Question 278 inflation, real and nominal returns and cash flows

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year.

Question 992 inflation, real and nominal returns and cash flows

You currently have $100 in the bank which pays a 10% pa interest rate.

Oranges currently cost $1 each at the shop and inflation is 5% pa which is the expected growth rate in the orange price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Oranges | ||||

| Time (year) | Bank account wealth ($) | Orange price ($) | Wealth in oranges | |

| 0 | 100 | 1 | 100 | |

| 1 | 110 | 1.05 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your:

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

Question 734 real and nominal returns and cash flows, inflation, DDM, no explanation

An equities analyst is using the dividend discount model to price a company's shares. The company operates domestically and has no plans to expand overseas. It is part of a mature industry with stable positive growth prospects.

The analyst has estimated the real required return (r) of the stock and the value of the dividend that the stock just paid a moment before ##(C_\text{0 before})##.

What is the highest perpetual real growth rate of dividends (g) that can be justified? Select the most correct statement from the following choices. The highest perpetual real expected growth rate of dividends that can be justified is the country's expected:

Question 1022 inflation linked bond, breakeven inflation rate, inflation, real and nominal returns and cash flows

Below is a graph of 10-year US treasury fixed coupon bond yields (red), inflation-indexed bond yields (green) and the 'breakeven' inflation rate (blue). Note that inflation-indexed bonds are also called treasury inflation protected securities (TIPS) in the US. In other countries they're called inflation-linked bonds (ILB's). For more information, see PIMCO's great article about inflation linked bonds here.

The 10 year breakeven inflation rate (blue) equals the:

PIMCO gives the following example of an Inflation Linked Bond (ILB), called Treasury Inflation Protected Securities (TIPS) in the US.

How do ILBs work?

An ILB’s explicit link to a nationally-recognized inflation measure means that any increase in price levels directly translates into higher principal values. As a hypothetical example, consider a $1,000 20-year U.S. TIPS with a 2.5% coupon (1.25% on semiannual basis), and an inflation rate of 4%. The principal on the TIPS note will adjust upward on a daily basis to account for the 4% inflation rate. At maturity, the principal value will be $2,208 (4% per year, compounded semiannually). Additionally, while the coupon rate remains fixed at 2.5%, the dollar value of each interest payment will rise, as the coupon will be paid on the inflation-adjusted principal value. The first semiannual coupon of 1.25% paid on the inflation-adjusted principal of $1,020 is $12.75, while the final semiannual interest payment will be 1.25% of $2,208, which is $27.60.

Forecast the semi-annual coupon paid in 10 years based on the bond details given above. The 20th semi-annual coupon, paid in 10 years, is expected to be:

Question 1023 monetary policy, inflation, breakeven inflation rate

If the breakeven inflation rate was far above the US Fed's long term 2% average inflation target, the Fed would be expected to:

Former Reserve Bank of Australia (RBA) Governor Phil Lowe says that the RBA cash rate is the interest rate in the Australian:

Former RBA Governor Phil Lowe says that if the economy is growing very strongly, then prices might be growing too:

Former RBA Governor Phil Lowe says that when the RBA raise interest rates, homeowners' mortgage loan interest expense will be:

Question 1018 RBA cash rate, monetary policy, foreign exchange rate

RBA Governor Phil Lowe says that when the RBA raises the cash rate (by surprise), the Australian dollar (AUD) tends to:

Question 1019 RBA cash rate, monetary policy, wealth effect

Former RBA Governor Phil Lowe says that when the RBA raise the cash rate, asset prices tend to:

Question 1020 Federal funds rate, monetary policy, dot plot

US Federal Reserve Chair Jerome Powell showed the 'dot plot' of Federal Open Market Committee (FOMC) members' estimated future Fed fund rates following their quarterly summary of economic projections on 15 Dec 2021. The dot plot shows that committee members intended to make monetary policy more:

Question 1021 Federal funds rate, monetary policy, quantitative easing, tapering

US Fed Chair Jerome Powell held a news conference following the 25-26 January 2022 FOMC meeting.

Nick Timiraos reporting for The Wall Street Journal asked: "Raising rates and reducing the balance sheet both restrain the economy, both tighten monetary policy. How should we think about the relationship between the two? For example, how much passive runoff is equal to every quarter percentage point increase in your benchmark rate?"

Jerome Powell replied: "So, again, we think of the balance sheet as moving in a predictable manner, sort of in the background, and that the active tool meeting to meeting is not -- both of them, it's the federal funds rate. There are rules of thumbs. I'm reluctant to land on one of them that equate this. And there's also an element of uncertainty around the balance sheet. I think we have a much better sense, frankly, of how rate increases affect financial conditions and, hence, economic conditions. Balance sheet is still a relatively new thing for the markets and for us, so we're less certain about that." (US Fed, 2022)

When Nick Timiraos mentioned 'reducing the balance sheet', he's referring to:

Estimate the US bank JP Morgan's share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- The major US banks JP Morgan Chase (JPM), Citi Group (C) and Wells Fargo (WFC) are comparable companies;

- JP Morgan Chase's historical earnings per share (EPS) is $4.37;

- Citi Group's share price is $50.05 and historical EPS is $4.26;

- Wells Fargo's share price is $48.98 and historical EPS is $3.89.

Note: Figures sourced from Google Finance on 24 March 2014.

Which firms tend to have low forward-looking price-earnings (PE) ratios?

Only consider firms with positive earnings, disregard firms with negative earnings and therefore negative PE ratios.

Which of the following investable assets are NOT suitable for valuation using PE multiples techniques?

Estimate the Chinese bank ICBC's share price using a backward-looking price earnings (PE) multiples approach with the following assumptions and figures only. Note that the renminbi (RMB) is the Chinese currency, also known as the yuan (CNY).

- The 4 major Chinese banks ICBC, China Construction Bank (CCB), Bank of China (BOC) and Agricultural Bank of China (ABC) are comparable companies;

- ICBC 's historical earnings per share (EPS) is RMB 0.74;

- CCB's backward-looking PE ratio is 4.59;

- BOC 's backward-looking PE ratio is 4.78;

- ABC's backward-looking PE ratio is also 4.78;

Note: Figures sourced from Google Finance on 25 March 2014. Share prices are from the Shanghai stock exchange.

Private equity firms are known to buy medium sized private companies operating in the same industry, merge them together into a larger company, and then sell it off in a public float (initial public offering, IPO).

If medium-sized private companies trade at PE ratios of 5 and larger listed companies trade at PE ratios of 15, what return can be achieved from this strategy?

Assume that:

- The medium-sized companies can be bought, merged and sold in an IPO instantaneously.

- There are no costs of finding, valuing, merging and restructuring the medium sized companies. Also, there is no competition to buy the medium-sized companies from other private equity firms.

- The large merged firm's earnings are the sum of the medium firms' earnings.

- The only reason for the difference in medium and large firm's PE ratios is due to the illiquidity of the medium firms' shares.

- Return is defined as: ##r_{0→1} = (p_1-p_0+c_1)/p_0## , where time zero is just before the merger and time one is just after.

Estimate the French bank Societe Generale's share price using a backward-looking price earnings (PE) multiples approach with the following assumptions and figures only. Note that EUR is the euro, the European monetary union's currency.

- The 4 major European banks Credit Agricole (ACA), Deutsche Bank AG (DBK), UniCredit (UCG) and Banco Santander (SAN) are comparable companies to Societe Generale (GLE);

- Societe Generale's (GLE's) historical earnings per share (EPS) is EUR 2.92;

- ACA's backward-looking PE ratio is 16.29 and historical EPS is EUR 0.84;

- DBK's backward-looking PE ratio is 25.01 and historical EPS is EUR 1.26;

- SAN's backward-looking PE ratio is 14.71 and historical EPS is EUR 0.47;

- UCG's backward-looking PE ratio is 15.78 and historical EPS is EUR 0.40;

Note: Figures sourced from Google Finance on 27 March 2015.

Question 749 Multiples valuation, PE ratio, price to revenue ratio, price to book ratio, NPV

A real estate agent says that the price of a house in Sydney Australia is approximately equal to the gross weekly rent times 1000.

What type of valuation method is the real estate agent using?

Question 935 real estate, NPV, perpetuity with growth, multi stage growth model, DDM

You're thinking of buying an investment property that costs $1,000,000. The property's rent revenue over the next year is expected to be $50,000 pa and rent expenses are $20,000 pa, so net rent cash flow is $30,000. Assume that net rent is paid annually in arrears, so this next expected net rent cash flow of $30,000 is paid one year from now.

The year after, net rent is expected to fall by 2% pa. So net rent at year 2 is expected to be $29,400 (=30,000*(1-0.02)^1).

The year after that, net rent is expected to rise by 1% pa. So net rent at year 3 is expected to be $29,694 (=30,000*(1-0.02)^1*(1+0.01)^1).

From year 3 onwards, net rent is expected to rise at 2.5% pa forever. So net rent at year 4 is expected to be $30,436.35 (=30,000*(1-0.02)^1*(1+0.01)^1*(1+0.025)^1).

Assume that the total required return on your investment property is 6% pa. Ignore taxes. All returns are given as effective annual rates.

What is the net present value (NPV) of buying the investment property?

Question 990 Multiples valuation, EV to EBITDA ratio, enterprise value

A firm has:

2 million shares;

$200 million EBITDA expected over the next year;

$100 million in cash (not included in EV);

1/3 market debt-to-assets ratio is (market assets = EV + cash);

4% pa expected dividend yield over the next year, paid annually with the next dividend expected in one year;

2% pa expected dividend growth rate;

40% expected payout ratio over the next year;10 times EV/EBITDA ratio.

30% corporate tax rate.

The stock can be valued using the EV/EBITDA multiple, dividend discount model, Gordon growth model or PE multiple. Which of the below statements is NOT correct based on an EV/EBITDA multiple valuation?

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

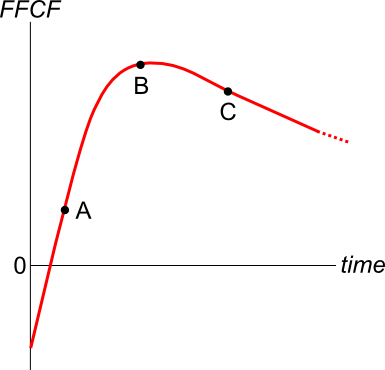

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $100m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $112m | Firm free cash flow or cash flow from assets (includes interest tax shields) |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 7% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 6.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 9% pa | Cost of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $48.5m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $50m | Firm free cash flow or cash flow from assets |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 10% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 9.7% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 11.25% pa | Cost of levered equity |

| ##D/V_L## | 20% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

Use the below information to value a levered company with annual perpetual cash flows from assets that grow. The next cash flow will be generated in one year from now. Note that ‘k’ means kilo or 1,000. So the $30k is $30,000.

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $30k | Operating free cash flow |

| ##g## | 1.5% pa | Growth rate of OFCF |

| ##r_\text{D}## | 4% pa | Cost of debt |

| ##r_\text{EL}## | 16.3% pa | Cost of levered equity |

| ##D/V_L## | 80% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

| ##n_\text{shares}## | 100k | Number of shares |

Which of the following statements is NOT correct?

Use the below information to value a mature levered company with growing annual perpetual cash flows and a constant debt-to-assets ratio. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. The firm's debt funding comprises annual fixed coupon bonds that all have the same seniority and coupon rate. When these bonds mature, new bonds will be re-issued, and so on in perpetuity. The yield curve is flat.

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}_1## | $12.5m | Operating free cash flow at time 1 |

| ##\text{FFCF}_1 \text{ or }\text{CFFA}_1## | $14m | Firm free cash flow or cash flow from assets at time 1 |

| ##\text{EFCF}_1## | $11m | Equity free cash flow at time 1 |

| ##\text{BondCoupons}_1## | $1.2m | Bond coupons paid to debt holders at time 1 |

| ##g## | 2% pa | Growth rate of OFCF, FFCF, EFCF and Debt cash flow |

| ##\text{WACC}_\text{BeforeTax}## | 9% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 8.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Bond yield |

| ##r_\text{EL}## | 13% pa | Cost or required return of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##n_\text{shares}## | 1m | Number of shares |

| ##t_c## | 30% | Corporate tax rate |

Which of the following statements is NOT correct?

Value the following business project to manufacture a new product.

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year | $3m | |

| Expected sale price of equipment at end of project | $0.6m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $5 | |

| Fixed costs per year, paid at the end of each year | $1m | |

| Interest expense per year | 0 | |

| Tax rate | 30% | |

| Weighted average cost of capital after tax per annum | 10% | |

Notes

- The firm's current assets and current liabilities are $3m and $2m respectively right now. This net working capital will not be used in this project, it will be used in other unrelated projects.

Due to the project, current assets (mostly inventory) will grow by $2m initially (at t = 0), and then by $0.2m at the end of the first year (t=1).

Current liabilities (mostly trade creditors) will increase by $0.1m at the end of the first year (t=1).

At the end of the project, the net working capital accumulated due to the project can be sold for the same price that it was bought. - The project cost $0.5m to research which was incurred one year ago.

Assumptions

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 3% pa.

- All rates are given as effective annual rates.

- The business considering the project is run as a 'sole tradership' (run by an individual without a company) and is therefore eligible for a 50% capital gains tax discount when the equipment is sold, as permitted by the Australian Tax Office.

What is the expected net present value (NPV) of the project?

Your friend just bought a house for $1,000,000. He financed it using a $900,000 mortgage loan and a deposit of $100,000.

In the context of residential housing and mortgages, the 'equity' or 'net wealth' tied up in a house is the value of the house less the value of the mortgage loan. Assuming that your friend's only asset is his house, his net wealth is $100,000.

If house prices suddenly fall by 15%, what would be your friend's percentage change in net wealth?

Assume that:

- No income (rent) was received from the house during the short time over which house prices fell.

- Your friend will not declare bankruptcy, he will always pay off his debts.

One year ago you bought $100,000 of shares partly funded using a margin loan. The margin loan size was $70,000 and the other $30,000 was your own wealth or 'equity' in the share assets.

The interest rate on the margin loan was 7.84% pa.

Over the year, the shares produced a dividend yield of 4% pa and a capital gain of 5% pa.

What was the total return on your wealth? Ignore taxes, assume that all cash flows (interest payments and dividends) were paid and received at the end of the year, and all rates above are effective annual rates.

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

Question 408 leverage, portfolio beta, portfolio risk, real estate, CAPM

You just bought a house worth $1,000,000. You financed it with an $800,000 mortgage loan and a deposit of $200,000.

You estimate that:

- The house has a beta of 1;

- The mortgage loan has a beta of 0.2.

What is the beta of the equity (the $200,000 deposit) that you have in your house?

Also, if the risk free rate is 5% pa and the market portfolio's return is 10% pa, what is the expected return on equity in your house? Ignore taxes, assume that all cash flows (interest payments and rent) were paid and received at the end of the year, and all rates are effective annual rates.

Question 800 leverage, portfolio return, risk, portfolio risk, capital structure, no explanation

Which of the following assets would you expect to have the highest required rate of return? All values are current market values.

Question 69 interest tax shield, capital structure, leverage, WACC

Which statement about risk, required return and capital structure is the most correct?

Your friend just bought a house for $400,000. He financed it using a $320,000 mortgage loan and a deposit of $80,000.

In the context of residential housing and mortgages, the 'equity' tied up in the value of a person's house is the value of the house less the value of the mortgage. So the initial equity your friend has in his house is $80,000. Let this amount be E, let the value of the mortgage be D and the value of the house be V. So ##V=D+E##.

If house prices suddenly fall by 10%, what would be your friend's percentage change in equity (E)? Assume that the value of the mortgage is unchanged and that no income (rent) was received from the house during the short time over which house prices fell.

Remember:

### r_{0\rightarrow1}=\frac{p_1-p_0+c_1}{p_0} ###

where ##r_{0-1}## is the return (percentage change) of an asset with price ##p_0## initially, ##p_1## one period later, and paying a cash flow of ##c_1## at time ##t=1##.

A firm has a debt-to-assets ratio of 50%. The firm then issues a large amount of debt to raise money for new projects of similar market risk to the company's existing projects. Assume a classical tax system. Which statement is correct?

Question 337 capital structure, interest tax shield, leverage, real and nominal returns and cash flows, multi stage growth model

A fast-growing firm is suitable for valuation using a multi-stage growth model.

It's nominal unlevered cash flow from assets (##CFFA_U##) at the end of this year (t=1) is expected to be $1 million. After that it is expected to grow at a rate of:

- 12% pa for the next two years (from t=1 to 3),

- 5% over the fourth year (from t=3 to 4), and

- -1% forever after that (from t=4 onwards). Note that this is a negative one percent growth rate.

Assume that:

- The nominal WACC after tax is 9.5% pa and is not expected to change.

- The nominal WACC before tax is 10% pa and is not expected to change.

- The firm has a target debt-to-equity ratio that it plans to maintain.

- The inflation rate is 3% pa.

- All rates are given as nominal effective annual rates.

What is the levered value of this fast growing firm's assets?

A firm has a debt-to-equity ratio of 25%. What is its debt-to-assets ratio?

A firm has a debt-to-equity ratio of 60%. What is its debt-to-assets ratio?

A firm has a debt-to-assets ratio of 20%. What is its debt-to-equity ratio?

Question 772 interest tax shield, capital structure, leverage

A firm issues debt and uses the funds to buy back equity. Assume that there are no costs of financial distress or transactions costs. Which of the following statements about interest tax shields is NOT correct?

One year ago you bought a $1,000,000 house partly funded using a mortgage loan. The loan size was $800,000 and the other $200,000 was your wealth or 'equity' in the house asset.

The interest rate on the home loan was 4% pa.

Over the year, the house produced a net rental yield of 2% pa and a capital gain of 2.5% pa.

Assuming that all cash flows (interest payments and net rental payments) were paid and received at the end of the year, and all rates are given as effective annual rates, what was the total return on your wealth over the past year?

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

In the home loan market, the acronym LVR stands for Loan to Valuation Ratio. If you bought a house worth one million dollars, partly funded by an $800,000 home loan, then your LVR was 80%. The LVR is equivalent to which of the following ratios?

Question 802 negative gearing, leverage, capital structure, no explanation

Which of the following statements about ‘negative gearing’ is NOT correct?

An analyst is valuing a levered company whose owners insist on keeping a constant market debt to assets ratio into the future.

The analyst is wondering how asset values and other things in her model will change when she changes the forecast sales growth rate.

Which of the below values will increase as the forecast growth rate of sales increases, with the debt to assets ratio remaining constant?

Assume that the cost of debt (yield) remains constant and the company’s asset beta will also remain constant since any expansion (or downsize) will involve buying (or selling) more of the same assets.

The analyst should expect which value or ratio to increase when the forecast growth rate of sales increases and the debt to assets ratio remains unchanged? In other words, which of the following values will NOT remain constant?

An analyst is valuing a levered company whose owners insist on keeping the dollar amount of debt funding fixed. So the company cannot issue or repay its debt, its dollar value must remain constant. Any funding gaps will be met with equity.

The analyst is wondering, as he changes inputs into his valuation, such as the forecast growth rate of sales, then asset values and other things will change. This makes it hard to figure out which values can be held constant and would therefore make good model inputs, rather than outputs which vary depending on the inputs. Assume that the cost of debt (yield) remains constant and the company’s asset beta will also remain constant since any expansion (or downsize) will involve buying (or selling) more of the same assets.

Which of the following values can be assumed to stay constant when projected sales growth increases?

Investment bank Canaccord's Think Childcare (TNK) initiation of coverage states: "What's the Differentiator? TNK are operators, not consolidators - Other listed childcare companies have led highly successful consolidation strategies involving multiple arbitrage combined with scale benefits and operating efficiencies. TNK’s focus is on operating the centres to the best of their individual potentials..." (Canaccord, 2016). Multiples arbitrage involves:

Question 1032 inflation, percent of sales forecasting, no explanation

Investment bank Canaccord's Think Childcare (TNK) initiation of coverage states: "Building lease costs – Rent expense is the second largest cost and TNK reported rent/sales of 12.1%, within the industry range that we typically see as 12-14% of sales. TNK lease all their properties and do not intend to own property. Leases are generally long term with 10-15 year terms and additional options. Although terms vary across properties and landlords, rental increases are generally tied to the consumer price index (CPI)" (Canaccord, 2016).

Assuming that sales grow faster than the CPI, when Canaccord forecast TNK's building lease costs using the 'percent of sales' method, that proportion should:

Read these quotes from Adir Shiffman's 26 July 2021 article in the AFR 'Roll up, roll up and make a mint off Amazon sellers'.

"Amazon sellers outsource their warehousing and logistics to the tech giant in a model known as “fulfilled by Amazon”, or FBA. Joining FBA provides access to one of the world’s largest global warehousing operations and even a fleet of Boeing 747 cargo jets. Just as significantly, FBA sellers can much more easily qualify for Amazon’s Prime program, which guarantees free and fast shipping to members."

"Companies want to acquire and integrate a selection, or in business parlance, do a 'roll-up'."

"More than 100 companies are now racing to roll-up FBA sellers, and almost all have launched since 2017. At least a dozen of these boast war chests of more than $US100 million. The largest, Thrasio, was founded in 2018 and has raised more than $US1.7 billion. Thrasio targets businesses with high quality and differentiated products that generate $US1 to $US100 million in revenue annually" (Shiffman, 2021).

If Thrasio's total funds available to spend on the roll up is $1.7 billion, and it's buying targets at price-to-revenue multiples of 2, what's the largest number of firms with $50 million of annual revenue that it could buy?

What proportion of managers are evaluating projects correctly, based on table 8 from Meier and Tarhan's (2006) survey of corporate managers?

| Table 8: Consistency of nominal or real hurdle rates and cash flows | |||

| Hurdle rate | Cash flows | Total | |

|---|---|---|---|

| Nominal | Real | ||

| Nominal | 29.8% | 11.6% | 41.3% |

| Real | 19.8% | 38.4% | 58.7% |

| Total | 49.6% | 50.4% | 100.0% |

Table 8 footnote: The rows in this cross-tabulation show whether the firm uses a nominal or real hurdle rate, the columns indicate whether cash flows are calculated in nominal or real terms. The fractions denote the number of firms for each combination relative to the total of 123 respondents that responded to both separate survey questions.

What proportion of managers are evaluating projects correctly?

Meier and Tarhan (2006) conducted an interesting survey of corporate managers. The results are copied in Table 7 below. What proportion of managers are evaluating levered projects correctly?

| Table 7: Consistency between hurdle rate and the calculation of cash flows | |||||||

| Hurdle rate | Cash flow calculation (see below notes) | ||||||

|---|---|---|---|---|---|---|---|

| (i) | (ii) | (iii) | (iv) | (v) | Other | Total | |

| WACC | 11.3% | 34.8% | 1.7% | 3.5% | 18.3% | 1.7% | 71.3% |

| Equity levered | 0.0% | 2.6% | 0.9% | 0.0% | 0.9% | 0.9% | 6.1% |

| Equity unlevered | 1.7% | 1.7% | 0.9% | 0.9% | 1.7% | 0.9% | 7.8% |

| Other | 2.6% | 5.2% | 1.7% | 0.9% | 3.5% | 0.9% | 14.8% |

| Total | 16.5% | 44.4% | 5.2% | 5.2% | 24.4% | 4.4% | 100.0% |

The rows of the cross-tabulation indicate what the self-reported hurdle rate represents and the columns denote five different ways to calculate cash flows, (i) to (v), plus the “other” category. Each cell then displays the fraction of all 113 respondents for a given combination of what the hurdle rate represents and how the firm calculates its cash flows when evaluating a project.

The definitions of the cash flow calculations (i)-(v) are as follows:

(i) Earnings before interest and after taxes (EBIAT) + depreciation

(ii) Earnings before interest and after taxes (EBIAT) + depreciation – capital expenditures – net change in working capital

(iii) Earnings

(iv) Earnings + depreciation

(v) Earnings + depreciation – capital expenditures – net change in working capital

Assume that the WACC is after tax, the required return on unlevered equity is the WACC before tax, all projects are levered, the benefit of interest tax shields should be included in the valuation, earnings = net profit after tax (NPAT) and EBIAT = EBIT*(1-tc) which is often also called net operating profit after tax (NOPAT).

What proportion of managers are evaluating levered projects correctly?

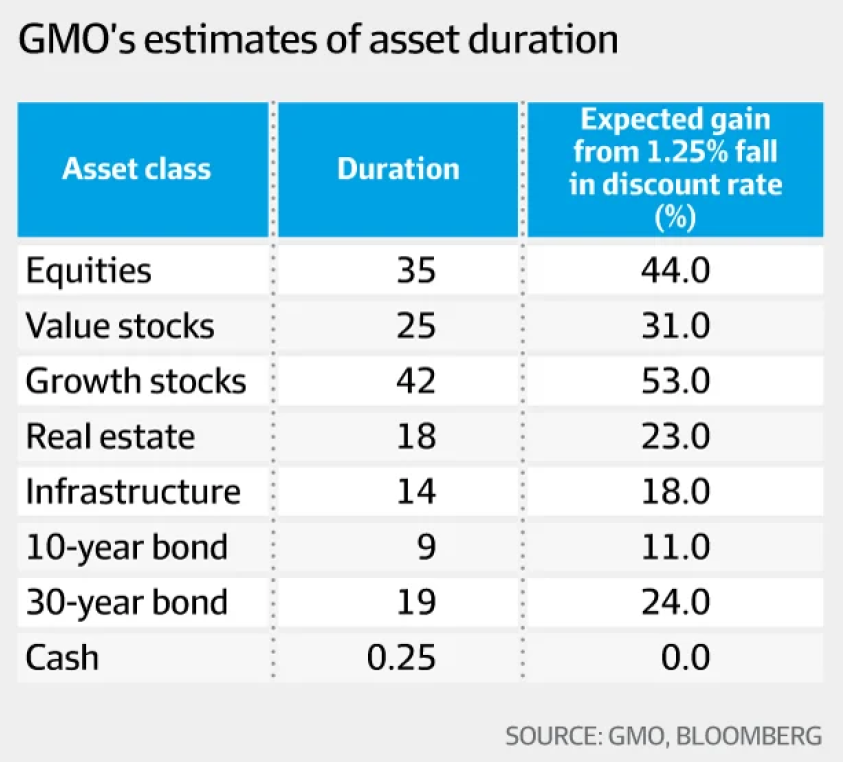

Below is a table showing GMO's 2016 estimates of different assets' durations, appearing in Slater (2017).

If you were certain that interest rates would fall more than the market expects, into what asset might you allocate more funds?

A stock has a beta of 0.5. Its next dividend is expected to be $3, paid one year from now. Dividends are expected to be paid annually and grow by 2% pa forever. Treasury bonds yield 3% pa and the market risk premium (MRP) is 6% pa. All returns are effective annual rates.

Which of the following statements is NOT correct?

Question 905 market capitalisation of equity, PE ratio, payout ratio

The below graph shows the computer software company Microsoft's stock price (MSFT) at the market close on the NASDAQ on Friday 1 June 2018.

Based on the screenshot above, which of the following statements about MSFT is NOT correct? MSFT's:

Question 1039 gross domestic product, inflation, business cycle

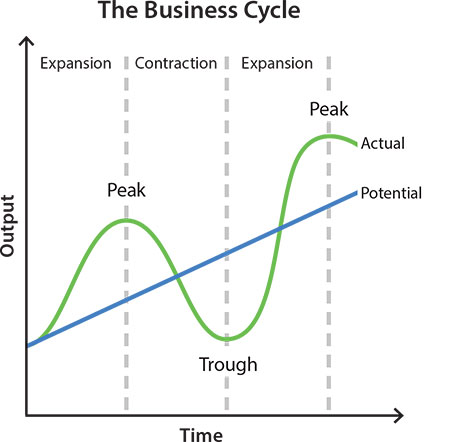

In this business cycle graph shown in the RBA's article explaining recessions, how might 'output' on the y-axis be measured?

The ‘output’ y-axis amount in the business cycle chart can be measured by:

Question 852 gross domestic product, inflation, employment, no explanation

When the economy is booming (in an upswing), you tend to see:

Calculate Australia’s GDP over the 2016 calendar year using the below table:

| Australian Gross Domestic Product Components | ||||

| A$ billion, 2016 Calendar Year from 1 Jan 2016 to 31 Dec 2016 inclusive | ||||

| Consumption | Investment | Government spending | Exports | Imports |

| 971 | 421 | 320 | 328 | 344 |

Source: ABS 5206.0 Australian National Accounts: National Income, Expenditure and Product. Table 3. Expenditure on Gross Domestic Product (GDP), Current prices.

Over the 2016 calendar year, Australia’s GDP was:

Question 850 gross domestic product, gross domestic product per capita

Below is a table showing some countries’ GDP, population and GDP per capita.

| Countries' GDP and Population | |||

| GDP | Population | GDP per capita | |

| USD million | millions of people | USD | |

| United States | 18,036,648 | 325 | 55,492 |

| China | 11,158,457 | 1,383 | 8,066 |

| Japan | 4,383,076 | 127 | 34,586 |

| Germany | 3,363,600 | 83 | 40,623 |

| Norway | 500,519 | 5 | 95,027 |

Source: "GDP and its breakdown at current prices in US Dollars" United Nations Statistics Division. December 2016.

Using this data only, which one of these countries’ citizens have the highest living standards?

Which form of production is included in the Gross Domestic Product (GDP) reported by the government statistics agency?

Question 1035 Minsky financial instability hypothesis, leverage

Which of the following statements about 'The Financial Instability Hypothesis' (Minsky, 1992) is NOT correct? Borrowers with sufficient income to pay:

Question 1036 Minsky financial instability hypothesis, leverage

Hyman Minsky, author of 'The Financial Instability Hypothesis' (1992), wrote:

In particular, over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. Consequently, units with cash flow shortfalls will be forced to try to make position by selling out position. This is likely to lead to a collapse of asset values.

Which of the below statements explaining this quote is NOT correct?

What effect is being referred to in the following quote from the MARTIN model description?

Economy-wide models also account for feedback between economic variables. For example, an increase in aggregate demand will encourage firms to hire more workers, which raises employment and lowers the unemployment rate. The tightening of the labour market is likely to lead to an increase in wages growth. The resulting increase in household incomes is likely to lead to an increase in consumption, further raising aggregate demand. (Ballantyne et al, 2019)

The name of the effect being referred to is:

Question 1038 fire sale, leverage, no explanation

Listen to 'Lessons and Questions from the GFC' on 6 December 2018 by RBA Deputy Governor Guy Debelle from 17:58 to 20:08 or read the below transcript:

Guy Debelle talks about the GFC and says that the Australian government’s guarantee of wholesale debt and deposits on 12 October 2008 was "introduced to facilitate the flow of credit to the real economy at a reasonable price and, in some cases, alleviate the need for asset fire sales, which have the capacity to tip markets and the economy into a worse equilibrium... The crisis very much demonstrated the critical importance of keeping the lending flowing. The lesson is that countries that did that fared better than countries that didn't. That lesson is relevant to the situation today in Australia, where there is a risk that a reduced appetite to lend will overly curtail borrowing with consequent effects for the Australian economy." (Debelle, 2019)

When assets are sold in a fire sale, there’s usually a large increase in the:

Question 1034 duration, monetary policy, inflation, market efficiency

On 18 March 2022 the AFR's James Thomson wrote: "In a world where the bombs are still falling in Ukraine and the Fed is just getting started on what looks likely to be a year-long cycle of rising interest rates, it would take a certain amount of bravery to embrace the sort of high-tech, long duration plays that Wood favours" (Thomson, 2022).

Which of the following US macro-economic data releases is most likely to cause Cathie Wood's ARK ETF share price to fall?

In the 1997 Asian financial crisis many countries' exchange rates depreciated rapidly against the US dollar (USD). The Thai, Indonesian, Malaysian, Korean and Filipino currencies were severely affected. The below graph shows these Asian countries' currencies in USD per one unit of their currency, indexed to 100 in June 1997.

Of the statements below, which is NOT correct? The Asian countries':

Question 882 Asian currency crisis, foreign exchange rate, original sin, no explanation

In the 1997 Asian currency crisis, the businesses most vulnerable to bankruptcy were those that:

Question 1013 book build, initial public offering, capital raising, demand schedule

A firm is floating its stock in an IPO and its underwriter has received the following bids, listed in order from highest to lowest share price:

| IPO Book Build Bids | ||

| Bidders | Share price | Number of shares |

| $/share | millions | |

| BidderA | 2.5 | 2 |

| BidderB | 2 | 1.5 |

| BidderC | 1.5 | 4 |

| BidderD | 1 | 3 |

| BidderE | 0.5 | 2 |

Suppose that the firm's owner wishes to sell all of their 8 million shares, so no new money will be raised and no money will re-invested back into the firm. Which of the following statements is NOT correct?

Question 1014 book build, initial public offering, capital raising, demand schedule

A firm is floating its stock in an IPO and its underwriter has received the following bids, listed in order from highest to lowest share price:

| IPO Book Build Bids | ||

| Bidders | Share price | Number of shares |

| $/share | millions | |

| BidderA | 2.5 | 2 |

| BidderB | 2 | 1.5 |

| BidderC | 1.5 | 4 |

| BidderD | 1 | 3 |

| BidderE | 0.5 | 2 |

Suppose that the firm's owner wishes to raise $6 million to expand the business by selling new stock in the initial public offering (IPO). The owner currently holds 8 million stock which are not for sale. Which of the following statements is NOT correct?

Question 568 rights issue, capital raising, capital structure

A company conducts a 1 for 5 rights issue at a subscription price of $7 when the pre-announcement stock price was $10. What is the percentage change in the stock price and the number of shares outstanding? The answers are given in the same order. Ignore all taxes, transaction costs and signalling effects.

A company conducts a 2 for 3 rights issue at a subscription price of $8 when the pre-announcement stock price was $9. Assume that all investors use their rights to buy those extra shares.

What is the percentage increase in the stock price and the number of shares outstanding? The answers are given in the same order.

A firm wishes to raise $100 million now. The firm's current market value of equity is $300m and the market price per share is $5. They estimate that they'll be able to issue shares in a rights issue at a subscription price of $4. All answers are rounded to 6 decimal places. Ignore the time value of money and assume that all shareholders exercise their rights. Which of the following statements is NOT correct?

A firm wishes to raise $30 million now. The firm's current market value of equity is $60m and the market price per share is $20. They estimate that they'll be able to issue shares in a rights issue at a subscription price of $15. Ignore the time value of money and assume that all shareholders exercise their rights. Which of the following statements is NOT correct?

Question 803 capital raising, rights issue, initial public offering, on market repurchase, no explanation

Which one of the following capital raisings or payouts involve the sale of shares to existing shareholders only?

Question 1010 lemons problem, asymmetric information, adverse selection, fungible

The ‘Lemons Problem’ is likely to more adversely affect the desirability of which type of investment?

A levered firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced.

| Balance Sheet Market Values and Betas | ||

| Balance sheet item | Market value ($m) | Beta |

| Cash asset | 0.5 | 0 |

| Truck assets | 0.5 | 2 |

| Loan liabilities | 0.25 | 0.1 |

| Equity funding | ? | ? |

Which of the following statements is NOT correct?

Question 1045 payout policy, leverage, capital structure, beta

A levered firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced.

| Balance Sheet Market Values and Betas | ||

| Balance sheet item | Market value ($m) | Beta |

| Cash asset | 0.5 | 0 |

| Truck assets | 0.5 | 2 |

| Loan liabilities | 0.25 | 0.1 |

| Equity funding | ? | ? |

The firm then pays out all of its cash as a dividend. Assume that the beta and yield on the loan liability remain unchanged. Ignore taxes, transaction costs, signalling, information asymmetries and other frictions.

Which of the following statements is NOT correct? This event led to a:

A levered firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced.

| Balance Sheet Market Values and Betas | ||

| Balance sheet item | Market value ($m) | Beta |

| Cash asset | 0.5 | 0 |

| Truck assets | 0.5 | 2 |

| Loan liabilities | 0.25 | 0.1 |

| Equity funding | ? | ? |

The firm then pays off (retires) all of its loan liabilities using its cash. Ignore interest tax shields.

Which of the following statements is NOT correct? All answers are given to 6 decimal places. This event led to a:

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $105 million. A cash offer will be made that pays the fair price for the target's shares plus 75% of the total synergy value. The cash will be paid out of the firm's cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 6,000 | 700 |

| Debt ($m) | 4,800 | 400 |

| Share price ($) | 40 | 20 |

| Number of shares (m) | 30 | 15 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $105 million. A scrip offer will be made that pays the fair price for the target's shares plus 75% of the total synergy value.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 6,000 | 700 |

| Debt ($m) | 4,800 | 400 |

| Share price ($) | 40 | 20 |

| Number of shares (m) | 30 | 15 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The firms operate in different industries and the CEO's rationale for the merger is to increase diversification and thereby decrease risk. The deal is not expected to create any synergies. An 80% scrip and 20% cash offer will be made that pays the fair price for the target's shares. The cash will be paid out of the firms' cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 6,000 | 700 |

| Debt ($m) | 4,800 | 400 |

| Share price ($) | 40 | 20 |

| Number of shares (m) | 30 | 15 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $105 million. A 40% scrip and 60% cash offer will be made that pays the fair price for the target's shares plus 75% of the total synergy value. The cash will be paid out of the firm's cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 6,000 | 700 |

| Debt ($m) | 4,800 | 400 |

| Share price ($) | 40 | 20 |

| Number of shares (m) | 30 | 15 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $2 million. A cash offer will be made that pays the fair price for the target's shares plus 70% of the total synergy value. The cash will be paid out of the firm's cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 60 | 10 |

| Debt ($m) | 20 | 2 |

| Share price ($) | 10 | 8 |

| Number of shares (m) | 4 | 1 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $2 million. A scrip offer will be made that pays the fair price for the target's shares plus 70% of the total synergy value.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 60 | 10 |

| Debt ($m) | 20 | 2 |

| Share price ($) | 10 | 8 |

| Number of shares (m) | 4 | 1 |

Ignore transaction costs and fees. Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

Acquirer firm plans to launch a takeover of Target firm. The deal is expected to create a present value of synergies totaling $0.5 million, but investment bank fees and integration costs with a present value of $1.5 million is expected. A 10% cash and 90% scrip offer will be made that pays the fair price for the target's shares only. Assume that the Target and Acquirer agree to the deal. The cash will be paid out of the firms' cash holdings, no new debt or equity will be raised.

| Firms Involved in the Takeover | ||

| Acquirer | Target | |

| Assets ($m) | 60 | 10 |

| Debt ($m) | 20 | 2 |

| Share price ($) | 10 | 8 |

| Number of shares (m) | 4 | 1 |

Assume that the firms' debt and equity are fairly priced, and that each firms' debts' risk, yield and values remain constant. The acquisition is planned to occur immediately, so ignore the time value of money.

Calculate the merged firm's share price and total number of shares after the takeover has been completed.

You believe that the price of a share will fall significantly very soon, but the rest of the market does not. The market thinks that the share price will remain the same. Assuming that your prediction will soon be true, which of the following trades is a bad idea? In other words, which trade will NOT make money or prevent losses?

A man just sold a call option to his counterparty, a lady. The man has just now:

A European call option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the call option?

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the put option?

A European call option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from having written (being short) the call option?

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from having written (being short) the put option?

Question 432 option, option intrinsic value, no explanation

An American style call option with a strike price of ##K## dollars will mature in ##T## years. The underlying asset has a price of ##S## dollars.

What is an expression for the current intrinsic value in dollars from owning (being long) the American style call option? Note that the intrinsic value of an option does not subtract the premium paid to buy the option.

Which of the following statements about option contracts is NOT correct? For every:

If trader A has sold the right that allows counterparty B to buy the underlying asset from him at maturity if counterparty B wants then trader A is:

After doing extensive fundamental analysis of a company, you believe that their shares are overpriced and will soon fall significantly. The market believes that there will be no such fall.

Which of the following strategies is NOT a good idea, assuming that your prediction is true?

Question 636 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being long a call option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Question 637 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being short a call option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Question 638 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being long a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Question 639 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being short a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Which one of the below option and futures contracts gives the possibility of potentially unlimited gains?

A trader buys one crude oil European style call option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

Which of the below formulas gives the profit ##(\pi)## from being long a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

Which of the below formulas gives the profit ##(\pi)## from being short a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

Which of the below formulas gives the profit ##(\pi)## from being long a put option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LP,0}##. Note that ##S_T##, ##X_T## and ##f_{LP,0}## are all positive numbers.

Which of the below formulas gives the profit ##(\pi)## from being short a put option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LP,0}##. Note that ##S_T##, ##X_T## and ##f_{LP,0}## are all positive numbers.

A trader sells one crude oil European style call option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

A trader buys one crude oil European style put option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

A trader just bought a European style put option on CBA stock. The current option premium is $2, the exercise price is $75, the option matures in one year and the spot CBA stock price is $74.

Which of the following statements is NOT correct?

A company runs a number of slaughterhouses which supply hamburger meat to McDonalds. The company is afraid that live cattle prices will increase over the next year, even though there is widespread belief in the market that they will be stable. What can the company do to hedge against the risk of increasing live cattle prices? Which statement(s) are correct?

(i) buy call options on live cattle.

(ii) buy put options on live cattle.

(iii) sell call options on live cattle.

Select the most correct response:

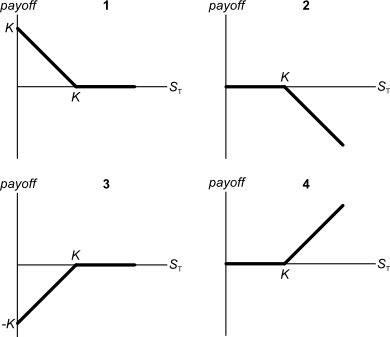

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered.

You have just sold an 'in the money' 6 month European put option on the mining company BHP at an exercise price of $40 for a premium of $3.

Which of the following statements best describes your situation?

You operate a cattle farm that supplies hamburger meat to the big fast food chains. You buy a lot of grain to feed your cattle, and you sell the fully grown cattle on the livestock market.

You're afraid of adverse movements in grain and livestock prices. What options should you buy to hedge your exposures in the grain and cattle livestock markets?

Select the most correct response:

Question 271 CAPM, option, risk, systematic risk, systematic and idiosyncratic risk

All things remaining equal, according to the capital asset pricing model, if the systematic variance of an asset increases, its required return will increase and its price will decrease.

If the idiosyncratic variance of an asset increases, its price will be unchanged.

What is the relationship between the price of a call or put option and the total, systematic and idiosyncratic variance of the underlying asset that the option is based on? Select the most correct answer.

Call and put option prices increase when the:

Being long a call and short a put which have the same exercise prices and underlying stock is equivalent to being:

A stock, a call, a put and a bond are available to trade. The call and put options' underlying asset is the stock they and have the same strike prices, ##K_T##.

You are currently long the stock. You want to hedge your long stock position without actually trading the stock. How would you do this?

A one year European-style put option has a strike price of $4. The option's underlying stock pays no dividends and currently trades at $5. The risk-free interest rate is 10% pa continuously compounded. Use a single step binomial tree to calculate the option price, assuming that the price could rise to $8 ##(u = 1.6)## or fall to $3.125 ##(d = 1/1.6)## in one year. The put option price now is:

A 12 month European-style call option with a strike price of $11 is written on a dividend paying stock currently trading at $10. The dividend is paid annually and the next dividend is expected to be $0.40, paid in 9 months. The risk-free interest rate is 5% pa continuously compounded and the standard deviation of the stock’s continuously compounded returns is 30 percentage points pa. The stock's continuously compounded returns are normally distributed. Using the Black-Scholes-Merton option valuation model, determine which of the following statements is NOT correct.

A one year European-style call option has a strike price of $4.

The option's underlying stock currently trades at $5, pays no dividends and its standard deviation of continuously compounded returns is 47% pa.

The risk-free interest rate is 10% pa continuously compounded.

Use the Black-Scholes-Merton formula to calculate the option price. The call option price now is:

A one year European-style put option has a strike price of $4.

The option's underlying stock currently trades at $5, pays no dividends and its standard deviation of continuously compounded returns is 47% pa.

The risk-free interest rate is 10% pa continuously compounded.

Use the Black-Scholes-Merton formula to calculate the option price. The put option price now is:

Question 794 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the Delta of a European call option?

Where:

###d_1=\dfrac{\ln[S_0/K]+(r+\sigma^2/2).T)}{\sigma.\sqrt{T}}### ###d_2=d_1-\sigma.\sqrt{T}=\dfrac{\ln[S_0/K]+(r-\sigma^2/2).T)}{\sigma.\sqrt{T}}###Question 795 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the Delta of a European put option?

Question 796 option, Black-Scholes-Merton option pricing, option delta, no explanation

Which of the following quantities from the Black-Scholes-Merton option pricing formula gives the risk-neutral probability that a European call option will be exercised?

Question 903 option, Black-Scholes-Merton option pricing, option on stock index

A six month European-style call option on the S&P500 stock index has a strike price of 2800 points.

The underlying S&P500 stock index currently trades at 2700 points, has a continuously compounded dividend yield of 2% pa and a standard deviation of continuously compounded returns of 25% pa.

The risk-free interest rate is 5% pa continuously compounded.

Use the Black-Scholes-Merton formula to calculate the option price. The call option price now is:

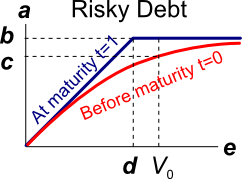

Question 382 Merton model of corporate debt, real option, option

In the Merton model of corporate debt, buying a levered company's shares is equivalent to:

Which of the following is the least useful method or model to calculate the value of a real option in a project?

Question 386 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

The risky corporate debt graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

One of the reasons why firms may not begin projects with relatively small positive net present values (NPV's) is because they wish to maximise the value of their:

A moped is a bicycle with pedals and a little motor that can be switched on to assist the rider. Mopeds are useful for quick transport using the motor, and for physical exercise when using the pedals unassisted. This offers the rider:

You're thinking of starting a new cafe business, but you're not sure if it will be profitable.

You have to decide what type of cups, mugs and glasses you wish to buy. You can pay to have your cafe's name printed on them, or just buy the plain un-marked ones. For marketing reasons it's better to have the cafe name printed. But the plain un-marked cups, mugs and glasses maximise your:

Some financially minded people insist on a prenuptial agreement before committing to marry their partner. This agreement states how the couple's assets should be divided in case they divorce. Prenuptial agreements are designed to give the richer partner more of the couples' assets if they divorce, thus maximising the richer partner's:

The cheapest mobile phones available tend to be those that are 'locked' into a cell phone operator's network. Locked phones can not be used with other cell phone operators' networks.

Locked mobile phones are cheaper than unlocked phones because the locked-in network operator helps create a monopoly by:

Question 397 financial distress, leverage, capital structure, NPV

A levered firm has a market value of assets of $10m. Its debt is all comprised of zero-coupon bonds which mature in one year and have a combined face value of $9.9m.

Investors are risk-neutral and therefore all debt and equity holders demand the same required return of 10% pa.

Therefore the current market capitalisation of debt ##(D_0)## is $9m and equity ##(E_0)## is $1m.

A new project presents itself which requires an investment of $2m and will provide a:

- $6.6m cash flow with probability 0.5 in the good state of the world, and a

- -$4.4m (notice the negative sign) cash flow with probability 0.5 in the bad state of the world.

The project can be funded using the company's excess cash, no debt or equity raisings are required.

What would be the new market capitalisation of equity ##(E_\text{0, with project})## if shareholders vote to proceed with the project, and therefore should shareholders proceed with the project?

Question 398 financial distress, capital raising, leverage, capital structure, NPV

A levered firm has zero-coupon bonds which mature in one year and have a combined face value of $9.9m.

Investors are risk-neutral and therefore all debt and equity holders demand the same required return of 10% pa.

In one year the firm's assets will be worth:

- $13.2m with probability 0.5 in the good state of the world, or

- $6.6m with probability 0.5 in the bad state of the world.

A new project presents itself which requires an investment of $2m and will provide a certain cash flow of $3.3m in one year.

The firm doesn't have any excess cash to make the initial $2m investment, but the funds can be raised from shareholders through a fairly priced rights issue. Ignore all transaction costs.

Should shareholders vote to proceed with the project and equity raising? What will be the gain in shareholder wealth if they decide to proceed?

Question 99 capital structure, interest tax shield, Miller and Modigliani, trade off theory of capital structure

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged.

Assume that:

- The firm and individual investors can borrow at the same rate and have the same tax rates.

- The firm's debt and shares are fairly priced and the shares are repurchased at the market price, not at a premium.

- There are no market frictions relating to debt such as asymmetric information or transaction costs.

- Shareholders wealth is measured in terms of utiliity. Shareholders are wealth-maximising and risk-averse. They have a preferred level of overall leverage. Before the firm's capital restructure all shareholders were optimally levered.

According to Miller and Modigliani's theory, which statement is correct?

Question 22 NPV, perpetuity with growth, effective rate, effective rate conversion

What is the NPV of the following series of cash flows when the discount rate is 10% given as an effective annual rate?

The first payment of $90 is in 3 years, followed by payments every 6 months in perpetuity after that which shrink by 3% every 6 months. That is, the growth rate every 6 months is actually negative 3%, given as an effective 6 month rate. So the payment at ## t=3.5 ## years will be ## 90(1-0.03)^1=87.3 ##, and so on.

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's approximate payout ratio over the 2014 financial year?

Note that the firm's interim and final dividends were $1.83 and $2.18 respectively over the 2014 financial year.