Question 580 price gains and returns over time, time calculation, effective rate

How many years will it take for an asset's price to quadruple (be four times as big, say from $1 to $4) if the price grows by 15% pa?

If a project's net present value (NPV) is zero, then its internal rate of return (IRR) will be:

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume an equal amount now (t=0) and in one year (t=1) and have nothing left in the bank at the end (t=1).

How much can you consume at each time?

Your neighbour asks you for a loan of $100 and offers to pay you back $120 in one year.

You don't actually have any money right now, but you can borrow and lend from the bank at a rate of 10% pa. Rates are given as effective annual rates.

Assume that your neighbour will definitely pay you back. Ignore interest tax shields and transaction costs.

The Net Present Value (NPV) of lending to your neighbour is $9.09. Describe what you would do to actually receive a $9.09 cash flow right now with zero net cash flows in the future.

Question 524 risk, expected and historical returns, bankruptcy or insolvency, capital structure, corporate financial decision theory, limited liability

Which of the following statements is NOT correct?

Question 727 inflation, real and nominal returns and cash flows

The Australian Federal Government lends money to domestic students to pay for their university education. This is known as the Higher Education Contribution Scheme (HECS). The nominal interest rate on the HECS loan is set equal to the consumer price index (CPI) inflation rate. The interest is capitalised every year, which means that the interest is added to the principal. The interest and principal does not need to be repaid by students until they finish study and begin working.

Which of the following statements about HECS loans is NOT correct?

Question 728 inflation, real and nominal returns and cash flows, income and capital returns, no explanation

Which of the following statements about gold is NOT correct? Assume that the gold price increases by inflation. Gold has a:

Question 739 real and nominal returns and cash flows, inflation

There are a number of different formulas involving real and nominal returns and cash flows. Which one of the following formulas is NOT correct? All returns are effective annual rates. Note that the symbol ##\approx## means 'approximately equal to'.

The saying "buy low, sell high" suggests that investors should make a:

One and a half years ago Frank bought a house for $600,000. Now it's worth only $500,000, based on recent similar sales in the area.

The expected total return on Frank's residential property is 7% pa.

He rents his house out for $1,600 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $18,617.27.

The future value of 12 months of rental payments one year in the future is $19,920.48.

What is the expected annual rental yield of the property? Ignore the costs of renting such as maintenance, real estate agent fees and so on.

Question 353 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

Question 577 inflation, real and nominal returns and cash flows

What is the present value of a real payment of $500 in 2 years? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

Question 745 real and nominal returns and cash flows, inflation, income and capital returns

If the nominal gold price is expected to increase at the same rate as inflation which is 3% pa, which of the following statements is NOT correct?

Question 531 bankruptcy or insolvency, capital structure, risk, limited liability

Who is most in danger of being personally bankrupt? Assume that all of their businesses' assets are highly liquid and can therefore be sold immediately.

Question 445 financing decision, corporate financial decision theory

The financing decision primarily affects which part of a business?

Question 443 corporate financial decision theory, investment decision, financing decision, working capital decision, payout policy

Business people make lots of important decisions. Which of the following is the most important long term decision?

Two years ago Fred bought a house for $300,000.

Now it's worth $500,000, based on recent similar sales in the area.

Fred's residential property has an expected total return of 8% pa.

He rents his house out for $2,000 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $23,173.86.

The future value of 12 months of rental payments one year ahead is $25,027.77.

What is the expected annual growth rate of the rental payments? In other words, by what percentage increase will Fred have to raise the monthly rent by each year to sustain the expected annual total return of 8%?

You just bought a nice dress which you plan to wear once per month on nights out. You bought it a moment ago for $600 (at t=0). In your experience, dresses used once per month last for 6 years.

Your younger sister is a student with no money and wants to borrow your dress once a month when she hits the town. With the increased use, your dress will only last for another 3 years rather than 6.

What is the present value of the cost of letting your sister use your current dress for the next 3 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new dress when your current one wears out; your sister will only use the current dress, not the next one that you will buy; and the price of a new dress never changes.

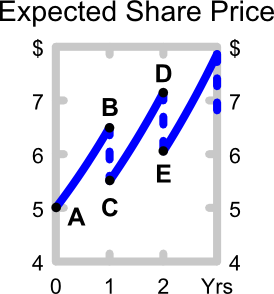

The perpetuity with growth formula, also known as the dividend discount model (DDM) or Gordon growth model, is appropriate for valuing a company's shares. ##P_0## is the current share price, ##C_1## is next year's expected dividend, ##r## is the total required return and ##g## is the expected growth rate of the dividend.

###P_0=\dfrac{C_1}{r-g}###

The below graph shows the expected future price path of the company's shares. Which of the following statements about the graph is NOT correct?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###P_0=\frac{d_1}{r-g}###

A stock pays dividends annually. It just paid a dividend, but the next dividend (##d_1##) will be paid in one year.

According to the DDM, what is the correct formula for the expected price of the stock in 2.5 years?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What will be the price of the stock in three and a half years (t = 3.5)?

Question 180 equivalent annual cash flow, inflation, real and nominal returns and cash flows

Details of two different types of light bulbs are given below:

- Low-energy light bulbs cost $3.50, have a life of nine years, and use about $1.60 of electricity a year, paid at the end of each year.

- Conventional light bulbs cost only $0.50, but last only about a year and use about $6.60 of energy a year, paid at the end of each year.

The real discount rate is 5%, given as an effective annual rate. Assume that all cash flows are real. The inflation rate is 3% given as an effective annual rate.

Find the Equivalent Annual Cost (EAC) of the low-energy and conventional light bulbs. The below choices are listed in that order.

Question 155 inflation, real and nominal returns and cash flows, Loan, effective rate conversion

You are a banker about to grant a 2 year loan to a customer. The loan's principal and interest will be repaid in a single payment at maturity, sometimes called a zero-coupon loan, discount loan or bullet loan.

You require a real return of 6% pa over the two years, given as an effective annual rate. Inflation is expected to be 2% this year and 4% next year, both given as effective annual rates.

You judge that the customer can afford to pay back $1,000,000 in 2 years, given as a nominal cash flow. How much should you lend to her right now?

Question 446 working capital decision, corporate financial decision theory

The working capital decision primarily affects which part of a business?

Question 447 payout policy, corporate financial decision theory

Payout policy is most closely related to which part of a business?

Question 490 expected and historical returns, accounting ratio

Which of the following is NOT a synonym of 'required return'?

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $1,500 per month. The interest rate is 9% pa which is not expected to change.

To your surprise, you can actually afford to pay $2,000 per month and your mortgage allows early repayments without fees. If you maintain these higher monthly payments, how long will it take to pay off your mortgage?

A prospective home buyer can afford to pay $2,000 per month in mortgage loan repayments. The central bank recently lowered its policy rate by 0.25%, and residential home lenders cut their mortgage loan rates from 4.74% to 4.49%.

How much more can the prospective home buyer borrow now that interest rates are 4.49% rather than 4.74%? Give your answer as a proportional increase over the original amount he could borrow (##V_\text{before}##), so:

###\text{Proportional increase} = \frac{V_\text{after}-V_\text{before}}{V_\text{before}} ###Assume that:

- Interest rates are expected to be constant over the life of the loan.

- Loans are interest-only and have a life of 30 years.

- Mortgage loan payments are made every month in arrears and all interest rates are given as annualised percentage rates compounding per month.

A European bond paying annual coupons of 6% offers a yield of 10% pa.

Convert the yield into an effective monthly rate, an effective annual rate and an effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff, monthly} , r_\text{eff, yearly} , r_\text{eff, daily} ###

Question 56 income and capital returns, bond pricing, premium par and discount bonds

Which of the following statements about risk free government bonds is NOT correct?

Hint: Total return can be broken into income and capital returns as follows:

###\begin{aligned} r_\text{total} &= \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0} \\ &= r_\text{income} + r_\text{capital} \end{aligned} ###

The capital return is the growth rate of the price.

The income return is the periodic cash flow. For a bond this is the coupon payment.

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid semi-annually. So there are two coupons per year, paid in arrears every six months.

A 10 year Australian government bond was just issued at par with a yield of 3.9% pa. The fixed coupon payments are semi-annual. The bond has a face value of $1,000.

Six months later, just after the first coupon is paid, the yield of the bond decreases to 3.65% pa. What is the bond's new price?

Question 213 income and capital returns, bond pricing, premium par and discount bonds

The coupon rate of a fixed annual-coupon bond is constant (always the same).

What can you say about the income return (##r_\text{income}##) of a fixed annual coupon bond? Remember that:

###r_\text{total} = r_\text{income} + r_\text{capital}###

###r_\text{total, 0 to 1} = \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0}###

Assume that there is no change in the bond's total annual yield to maturity from when it is issued to when it matures.

Select the most correct statement.

From its date of issue until maturity, the income return of a fixed annual coupon:

On his 20th birthday, a man makes a resolution. He will deposit $30 into a bank account at the end of every month starting from now, which is the start of the month. So the first payment will be in one month. He will write in his will that when he dies the money in the account should be given to charity.

The bank account pays interest at 6% pa compounding monthly, which is not expected to change.

If the man lives for another 60 years, how much money will be in the bank account if he dies just after making his last (720th) payment?

Question 48 IRR, NPV, bond pricing, premium par and discount bonds, market efficiency

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

An investor bought two fixed-coupon bonds issued by the same company, a zero-coupon bond and a 7% pa semi-annual coupon bond. Both bonds have a face value of $1,000, mature in 10 years, and had a yield at the time of purchase of 8% pa.

A few years later, yields fell to 6% pa. Which of the following statements is correct? Note that a capital gain is an increase in price.

You're trying to save enough money to buy your first car which costs $2,500. You can save $100 at the end of each month starting from now. You currently have no money at all. You just opened a bank account with an interest rate of 6% pa payable monthly.

How many months will it take to save enough money to buy the car? Assume that the price of the car will stay the same over time.

Find Candys Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Candys Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 50 | |

| Operating expense | 10 | |

| Depreciation | 20 | |

| Interest expense | 10 | |

| Income before tax | 110 | |

| Tax at 30% | 33 | |

| Net income | 77 | |

| Candys Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 220 | 180 |

| PPE | ||

| Cost | 300 | 340 |

| Accumul. depr. | 60 | 40 |

| Carrying amount | 240 | 300 |

| Total assets | 460 | 480 |

| Liabilities | ||

| Current liabilities | 175 | 190 |

| Non-current liabilities | 135 | 130 |

| Owners' equity | ||

| Retained earnings | 50 | 60 |

| Contributed equity | 100 | 100 |

| Total L and OE | 460 | 480 |

Note: all figures are given in millions of dollars ($m).

Find Ching-A-Lings Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Ching-A-Lings Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 100 | |

| COGS | 20 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 30 | |

| Taxes at 30% | 9 | |

| Net income | 21 | |

| Ching-A-Lings Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 49 | 38 |

| Trade debtors | 14 | 2 |

| Rent paid in advance | 5 | 5 |

| PPE | 400 | 400 |

| Total assets | 468 | 445 |

| Trade creditors | 4 | 10 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 145 | 145 |

| Retained profits | 119 | 100 |

| Total L and OE | 468 | 445 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

Find the cash flow from assets (CFFA) of the following project.

| One Year Mining Project Data | ||

| Project life | 1 year | |

| Initial investment in building mine and equipment | $9m | |

| Depreciation of mine and equipment over the year | $8m | |

| Kilograms of gold mined at end of year | 1,000 | |

| Sale price per kilogram | $0.05m | |

| Variable cost per kilogram | $0.03m | |

| Before-tax cost of closing mine at end of year | $4m | |

| Tax rate | 30% | |

Note 1: Due to the project, the firm also anticipates finding some rare diamonds which will give before-tax revenues of $1m at the end of the year.

Note 2: The land that will be mined actually has thermal springs and a family of koalas that could be sold to an eco-tourist resort for an after-tax amount of $3m right now. However, if the mine goes ahead then this natural beauty will be destroyed.

Note 3: The mining equipment will have a book value of $1m at the end of the year for tax purposes. However, the equipment is expected to fetch $2.5m when it is sold.

Find the project's CFFA at time zero and one. Answers are given in millions of dollars ($m), with the first cash flow at time zero, and the second at time one.

Over the next year, the management of an unlevered company plans to:

- Achieve firm free cash flow (FFCF or CFFA) of $1m.

- Pay dividends of $1.8m

- Complete a $1.3m share buy-back.

- Spend $0.8m on new buildings without buying or selling any other fixed assets. This capital expenditure is included in the CFFA figure quoted above.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

Value the following business project to manufacture a new product.

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year | $3m | |

| Expected sale price of equipment at end of project | $0.6m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $5 | |

| Fixed costs per year, paid at the end of each year | $1m | |

| Interest expense per year | 0 | |

| Tax rate | 30% | |

| Weighted average cost of capital after tax per annum | 10% | |

Notes

- The firm's current assets and current liabilities are $3m and $2m respectively right now. This net working capital will not be used in this project, it will be used in other unrelated projects.

Due to the project, current assets (mostly inventory) will grow by $2m initially (at t = 0), and then by $0.2m at the end of the first year (t=1).

Current liabilities (mostly trade creditors) will increase by $0.1m at the end of the first year (t=1).

At the end of the project, the net working capital accumulated due to the project can be sold for the same price that it was bought. - The project cost $0.5m to research which was incurred one year ago.

Assumptions

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 3% pa.

- All rates are given as effective annual rates.

- The business considering the project is run as a 'sole tradership' (run by an individual without a company) and is therefore eligible for a 50% capital gains tax discount when the equipment is sold, as permitted by the Australian Tax Office.

What is the expected net present value (NPV) of the project?

Read the following financial statements and calculate the firm's free cash flow over the 2014 financial year.

| UBar Corp | ||

| Income Statement for | ||

| year ending 30th June 2014 | ||

| $m | ||

| Sales | 293 | |

| COGS | 200 | |

| Rent expense | 15 | |

| Gas expense | 8 | |

| Depreciation | 10 | |

| EBIT | 60 | |

| Interest expense | 0 | |

| Taxable income | 60 | |

| Taxes | 18 | |

| Net income | 42 | |

| UBar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2014 | 2013 |

| $m | $m | |

| Assets | ||

| Cash | 30 | 29 |

| Accounts receivable | 5 | 7 |

| Pre-paid rent expense | 1 | 0 |

| Inventory | 50 | 46 |

| PPE | 290 | 300 |

| Total assets | 376 | 382 |

| Liabilities | ||

| Trade payables | 20 | 18 |

| Accrued gas expense | 3 | 2 |

| Non-current liabilities | 0 | 0 |

| Contributed equity | 212 | 212 |

| Retained profits | 136 | 150 |

| Asset revaluation reserve | 5 | 0 |

| Total L and OE | 376 | 382 |

Note: all figures are given in millions of dollars ($m).

The firm's free cash flow over the 2014 financial year was:

Find Trademark Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Trademark Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 100 | |

| COGS | 25 | |

| Operating expense | 5 | |

| Depreciation | 20 | |

| Interest expense | 20 | |

| Income before tax | 30 | |

| Tax at 30% | 9 | |

| Net income | 21 | |

| Trademark Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 120 | 80 |

| PPE | ||

| Cost | 150 | 140 |

| Accumul. depr. | 60 | 40 |

| Carrying amount | 90 | 100 |

| Total assets | 210 | 180 |

| Liabilities | ||

| Current liabilities | 75 | 65 |

| Non-current liabilities | 75 | 55 |

| Owners' equity | ||

| Retained earnings | 10 | 10 |

| Contributed equity | 50 | 50 |

| Total L and OE | 210 | 180 |

Note: all figures are given in millions of dollars ($m).

Find Scubar Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Scubar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 60 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 90 | |

| Taxes at 30% | 27 | |

| Net income | 63 | |

| Scubar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 60 | 50 |

| Trade debtors | 19 | 6 |

| Rent paid in advance | 3 | 2 |

| PPE | 420 | 400 |

| Total assets | 502 | 458 |

| Trade creditors | 10 | 8 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 130 | 130 |

| Retained profits | 162 | 130 |

| Total L and OE | 502 | 458 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

One year ago you bought a $1,000,000 house partly funded using a mortgage loan. The loan size was $800,000 and the other $200,000 was your wealth or 'equity' in the house asset.

The interest rate on the home loan was 4% pa.

Over the year, the house produced a net rental yield of 2% pa and a capital gain of 2.5% pa.

Assuming that all cash flows (interest payments and net rental payments) were paid and received at the end of the year, and all rates are given as effective annual rates, what was the total return on your wealth over the past year?

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

Interest expense (IntExp) is an important part of a company's income statement (or 'profit and loss' or 'statement of financial performance').

How does an accountant calculate the annual interest expense of a fixed-coupon bond that has a liquid secondary market? Select the most correct answer:

Annual interest expense is equal to:

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

One formula for calculating a levered firm's free cash flow (FFCF, or CFFA) is to use net operating profit after tax (NOPAT).

###\begin{aligned} FFCF &= NOPAT + Depr - CapEx -\Delta NWC \\ &= (Rev - COGS - Depr - FC)(1-t_c) + Depr - CapEx -\Delta NWC \\ \end{aligned} \\###

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA). Some include the annual interest tax shield in the cash flow and some do not.

Which of the below FFCF formulas include the interest tax shield in the cash flow?

###(1) \quad FFCF=NI + Depr - CapEx -ΔNWC + IntExp### ###(2) \quad FFCF=NI + Depr - CapEx -ΔNWC + IntExp.(1-t_c)### ###(3) \quad FFCF=EBIT.(1-t_c )+ Depr- CapEx -ΔNWC+IntExp.t_c### ###(4) \quad FFCF=EBIT.(1-t_c) + Depr- CapEx -ΔNWC### ###(5) \quad FFCF=EBITDA.(1-t_c )+Depr.t_c- CapEx -ΔNWC+IntExp.t_c### ###(6) \quad FFCF=EBITDA.(1-t_c )+Depr.t_c- CapEx -ΔNWC### ###(7) \quad FFCF=EBIT-Tax + Depr - CapEx -ΔNWC### ###(8) \quad FFCF=EBIT-Tax + Depr - CapEx -ΔNWC-IntExp.t_c### ###(9) \quad FFCF=EBITDA-Tax - CapEx -ΔNWC### ###(10) \quad FFCF=EBITDA-Tax - CapEx -ΔNWC-IntExp.t_c###The formulas for net income (NI also called earnings), EBIT and EBITDA are given below. Assume that depreciation and amortisation are both represented by 'Depr' and that 'FC' represents fixed costs such as rent.

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )### ###EBIT=Rev - COGS - FC-Depr### ###EBITDA=Rev - COGS - FC### ###Tax =(Rev - COGS - Depr - FC - IntExp).t_c= \dfrac{NI.t_c}{1-t_c}###There are a number of ways that assets can be depreciated. Generally the government's tax office stipulates a certain method.

But if it didn't, what would be the ideal way to depreciate an asset from the perspective of a businesses owner?

Question 241 Miller and Modigliani, leverage, payout policy, diversification, NPV

One of Miller and Modigliani's (M&M's) important insights is that a firm's managers should not try to achieve a particular level of leverage in a world with zero taxes and perfect information since investors can make their own leverage. Therefore corporate capital structure policy is irrelevant since investors can achieve their own desired leverage at the personal level by borrowing or lending on their own.

This principal of 'home-made' or 'do-it-yourself' leverage can also be applied to other topics. Read the following statements to decide which are true:

(I) Payout policy: a firm's managers should not try to achieve a particular pattern of equity payout.

(II) Agency costs: a firm's managers should not try to minimise agency costs.

(III) Diversification: a firm's managers should not try to diversify across industries.

(IV) Shareholder wealth: a firm's managers should not try to maximise shareholders' wealth.

Which of the above statement(s) are true?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume twice as much now (t=0) as in one year (t=1) and have nothing left in the bank at the end.

How much can you consume at time zero and one? The answer choices are given in the same order.

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume half as much now (t=0) as in one year (t=1) and have nothing left in the bank at the end.

How much can you consume at time zero and one? The answer choices are given in the same order.

A project to build a toll road will take 3 years to complete, costing three payments of $50 million, paid at the start of each year (at times 0, 1, and 2).

After completion, the toll road will yield a constant $10 million at the end of each year forever with no costs. So the first payment will be at t=4.

The required return of the project is 10% pa given as an effective nominal rate. All cash flows are nominal.

What is the payback period?

An investor bought a 10 year 2.5% pa fixed coupon government bond priced at par. The face value is $100. Coupons are paid semi-annually and the next one is in 6 months.

Six months later, just after the coupon at that time was paid, yields suddenly and unexpectedly fell to 2% pa. Note that all yields above are given as APR's compounding semi-annually.

What was the bond investors' historical total return over that first 6 month period, given as an effective semi-annual rate?

Question 370 capital budgeting, NPV, interest tax shield, WACC, CFFA

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $600k | |

| Depreciation of equipment per year | $250k | |

| Expected sale price of equipment at end of project | $200k | |

| Revenue per job | $12k | |

| Variable cost per job | $4k | |

| Quantity of jobs per year | 120 | |

| Fixed costs per year, paid at the end of each year | $100k | |

| Interest expense in first year (at t=1) | $16.091k | |

| Interest expense in second year (at t=2) | $9.711k | |

| Tax rate | 30% | |

| Government treasury bond yield | 5% | |

| Bank loan debt yield | 6% | |

| Levered cost of equity | 12.5% | |

| Market portfolio return | 10% | |

| Beta of assets | 1.24 | |

| Beta of levered equity | 1.5 | |

| Firm's and project's debt-to-equity ratio | 25% | |

Notes

- The project will require an immediate purchase of $50k of inventory, which will all be sold at cost when the project ends. Current liabilities are negligible so they can be ignored.

Assumptions

- The debt-to-equity ratio will be kept constant throughout the life of the project. The amount of interest expense at the end of each period has been correctly calculated to maintain this constant debt-to-equity ratio. Note that interest expense is different in each year.

- Thousands are represented by 'k' (kilo).

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are nominal. The inflation rate is 2% pa.

- All rates are given as effective annual rates.

- The 50% capital gains tax discount is not available since the project is undertaken by a firm, not an individual.

What is the net present value (NPV) of the project?

The standard deviation and variance of a stock's annual returns are calculated over a number of years. The units of the returns are percent per annum ##(\% pa)##.

What are the units of the standard deviation ##(\sigma)## and variance ##(\sigma^2)## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation ##(\rho_{A,B})## | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the standard deviation (not variance) of returns of the above portfolio?

Two risky stocks A and B comprise an equal-weighted portfolio. The correlation between the stocks' returns is 70%.

If the variance of stock A's returns increases but the:

- Prices and expected returns of each stock stays the same,

- Variance of stock B's returns stays the same,

- Correlation of returns between the stocks stays the same.

Which of the following statements is NOT correct?

Question 556 portfolio risk, portfolio return, standard deviation

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 12% pa.

- Stock A has an expected return of 10% pa and a standard deviation of 20% pa.

- Stock B has an expected return of 15% pa and a standard deviation of 30% pa.

The correlation coefficient between stock A and B's expected returns is 70%.

What will be the annual standard deviation of the portfolio with this 12% pa target return?

Let the standard deviation of returns for a share per month be ##\sigma_\text{monthly}##.

What is the formula for the standard deviation of the share's returns per year ##(\sigma_\text{yearly})##?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

Question 408 leverage, portfolio beta, portfolio risk, real estate, CAPM

You just bought a house worth $1,000,000. You financed it with an $800,000 mortgage loan and a deposit of $200,000.

You estimate that:

- The house has a beta of 1;

- The mortgage loan has a beta of 0.2.

What is the beta of the equity (the $200,000 deposit) that you have in your house?

Also, if the risk free rate is 5% pa and the market portfolio's return is 10% pa, what is the expected return on equity in your house? Ignore taxes, assume that all cash flows (interest payments and rent) were paid and received at the end of the year, and all rates are effective annual rates.

A stock has a beta of 1.5. The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

Over the last year, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 1%. So ##r_{m} = (P_{0} - P_{-1})/P_{-1} = -0.01##, where the current time is zero and one year ago is time -1. The risk free rate was unchanged.

What do you think was the stock's historical return over the last year, given as an effective annual rate?

Question 418 capital budgeting, NPV, interest tax shield, WACC, CFFA, CAPM

| Project Data | ||

| Project life | 1 year | |

| Initial investment in equipment | $8m | |

| Depreciation of equipment per year | $8m | |

| Expected sale price of equipment at end of project | 0 | |

| Unit sales per year | 4m | |

| Sale price per unit | $10 | |

| Variable cost per unit | $5 | |

| Fixed costs per year, paid at the end of each year | $2m | |

| Interest expense in first year (at t=1) | $0.562m | |

| Corporate tax rate | 30% | |

| Government treasury bond yield | 5% | |

| Bank loan debt yield | 9% | |

| Market portfolio return | 10% | |

| Covariance of levered equity returns with market | 0.32 | |

| Variance of market portfolio returns | 0.16 | |

| Firm's and project's debt-to-equity ratio | 50% | |

Notes

- Due to the project, current assets will increase by $6m now (t=0) and fall by $6m at the end (t=1). Current liabilities will not be affected.

Assumptions

- The debt-to-equity ratio will be kept constant throughout the life of the project. The amount of interest expense at the end of each period has been correctly calculated to maintain this constant debt-to-equity ratio.

- Millions are represented by 'm'.

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 2% pa. All rates are given as effective annual rates.

- The project is undertaken by a firm, not an individual.

What is the net present value (NPV) of the project?

An economy has only two investable assets: stocks and cash.

Stocks had a historical nominal average total return of negative two percent per annum (-2% pa) over the last 20 years. Stocks are liquid and actively traded. Stock returns are variable, they have risk.

Cash is riskless and has a nominal constant return of zero percent per annum (0% pa), which it had in the past and will have in the future. Cash can be kept safely at zero cost. Cash can be converted into shares and vice versa at zero cost.

The nominal total return of the shares over the next year is expected to be:

A person is thinking about borrowing $100 from the bank at 7% pa and investing it in shares with an expected return of 10% pa. One year later the person intends to sell the shares and pay back the loan in full. Both the loan and the shares are fairly priced.

What is the Net Present Value (NPV) of this one year investment? Note that you are asked to find the present value (##V_0##), not the value in one year (##V_1##).

A managed fund charges fees based on the amount of money that you keep with them. The fee is 2% of the start-of-year amount, but it is paid at the end of every year.

This fee is charged regardless of whether the fund makes gains or losses on your money.

The fund offers to invest your money in shares which have an expected return of 10% pa before fees.

You are thinking of investing $100,000 in the fund and keeping it there for 40 years when you plan to retire.

What is the Net Present Value (NPV) of investing your money in the fund? Note that the question is not asking how much money you will have in 40 years, it is asking: what is the NPV of investing in the fund? Assume that:

- The fund has no private information.

- Markets are weak and semi-strong form efficient.

- The fund's transaction costs are negligible.

- The cost and trouble of investing your money in shares by yourself, without the managed fund, is negligible.

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Of the 15% pa total expected return, the dividend yield is expected to always be 7% pa and rest is the capital yield.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% total return lasts for the next 100 years (t=0 to 100), then reverts to 10% after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant, the dividends can only be re-invested at 10% pa and all returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

Question 119 market efficiency, fundamental analysis, joint hypothesis problem

Your friend claims that by reading 'The Economist' magazine's economic news articles, she can identify shares that will have positive abnormal expected returns over the next 2 years. Assuming that her claim is true, which statement(s) are correct?

(i) Weak form market efficiency is broken.

(ii) Semi-strong form market efficiency is broken.

(iii) Strong form market efficiency is broken.

(iv) The asset pricing model used to measure the abnormal returns (such as the CAPM) is either wrong (mis-specification error) or is measured using the wrong inputs (data errors) so the returns may not be abnormal but rather fair for the level of risk.

Select the most correct response:

Question 339 bond pricing, inflation, market efficiency, income and capital returns

Economic statistics released this morning were a surprise: they show a strong chance of consumer price inflation (CPI) reaching 5% pa over the next 2 years.

This is much higher than the previous forecast of 3% pa.

A vanilla fixed-coupon 2-year risk-free government bond was issued at par this morning, just before the economic news was released.

What is the expected change in bond price after the economic news this morning, and in the next 2 years? Assume that:

- Inflation remains at 5% over the next 2 years.

- Investors demand a constant real bond yield.

- The bond price falls by the (after-tax) value of the coupon the night before the ex-coupon date, as in real life.

Question 338 market efficiency, CAPM, opportunity cost, technical analysis

A man inherits $500,000 worth of shares.

He believes that by learning the secrets of trading, keeping up with the financial news and doing complex trend analysis with charts that he can quit his job and become a self-employed day trader in the equities markets.

What is the expected gain from doing this over the first year? Measure the net gain in wealth received at the end of this first year due to the decision to become a day trader. Assume the following:

- He earns $60,000 pa in his current job, paid in a lump sum at the end of each year.

- He enjoys examining share price graphs and day trading just as much as he enjoys his current job.

- Stock markets are weak form and semi-strong form efficient.

- He has no inside information.

- He makes 1 trade every day and there are 250 trading days in the year. Trading costs are $20 per trade. His broker invoices him for the trading costs at the end of the year.

- The shares that he currently owns and the shares that he intends to trade have the same level of systematic risk as the market portfolio.

- The market portfolio's expected return is 10% pa.

Measure the net gain over the first year as an expected wealth increase at the end of the year.

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Assume that there are no dividend payments so the entire 15% total return is all capital return.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% return lasts for the next 100 years (t=0 to 100), then reverts to 10% pa after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant. All returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

Question 780 mispriced asset, NPV, DDM, market efficiency, no explanation

A company advertises an investment costing $1,000 which they say is under priced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Of the 15% pa total expected return, the dividend yield is expected to be 4% pa and the capital yield 11% pa. Assume that the company's statements are correct.

What is the NPV of buying the investment if the 15% total return lasts for the next 100 years (t=0 to 100), then reverts to 10% after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant, the dividends can only be re-invested at 10% pa and all returns are given as effective annual rates. The answer choices below are given in the same order (15% for 100 years, and 15% forever):

In mid 2009 the listed mining company Rio Tinto announced a 21-for-40 renounceable rights issue. Below is the chronology of events:

- 04/06/2009. Share price opens at $69.00 and closes at $66.90.

- 05/06/2009. 21-for-40 rights issue announced at a subscription price of $28.29.

- 16/06/2009. Last day that shares trade cum-rights. Share price opens at $76.40 and closes at $75.50.

- 17/06/2009. Shares trade ex-rights. Rights trading commences.

All things remaining equal, what would you expect Rio Tinto's stock price to open at on the first day that it trades ex-rights (17/6/2009)? Ignore the time value of money since time is negligibly short. Also ignore taxes.

Question 455 income and capital returns, payout policy, DDM, market efficiency

A fairly priced unlevered firm plans to pay a dividend of $1 next year (t=1) which is expected to grow by 3% pa every year after that. The firm's required return on equity is 8% pa.

The firm is thinking about reducing its future dividend payments by 10% so that it can use the extra cash to invest in more projects which are expected to return 8% pa, and have the same risk as the existing projects. Therefore, next year's dividend will be $0.90. No new equity or debt will be issued to fund the new projects, they'll all be funded by the cut in dividends.

What will be the stock's new annual capital return (proportional increase in price per year) if the change in payout policy goes ahead?

Assume that payout policy is irrelevant to firm value (so there's no signalling effects) and that all rates are effective annual rates.

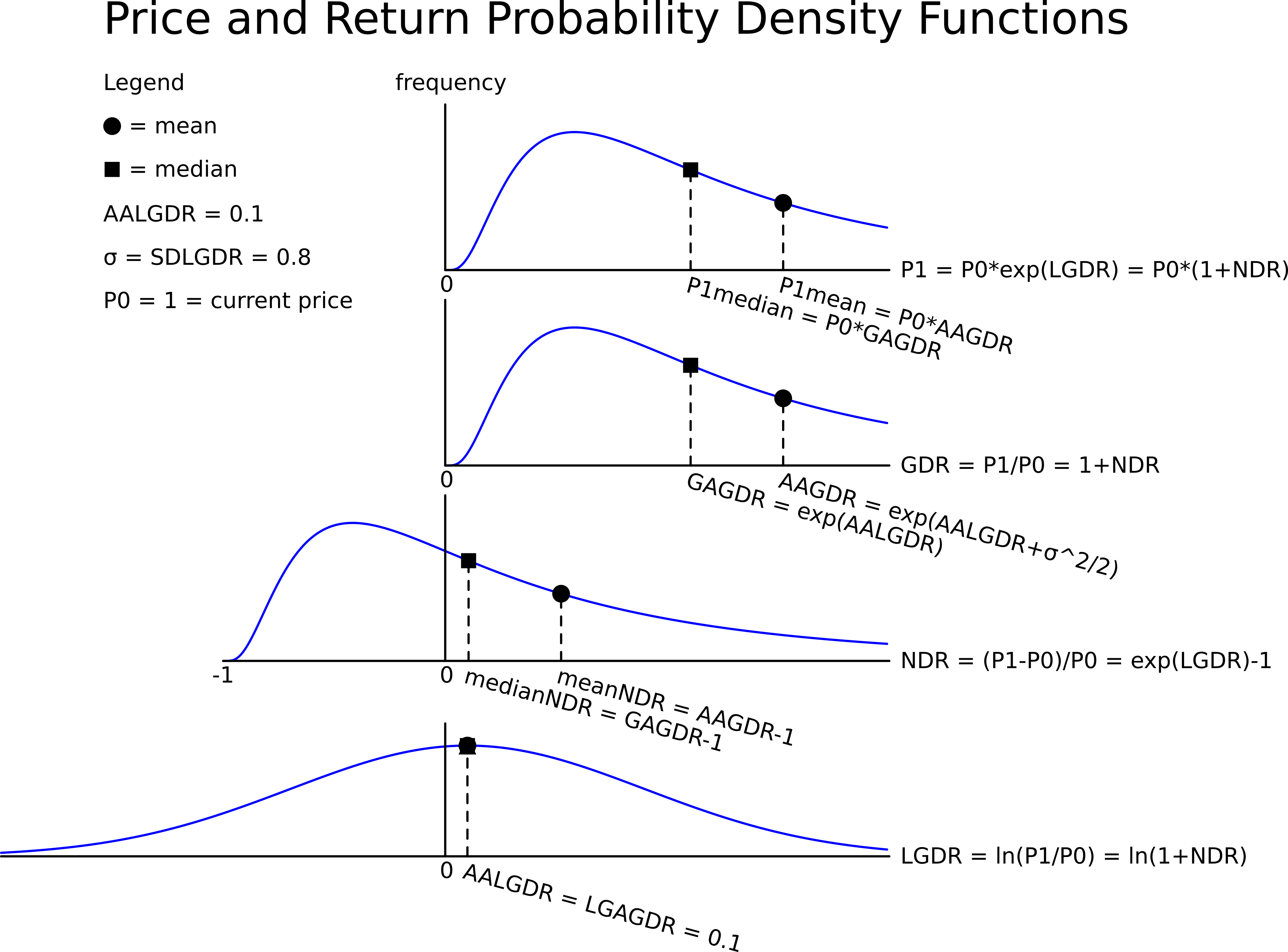

Question 719 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

A stock has an arithmetic average continuously compounded return (AALGDR) of 10% pa, a standard deviation of continuously compounded returns (SDLGDR) of 80% pa and current stock price of $1. Assume that stock prices are log-normally distributed. The graph below summarises this information and provides some helpful formulas.

In one year, what do you expect the median and mean prices to be? The answer options are given in the same order.

Question 626 cross currency interest rate parity, foreign exchange rate, forward foreign exchange rate

The Australian cash rate is expected to be 2% pa over the next one year, while the Japanese cash rate is expected to be 0% pa, both given as nominal effective annual rates. The current exchange rate is 100 JPY per AUD.

What is the implied 1 year forward foreign exchange rate?

The Chinese government attempts to fix its exchange rate against the US dollar and at the same time use monetary policy to fix its interest rate at a set level.

To be able to fix its exchange rate and interest rate in this way, what does the Chinese government actually do?

- Adopts capital controls to prevent financial arbitrage by private firms and individuals.

- Adopts the same interest rate (monetary policy) as the United States.

- Fixes inflation so that the domestic real interest rate is equal to the United States' real interest rate.

Which of the above statements is or are true?

Question 779 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

Fred owns some BHP shares. He has calculated BHP’s monthly returns for each month in the past 30 years using this formula:

###r_\text{t monthly}=\ln \left( \dfrac{P_t}{P_{t-1}} \right)###He then took the arithmetic average and found it to be 0.8% per month using this formula:

###\bar{r}_\text{monthly}= \dfrac{ \displaystyle\sum\limits_{t=1}^T{\left( r_\text{t monthly} \right)} }{T} =0.008=0.8\% \text{ per month}###He also found the standard deviation of these monthly returns which was 15% per month:

###\sigma_\text{monthly} = \dfrac{ \displaystyle\sum\limits_{t=1}^T{\left( \left( r_\text{t monthly} - \bar{r}_\text{monthly} \right)^2 \right)} }{T} =0.15=15\%\text{ per month}###Assume that the past historical average return is the true population average of future expected returns and the stock's returns calculated above ##(r_\text{t monthly})## are normally distributed. Which of the below statements about Fred’s BHP shares is NOT correct?