Question 447 payout policy, corporate financial decision theory

Payout policy is most closely related to which part of a business?

An asset's total expected return over the next year is given by:

###r_\text{total} = \dfrac{c_1+p_1-p_0}{p_0} ###

Where ##p_0## is the current price, ##c_1## is the expected income in one year and ##p_1## is the expected price in one year. The total return can be split into the income return and the capital return.

Which of the following is the expected capital return?

Total cash flows can be broken into income and capital cash flows. What is the name given to the income cash flow from owning shares?

The saying "buy low, sell high" suggests that investors should make a:

One and a half years ago Frank bought a house for $600,000. Now it's worth only $500,000, based on recent similar sales in the area.

The expected total return on Frank's residential property is 7% pa.

He rents his house out for $1,600 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $18,617.27.

The future value of 12 months of rental payments one year in the future is $19,920.48.

What is the expected annual rental yield of the property? Ignore the costs of renting such as maintenance, real estate agent fees and so on.

A share was bought for $30 (at t=0) and paid its annual dividend of $6 one year later (at t=1).

Just after the dividend was paid, the share price fell to $27 (at t=1). What were the total, capital and income returns given as effective annual rates?

The choices are given in the same order:

##r_\text{total}## , ##r_\text{capital}## , ##r_\text{dividend}##.

Question 525 income and capital returns, real and nominal returns and cash flows, inflation

Which of the following statements about cash in the form of notes and coins is NOT correct? Assume that inflation is positive.

Notes and coins:

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

Question 526 real and nominal returns and cash flows, inflation, no explanation

How can a nominal cash flow be precisely converted into a real cash flow?

Question 575 inflation, real and nominal returns and cash flows

You expect a nominal payment of $100 in 5 years. The real discount rate is 10% pa and the inflation rate is 3% pa. Which of the following statements is NOT correct?

Question 577 inflation, real and nominal returns and cash flows

What is the present value of a real payment of $500 in 2 years? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

Question 554 inflation, real and nominal returns and cash flows

On his 20th birthday, a man makes a resolution. He will put $30 cash under his bed at the end of every month starting from today. His birthday today is the first day of the month. So the first addition to his cash stash will be in one month. He will write in his will that when he dies the cash under the bed should be given to charity.

If the man lives for another 60 years, how much money will be under his bed if he dies just after making his last (720th) addition?

Also, what will be the real value of that cash in today's prices if inflation is expected to 2.5% pa? Assume that the inflation rate is an effective annual rate and is not expected to change.

The answers are given in the same order, the amount of money under his bed in 60 years, and the real value of that money in today's prices.

You're considering making an investment in a particular company. They have preference shares, ordinary shares, senior debt and junior debt.

Which is the safest investment? Which has the highest expected returns?

Which business structure or structures have the advantage of limited liability for equity investors?

Question 531 bankruptcy or insolvency, capital structure, risk, limited liability

Who is most in danger of being personally bankrupt? Assume that all of their businesses' assets are highly liquid and can therefore be sold immediately.

Which of the following statements about book and market equity is NOT correct?

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's market capitalisation of equity?

Question 444 investment decision, corporate financial decision theory

The investment decision primarily affects which part of a business?

Question 445 financing decision, corporate financial decision theory

The financing decision primarily affects which part of a business?

Question 443 corporate financial decision theory, investment decision, financing decision, working capital decision, payout policy

Business people make lots of important decisions. Which of the following is the most important long term decision?

The expression 'you have to spend money to make money' relates to which business decision?

Suppose you had $100 in a savings account and the interest rate was 2% per year.

After 5 years, how much do you think you would have in the account if you left the money to grow?

Question 278 inflation, real and nominal returns and cash flows

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year.

Jan asks you for a loan. He wants $100 now and offers to pay you back $120 in 1 year. You can borrow and lend from the bank at an interest rate of 10% pa, given as an effective annual rate.

Ignore credit risk. Remember:

### V_0 = \frac{V_t}{(1+r_\text{eff})^t} ###

Katya offers to pay you $10 at the end of every year for the next 5 years (t=1,2,3,4,5) if you pay her $50 now (t=0). You can borrow and lend from the bank at an interest rate of 10% pa, given as an effective annual rate. Ignore credit risk.

Your friend wants to borrow $1,000 and offers to pay you back $100 in 6 months, with more $100 payments at the end of every month for another 11 months. So there will be twelve $100 payments in total. She says that 12 payments of $100 equals $1,200 so she's being generous.

If interest rates are 12% pa, given as an APR compounding monthly, what is the Net Present Value (NPV) of your friend's deal?

The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Net Present Value (NPV) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

The phone company Telstra have 2 mobile service plans on offer which both have the same amount of phone call, text message and internet data credit. Both plans have a contract length of 24 months and the monthly cost is payable in advance. The only difference between the two plans is that one is a:

- 'Bring Your Own' (BYO) mobile service plan, costing $50 per month. There is no phone included in this plan. The other plan is a:

- 'Bundled' mobile service plan that comes with the latest smart phone, costing $71 per month. This plan includes the latest smart phone.

Neither plan has any additional payments at the start or end.

The only difference between the plans is the phone, so what is the implied cost of the phone as a present value?

Assume that the discount rate is 2% per month given as an effective monthly rate, the same high interest rate on credit cards.

Question 58 NPV, inflation, real and nominal returns and cash flows, Annuity

A project to build a toll bridge will take two years to complete, costing three payments of $100 million at the start of each year for the next three years, that is at t=0, 1 and 2.

After completion, the toll bridge will yield a constant $50 million at the end of each year for the next 10 years. So the first payment will be at t=3 and the last at t=12. After the last payment at t=12, the bridge will be given to the government.

The required return of the project is 21% pa given as an effective annual nominal rate.

All cash flows are real and the expected inflation rate is 10% pa given as an effective annual rate. Ignore taxes.

The Net Present Value is:

The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Net Present Value (NPV) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 11 |

| 2 | 121 |

In Australia, domestic university students are allowed to buy concession tickets for the bus, train and ferry which sell at a discount of 50% to full-price tickets.

The Australian Government do not allow international university students to buy concession tickets, they have to pay the full price.

Some international students see this as unfair and they are willing to pay for fake university identification cards which have the concession sticker.

What is the most that an international student would be willing to pay for a fake identification card?

Assume that international students:

- consider buying their fake card on the morning of the first day of university from their neighbour, just before they leave to take the train into university.

- buy their weekly train tickets on the morning of the first day of each week.

- ride the train to university and back home again every day seven days per week until summer holidays 40 weeks from now. The concession card only lasts for those 40 weeks. Assume that there are 52 weeks in the year for the purpose of interest rate conversion.

- a single full-priced one-way train ride costs $5.

- have a discount rate of 11% pa, given as an effective annual rate.

Approach this question from a purely financial view point, ignoring the illegality, embarrassment and the morality of committing fraud.

The following cash flows are expected:

- 10 yearly payments of $60, with the first payment in 3 years from now (first payment at t=3 and last at t=12).

- 1 payment of $400 in 5 years and 6 months (t=5.5) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

Question 49 inflation, real and nominal returns and cash flows, APR, effective rate

In Australia, nominal yields on semi-annual coupon paying Government Bonds with 2 years until maturity are currently 2.83% pa.

The inflation rate is currently 2.2% pa, given as an APR compounding per quarter. The inflation rate is not expected to change over the next 2 years.

What is the real yield on these bonds, given as an APR compounding every 6 months?

Question 64 inflation, real and nominal returns and cash flows, APR, effective rate

In Germany, nominal yields on semi-annual coupon paying Government Bonds with 2 years until maturity are currently 0.04% pa.

The inflation rate is currently 1.4% pa, given as an APR compounding per quarter. The inflation rate is not expected to change over the next 2 years.

What is the real yield on these bonds, given as an APR compounding every 6 months?

Question 155 inflation, real and nominal returns and cash flows, Loan, effective rate conversion

You are a banker about to grant a 2 year loan to a customer. The loan's principal and interest will be repaid in a single payment at maturity, sometimes called a zero-coupon loan, discount loan or bullet loan.

You require a real return of 6% pa over the two years, given as an effective annual rate. Inflation is expected to be 2% this year and 4% next year, both given as effective annual rates.

You judge that the customer can afford to pay back $1,000,000 in 2 years, given as a nominal cash flow. How much should you lend to her right now?

If a project's net present value (NPV) is zero, then its internal rate of return (IRR) will be:

Question 48 IRR, NPV, bond pricing, premium par and discount bonds, market efficiency

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

A three year project's NPV is negative. The cash flows of the project include a negative cash flow at the very start and positive cash flows over its short life. The required return of the project is 10% pa. Select the most correct statement.

What is the Internal Rate of Return (IRR) of the project detailed in the table below?

Assume that the cash flows shown in the table are paid all at once at the given point in time. All answers are given as effective annual rates.

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

A project has an internal rate of return (IRR) which is greater than its required return. Select the most correct statement.

A project's net present value (NPV) is negative. Select the most correct statement.

A project's NPV is positive. Select the most correct statement:

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 0 |

| 2 | 500 |

The required return on the project is 10%, given as an effective annual rate.

What is the Internal Rate of Return (IRR) of this project? The following choices are effective annual rates. Assume that the cash flows shown in the table are paid all at once at the given point in time.

A project's Profitability Index (PI) is less than 1. Select the most correct statement:

Question 218 NPV, IRR, profitability index, average accounting return

Which of the following statements is NOT correct?

A firm is considering a business project which costs $11m now and is expected to pay a constant $1m at the end of every year forever.

Assume that the initial $11m cost is funded using the firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

A firm is considering a business project which costs $10m now and is expected to pay a single cash flow of $12.1m in two years.

Assume that the initial $10m cost is funded using the firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

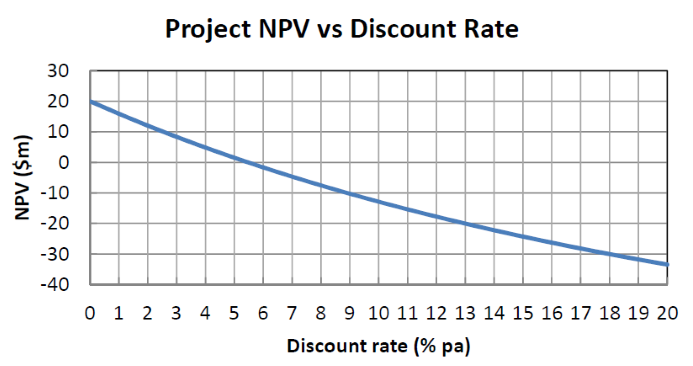

The below graph shows a project's net present value (NPV) against its annual discount rate.

For what discount rate or range of discount rates would you accept and commence the project?

All answer choices are given as approximations from reading off the graph.

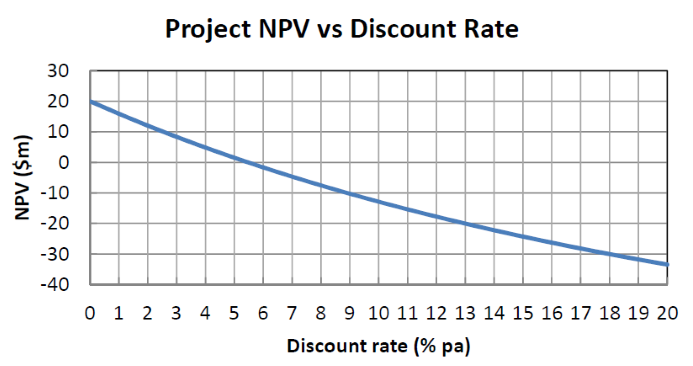

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

An investor owns a whole level of an old office building which is currently worth $1 million. There are three mutually exclusive projects that can be started by the investor. The office building level can be:

- Rented out to a tenant for one year at $0.1m paid immediately, and then sold for $0.99m in one year.

- Refurbished into more modern commercial office rooms at a cost of $1m now, and then sold for $2.4m when the refurbishment is finished in one year.

- Converted into residential apartments at a cost of $2m now, and then sold for $3.4m when the conversion is finished in one year.

All of the development projects have the same risk so the required return of each is 10% pa. The table below shows the estimated cash flows and internal rates of returns (IRR's).

| Mutually Exclusive Projects | |||

| Project | Cash flow now ($) |

Cash flow in one year ($) |

IRR (% pa) |

| Rent then sell as is | -900,000 | 990,000 | 10 |

| Refurbishment into modern offices | -2,000,000 | 2,400,000 | 20 |

| Conversion into residential apartments | -3,000,000 | 3,400,000 | 13.33 |

Which project should the investor accept?

An investor owns an empty block of land that has local government approval to be developed into a petrol station, car wash or car park. The council will only allow a single development so the projects are mutually exclusive.

All of the development projects have the same risk and the required return of each is 10% pa. Each project has an immediate cost and once construction is finished in one year the land and development will be sold. The table below shows the estimated costs payable now, expected sale prices in one year and the internal rates of returns (IRR's).

| Mutually Exclusive Projects | |||

| Project | Cost now ($) |

Sale price in one year ($) |

IRR (% pa) |

| Petrol station | 9,000,000 | 11,000,000 | 22.22 |

| Car wash | 800,000 | 1,100,000 | 37.50 |

| Car park | 70,000 | 110,000 | 57.14 |

Which project should the investor accept?

Question 542 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to double every 10 years, what must be the expected future capital return, given as an effective annual rate?

Question 543 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to triple every 5 years, what must be the expected future capital return, given as an effective annual rate?

There are many ways to write the ordinary annuity formula.

Which of the following is NOT equal to the ordinary annuity formula?

This annuity formula ##\dfrac{C_1}{r}\left(1-\dfrac{1}{(1+r)^3} \right)## is equivalent to which of the following formulas? Note the 3.

In the below formulas, ##C_t## is a cash flow at time t. All of the cash flows are equal, but paid at different times.

The following cash flows are expected:

- 10 yearly payments of $80, with the first payment in 6.5 years from now (first payment at t=6.5).

- A single payment of $500 in 4 years and 3 months (t=4.25) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

Your friend overheard that you need some cash and asks if you would like to borrow some money. She can lend you $5,000 now (t=0), and in return she wants you to pay her back $1,000 in two years (t=2) and every year after that for the next 5 years, so there will be 6 payments of $1,000 from t=2 to t=7 inclusive.

What is the net present value (NPV) of borrowing from your friend?

Assume that banks loan funds at interest rates of 10% pa, given as an effective annual rate.

Some countries' interest rates are so low that they're zero.

If interest rates are 0% pa and are expected to stay at that level for the foreseeable future, what is the most that you would be prepared to pay a bank now if it offered to pay you $10 at the end of every year for the next 5 years?

In other words, what is the present value of five $10 payments at time 1, 2, 3, 4 and 5 if interest rates are 0% pa?

You are promised 20 payments of $100, where the first payment is immediate (t=0) and the last is at the end of the 19th year (t=19). The effective annual discount rate is ##r##.

Which of the following equations does NOT give the correct present value of these 20 payments?

A stock is expected to pay its next dividend of $1 in one year. Future annual dividends are expected to grow by 2% pa. So the first dividend of $1 will be in one year, the year after that $1.02 (=1*(1+0.02)^1), and a year later $1.0404 (=1*(1+0.02)^2) and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

A stock just paid a dividend of $1. Future annual dividends are expected to grow by 2% pa. The next dividend of $1.02 (=1*(1+0.02)^1) will be in one year, and the year after that the dividend will be $1.0404 (=1*(1+0.02)^2), and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

A stock is just about to pay a dividend of $1 tonight. Future annual dividends are expected to grow by 2% pa. The next dividend of $1 will be paid tonight, and the year after that the dividend will be $1.02 (=1*(1+0.02)^1), and a year later 1.0404 (=1*(1+0.04)^2) and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

Discounted cash flow (DCF) valuation prices assets by finding the present value of the asset's future cash flows. The single cash flow, annuity, and perpetuity equations are very useful for this.

Which of the following equations is the 'perpetuity with growth' equation?

The following equation is called the Dividend Discount Model (DDM), Gordon Growth Model or the perpetuity with growth formula: ### P_0 = \frac{ C_1 }{ r - g } ###

What is ##g##? The value ##g## is the long term expected:

For a price of $13, Carla will sell you a share paying a dividend of $1 in one year and every year after that forever. The required return of the stock is 10% pa.

The first payment of a constant perpetual annual cash flow is received at time 5. Let this cash flow be ##C_5## and the required return be ##r##.

So there will be equal annual cash flows at time 5, 6, 7 and so on forever, and all of the cash flows will be equal so ##C_5 = C_6 = C_7 = ...##

When the perpetuity formula is used to value this stream of cash flows, it will give a value (V) at time:

For a price of $1040, Camille will sell you a share which just paid a dividend of $100, and is expected to pay dividends every year forever, growing at a rate of 5% pa.

So the next dividend will be ##100(1+0.05)^1=$105.00##, and the year after it will be ##100(1+0.05)^2=110.25## and so on.

The required return of the stock is 15% pa.

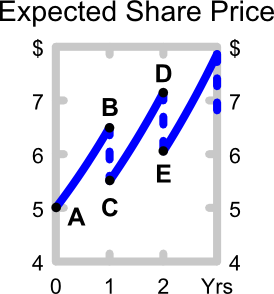

The perpetuity with growth formula, also known as the dividend discount model (DDM) or Gordon growth model, is appropriate for valuing a company's shares. ##P_0## is the current share price, ##C_1## is next year's expected dividend, ##r## is the total required return and ##g## is the expected growth rate of the dividend.

###P_0=\dfrac{C_1}{r-g}###

The below graph shows the expected future price path of the company's shares. Which of the following statements about the graph is NOT correct?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###P_0=\frac{d_1}{r-g}###

A stock pays dividends annually. It just paid a dividend, but the next dividend (##d_1##) will be paid in one year.

According to the DDM, what is the correct formula for the expected price of the stock in 2.5 years?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### P_{0} = \frac{C_1}{r_{\text{eff}} - g_{\text{eff}}} ###

What would you call the expression ## C_1/P_0 ##?

The following is the Dividend Discount Model (DDM) used to price stocks:

###P_0=\dfrac{C_1}{r-g}###

If the assumptions of the DDM hold and the stock is fairly priced, which one of the following statements is NOT correct? The long term expected:

A stock just paid its annual dividend of $9. The share price is $60. The required return of the stock is 10% pa as an effective annual rate.

What is the implied growth rate of the dividend per year?

Question 497 income and capital returns, DDM, ex dividend date

A stock will pay you a dividend of $10 tonight if you buy it today. Thereafter the annual dividend is expected to grow by 5% pa, so the next dividend after the $10 one tonight will be $10.50 in one year, then in two years it will be $11.025 and so on. The stock's required return is 10% pa.

What is the stock price today and what do you expect the stock price to be tomorrow, approximately?

In the dividend discount model:

###P_0 = \dfrac{C_1}{r-g}###

The return ##r## is supposed to be the:

Two years ago Fred bought a house for $300,000.

Now it's worth $500,000, based on recent similar sales in the area.

Fred's residential property has an expected total return of 8% pa.

He rents his house out for $2,000 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $23,173.86.

The future value of 12 months of rental payments one year ahead is $25,027.77.

What is the expected annual growth rate of the rental payments? In other words, by what percentage increase will Fred have to raise the monthly rent by each year to sustain the expected annual total return of 8%?

Question 490 expected and historical returns, accounting ratio

Which of the following is NOT a synonym of 'required return'?

Total cash flows can be broken into income and capital cash flows.

What is the name given to the cash flow generated from selling shares at a higher price than they were bought?

Which of the following equations is NOT equal to the total return of an asset?

Let ##p_0## be the current price, ##p_1## the expected price in one year and ##c_1## the expected income in one year.

A stock was bought for $8 and paid a dividend of $0.50 one year later (at t=1 year). Just after the dividend was paid, the stock price was $7 (at t=1 year).

What were the total, capital and dividend returns given as effective annual rates? The choices are given in the same order:

##r_\text{total}##, ##r_\text{capital}##, ##r_\text{dividend}##.

A fixed coupon bond was bought for $90 and paid its annual coupon of $3 one year later (at t=1 year). Just after the coupon was paid, the bond price was $92 (at t=1 year). What was the total return, capital return and income return? Calculate your answers as effective annual rates.

The choices are given in the same order: ## r_\text{total},r_\text{capital},r_\text{income} ##.

Question 604 inflation, real and nominal returns and cash flows

Apples and oranges currently cost $1 each. Inflation is 5% pa, and apples and oranges are equally affected by this inflation rate. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

Which of the following statements is NOT correct?

In the 'Austin Powers' series of movies, the character Dr. Evil threatens to destroy the world unless the United Nations pays him a ransom (video 1, video 2). Dr. Evil makes the threat on two separate occasions:

- In 1969 he demands a ransom of $1 million (=10^6), and again;

- In 1997 he demands a ransom of $100 billion (=10^11).

If Dr. Evil's demands are equivalent in real terms, in other words $1 million will buy the same basket of goods in 1969 as $100 billion would in 1997, what was the implied inflation rate over the 28 years from 1969 to 1997?

The answer choices below are given as effective annual rates:

Question 353 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

Question 363 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 8% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

Question 407 income and capital returns, inflation, real and nominal returns and cash flows

A stock has a real expected total return of 7% pa and a real expected capital return of 2% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What is the nominal expected total return, capital return and dividend yield? The answers below are given in the same order.

Question 574 inflation, real and nominal returns and cash flows, NPV

What is the present value of a nominal payment of $100 in 5 years? The real discount rate is 10% pa and the inflation rate is 3% pa.

Question 576 inflation, real and nominal returns and cash flows

What is the present value of a nominal payment of $1,000 in 4 years? The nominal discount rate is 8% pa and the inflation rate is 2% pa.

Question 578 inflation, real and nominal returns and cash flows

Which of the following statements about inflation is NOT correct?

A newly floated farming company is financed with senior bonds, junior bonds, cumulative non-voting preferred stock and common stock. The new company has no retained profits and due to floods it was unable to record any revenues this year, leading to a loss. The firm is not bankrupt yet since it still has substantial contributed equity (same as paid-up capital).

On which securities must it pay interest or dividend payments in this terrible financial year?

Question 452 limited liability, expected and historical returns

What is the lowest and highest expected share price and expected return from owning shares in a company over a finite period of time?

Let the current share price be ##p_0##, the expected future share price be ##p_1##, the expected future dividend be ##d_1## and the expected return be ##r##. Define the expected return as:

##r=\dfrac{p_1-p_0+d_1}{p_0} ##

The answer choices are stated using inequalities. As an example, the first answer choice "(a) ##0≤p<∞## and ##0≤r< 1##", states that the share price must be larger than or equal to zero and less than positive infinity, and that the return must be larger than or equal to zero and less than one.

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's market capitalisation of equity?

Which of the following decisions relates to the current assets and current liabilities of the firm?

Question 446 working capital decision, corporate financial decision theory

The working capital decision primarily affects which part of a business?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume twice as much now (t=0) as in one year (t=1) and have nothing left in the bank at the end.

How much can you consume at time zero and one? The answer choices are given in the same order.

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume half as much now (t=0) as in one year (t=1) and have nothing left in the bank at the end.

How much can you consume at time zero and one? The answer choices are given in the same order.

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume an equal amount now (t=0) and in one year (t=1) and have nothing left in the bank at the end (t=1).

How much can you consume at each time?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume an equal amount now (t=0), in one year (t=1) and in two years (t=2), and still have $50,000 in the bank after that (t=2).

How much can you consume at each time?

Your neighbour asks you for a loan of $100 and offers to pay you back $120 in one year.

You don't actually have any money right now, but you can borrow and lend from the bank at a rate of 10% pa. Rates are given as effective annual rates.

Assume that your neighbour will definitely pay you back. Ignore interest tax shields and transaction costs.

The Net Present Value (NPV) of lending to your neighbour is $9.09. Describe what you would do to actually receive a $9.09 cash flow right now with zero net cash flows in the future.

The boss of WorkingForTheManCorp has a wicked (and unethical) idea. He plans to pay his poor workers one week late so that he can get more interest on his cash in the bank.

Every week he is supposed to pay his 1,000 employees $1,000 each. So $1 million is paid to employees every week.

The boss was just about to pay his employees today, until he thought of this idea so he will actually pay them one week (7 days) later for the work they did last week and every week in the future, forever.

Bank interest rates are 10% pa, given as a real effective annual rate. So ##r_\text{eff annual, real} = 0.1## and the real effective weekly rate is therefore ##r_\text{eff weekly, real} = (1+0.1)^{1/52}-1 = 0.001834569##

All rates and cash flows are real, the inflation rate is 3% pa and there are 52 weeks per year. The boss will always pay wages one week late. The business will operate forever with constant real wages and the same number of employees.

What is the net present value (NPV) of the boss's decision to pay later?

The required return of a project is 10%, given as an effective annual rate.

What is the payback period of the project in years?

Assume that the cash flows shown in the table are received smoothly over the year. So the $121 at time 2 is actually earned smoothly from t=1 to t=2.

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 11 |

| 2 | 121 |

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 0 |

| 2 | 500 |

What is the payback period of the project in years?

Normally cash flows are assumed to happen at the given time. But here, assume that the cash flows are received smoothly over the year. So the $500 at time 2 is actually earned smoothly from t=1 to t=2.

A project to build a toll road will take 3 years to complete, costing three payments of $50 million, paid at the start of each year (at times 0, 1, and 2).

After completion, the toll road will yield a constant $10 million at the end of each year forever with no costs. So the first payment will be at t=4.

The required return of the project is 10% pa given as an effective nominal rate. All cash flows are nominal.

What is the payback period?

Question 579 price gains and returns over time, time calculation, effective rate

How many years will it take for an asset's price to double if the price grows by 10% pa?

Question 580 price gains and returns over time, time calculation, effective rate

How many years will it take for an asset's price to quadruple (be four times as big, say from $1 to $4) if the price grows by 15% pa?

A stock pays annual dividends which are expected to continue forever. It just paid a dividend of $10. The growth rate in the dividend is 2% pa. You estimate that the stock's required return is 10% pa. Both the discount rate and growth rate are given as effective annual rates. Using the dividend discount model, what will be the share price?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What will be the price of the stock in three and a half years (t = 3.5)?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### p_0 = \frac{d_1}{r - g} ###

Which expression is NOT equal to the expected dividend yield?

A fairly valued share's current price is $4 and it has a total required return of 30%. Dividends are paid annually and next year's dividend is expected to be $1. After that, dividends are expected to grow by 5% pa in perpetuity. All rates are effective annual returns.

What is the expected dividend income paid at the end of the second year (t=2) and what is the expected capital gain from just after the first dividend (t=1) to just after the second dividend (t=2)? The answers are given in the same order, the dividend and then the capital gain.

Question 50 DDM, stock pricing, inflation, real and nominal returns and cash flows

Most listed Australian companies pay dividends twice per year, the 'interim' and 'final' dividends, which are roughly 6 months apart.

You are an equities analyst trying to value the company BHP. You decide to use the Dividend Discount Model (DDM) as a starting point, so you study BHP's dividend history and you find that BHP tends to pay the same interim and final dividend each year, and that both grow by the same rate.

You expect BHP will pay a $0.55 interim dividend in six months and a $0.55 final dividend in one year. You expect each to grow by 4% next year and forever, so the interim and final dividends next year will be $0.572 each, and so on in perpetuity.

Assume BHP's cost of equity is 8% pa. All rates are quoted as nominal effective rates. The dividends are nominal cash flows and the inflation rate is 2.5% pa.

What is the current price of a BHP share?

A home loan company advertises an interest rate of 6% pa, payable monthly. Which of the following statements about the interest rate is NOT correct? All rates are given to four decimal places.

A semi-annual coupon bond has a yield of 3% pa. Which of the following statements about the yield is NOT correct? All rates are given to four decimal places.

Which of the below statements about effective rates and annualised percentage rates (APR's) is NOT correct?

A credit card offers an interest rate of 18% pa, compounding monthly.

Find the effective monthly rate, effective annual rate and the effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff monthly} , r_\text{eff yearly} , r_\text{eff daily} ###

Calculate the effective annual rates of the following three APR's:

- A credit card offering an interest rate of 18% pa, compounding monthly.

- A bond offering a yield of 6% pa, compounding semi-annually.

- An annual dividend-paying stock offering a return of 10% pa compounding annually.

All answers are given in the same order:

##r_\text{credit card, eff yrly}##, ##r_\text{bond, eff yrly}##, ##r_\text{stock, eff yrly}##

On his 20th birthday, a man makes a resolution. He will deposit $30 into a bank account at the end of every month starting from now, which is the start of the month. So the first payment will be in one month. He will write in his will that when he dies the money in the account should be given to charity.

The bank account pays interest at 6% pa compounding monthly, which is not expected to change.

If the man lives for another 60 years, how much money will be in the bank account if he dies just after making his last (720th) payment?

You want to buy an apartment priced at $300,000. You have saved a deposit of $30,000. The bank has agreed to lend you the $270,000 as a fully amortising loan with a term of 25 years. The interest rate is 12% pa and is not expected to change.

What will be your monthly payments? Remember that mortgage loan payments are paid in arrears (at the end of the month).

You want to buy an apartment worth $400,000. You have saved a deposit of $80,000. The bank has agreed to lend you the $320,000 as a fully amortising mortgage loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $2,000 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 5 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $1,500 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 10 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

You just agreed to a 30 year fully amortising mortgage loan with monthly payments of $2,500. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 10 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change. The below choices are given in the same order.

You want to buy an apartment priced at $300,000. You have saved a deposit of $30,000. The bank has agreed to lend you the $270,000 as an interest only loan with a term of 25 years. The interest rate is 12% pa and is not expected to change.

What will be your monthly payments? Remember that mortgage payments are paid in arrears (at the end of the month).

You just borrowed $400,000 in the form of a 25 year interest-only mortgage with monthly payments of $3,000 per month. The interest rate is 9% pa which is not expected to change.

You actually plan to pay more than the required interest payment. You plan to pay $3,300 in mortgage payments every month, which your mortgage lender allows. These extra payments will reduce the principal and the minimum interest payment required each month.

At the maturity of the mortgage, what will be the principal? That is, after the last (300th) interest payment of $3,300 in 25 years, how much will be owing on the mortgage?

You want to buy an apartment worth $300,000. You have saved a deposit of $60,000.

The bank has agreed to lend you $240,000 as an interest only mortgage loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

Question 239 income and capital returns, inflation, real and nominal returns and cash flows, interest only loan

A bank grants a borrower an interest-only residential mortgage loan with a very large 50% deposit and a nominal interest rate of 6% that is not expected to change. Assume that inflation is expected to be a constant 2% pa over the life of the loan. Ignore credit risk.

From the bank's point of view, what is the long term expected nominal capital return of the loan asset?

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid annually. So there's only one coupon per year, paid in arrears every year.

A credit card company advertises an interest rate of 18% pa, payable monthly. Which of the following statements about the interest rate is NOT correct? All rates are given to four decimal places.

Which of the following statements about effective rates and annualised percentage rates (APR's) is NOT correct?

A European bond paying annual coupons of 6% offers a yield of 10% pa.

Convert the yield into an effective monthly rate, an effective annual rate and an effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff, monthly} , r_\text{eff, yearly} , r_\text{eff, daily} ###

Which of the following statements is NOT equivalent to the yield on debt?

Assume that the debt being referred to is fairly priced, but do not assume that it's priced at par.

Question 35 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

A European company just issued two bonds, a

- 1 year zero coupon bond at a yield of 8% pa, and a

- 2 year zero coupon bond at a yield of 10% pa.

What is the company's forward rate over the second year (from t=1 to t=2)? Give your answer as an effective annual rate, which is how the above bond yields are quoted.

Question 25 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

A European company just issued two bonds, a

- 2 year zero coupon bond at a yield of 8% pa, and a

- 3 year zero coupon bond at a yield of 10% pa.

What is the company's forward rate over the third year (from t=2 to t=3)? Give your answer as an effective annual rate, which is how the above bond yields are quoted.

A European company just issued two bonds, a

- 3 year zero coupon bond at a yield of 6% pa, and a

- 4 year zero coupon bond at a yield of 6.5% pa.

What is the company's forward rate over the fourth year (from t=3 to t=4)? Give your answer as an effective annual rate, which is how the above bond yields are quoted.

Question 143 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds:

- A 6-month zero coupon bond at a yield of 6% pa, and

- A 12 month zero coupon bond at a yield of 7% pa.

What is the company's forward rate from 6 to 12 months? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

Question 96 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds paying semi-annual coupons:

- 1 year zero coupon bond at a yield of 8% pa, and a

- 2 year zero coupon bond at a yield of 10% pa.

What is the forward rate on the company's debt from years 1 to 2? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

Question 108 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds:

- A 1 year zero coupon bond at a yield of 10% pa, and

- A 2 year zero coupon bond at a yield of 8% pa.

What is the forward rate on the company's debt from years 1 to 2? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

Question 572 bond pricing, zero coupon bond, term structure of interest rates, expectations hypothesis, forward interest rate, yield curve

In the below term structure of interest rates equation, all rates are effective annual yields and the numbers in subscript represent the years that the yields are measured over:

###(1+r_{0-3})^3 = (1+r_{0-1})(1+r_{1-2})(1+r_{2-3}) ###

Which of the following statements is NOT correct?

Question 573 bond pricing, zero coupon bond, term structure of interest rates, expectations hypothesis, liquidity premium theory, forward interest rate, yield curve

In the below term structure of interest rates equation, all rates are effective annual yields and the numbers in subscript represent the years that the yields are measured over:

###(1+r_{0-3})^3 = (1+r_{0-1})(1+r_{1-2})(1+r_{2-3}) ###

Which of the following statements is NOT correct?

Which of the following statements about yield curves is NOT correct?

You're trying to save enough money to buy your first car which costs $2,500. You can save $100 at the end of each month starting from now. You currently have no money at all. You just opened a bank account with an interest rate of 6% pa payable monthly.

How many months will it take to save enough money to buy the car? Assume that the price of the car will stay the same over time.

Your main expense is fuel for your car which costs $100 per month. You just refueled, so you won't need any more fuel for another month (first payment at t=1 month).

You have $2,500 in a bank account which pays interest at a rate of 6% pa, payable monthly. Interest rates are not expected to change.

Assuming that you have no income, in how many months time will you not have enough money to fully refuel your car?

You really want to go on a back packing trip to Europe when you finish university. Currently you have $1,500 in the bank. Bank interest rates are 8% pa, given as an APR compounding per month. If the holiday will cost $2,000, how long will it take for your bank account to reach that amount?

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $1,500 per month. The interest rate is 9% pa which is not expected to change.

To your surprise, you can actually afford to pay $2,000 per month and your mortgage allows early repayments without fees. If you maintain these higher monthly payments, how long will it take to pay off your mortgage?

You're trying to save enough money for a deposit to buy a house. You want to buy a house worth $400,000 and the bank requires a 20% deposit ($80,000) before it will give you a loan for the other $320,000 that you need.

You currently have no savings, but you just started working and can save $2,000 per month, with the first payment in one month from now. Bank interest rates on savings accounts are 4.8% pa with interest paid monthly and interest rates are not expected to change.

How long will it take to save the $80,000 deposit? Round your answer up to the nearest month.

A student won $1m in a lottery. Currently the money is in a bank account which pays interest at 6% pa, given as an APR compounding per month.

She plans to spend $20,000 at the beginning of every month from now on (so the first withdrawal will be at t=0). After each withdrawal, she will check how much money is left in the account. When there is less than $500,000 left, she will donate that remaining amount to charity.

In how many months will she make her last withdrawal and donate the remainder to charity?

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid semi-annually. So there are two coupons per year, paid in arrears every six months.

"Buy low, sell high" is a phrase commonly heard in financial markets. It states that traders should try to buy assets at low prices and sell at high prices.

Traders in the fixed-coupon bond markets often quote promised bond yields rather than prices. Fixed-coupon bond traders should try to:

For a price of $100, Vera will sell you a 2 year bond paying semi-annual coupons of 10% pa. The face value of the bond is $100. Other bonds with similar risk, maturity and coupon characteristics trade at a yield of 8% pa.

For a price of $95, Nicole will sell you a 10 year bond paying semi-annual coupons of 8% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 8% pa.

Bonds X and Y are issued by the same US company. Both bonds yield 10% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X and Y's coupon rates are 8 and 12% pa respectively. Which of the following statements is true?

Bonds A and B are issued by the same company. They have the same face value, maturity, seniority and coupon payment frequency. The only difference is that bond A has a 5% coupon rate, while bond B has a 10% coupon rate. The yield curve is flat, which means that yields are expected to stay the same.

Which bond would have the higher current price?

A two year Government bond has a face value of $100, a yield of 0.5% and a fixed coupon rate of 0.5%, paid semi-annually. What is its price?

A two year Government bond has a face value of $100, a yield of 2.5% pa and a fixed coupon rate of 0.5% pa, paid semi-annually. What is its price?

Question 56 income and capital returns, bond pricing, premium par and discount bonds

Which of the following statements about risk free government bonds is NOT correct?

Hint: Total return can be broken into income and capital returns as follows:

###\begin{aligned} r_\text{total} &= \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0} \\ &= r_\text{income} + r_\text{capital} \end{aligned} ###

The capital return is the growth rate of the price.

The income return is the periodic cash flow. For a bond this is the coupon payment.

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

A bond maturing in 10 years has a coupon rate of 4% pa, paid semi-annually. The bond's yield is currently 6% pa. The face value of the bond is $100. What is its price?

Bonds A and B are issued by the same Australian company. Both bonds yield 7% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond A pays coupons of 10% pa and bond B pays coupons of 5% pa. Which of the following statements is true about the bonds' prices?

Bonds X and Y are issued by different companies, but they both pay a semi-annual coupon of 10% pa and they have the same face value ($100) and maturity (3 years).

The only difference is that bond X and Y's yields are 8 and 12% pa respectively. Which of the following statements is true?

A three year bond has a fixed coupon rate of 12% pa, paid semi-annually. The bond's yield is currently 6% pa. The face value is $100. What is its price?

Bonds X and Y are issued by different companies, but they both pay a semi-annual coupon of 10% pa and they have the same face value ($100), maturity (3 years) and yield (10%) as each other.

Which of the following statements is true?

A four year bond has a face value of $100, a yield of 6% and a fixed coupon rate of 12%, paid semi-annually. What is its price?

Which one of the following bonds is trading at a discount?

A firm wishes to raise $20 million now. They will issue 8% pa semi-annual coupon bonds that will mature in 5 years and have a face value of $100 each. Bond yields are 6% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

A five year bond has a face value of $100, a yield of 12% and a fixed coupon rate of 6%, paid semi-annually.

What is the bond's price?

Which one of the following bonds is trading at par?

A firm wishes to raise $8 million now. They will issue 7% pa semi-annual coupon bonds that will mature in 10 years and have a face value of $100 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

Question 207 income and capital returns, bond pricing, coupon rate, no explanation

For a bond that pays fixed semi-annual coupons, how is the annual coupon rate defined, and how is the bond's annual income yield from time 0 to 1 defined mathematically?

Let: ##P_0## be the bond price now,

##F_T## be the bond's face value,

##T## be the bond's maturity in years,

##r_\text{total}## be the bond's total yield,

##r_\text{income}## be the bond's income yield,

##r_\text{capital}## be the bond's capital yield, and

##C_t## be the bond's coupon at time t in years. So ##C_{0.5}## is the coupon in 6 months, ##C_1## is the coupon in 1 year, and so on.

Question 213 income and capital returns, bond pricing, premium par and discount bonds

The coupon rate of a fixed annual-coupon bond is constant (always the same).

What can you say about the income return (##r_\text{income}##) of a fixed annual coupon bond? Remember that:

###r_\text{total} = r_\text{income} + r_\text{capital}###

###r_\text{total, 0 to 1} = \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0}###

Assume that there is no change in the bond's total annual yield to maturity from when it is issued to when it matures.

Select the most correct statement.

From its date of issue until maturity, the income return of a fixed annual coupon:

Which one of the following bonds is trading at a premium?

An investor bought two fixed-coupon bonds issued by the same company, a zero-coupon bond and a 7% pa semi-annual coupon bond. Both bonds have a face value of $1,000, mature in 10 years, and had a yield at the time of purchase of 8% pa.

A few years later, yields fell to 6% pa. Which of the following statements is correct? Note that a capital gain is an increase in price.

A firm wishes to raise $10 million now. They will issue 6% pa semi-annual coupon bonds that will mature in 8 years and have a face value of $1,000 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue? All numbers are rounded up.

A four year bond has a face value of $100, a yield of 9% and a fixed coupon rate of 6%, paid semi-annually. What is its price?

In these tough economic times, central banks around the world have cut interest rates so low that they are practically zero. In some countries, government bond yields are also very close to zero.

A three year government bond with a face value of $100 and a coupon rate of 2% pa paid semi-annually was just issued at a yield of 0%. What is the price of the bond?

A 10 year bond has a face value of $100, a yield of 6% pa and a fixed coupon rate of 8% pa, paid semi-annually. What is its price?

Bonds X and Y are issued by the same company. Both bonds yield 10% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X pays coupons of 6% pa and bond Y pays coupons of 8% pa. Which of the following statements is true?

A 10 year Australian government bond was just issued at par with a yield of 3.9% pa. The fixed coupon payments are semi-annual. The bond has a face value of $1,000.

Six months later, just after the first coupon is paid, the yield of the bond decreases to 3.65% pa. What is the bond's new price?

A 30 year Japanese government bond was just issued at par with a yield of 1.7% pa. The fixed coupon payments are semi-annual. The bond has a face value of $100.

Six months later, just after the first coupon is paid, the yield of the bond increases to 2% pa. What is the bond's new price?

Bonds X and Y are issued by the same US company. Both bonds yield 6% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X pays coupons of 8% pa and bond Y pays coupons of 12% pa. Which of the following statements is true?

Below are some statements about loans and bonds. The first descriptive sentence is correct. But one of the second sentences about the loans' or bonds' prices is not correct. Which statement is NOT correct? Assume that interest rates are positive.

Note that coupons or interest payments are the periodic payments made throughout a bond or loan's life. The face or par value of a bond or loan is the amount paid at the end when the debt matures.

What is the covariance of a variable X with itself?

The cov(X, X) or ##\sigma_{X,X}## equals:

What is the covariance of a variable X with a constant C?

The cov(X, C) or ##\sigma_{X,C}## equals:

A firm can issue 5 year annual coupon bonds at a yield of 8% pa and a coupon rate of 12% pa.

The beta of its levered equity is 1. Five year government bonds yield 5% pa with a coupon rate of 6% pa. The market's expected dividend return is 4% pa and its expected capital return is 6% pa.

The firm's debt-to-equity ratio is 2:1. The corporate tax rate is 30%.

What is the firm's after-tax WACC? Assume a classical tax system.

Find the cash flow from assets (CFFA) of the following project.

| One Year Mining Project Data | ||

| Project life | 1 year | |

| Initial investment in building mine and equipment | $9m | |

| Depreciation of mine and equipment over the year | $8m | |

| Kilograms of gold mined at end of year | 1,000 | |

| Sale price per kilogram | $0.05m | |

| Variable cost per kilogram | $0.03m | |

| Before-tax cost of closing mine at end of year | $4m | |

| Tax rate | 30% | |

Note 1: Due to the project, the firm also anticipates finding some rare diamonds which will give before-tax revenues of $1m at the end of the year.

Note 2: The land that will be mined actually has thermal springs and a family of koalas that could be sold to an eco-tourist resort for an after-tax amount of $3m right now. However, if the mine goes ahead then this natural beauty will be destroyed.

Note 3: The mining equipment will have a book value of $1m at the end of the year for tax purposes. However, the equipment is expected to fetch $2.5m when it is sold.

Find the project's CFFA at time zero and one. Answers are given in millions of dollars ($m), with the first cash flow at time zero, and the second at time one.

Here are the Net Income (NI) and Cash Flow From Assets (CFFA) equations:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c)###

###CFFA=NI+Depr-CapEx - \varDelta NWC+IntExp###

What is the formula for calculating annual interest expense (IntExp) which is used in the equations above?

Select one of the following answers. Note that D is the value of debt which is constant through time, and ##r_D## is the cost of debt.

A manufacturing company is considering a new project in the more risky services industry. The cash flows from assets (CFFA) are estimated for the new project, with interest expense excluded from the calculations. To get the levered value of the project, what should these unlevered cash flows be discounted by?

Assume that the manufacturing firm has a target debt-to-assets ratio that it sticks to.

Find the cash flow from assets (CFFA) of the following project.

| Project Data | |

| Project life | 2 years |

| Initial investment in equipment | $8m |

| Depreciation of equipment per year for tax purposes | $3m |

| Unit sales per year | 10m |

| Sale price per unit | $9 |

| Variable cost per unit | $4 |

| Fixed costs per year, paid at the end of each year | $2m |

| Tax rate | 30% |

Note 1: Due to the project, the firm will have to purchase $40m of inventory initially (at t=0). Half of this inventory will be sold at t=1 and the other half at t=2.

Note 2: The equipment will have a book value of $2m at the end of the project for tax purposes. However, the equipment is expected to fetch $1m when it is sold. Assume that the full capital loss is tax-deductible and taxed at the full corporate tax rate.

Note 3: The project will be fully funded by equity which investors will expect to pay dividends totaling $10m at the end of each year.

Find the project's CFFA at time zero, one and two. Answers are given in millions of dollars ($m).

For a price of $6, Carlos will sell you a share which will pay a dividend of $1 in one year and every year after that forever. The required return of the stock is 10% pa.

For a price of $102, Andrea will sell you a share which just paid a dividend of $10 yesterday, and is expected to pay dividends every year forever, growing at a rate of 5% pa.

So the next dividend will be ##10(1+0.05)^1=$10.50## in one year from now, and the year after it will be ##10(1+0.05)^2=11.025## and so on.

The required return of the stock is 15% pa.

For a price of $10.20 each, Renee will sell you 100 shares. Each share is expected to pay dividends in perpetuity, growing at a rate of 5% pa. The next dividend is one year away (t=1) and is expected to be $1 per share.

The required return of the stock is 15% pa.

For a price of $129, Joanne will sell you a share which is expected to pay a $30 dividend in one year, and a $10 dividend every year after that forever. So the stock's dividends will be $30 at t=1, $10 at t=2, $10 at t=3, and $10 forever onwards.

The required return of the stock is 10% pa.

For a price of $95, Sherylanne will sell you a share which is expected to pay its first dividend of $10 in 7 years (t=7), and will continue to pay the same $10 dividend every year after that forever.

The required return of the stock is 10% pa.

For a price of $100, Carol will sell you a 5 year bond paying semi-annual coupons of 16% pa. The face value of the bond is $100. Other bonds with similar risk, maturity and coupon characteristics trade at a yield of 12% pa.

For a price of $100, Andrea will sell you a 2 year bond paying annual coupons of 10% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 6% pa.

For a price of $100, Rad will sell you a 5 year bond paying semi-annual coupons of 16% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 6% pa.

A three year bond has a face value of $100, a yield of 10% and a fixed coupon rate of 5%, paid semi-annually. What is its price?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### p_{0} = \frac{c_1}{r_{\text{eff}} - g_{\text{eff}}} ###

What is the discount rate '## r_\text{eff} ##' in this equation?

Question 22 NPV, perpetuity with growth, effective rate, effective rate conversion

What is the NPV of the following series of cash flows when the discount rate is 10% given as an effective annual rate?

The first payment of $90 is in 3 years, followed by payments every 6 months in perpetuity after that which shrink by 3% every 6 months. That is, the growth rate every 6 months is actually negative 3%, given as an effective 6 month rate. So the payment at ## t=3.5 ## years will be ## 90(1-0.03)^1=87.3 ##, and so on.

A 180-day Bank Accepted Bill has a face value of $1,000,000. The interest rate is 8% pa and there are 365 days in the year. What is its price now?

A share was bought for $20 (at t=0) and paid its annual dividend of $3 one year later (at t=1). Just after the dividend was paid, the share price was $16 (at t=1). What was the total return, capital return and income return? Calculate your answers as effective annual rates.

The choices are given in the same order: ## r_\text{total},r_\text{capital},r_\text{income} ##.

Question 31 DDM, perpetuity with growth, effective rate conversion

What is the NPV of the following series of cash flows when the discount rate is 5% given as an effective annual rate?

The first payment of $10 is in 4 years, followed by payments every 6 months forever after that which shrink by 2% every 6 months. That is, the growth rate every 6 months is actually negative 2%, given as an effective 6 month rate. So the payment at ## t=4.5 ## years will be ## 10(1-0.02)^1=9.80 ##, and so on.

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates. What is the current price of the stock?

The following is the Dividend Discount Model (DDM) used to price stocks:

### P_0 = \frac{d_1}{r-g} ###Assume that the assumptions of the DDM hold and that the time period is measured in years.

Which of the following is equal to the expected dividend in 3 years, ## d_3 ##?

You just signed up for a 30 year interest-only mortgage with monthly payments of $3,000 per month. The interest rate is 6% pa which is not expected to change.

How much did you borrow? After 15 years, just after the 180th payment at that time, how much will be owing on the mortgage? The interest rate is still 6% and is not expected to change. Remember that the mortgage is interest-only and that mortgage payments are paid in arrears (at the end of the month).

The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Profitability Index (PI) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

A stock pays semi-annual dividends. It just paid a dividend of $10. The growth rate in the dividend is 1% every 6 months, given as an effective 6 month rate. You estimate that the stock's required return is 21% pa, as an effective annual rate.

Using the dividend discount model, what will be the share price?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.15 | 1.10 | 1.05 | 1.00 | ... |

After year 4, the annual dividend will grow in perpetuity at -5% pa. Note that this is a negative growth rate, so the dividend will actually shrink. So,

- the dividend at t=5 will be ##$1(1-0.05) = $0.95##,

- the dividend at t=6 will be ##$1(1-0.05)^2 = $0.9025##, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What is the current price of the stock?

Question 65 annuity with growth, needs refinement

Which of the below formulas gives the present value of an annuity with growth?

Hint: The equation of a perpetuity without growth is: ###V_\text{0, perp without growth} = \frac{C_\text{1}}{r}###

The formula for the present value of an annuity without growth is derived from the formula for a perpetuity without growth.

The idea is than an annuity with T payments from t=1 to T inclusive is equivalent to a perpetuity starting at t=1 with fixed positive cash flows, plus a perpetuity starting T periods later (t=T+1) with fixed negative cash flows. The positive and negative cash flows after time period T cancel each other out, leaving the positive cash flows between t=1 to T, which is the annuity.

###\begin{aligned} V_\text{0, annuity} &= V_\text{0, perp without growth from t=1} - V_\text{0, perp without growth from t=T+1} \\ &= \dfrac{C_\text{1}}{r} - \dfrac{ \left( \dfrac{C_\text{T+1}}{r} \right) }{(1+r)^T} \\ &= \dfrac{C_\text{1}}{r} - \dfrac{ \left( \dfrac{C_\text{1}}{r} \right) }{(1+r)^T} \\ &= \dfrac{C_\text{1}}{r}\left(1 - \dfrac{1}{(1+r)^T}\right) \\ \end{aligned}###

The equation of a perpetuity with growth is:

###V_\text{0, perp with growth} = \dfrac{C_\text{1}}{r-g}###Government bonds currently have a return of 5% pa. A stock has an expected return of 6% pa and the market return is 7% pa. What is the beta of the stock?

Question 69 interest tax shield, capital structure, leverage, WACC

Which statement about risk, required return and capital structure is the most correct?

Due to floods overseas, there is a cut in the supply of the mineral iron ore and its price increases dramatically. An Australian iron ore mining company therefore expects a large but temporary increase in its profit and cash flows. The mining company does not have any positive NPV projects to begin, so what should it do? Select the most correct answer.

Stock A has a beta of 0.5 and stock B has a beta of 1. Which statement is NOT correct?

Government bonds currently have a return of 5%. A stock has a beta of 2 and the market return is 7%. What is the expected return of the stock?

The equations for Net Income (NI, also known as Earnings or Net Profit After Tax) and Cash Flow From Assets (CFFA, also known as Free Cash Flow to the Firm) per year are:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c)###

###CFFA=NI+Depr-CapEx - \varDelta NWC+IntExp###

For a firm with debt, what is the amount of the interest tax shield per year?

A company issues a large amount of bonds to raise money for new projects of similar risk to the company's existing projects. The net present value (NPV) of the new projects is positive but small. Assume a classical tax system. Which statement is NOT correct?

A share pays annual dividends. It just paid a dividend of $2. The growth rate in the dividend is 3% pa. You estimate that the stock's required return is 8% pa. Both the discount rate and growth rate are given as effective annual rates.

Using the dividend discount model, what is the share price?

A stock's required total return will increase when its:

To value a business's assets, the free cash flow of the firm (FCFF, also called CFFA) needs to be calculated. This requires figures from the firm's income statement and balance sheet. For what figures is the balance sheet needed? Note that the balance sheet is sometimes also called the statement of financial position.

Let the 'income return' of a bond be the coupon at the end of the period divided by the market price now at the start of the period ##(C_1/P_0)##. The expected income return of a premium fixed coupon bond is:

An economy has only two investable assets: stocks and cash.

Stocks had a historical nominal average total return of negative two percent per annum (-2% pa) over the last 20 years. Stocks are liquid and actively traded. Stock returns are variable, they have risk.

Cash is riskless and has a nominal constant return of zero percent per annum (0% pa), which it had in the past and will have in the future. Cash can be kept safely at zero cost. Cash can be converted into shares and vice versa at zero cost.

The nominal total return of the shares over the next year is expected to be:

The efficient markets hypothesis (EMH) and no-arbitrage pricing theory are most closely related to which of the following concepts?

Question 624 franking credit, personal tax on dividends, imputation tax system, no explanation

Which of the following statements about Australian franking credits is NOT correct? Franking credits:

Question 625 dividend re-investment plan, capital raising

Which of the following statements about dividend re-investment plans (DRP's) is NOT correct?

Question 626 cross currency interest rate parity, foreign exchange rate, forward foreign exchange rate

The Australian cash rate is expected to be 2% pa over the next one year, while the Japanese cash rate is expected to be 0% pa, both given as nominal effective annual rates. The current exchange rate is 100 JPY per AUD.

What is the implied 1 year forward foreign exchange rate?

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Which of the below statements is NOT correct?

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Of the 15% pa total expected return, the dividend yield is expected to always be 7% pa and rest is the capital yield.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% total return lasts for the next 100 years (t=0 to 100), then reverts to 10% after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant, the dividends can only be re-invested at 10% pa and all returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

The 'time value of money' is most closely related to which of the following concepts?

Question 657 systematic and idiosyncratic risk, CAPM, no explanation

A stock's required total return will decrease when its:

Question 658 CFFA, income statement, balance sheet, no explanation

To value a business's assets, the free cash flow of the firm (FCFF, also called CFFA) needs to be calculated. This requires figures from the firm's income statement and balance sheet. For what figures is the income statement needed? Note that the income statement is sometimes also called the profit and loss, P&L, or statement of financial performance.

Question 659 APR, effective rate, effective rate conversion, no explanation

A home loan company advertises an interest rate of 9% pa, payable monthly. Which of the following statements about the interest rate is NOT correct? All rates are given with an accuracy of 4 decimal places.