The expression 'you have to spend money to make money' relates to which business decision?

Question 444 investment decision, corporate financial decision theory

The investment decision primarily affects which part of a business?

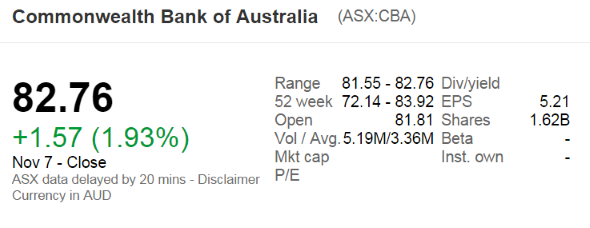

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's market capitalisation of equity?

You're considering making an investment in a particular company. They have preference shares, ordinary shares, senior debt and junior debt.

Which is the safest investment? Which has the highest expected returns?

Which business structure or structures have the advantage of limited liability for equity investors?

Question 531 bankruptcy or insolvency, capital structure, risk, limited liability

Who is most in danger of being personally bankrupt? Assume that all of their businesses' assets are highly liquid and can therefore be sold immediately.

Which of the following statements about book and market equity is NOT correct?

Question 732 real and nominal returns and cash flows, inflation, income and capital returns

An investor bought a bond for $100 (at t=0) and one year later it paid its annual coupon of $1 (at t=1). Just after the coupon was paid, the bond price was $100.50 (at t=1). Inflation over the past year (from t=0 to t=1) was 3% pa, given as an effective annual rate.

Which of the following statements is NOT correct? The bond investment produced a:

Question 745 real and nominal returns and cash flows, inflation, income and capital returns

If the nominal gold price is expected to increase at the same rate as inflation which is 3% pa, which of the following statements is NOT correct?

Question 554 inflation, real and nominal returns and cash flows

On his 20th birthday, a man makes a resolution. He will put $30 cash under his bed at the end of every month starting from today. His birthday today is the first day of the month. So the first addition to his cash stash will be in one month. He will write in his will that when he dies the cash under the bed should be given to charity.

If the man lives for another 60 years, how much money will be under his bed if he dies just after making his last (720th) addition?

Also, what will be the real value of that cash in today's prices if inflation is expected to 2.5% pa? Assume that the inflation rate is an effective annual rate and is not expected to change.

The answers are given in the same order, the amount of money under his bed in 60 years, and the real value of that money in today's prices.

Question 577 inflation, real and nominal returns and cash flows

What is the present value of a real payment of $500 in 2 years? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

Question 526 real and nominal returns and cash flows, inflation, no explanation

How can a nominal cash flow be precisely converted into a real cash flow?

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

Question 525 income and capital returns, real and nominal returns and cash flows, inflation

Which of the following statements about cash in the form of notes and coins is NOT correct? Assume that inflation is positive.

Notes and coins:

Total cash flows can be broken into income and capital cash flows. What is the name given to the income cash flow from owning shares?

The saying "buy low, sell high" suggests that investors should make a:

An asset's total expected return over the next year is given by:

###r_\text{total} = \dfrac{c_1+p_1-p_0}{p_0} ###

Where ##p_0## is the current price, ##c_1## is the expected income in one year and ##p_1## is the expected price in one year. The total return can be split into the income return and the capital return.

Which of the following is the expected capital return?

A young lady is trying to decide if she should attend university or not.

The young lady's parents say that she must attend university because otherwise all of her hard work studying and attending school during her childhood was a waste.

What's the correct way to classify this item from a capital budgeting perspective when trying to decide whether to attend university?

The hard work studying at school in her childhood should be classified as:

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### P_{0} = \frac{C_1}{r_{\text{eff}} - g_{\text{eff}}} ###

What would you call the expression ## C_1/P_0 ##?

When using the dividend discount model to price a stock:

### p_{0} = \frac{d_1}{r - g} ###

The growth rate of dividends (g):

In the dividend discount model:

###P_0 = \dfrac{C_1}{r-g}###

The return ##r## is supposed to be the:

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###p_0=\frac{d_1}{r_\text{eff}-g_\text{eff}}###

Which expression is NOT equal to the expected capital return?

The following is the Dividend Discount Model used to price stocks:

### p_0=\frac{d_1}{r-g} ###

Which of the following statements about the Dividend Discount Model is NOT correct?

Over the next year, the management of an unlevered company plans to:

- Make $5m in sales, $1.9m in net income and $2m in equity free cash flow (EFCF).

- Pay dividends of $1m.

- Complete a $1.3m share buy-back.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to legally pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

Over the next year, the management of an unlevered company plans to:

- Achieve firm free cash flow (FFCF or CFFA) of $1m.

- Pay dividends of $1.8m

- Complete a $1.3m share buy-back.

- Spend $0.8m on new buildings without buying or selling any other fixed assets. This capital expenditure is included in the CFFA figure quoted above.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

A firm has forecast its Cash Flow From Assets (CFFA) for this year and management is worried that it is too low. Which one of the following actions will lead to a higher CFFA for this year (t=0 to 1)? Only consider cash flows this year. Do not consider cash flows after one year, or the change in the NPV of the firm. Consider each action in isolation.

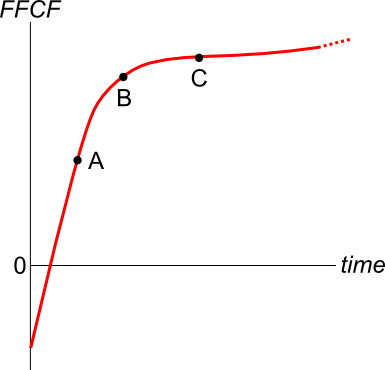

A new company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

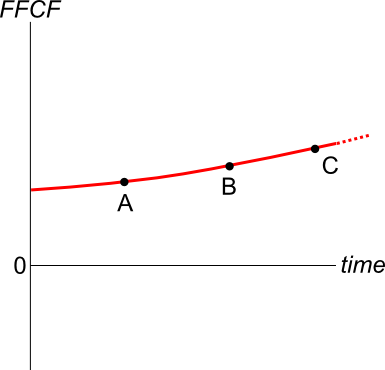

An old company's Firm Free Cash Flow (FFCF, same as CFFA) is forecast in the graph below.

To value the firm's assets, the terminal value needs to be calculated using the perpetuity with growth formula:

###V_{\text{terminal, }t-1} = \dfrac{FFCF_{\text{terminal, }t}}{r-g}###

Which point corresponds to the best time to calculate the terminal value?

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA). Some include the annual interest tax shield in the cash flow and some do not.

Which of the below FFCF formulas include the interest tax shield in the cash flow?

###(1) \quad FFCF=NI + Depr - CapEx -ΔNWC + IntExp### ###(2) \quad FFCF=NI + Depr - CapEx -ΔNWC + IntExp.(1-t_c)### ###(3) \quad FFCF=EBIT.(1-t_c )+ Depr- CapEx -ΔNWC+IntExp.t_c### ###(4) \quad FFCF=EBIT.(1-t_c) + Depr- CapEx -ΔNWC### ###(5) \quad FFCF=EBITDA.(1-t_c )+Depr.t_c- CapEx -ΔNWC+IntExp.t_c### ###(6) \quad FFCF=EBITDA.(1-t_c )+Depr.t_c- CapEx -ΔNWC### ###(7) \quad FFCF=EBIT-Tax + Depr - CapEx -ΔNWC### ###(8) \quad FFCF=EBIT-Tax + Depr - CapEx -ΔNWC-IntExp.t_c### ###(9) \quad FFCF=EBITDA-Tax - CapEx -ΔNWC### ###(10) \quad FFCF=EBITDA-Tax - CapEx -ΔNWC-IntExp.t_c###The formulas for net income (NI also called earnings), EBIT and EBITDA are given below. Assume that depreciation and amortisation are both represented by 'Depr' and that 'FC' represents fixed costs such as rent.

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )### ###EBIT=Rev - COGS - FC-Depr### ###EBITDA=Rev - COGS - FC### ###Tax =(Rev - COGS - Depr - FC - IntExp).t_c= \dfrac{NI.t_c}{1-t_c}###Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $100m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $112m | Firm free cash flow or cash flow from assets (includes interest tax shields) |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 7% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 6.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 9% pa | Cost of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

Question 905 market capitalisation of equity, PE ratio, payout ratio

The below graph shows the computer software company Microsoft's stock price (MSFT) at the market close on the NASDAQ on Friday 1 June 2018.

Based on the screenshot above, which of the following statements about MSFT is NOT correct? MSFT's:

An analyst is valuing a levered company whose owners insist on keeping a constant market debt to assets ratio into the future.

The analyst is wondering how asset values and other things in her model will change when she changes the forecast sales growth rate.

Which of the below values will increase as the forecast growth rate of sales increases, with the debt to assets ratio remaining constant?

Assume that the cost of debt (yield) remains constant and the company’s asset beta will also remain constant since any expansion (or downsize) will involve buying (or selling) more of the same assets.

The analyst should expect which value or ratio to increase when the forecast growth rate of sales increases and the debt to assets ratio remains unchanged? In other words, which of the following values will NOT remain constant?

Question 989 PE ratio, Multiples valuation, leverage, accounting ratio

A firm has 20 million stocks, earnings (or net income) of $100 million per annum and a 60% debt-to-equity ratio where both the debt and asset values are market values rather than book values. Similar firms have a PE ratio of 12.

Which of the below statements is NOT correct based on a PE multiples valuation?

What proportion of managers are evaluating projects correctly, based on table 8 from Meier and Tarhan's (2006) survey of corporate managers?

| Table 8: Consistency of nominal or real hurdle rates and cash flows | |||

| Hurdle rate | Cash flows | Total | |

|---|---|---|---|

| Nominal | Real | ||

| Nominal | 29.8% | 11.6% | 41.3% |

| Real | 19.8% | 38.4% | 58.7% |

| Total | 49.6% | 50.4% | 100.0% |

Table 8 footnote: The rows in this cross-tabulation show whether the firm uses a nominal or real hurdle rate, the columns indicate whether cash flows are calculated in nominal or real terms. The fractions denote the number of firms for each combination relative to the total of 123 respondents that responded to both separate survey questions.

What proportion of managers are evaluating projects correctly?

Question 1023 monetary policy, inflation, breakeven inflation rate

If the breakeven inflation rate was far above the US Fed's long term 2% average inflation target, the Fed would be expected to:

Question 1022 inflation linked bond, breakeven inflation rate, inflation, real and nominal returns and cash flows

Below is a graph of 10-year US treasury fixed coupon bond yields (red), inflation-indexed bond yields (green) and the 'breakeven' inflation rate (blue). Note that inflation-indexed bonds are also called treasury inflation protected securities (TIPS) in the US. In other countries they're called inflation-linked bonds (ILB's). For more information, see PIMCO's great article about inflation linked bonds here.

The 10 year breakeven inflation rate (blue) equals the:

Investment bank Canaccord's Think Childcare (TNK) initiation of coverage states: "What's the Differentiator? TNK are operators, not consolidators - Other listed childcare companies have led highly successful consolidation strategies involving multiple arbitrage combined with scale benefits and operating efficiencies. TNK’s focus is on operating the centres to the best of their individual potentials..." (Canaccord, 2016). Multiples arbitrage involves:

Question 1032 inflation, percent of sales forecasting, no explanation

Investment bank Canaccord's Think Childcare (TNK) initiation of coverage states: "Building lease costs – Rent expense is the second largest cost and TNK reported rent/sales of 12.1%, within the industry range that we typically see as 12-14% of sales. TNK lease all their properties and do not intend to own property. Leases are generally long term with 10-15 year terms and additional options. Although terms vary across properties and landlords, rental increases are generally tied to the consumer price index (CPI)" (Canaccord, 2016).

Assuming that sales grow faster than the CPI, when Canaccord forecast TNK's building lease costs using the 'percent of sales' method, that proportion should:

Read these quotes from Adir Shiffman's 26 July 2021 article in the AFR 'Roll up, roll up and make a mint off Amazon sellers'.

"Amazon sellers outsource their warehousing and logistics to the tech giant in a model known as “fulfilled by Amazon”, or FBA. Joining FBA provides access to one of the world’s largest global warehousing operations and even a fleet of Boeing 747 cargo jets. Just as significantly, FBA sellers can much more easily qualify for Amazon’s Prime program, which guarantees free and fast shipping to members."

"Companies want to acquire and integrate a selection, or in business parlance, do a 'roll-up'."

"More than 100 companies are now racing to roll-up FBA sellers, and almost all have launched since 2017. At least a dozen of these boast war chests of more than $US100 million. The largest, Thrasio, was founded in 2018 and has raised more than $US1.7 billion. Thrasio targets businesses with high quality and differentiated products that generate $US1 to $US100 million in revenue annually" (Shiffman, 2021).

If Thrasio's total funds available to spend on the roll up is $1.7 billion, and it's buying targets at price-to-revenue multiples of 2, what's the largest number of firms with $50 million of annual revenue that it could buy?

PIMCO gives the following example of an Inflation Linked Bond (ILB), called Treasury Inflation Protected Securities (TIPS) in the US.

How do ILBs work?

An ILB’s explicit link to a nationally-recognized inflation measure means that any increase in price levels directly translates into higher principal values. As a hypothetical example, consider a $1,000 20-year U.S. TIPS with a 2.5% coupon (1.25% on semiannual basis), and an inflation rate of 4%. The principal on the TIPS note will adjust upward on a daily basis to account for the 4% inflation rate. At maturity, the principal value will be $2,208 (4% per year, compounded semiannually). Additionally, while the coupon rate remains fixed at 2.5%, the dollar value of each interest payment will rise, as the coupon will be paid on the inflation-adjusted principal value. The first semiannual coupon of 1.25% paid on the inflation-adjusted principal of $1,020 is $12.75, while the final semiannual interest payment will be 1.25% of $2,208, which is $27.60.

Forecast the semi-annual coupon paid in 10 years based on the bond details given above. The 20th semi-annual coupon, paid in 10 years, is expected to be:

Meier and Tarhan (2006) conducted an interesting survey of corporate managers. The results are copied in Table 7 below. What proportion of managers are evaluating levered projects correctly?

| Table 7: Consistency between hurdle rate and the calculation of cash flows | |||||||

| Hurdle rate | Cash flow calculation (see below notes) | ||||||

|---|---|---|---|---|---|---|---|

| (i) | (ii) | (iii) | (iv) | (v) | Other | Total | |

| WACC | 11.3% | 34.8% | 1.7% | 3.5% | 18.3% | 1.7% | 71.3% |

| Equity levered | 0.0% | 2.6% | 0.9% | 0.0% | 0.9% | 0.9% | 6.1% |

| Equity unlevered | 1.7% | 1.7% | 0.9% | 0.9% | 1.7% | 0.9% | 7.8% |

| Other | 2.6% | 5.2% | 1.7% | 0.9% | 3.5% | 0.9% | 14.8% |

| Total | 16.5% | 44.4% | 5.2% | 5.2% | 24.4% | 4.4% | 100.0% |

The rows of the cross-tabulation indicate what the self-reported hurdle rate represents and the columns denote five different ways to calculate cash flows, (i) to (v), plus the “other” category. Each cell then displays the fraction of all 113 respondents for a given combination of what the hurdle rate represents and how the firm calculates its cash flows when evaluating a project.

The definitions of the cash flow calculations (i)-(v) are as follows:

(i) Earnings before interest and after taxes (EBIAT) + depreciation

(ii) Earnings before interest and after taxes (EBIAT) + depreciation – capital expenditures – net change in working capital

(iii) Earnings

(iv) Earnings + depreciation

(v) Earnings + depreciation – capital expenditures – net change in working capital

Assume that the WACC is after tax, the required return on unlevered equity is the WACC before tax, all projects are levered, the benefit of interest tax shields should be included in the valuation, earnings = net profit after tax (NPAT) and EBIAT = EBIT*(1-tc) which is often also called net operating profit after tax (NOPAT).

What proportion of managers are evaluating levered projects correctly?

Which of the following statements about Macaulay duration is NOT correct? The Macaulay duration:

Assume that the market portfolio has a duration of 15 years and an individual stock has a duration of 20 years.

What can you say about the stock's (single factor CAPM) beta with respect to the market portfolio? The stock's beta is likely to be:

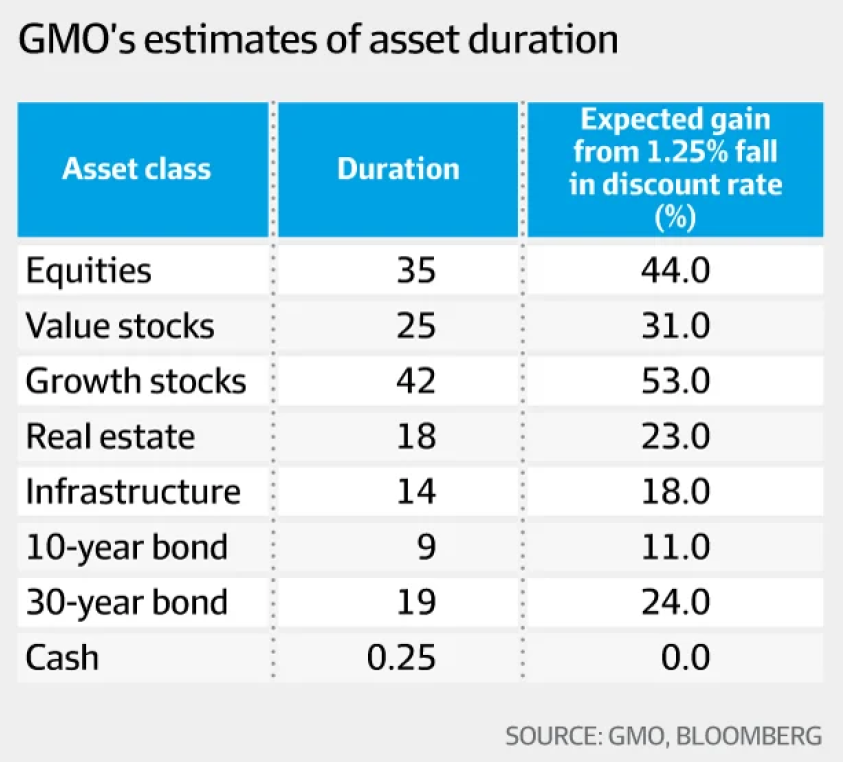

Below is a table showing GMO's 2016 estimates of different assets' durations, appearing in Slater (2017).

If you were certain that interest rates would fall more than the market expects, into what asset might you allocate more funds?

Question 1034 duration, monetary policy, inflation, market efficiency

On 18 March 2022 the AFR's James Thomson wrote: "In a world where the bombs are still falling in Ukraine and the Fed is just getting started on what looks likely to be a year-long cycle of rising interest rates, it would take a certain amount of bravery to embrace the sort of high-tech, long duration plays that Wood favours" (Thomson, 2022).

Which of the following US macro-economic data releases is most likely to cause Cathie Wood's ARK ETF share price to fall?

A stock has a beta of 0.5. Its next dividend is expected to be $3, paid one year from now. Dividends are expected to be paid annually and grow by 2% pa forever. Treasury bonds yield 3% pa and the market risk premium (MRP) is 6% pa. All returns are effective annual rates.

Which of the following statements is NOT correct?

Find the Macaulay duration of a 2 year 5% pa semi-annual fixed coupon bond which has a $100 face value and currently has a yield to maturity of 8% pa. The Macaulay duration is:

Which of the following statements about bond convexity is NOT correct?

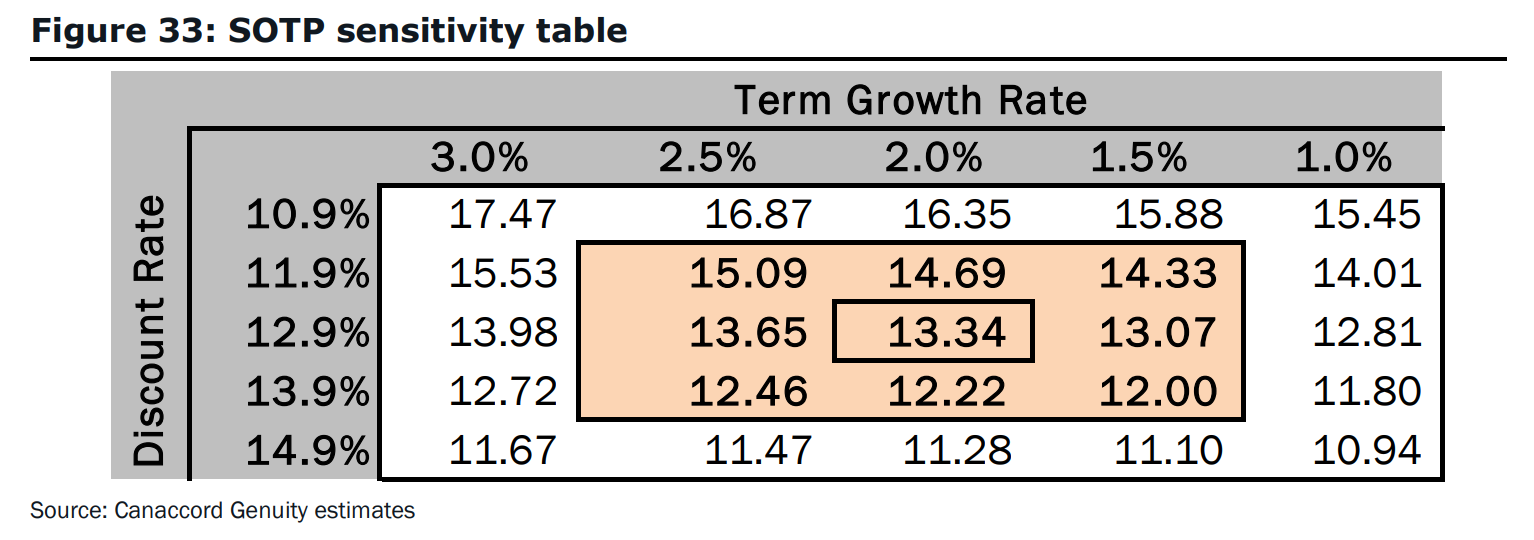

Canaccord conducts a sensitivity analysis of the Israeli pharmaceutical firm InterCure's (INCR) estimated share price in figure 33 on page 30:

Estimate the Macaulay duration of INCR's equity. The Macaulay duration is approximately:

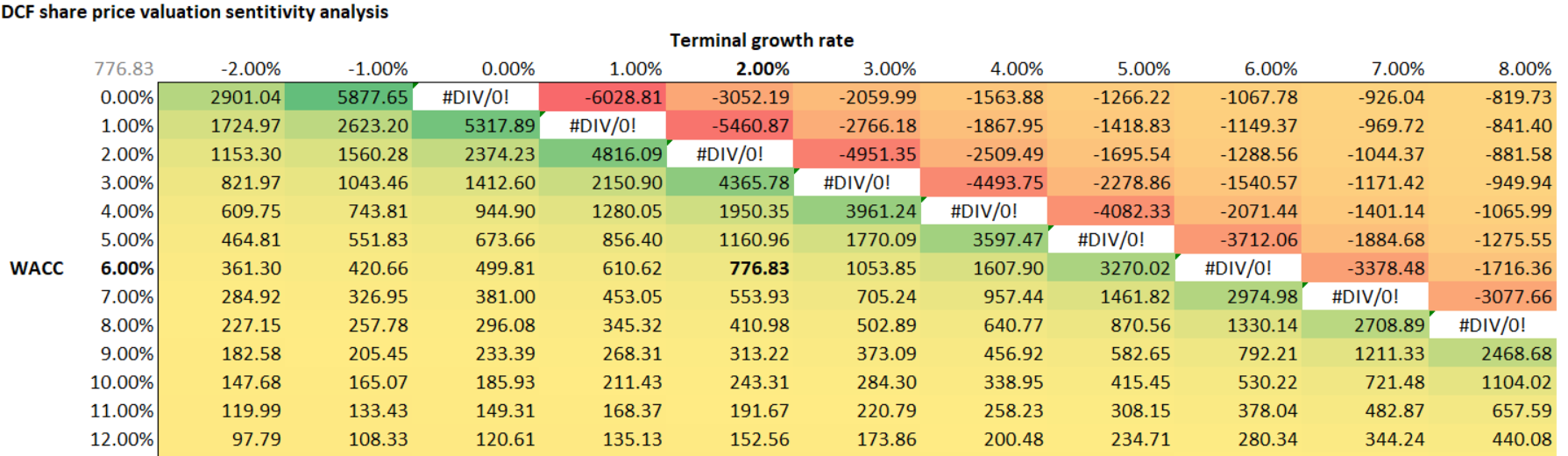

An analyst has prepared a discounted cash flow model to value a firm's share price. A sensitivity analysis data table with ‘conditional formatting’ shading is shown below. The table shows how changes in the weighted average cost of capital (WACC, left column) and terminal value growth rate (top row) affect the firm's model-estimated share price.

The base case estimates are shown in bold.

Which of the following statements is NOT correct? The model-estimated share price would normally be expected to:

Question 1039 gross domestic product, inflation, business cycle

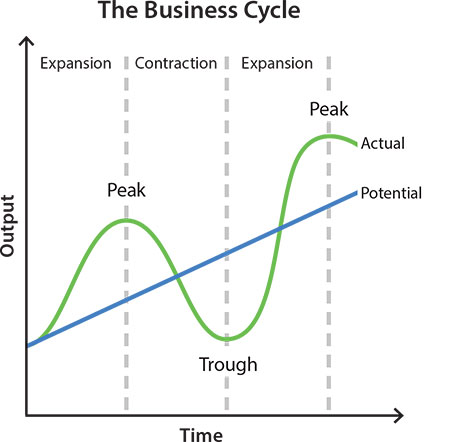

In this business cycle graph shown in the RBA's article explaining recessions, how might 'output' on the y-axis be measured?

The ‘output’ y-axis amount in the business cycle chart can be measured by:

Question 852 gross domestic product, inflation, employment, no explanation

When the economy is booming (in an upswing), you tend to see:

Calculate Australia’s GDP over the 2016 calendar year using the below table:

| Australian Gross Domestic Product Components | ||||

| A$ billion, 2016 Calendar Year from 1 Jan 2016 to 31 Dec 2016 inclusive | ||||

| Consumption | Investment | Government spending | Exports | Imports |

| 971 | 421 | 320 | 328 | 344 |

Source: ABS 5206.0 Australian National Accounts: National Income, Expenditure and Product. Table 3. Expenditure on Gross Domestic Product (GDP), Current prices.

Over the 2016 calendar year, Australia’s GDP was:

Question 850 gross domestic product, gross domestic product per capita

Below is a table showing some countries’ GDP, population and GDP per capita.

| Countries' GDP and Population | |||

| GDP | Population | GDP per capita | |

| USD million | millions of people | USD | |

| United States | 18,036,648 | 325 | 55,492 |

| China | 11,158,457 | 1,383 | 8,066 |

| Japan | 4,383,076 | 127 | 34,586 |

| Germany | 3,363,600 | 83 | 40,623 |

| Norway | 500,519 | 5 | 95,027 |

Source: "GDP and its breakdown at current prices in US Dollars" United Nations Statistics Division. December 2016.

Using this data only, which one of these countries’ citizens have the highest living standards?

Question 841 gross domestic product, government spending

The government spends money on:

- Goods and services such as defence, police, schools, hospitals and roads; and

- Transfer payments (also called welfare) such as the pension, dole, disability support and student support.

When calculating GDP (=C+I+G+X-M), the ‘government spending’ component (G) is supposed to include:

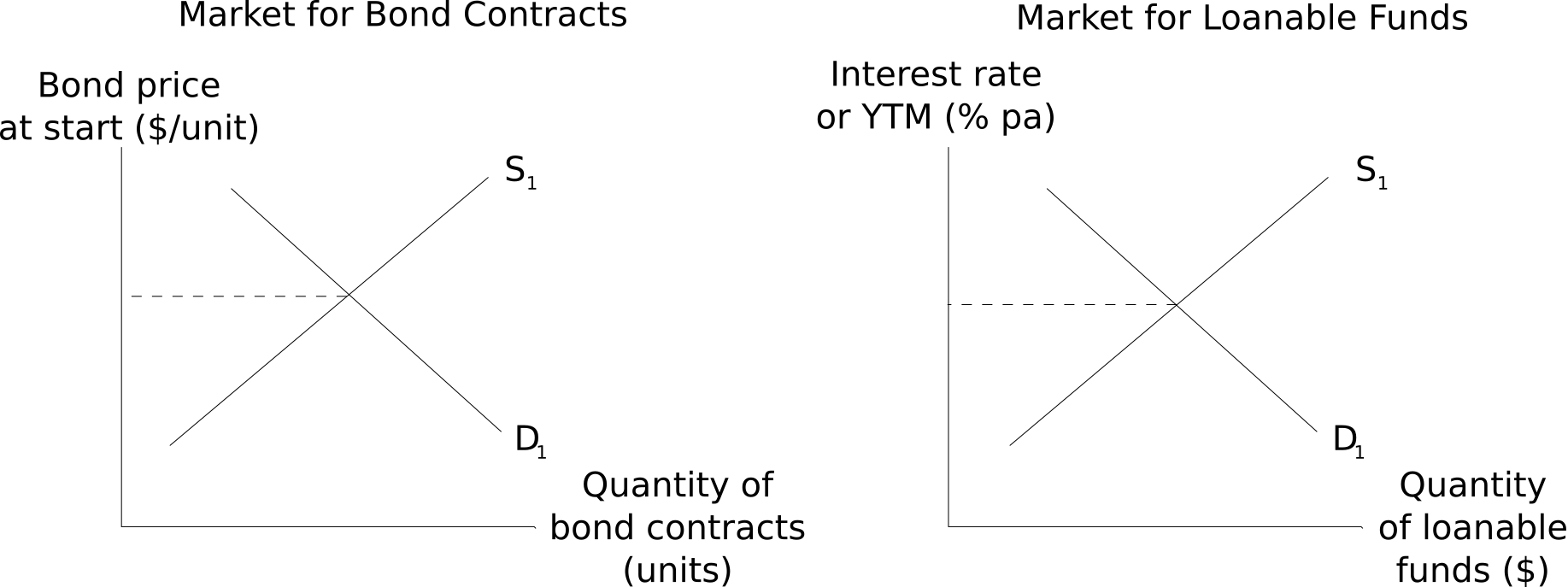

Question 1053 bond pricing, monetary policy, supply and demand

In his 31 August 2021 article 'The rich get richer and rates get lower', Robert Armstrong states that: "Savings chase returns, so when there are more savings and the same number of places to put them, rates of return must fall" (Armstrong, 2021).

Another way of saying that "rates of return must fall" when there are more savings (loanable funds) invested into fixed coupon government and corporate bonds, is that increased:

Which form of production is included in the Gross Domestic Product (GDP) reported by the government statistics agency?

Question 1038 fire sale, leverage, no explanation

Listen to 'Lessons and Questions from the GFC' on 6 December 2018 by RBA Deputy Governor Guy Debelle from 17:58 to 20:08 or read the below transcript:

Guy Debelle talks about the GFC and says that the Australian government’s guarantee of wholesale debt and deposits on 12 October 2008 was "introduced to facilitate the flow of credit to the real economy at a reasonable price and, in some cases, alleviate the need for asset fire sales, which have the capacity to tip markets and the economy into a worse equilibrium... The crisis very much demonstrated the critical importance of keeping the lending flowing. The lesson is that countries that did that fared better than countries that didn't. That lesson is relevant to the situation today in Australia, where there is a risk that a reduced appetite to lend will overly curtail borrowing with consequent effects for the Australian economy." (Debelle, 2019)

When assets are sold in a fire sale, there’s usually a large increase in the:

Question 1035 Minsky financial instability hypothesis, leverage

Which of the following statements about 'The Financial Instability Hypothesis' (Minsky, 1992) is NOT correct? Borrowers with sufficient income to pay:

Question 1047 five Cs of credit, banking, debt terminology, Loan, credit risk, risk, leverage, financial distress

Which of the following is NOT one of the "five C's" of credit used by bankers?

Question 1050 Miller debt and taxes, interest tax shields, Miller and Modigliani, no explanation

In Miller's 1977 article 'Debt and Taxes', he argues that interest tax shields are likely to benefit who? Note that this 1977 article is contrary to his past research findings with Modigliani (1958), modern textbooks and common practice by valuers.

Miller (1977) concludes that the benefits of interest tax shields are likely to benefit:

An asset price suddenly increased by 10%. Multiplication by which of the following leverage ratios will give the proportional increase in equity or net wealth?

Over a short time period the equity capital return will equal the asset capital return multiplied by the:

Which of the following income statement and balance sheet items should NOT be forecast using the 'percent of sales' technique?

Which of the following formulas for the carrying or net amount of 'intangible assets' such as patents from the balance sheet is correct? Assume that now is time 1 and last year is time 0, and that 'IntangibleAssets' is a carrying value net of accumulated depreciation.

Question 729 book and market values, balance sheet, no explanation

If a firm makes a profit and pays no dividends, which of the firm’s accounts will increase?

Question 983 corporate financial decision theory, DuPont formula, accounting ratio

A company manager is thinking about the firm's book assets-to-equity ratio, also called the 'equity multiplier' in the DuPont formula:

###\text{Equity multiplier} = \dfrac{\text{Total Assets}}{\text{Owners' Equity}}###What's the name of the decision that the manager is thinking about? In other words, the assets-to-equity ratio is the main subject of what decision?

Note: DuPont formula for analysing book return on equity:

###\begin{aligned} \text{ROE} &= \dfrac{\text{Net Profit}}{\text{Sales}} \times \dfrac{\text{Sales}}{\text{Total Assets}} \times \dfrac{\text{Total Assets}}{\text{Owners' Equity}} \\ &= \text{Net profit margin} \times \text{Total asset turnover} \times \text{Equity multiplier} \\ \end{aligned}###A levered firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced.

| Balance Sheet Market Values and Betas | ||

| Balance sheet item | Market value ($m) | Beta |

| Cash asset | 0.5 | 0 |

| Truck assets | 0.5 | 2 |

| Loan liabilities | 0.25 | 0.1 |

| Equity funding | ? | ? |

Which of the following statements is NOT correct?

Question 1045 payout policy, leverage, capital structure, beta

A levered firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced.

| Balance Sheet Market Values and Betas | ||

| Balance sheet item | Market value ($m) | Beta |

| Cash asset | 0.5 | 0 |

| Truck assets | 0.5 | 2 |

| Loan liabilities | 0.25 | 0.1 |

| Equity funding | ? | ? |

The firm then pays out all of its cash as a dividend. Assume that the beta and yield on the loan liability remain unchanged. Ignore taxes, transaction costs, signalling, information asymmetries and other frictions.

Which of the following statements is NOT correct? This event led to a:

A levered firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced.

| Balance Sheet Market Values and Betas | ||

| Balance sheet item | Market value ($m) | Beta |

| Cash asset | 0.5 | 0 |

| Truck assets | 0.5 | 2 |

| Loan liabilities | 0.25 | 0.1 |

| Equity funding | ? | ? |

The firm then pays off (retires) all of its loan liabilities using its cash. Ignore interest tax shields.

Which of the following statements is NOT correct? All answers are given to 6 decimal places. This event led to a:

The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

A stock has a beta of 0.7.

In the last 5 minutes, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 2%. The risk free rate was unchanged. What do you think was the stock's historical return over the last 5 minutes, given as an effective 5 minute rate?

Question 959 negative gearing, leverage, capital structure, interest tax shield, real estate

Last year, two friends Gear and Nogear invested in residential apartments. Each invested $1 million of their own money (their net wealth).

Apartments cost $1,000,000 last year and they earned net rents of $30,000 pa over the last year. Net rents are calculated as rent revenues less the costs of renting such as property maintenance, land tax and council rates. However, interest expense and personal income taxes are not deducted from net rents.

Gear and Nogear funded their purchases in different ways:

- Gear used $1,000,000 of her own money and borrowed $4,000,000 from the bank in the form of an interest-only loan with an interest rate of 5% pa to buy 5 apartments.

- Nogear used $1,000,000 of his own money to buy one apartment. He has no mortgage loan on his property.

Both Gear and Nogear also work in high-paying jobs and are subject personal marginal tax rates of 45%.

Which of the below statements about the past year is NOT correct?

Question 566 capital structure, capital raising, rights issue, on market repurchase, dividend, stock split, bonus issue

A company's share price fell by 20% and its number of shares rose by 25%. Assume that there are no taxes, no signalling effects and no transaction costs.

Which one of the following corporate events may have happened?

Question 625 dividend re-investment plan, capital raising

Which of the following statements about dividend re-investment plans (DRP's) is NOT correct?

A company conducts a 2 for 3 rights issue at a subscription price of $8 when the pre-announcement stock price was $9. Assume that all investors use their rights to buy those extra shares.

What is the percentage increase in the stock price and the number of shares outstanding? The answers are given in the same order.

Question 803 capital raising, rights issue, initial public offering, on market repurchase, no explanation

Which one of the following capital raisings or payouts involve the sale of shares to existing shareholders only?

Question 1011 winners curse

A teacher fills up a large jar with coins. The jar is auctioned among a large class of wealthy accounting students who have never studied economics or finance.

The auction is conducted in the English style, which is as an open-outcry ascending auction. This means that the winning bidder is able to bid, win and pay slightly more than the second highest bidder's private valuation, but less than their own private valuation.

The jar of coins is not allowed to be weighed by students and is filled with different-valued coins so it’s difficult to value. Therefore there is a wide distribution of bidders’ fair value estimates. Students’ bids are purely profit-driven, there is no fame to be gained by being the winner or loser.

Assume that each bidder bids up to their personal estimate of the fair value of the jar of coins without observing the number of other bidders during the auction. The winning bidder is likely to:

Question 1012 moral hazard, principal agent problem, asymmetric information

When does the ‘principal-agent problem’ occur? Is it when:

I. The principal has conflicting incentives (moral hazard);

II. The agent has conflicting incentives (moral hazard);

III. The principal has incomplete information about the agent (asymmetric information); or

IV. The agent has incomplete information about the principal (asymmetric information)?

The principal-agent problem occurs when the following statements are true:

Question 1010 lemons problem, asymmetric information, adverse selection, fungible

The ‘Lemons Problem’ is likely to more adversely affect the desirability of which type of investment?

A firm wishes to raise $30 million now. The firm's current market value of equity is $60m and the market price per share is $20. They estimate that they'll be able to issue shares in a rights issue at a subscription price of $15. Ignore the time value of money and assume that all shareholders exercise their rights. Which of the following statements is NOT correct?

A firm wishes to raise $100 million now. The firm's current market value of equity is $300m and the market price per share is $5. They estimate that they'll be able to issue shares in a rights issue at a subscription price of $4. All answers are rounded to 6 decimal places. Ignore the time value of money and assume that all shareholders exercise their rights. Which of the following statements is NOT correct?

Question 1036 Minsky financial instability hypothesis, leverage

Hyman Minsky, author of 'The Financial Instability Hypothesis' (1992), wrote:

In particular, over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. Consequently, units with cash flow shortfalls will be forced to try to make position by selling out position. This is likely to lead to a collapse of asset values.

Which of the below statements explaining this quote is NOT correct?

Here's an excerpt from an interview between Magellan fund co-founder Hamish Douglass and AFR reporter Vesna Poljak, which appeared in the Australian Financial Review article ‘It's all about interest rates: Hamish Douglass’, 19 July 2019:

Take a business growing at 4 per cent a year, with a cost of equity of 10 per cent based off a 5 per cent risk-free rate and a 5 per cent market risk premium: you would value that at around 16.6 times free cashflow.

Now take a business growing at the same rate, with a 4 per cent risk free rate. At a 9 per cent cost of equity that would command a 20 times multiple, he says.

At a 3 per cent risk-free rate, the cost of equity is 8 per cent, and the multiple is 25.

Finally at 2 per cent – 'which is where the world is at the moment' – the same business would be worth around 33 times free cashflow.

In August 2021, the RBA overnight cash rate and 3 year Australian government treasury bond yield were both 0.1% pa. If this low risk-free yield was expected to persist forever, what approximate equity price-to-cashflow multiple would that imply for a business expected to grow at 4% pa in perpetuity with a 5% equity risk premium?

You believe that the price of a share will fall significantly very soon, but the rest of the market does not. The market thinks that the share price will remain the same. Assuming that your prediction will soon be true, which of the following trades is a bad idea? In other words, which trade will NOT make money or prevent losses?

A man just sold a call option to his counterparty, a lady. The man has just now:

A European call option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the call option?

Question 432 option, option intrinsic value, no explanation

An American style call option with a strike price of ##K## dollars will mature in ##T## years. The underlying asset has a price of ##S## dollars.

What is an expression for the current intrinsic value in dollars from owning (being long) the American style call option? Note that the intrinsic value of an option does not subtract the premium paid to buy the option.

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from owning (being long) the put option?

A European call option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from having written (being short) the call option?

A European put option will mature in ##T## years with a strike price of ##K## dollars. The underlying asset has a price of ##S## dollars.

What is an expression for the payoff at maturity ##(f_T)## in dollars from having written (being short) the put option?

Which of the following statements about option contracts is NOT correct? For every:

If trader A has sold the right that allows counterparty B to buy the underlying asset from him at maturity if counterparty B wants then trader A is:

After doing extensive fundamental analysis of a company, you believe that their shares are overpriced and will soon fall significantly. The market believes that there will be no such fall.

Which of the following strategies is NOT a good idea, assuming that your prediction is true?

Question 636 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being long a call option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Question 637 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being short a call option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Question 638 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being long a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Question 639 option, option payoff at maturity, no explanation

Which of the below formulas gives the payoff ##(f)## at maturity ##(T)## from being short a put option? Let the underlying asset price at maturity be ##S_T## and the exercise price be ##X_T##.

Which one of the below option and futures contracts gives the possibility of potentially unlimited gains?

A trader buys one crude oil European style call option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

Which of the below formulas gives the profit ##(\pi)## from being long a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

Which of the below formulas gives the profit ##(\pi)## from being short a call option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LC,0}##. Note that ##S_T##, ##X_T## and ##f_{LC,0}## are all positive numbers.

Which of the below formulas gives the profit ##(\pi)## from being long a put option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LP,0}##. Note that ##S_T##, ##X_T## and ##f_{LP,0}## are all positive numbers.

Which of the below formulas gives the profit ##(\pi)## from being short a put option? Let the underlying asset price at maturity be ##S_T##, the exercise price be ##X_T## and the option price be ##f_{LP,0}##. Note that ##S_T##, ##X_T## and ##f_{LP,0}## are all positive numbers.

A trader sells one crude oil European style call option contract on the CME expiring in one year with an exercise price of $44 per barrel for a price of $6.64. The crude oil spot price is $40.33. If the trader doesn’t close out her contract before maturity, then at maturity she will have the:

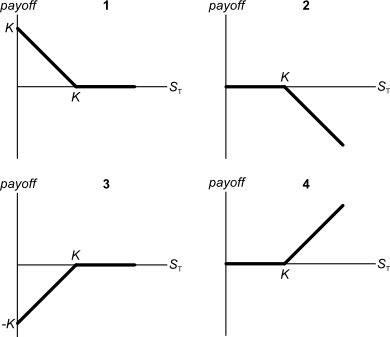

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered.

You're thinking of starting a new cafe business, but you're not sure if it will be profitable.

You have to decide what type of cups, mugs and glasses you wish to buy. You can pay to have your cafe's name printed on them, or just buy the plain un-marked ones. For marketing reasons it's better to have the cafe name printed. But the plain un-marked cups, mugs and glasses maximise your:

Some financially minded people insist on a prenuptial agreement before committing to marry their partner. This agreement states how the couple's assets should be divided in case they divorce. Prenuptial agreements are designed to give the richer partner more of the couples' assets if they divorce, thus maximising the richer partner's:

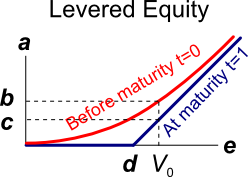

Question 385 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

The levered equity graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

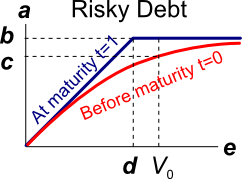

Question 386 Merton model of corporate debt, real option, option

A risky firm will last for one period only (t=0 to 1), then it will be liquidated. So it's assets will be sold and the debt holders and equity holders will be paid out in that order. The firm has the following quantities:

##V## = Market value of assets.

##E## = Market value of (levered) equity.

##D## = Market value of zero coupon bonds.

##F_1## = Total face value of zero coupon bonds which is promised to be paid in one year.

The risky corporate debt graph above contains bold labels a to e. Which of the following statements about those labels is NOT correct?

Question 382 Merton model of corporate debt, real option, option

In the Merton model of corporate debt, buying a levered company's shares is equivalent to:

Which of the following is the least useful method or model to calculate the value of a real option in a project?