009 | -0.1 | -0.3 |

| 2010 | 0.18 | 0.5 |

What is the historical sample covariance (##\hat{\sigma}_{A,B}##) and correlation (##\rho_{A,B}##) of stock A and B's total effective annual returns?

Diversification is achieved by investing in a large amount of stocks. What type of risk is reduced by diversification?

According to the theory of the Capital Asset Pricing Model (CAPM), total risk can be broken into two components, systematic risk and idiosyncratic risk. Which of the following events would be considered a systematic, undiversifiable event according to the theory of the CAPM?

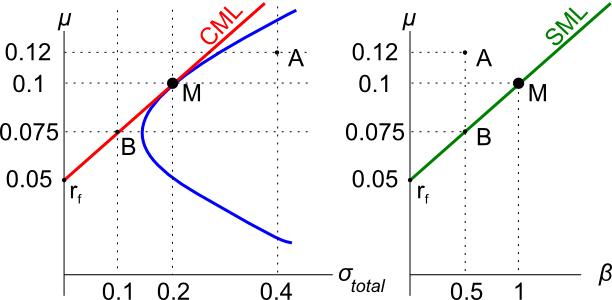

The security market line (SML) shows the relationship between beta and expected return.

Buying investment projects that plot above the SML would lead to:

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

A firm changes its capital structure by issuing a large amount of equity and using the funds to repay debt. Its assets are unchanged. Ignore interest tax shields.

According to the Capital Asset Pricing Model (CAPM), which statement is correct?

Which of the following statements about the weighted average cost of capital (WACC) is NOT correct?

Which of the following is NOT a valid method for estimating the beta of a company's stock? Assume that markets are efficient, a long history of past data is available, the stock possesses idiosyncratic and market risk. The variances and standard deviations below denote total risks.

Question 776 market efficiency, systematic and idiosyncratic risk, beta, income and capital returns

Which of the following statements about returns is NOT correct? A stock's:

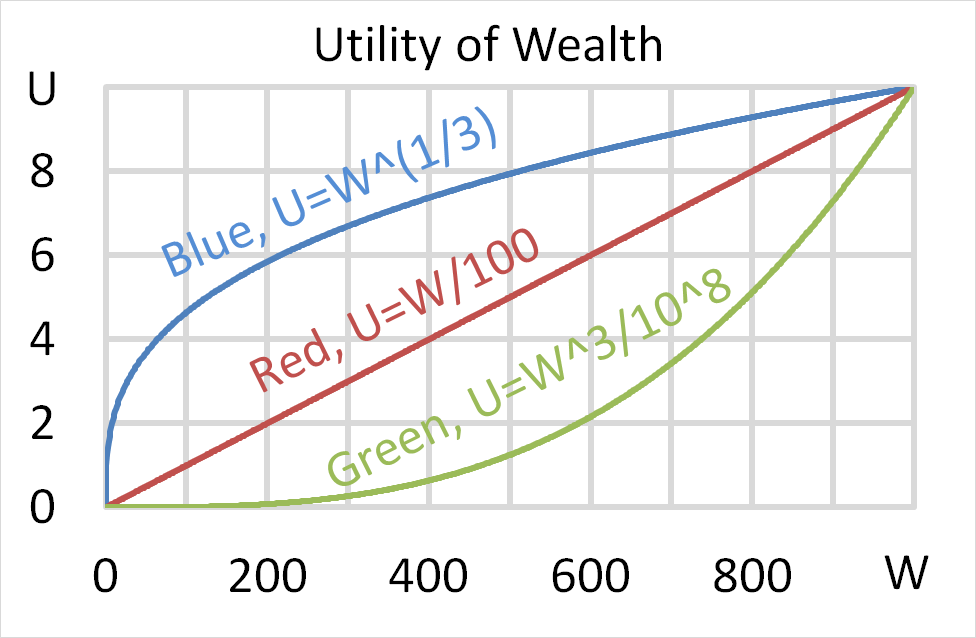

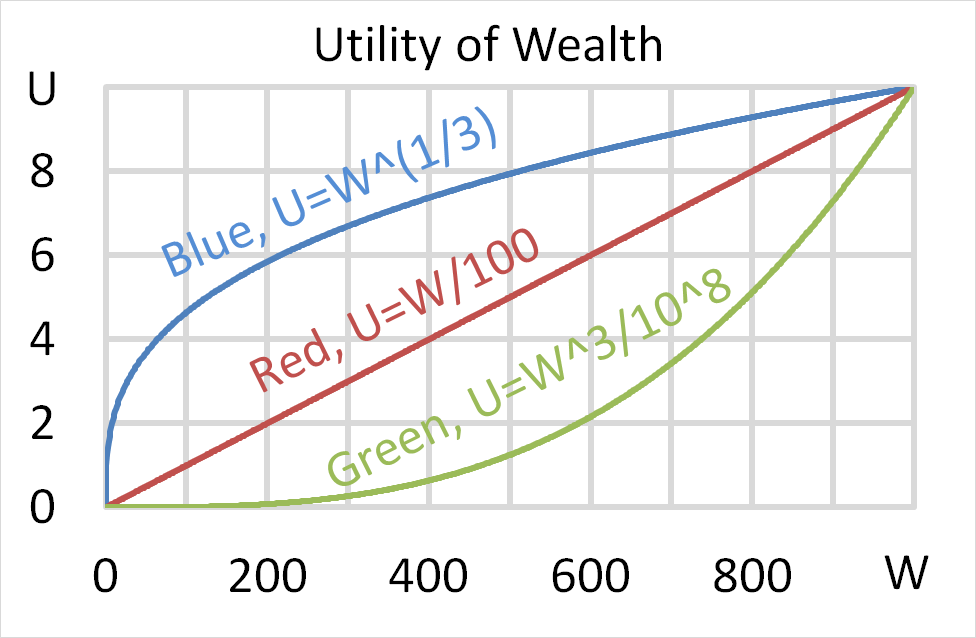

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Note that a fair gamble is a bet that has an expected value of zero, such as paying $0.50 to win $1 in a coin flip with heads or nothing if it lands tails. Fairly priced insurance is when the expected present value of the insurance premiums is equal to the expected loss from the disaster that the insurance protects against, such as the cost of rebuilding a home after a catastrophic fire.

Which of the following statements is NOT correct?

Question 703 utility, risk aversion, utility function, gamble

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Each person has $500 of initial wealth. A coin toss game is offered to each person at a casino where the player can win or lose $500. Each player can flip a coin and if they flip heads, they receive $500. If they flip tails then they will lose $500. Which of the following statements is NOT correct?

Question 119 market efficiency, fundamental analysis, joint hypothesis problem

Your friend claims that by reading 'The Economist' magazine's economic news articles, she can identify shares that will have positive abnormal expected returns over the next 2 years. Assuming that her claim is true, which statement(s) are correct?

(i) Weak form market efficiency is broken.

(ii) Semi-strong form market efficiency is broken.

(iii) Strong form market efficiency is broken.

(iv) The asset pricing model used to measure the abnormal returns (such as the CAPM) is either wrong (mis-specification error) or is measured using the wrong inputs (data errors) so the returns may not be abnormal but rather fair for the level of risk.

Select the most correct response:

Question 338 market efficiency, CAPM, opportunity cost, technical analysis

A man inherits $500,000 worth of shares.

He believes that by learning the secrets of trading, keeping up with the financial news and doing complex trend analysis with charts that he can quit his job and become a self-employed day trader in the equities markets.

What is the expected gain from doing this over the first year? Measure the net gain in wealth received at the end of this first year due to the decision to become a day trader. Assume the following:

- He earns $60,000 pa in his current job, paid in a lump sum at the end of each year.

- He enjoys examining share price graphs and day trading just as much as he enjoys his current job.

- Stock markets are weak form and semi-strong form efficient.

- He has no inside information.

- He makes 1 trade every day and there are 250 trading days in the year. Trading costs are $20 per trade. His broker invoices him for the trading costs at the end of the year.

- The shares that he currently owns and the shares that he intends to trade have the same level of systematic risk as the market portfolio.

- The market portfolio's expected return is 10% pa.

Measure the net gain over the first year as an expected wealth increase at the end of the year.

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Assume that there are no dividend payments so the entire 15% total return is all capital return.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% return lasts for the next 100 years (t=0 to 100), then reverts to 10% pa after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant. All returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

A company announces that it will pay a dividend, as the market expected. The company's shares trade on the stock exchange which is open from 10am in the morning to 4pm in the afternoon each weekday. When would the share price be expected to fall by the amount of the dividend? Ignore taxes.

The share price is expected to fall during the:

Currently, a mining company has a share price of $6 and pays constant annual dividends of $0.50. The next dividend will be paid in 1 year. Suddenly and unexpectedly the mining company announces that due to higher than expected profits, all of these windfall profits will be paid as a special dividend of $0.30 in 1 year.

If investors believe that the windfall profits and dividend is a one-off event, what will be the new share price? If investors believe that the additional dividend is actually permanent and will continue to be paid, what will be the new share price? Assume that the required return on equity is unchanged. Choose from the following, where the first share price includes the one-off increase in earnings and dividends for the first year only ##(P_\text{0 one-off})## , and the second assumes that the increase is permanent ##(P_\text{0 permanent})##:

Note: When a firm makes excess profits they sometimes pay them out as special dividends. Special dividends are just like ordinary dividends but they are one-off and investors do not expect them to continue, unlike ordinary dividends which are expected to persist.

Question 568 rights issue, capital raising, capital structure

A company conducts a 1 for 5 rights issue at a subscription price of $7 when the pre-announcement stock price was $10. What is the percentage change in the stock price and the number of shares outstanding? The answers are given in the same order. Ignore all taxes, transaction costs and signalling effects.

Question 625 dividend re-investment plan, capital raising

Which of the following statements about dividend re-investment plans (DRP's) is NOT correct?

Question 722 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

Here is a table of stock prices and returns. Which of the statements below the table is NOT correct?

| Price and Return Population Statistics | ||||

| Time | Prices | LGDR | GDR | NDR |

| 0 | 100 | |||

| 1 | 50 | -0.6931 | 0.5 | -0.5 |

| 2 | 100 | 0.6931 | 2 | 1 |

| Arithmetic average | 0 | 1.25 | 0.25 | |

| Arithmetic standard deviation | 0.9802 | 1.0607 | 1.0607 | |