The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Profitability Index (PI) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 200 |

| 2 | 250 |

What is the Profitability Index (PI) of the project? Assume that the cash flows shown in the table are paid all at once at the given point in time. The required return is 10% pa, given as an effective annual rate.

A project's Profitability Index (PI) is less than 1. Select the most correct statement:

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -90 |

| 1 | 30 |

| 2 | 105 |

The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Profitability Index (PI) of the project?

The saying "buy low, sell high" suggests that investors should make a:

Question 490 expected and historical returns, accounting ratio

Which of the following is NOT a synonym of 'required return'?

Total cash flows can be broken into income and capital cash flows. What is the name given to the income cash flow from owning shares?

Which of the following equations is NOT equal to the total return of an asset?

Let ##p_0## be the current price, ##p_1## the expected price in one year and ##c_1## the expected income in one year.

An asset's total expected return over the next year is given by:

###r_\text{total} = \dfrac{c_1+p_1-p_0}{p_0} ###

Where ##p_0## is the current price, ##c_1## is the expected income in one year and ##p_1## is the expected price in one year. The total return can be split into the income return and the capital return.

Which of the following is the expected capital return?

A stock was bought for $8 and paid a dividend of $0.50 one year later (at t=1 year). Just after the dividend was paid, the stock price was $7 (at t=1 year).

What were the total, capital and dividend returns given as effective annual rates? The choices are given in the same order:

##r_\text{total}##, ##r_\text{capital}##, ##r_\text{dividend}##.

A share was bought for $30 (at t=0) and paid its annual dividend of $6 one year later (at t=1).

Just after the dividend was paid, the share price fell to $27 (at t=1). What were the total, capital and income returns given as effective annual rates?

The choices are given in the same order:

##r_\text{total}## , ##r_\text{capital}## , ##r_\text{dividend}##.

A fixed coupon bond was bought for $90 and paid its annual coupon of $3 one year later (at t=1 year). Just after the coupon was paid, the bond price was $92 (at t=1 year). What was the total return, capital return and income return? Calculate your answers as effective annual rates.

The choices are given in the same order: ## r_\text{total},r_\text{capital},r_\text{income} ##.

One and a half years ago Frank bought a house for $600,000. Now it's worth only $500,000, based on recent similar sales in the area.

The expected total return on Frank's residential property is 7% pa.

He rents his house out for $1,600 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $18,617.27.

The future value of 12 months of rental payments one year in the future is $19,920.48.

What is the expected annual rental yield of the property? Ignore the costs of renting such as maintenance, real estate agent fees and so on.

Question 278 inflation, real and nominal returns and cash flows

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year.

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

In the 'Austin Powers' series of movies, the character Dr. Evil threatens to destroy the world unless the United Nations pays him a ransom (video 1, video 2). Dr. Evil makes the threat on two separate occasions:

- In 1969 he demands a ransom of $1 million (=10^6), and again;

- In 1997 he demands a ransom of $100 billion (=10^11).

If Dr. Evil's demands are equivalent in real terms, in other words $1 million will buy the same basket of goods in 1969 as $100 billion would in 1997, what was the implied inflation rate over the 28 years from 1969 to 1997?

The answer choices below are given as effective annual rates:

Question 353 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

Question 363 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 8% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

Question 407 income and capital returns, inflation, real and nominal returns and cash flows

A stock has a real expected total return of 7% pa and a real expected capital return of 2% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What is the nominal expected total return, capital return and dividend yield? The answers below are given in the same order.

Question 155 inflation, real and nominal returns and cash flows, Loan, effective rate conversion

You are a banker about to grant a 2 year loan to a customer. The loan's principal and interest will be repaid in a single payment at maturity, sometimes called a zero-coupon loan, discount loan or bullet loan.

You require a real return of 6% pa over the two years, given as an effective annual rate. Inflation is expected to be 2% this year and 4% next year, both given as effective annual rates.

You judge that the customer can afford to pay back $1,000,000 in 2 years, given as a nominal cash flow. How much should you lend to her right now?

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's market capitalisation of equity?

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's market capitalisation of equity?

Which of the following statements about book and market equity is NOT correct?

Question 461 book and market values, ROE, ROA, market efficiency

One year ago a pharmaceutical firm floated by selling its 1 million shares for $100 each. Its book and market values of equity were both $100m. Its debt totalled $50m. The required return on the firm's assets was 15%, equity 20% and debt 5% pa.

In the year since then, the firm:

- Earned net income of $29m.

- Paid dividends totaling $10m.

- Discovered a valuable new drug that will lead to a massive 1,000 times increase in the firm's net income in 10 years after the research is commercialised. News of the discovery was publicly announced. The firm's systematic risk remains unchanged.

Which of the following statements is NOT correct? All statements are about current figures, not figures one year ago.

Hint: Book return on assets (ROA) and book return on equity (ROE) are ratios that accountants like to use to measure a business's past performance.

###\text{ROA}= \dfrac{\text{Net income}}{\text{Book value of assets}}###

###\text{ROE}= \dfrac{\text{Net income}}{\text{Book value of equity}}###

The required return on assets ##r_V## is a return that financiers like to use to estimate a business's future required performance which compensates them for the firm's assets' risks. If the business were to achieve realised historical returns equal to its required returns, then investment into the business's assets would have been a zero-NPV decision, which is neither good nor bad but fair.

###r_\text{V, 0 to 1}= \dfrac{\text{Cash flow from assets}_\text{1}}{\text{Market value of assets}_\text{0}} = \dfrac{CFFA_\text{1}}{V_\text{0}}###

Similarly for equity and debt.

Question 444 investment decision, corporate financial decision theory

The investment decision primarily affects which part of a business?

Question 446 working capital decision, corporate financial decision theory

The working capital decision primarily affects which part of a business?

Question 445 financing decision, corporate financial decision theory

The financing decision primarily affects which part of a business?

Question 447 payout policy, corporate financial decision theory

Payout policy is most closely related to which part of a business?

Question 443 corporate financial decision theory, investment decision, financing decision, working capital decision, payout policy

Business people make lots of important decisions. Which of the following is the most important long term decision?

You're considering making an investment in a particular company. They have preference shares, ordinary shares, senior debt and junior debt.

Which is the safest investment? Which has the highest expected returns?

A newly floated farming company is financed with senior bonds, junior bonds, cumulative non-voting preferred stock and common stock. The new company has no retained profits and due to floods it was unable to record any revenues this year, leading to a loss. The firm is not bankrupt yet since it still has substantial contributed equity (same as paid-up capital).

On which securities must it pay interest or dividend payments in this terrible financial year?

Which business structure or structures have the advantage of limited liability for equity investors?

Question 452 limited liability, expected and historical returns

What is the lowest and highest expected share price and expected return from owning shares in a company over a finite period of time?

Let the current share price be ##p_0##, the expected future share price be ##p_1##, the expected future dividend be ##d_1## and the expected return be ##r##. Define the expected return as:

##r=\dfrac{p_1-p_0+d_1}{p_0} ##

The answer choices are stated using inequalities. As an example, the first answer choice "(a) ##0≤p<∞## and ##0≤r< 1##", states that the share price must be larger than or equal to zero and less than positive infinity, and that the return must be larger than or equal to zero and less than one.

Question 992 inflation, real and nominal returns and cash flows

You currently have $100 in the bank which pays a 10% pa interest rate.

Oranges currently cost $1 each at the shop and inflation is 5% pa which is the expected growth rate in the orange price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Oranges | ||||

| Time (year) | Bank account wealth ($) | Orange price ($) | Wealth in oranges | |

| 0 | 100 | 1 | 100 | |

| 1 | 110 | 1.05 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your:

Question 993 inflation, real and nominal returns and cash flows

In February 2020, the RBA cash rate was 0.75% pa and the Australian CPI inflation rate was 1.8% pa.

You currently have $100 in the bank which pays a 0.75% pa interest rate.

Apples currently cost $1 each at the shop and inflation is 1.8% pa which is the expected growth rate in the apple price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Apples | ||||

| Time (year) | Bank account wealth ($) | Apple price ($) | Wealth in apples | |

| 0 | 100 | 1 | 100 | |

| 1 | 100.75 | 1.018 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your:

Question 522 income and capital returns, real and nominal returns and cash flows, inflation, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 2.5% pa. Inflation is expected to be 2.5% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the property's expected real total, capital and income returns?

The answer choices below are given in the same order.

Question 523 income and capital returns, real and nominal returns and cash flows, inflation

A low-growth mature stock has an expected nominal total return of 6% pa and nominal capital return of 2% pa. Inflation is expected to be 3% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the stock's expected real total, capital and income returns?

The answer choices below are given in the same order.

Question 525 income and capital returns, real and nominal returns and cash flows, inflation

Which of the following statements about cash in the form of notes and coins is NOT correct? Assume that inflation is positive.

Notes and coins:

Question 526 real and nominal returns and cash flows, inflation, no explanation

How can a nominal cash flow be precisely converted into a real cash flow?

Question 574 inflation, real and nominal returns and cash flows, NPV

What is the present value of a nominal payment of $100 in 5 years? The real discount rate is 10% pa and the inflation rate is 3% pa.

Question 575 inflation, real and nominal returns and cash flows

You expect a nominal payment of $100 in 5 years. The real discount rate is 10% pa and the inflation rate is 3% pa. Which of the following statements is NOT correct?

Question 576 inflation, real and nominal returns and cash flows

What is the present value of a nominal payment of $1,000 in 4 years? The nominal discount rate is 8% pa and the inflation rate is 2% pa.

Question 577 inflation, real and nominal returns and cash flows

What is the present value of a real payment of $500 in 2 years? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

Question 578 inflation, real and nominal returns and cash flows

Which of the following statements about inflation is NOT correct?

Question 604 inflation, real and nominal returns and cash flows

Apples and oranges currently cost $1 each. Inflation is 5% pa, and apples and oranges are equally affected by this inflation rate. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

Which of the following statements is NOT correct?

Question 664 real and nominal returns and cash flows, inflation, no explanation

What is the present value of real payments of $100 every year forever, with the first payment in one year? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

Question 728 inflation, real and nominal returns and cash flows, income and capital returns, no explanation

Which of the following statements about gold is NOT correct? Assume that the gold price increases by inflation. Gold has a:

Question 732 real and nominal returns and cash flows, inflation, income and capital returns

An investor bought a bond for $100 (at t=0) and one year later it paid its annual coupon of $1 (at t=1). Just after the coupon was paid, the bond price was $100.50 (at t=1). Inflation over the past year (from t=0 to t=1) was 3% pa, given as an effective annual rate.

Which of the following statements is NOT correct? The bond investment produced a:

Question 734 real and nominal returns and cash flows, inflation, DDM, no explanation

An equities analyst is using the dividend discount model to price a company's shares. The company operates domestically and has no plans to expand overseas. It is part of a mature industry with stable positive growth prospects.

The analyst has estimated the real required return (r) of the stock and the value of the dividend that the stock just paid a moment before ##(C_\text{0 before})##.

What is the highest perpetual real growth rate of dividends (g) that can be justified? Select the most correct statement from the following choices. The highest perpetual real expected growth rate of dividends that can be justified is the country's expected:

Question 739 real and nominal returns and cash flows, inflation

There are a number of different formulas involving real and nominal returns and cash flows. Which one of the following formulas is NOT correct? All returns are effective annual rates. Note that the symbol ##\approx## means 'approximately equal to'.

Question 740 real and nominal returns and cash flows, DDM, inflation

Taking inflation into account when using the DDM can be hard. Which of the following formulas will NOT give a company's current stock price ##(P_0)##? Assume that the annual dividend was just paid ##(C_0)##, and the next dividend will be paid in one year ##(C_1)##.

Question 744 income and capital returns, real and nominal returns and cash flows, inflation

If someone says "my shares rose by 10% last year", what do you assume that they mean? The effective annual:

Question 745 real and nominal returns and cash flows, inflation, income and capital returns

If the nominal gold price is expected to increase at the same rate as inflation which is 3% pa, which of the following statements is NOT correct?

Estimate the US bank JP Morgan's share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- The major US banks JP Morgan Chase (JPM), Citi Group (C) and Wells Fargo (WFC) are comparable companies;

- JP Morgan Chase's historical earnings per share (EPS) is $4.37;

- Citi Group's share price is $50.05 and historical EPS is $4.26;

- Wells Fargo's share price is $48.98 and historical EPS is $3.89.

Note: Figures sourced from Google Finance on 24 March 2014.

Which firms tend to have low forward-looking price-earnings (PE) ratios?

Only consider firms with positive earnings, disregard firms with negative earnings and therefore negative PE ratios.

Which of the following investable assets are NOT suitable for valuation using PE multiples techniques?

Estimate the Chinese bank ICBC's share price using a backward-looking price earnings (PE) multiples approach with the following assumptions and figures only. Note that the renminbi (RMB) is the Chinese currency, also known as the yuan (CNY).

- The 4 major Chinese banks ICBC, China Construction Bank (CCB), Bank of China (BOC) and Agricultural Bank of China (ABC) are comparable companies;

- ICBC 's historical earnings per share (EPS) is RMB 0.74;

- CCB's backward-looking PE ratio is 4.59;

- BOC 's backward-looking PE ratio is 4.78;

- ABC's backward-looking PE ratio is also 4.78;

Note: Figures sourced from Google Finance on 25 March 2014. Share prices are from the Shanghai stock exchange.

Which firms tend to have high forward-looking price-earnings (PE) ratios?

Which firms tend to have low forward-looking price-earnings (PE) ratios? Only consider firms with positive PE ratios.

Private equity firms are known to buy medium sized private companies operating in the same industry, merge them together into a larger company, and then sell it off in a public float (initial public offering, IPO).

If medium-sized private companies trade at PE ratios of 5 and larger listed companies trade at PE ratios of 15, what return can be achieved from this strategy?

Assume that:

- The medium-sized companies can be bought, merged and sold in an IPO instantaneously.

- There are no costs of finding, valuing, merging and restructuring the medium sized companies. Also, there is no competition to buy the medium-sized companies from other private equity firms.

- The large merged firm's earnings are the sum of the medium firms' earnings.

- The only reason for the difference in medium and large firm's PE ratios is due to the illiquidity of the medium firms' shares.

- Return is defined as: ##r_{0→1} = (p_1-p_0+c_1)/p_0## , where time zero is just before the merger and time one is just after.

Estimate the French bank Societe Generale's share price using a backward-looking price earnings (PE) multiples approach with the following assumptions and figures only. Note that EUR is the euro, the European monetary union's currency.

- The 4 major European banks Credit Agricole (ACA), Deutsche Bank AG (DBK), UniCredit (UCG) and Banco Santander (SAN) are comparable companies to Societe Generale (GLE);

- Societe Generale's (GLE's) historical earnings per share (EPS) is EUR 2.92;

- ACA's backward-looking PE ratio is 16.29 and historical EPS is EUR 0.84;

- DBK's backward-looking PE ratio is 25.01 and historical EPS is EUR 1.26;

- SAN's backward-looking PE ratio is 14.71 and historical EPS is EUR 0.47;

- UCG's backward-looking PE ratio is 15.78 and historical EPS is EUR 0.40;

Note: Figures sourced from Google Finance on 27 March 2015.

Question 547 PE ratio, Multiples valuation, DDM, income and capital returns, no explanation

A firm pays out all of its earnings as dividends. Because of this, the firm has no real growth in earnings, dividends or stock price since there is no re-investment back into the firm to buy new assets and make higher earnings. The dividend discount model is suitable to value this company.

The firm's revenues and costs are expected to increase by inflation in the foreseeable future. The firm has no debt. It operates in the services industry and has few physical assets so there is negligible depreciation expense and negligible net working capital required.

Which of the following statements about this firm's PE ratio is NOT correct? The PE ratio should:

Note: The inverse of x is 1/x.

Question 749 Multiples valuation, PE ratio, price to revenue ratio, price to book ratio, NPV

A real estate agent says that the price of a house in Sydney Australia is approximately equal to the gross weekly rent times 1000.

What type of valuation method is the real estate agent using?

Itau Unibanco is a major listed bank in Brazil with a market capitalisation of equity equal to BRL 85.744 billion, EPS of BRL 3.96 and 2.97 billion shares on issue.

Banco Bradesco is another major bank with total earnings of BRL 8.77 billion and 2.52 billion shares on issue.

Estimate Banco Bradesco's current share price using a price-earnings multiples approach assuming that Itau Unibanco is a comparable firm.

Note that BRL is the Brazilian Real, their currency. Figures sourced from Google Finance on the market close of the BVMF on 24 July 2015.

A stock has a beta of 1.2. Its next dividend is expected to be $20, paid one year from now.

Dividends are expected to be paid annually and grow by 1.5% pa forever.

Treasury bonds yield 3% pa and the market portfolio's expected return is 7% pa. All returns are effective annual rates.

What is the price of the stock now?

Question 935 real estate, NPV, perpetuity with growth, multi stage growth model, DDM

You're thinking of buying an investment property that costs $1,000,000. The property's rent revenue over the next year is expected to be $50,000 pa and rent expenses are $20,000 pa, so net rent cash flow is $30,000. Assume that net rent is paid annually in arrears, so this next expected net rent cash flow of $30,000 is paid one year from now.

The year after, net rent is expected to fall by 2% pa. So net rent at year 2 is expected to be $29,400 (=30,000*(1-0.02)^1).

The year after that, net rent is expected to rise by 1% pa. So net rent at year 3 is expected to be $29,694 (=30,000*(1-0.02)^1*(1+0.01)^1).

From year 3 onwards, net rent is expected to rise at 2.5% pa forever. So net rent at year 4 is expected to be $30,436.35 (=30,000*(1-0.02)^1*(1+0.01)^1*(1+0.025)^1).

Assume that the total required return on your investment property is 6% pa. Ignore taxes. All returns are given as effective annual rates.

What is the net present value (NPV) of buying the investment property?

Question 989 PE ratio, Multiples valuation, leverage, accounting ratio

A firm has 20 million stocks, earnings (or net income) of $100 million per annum and a 60% debt-to-equity ratio where both the debt and asset values are market values rather than book values. Similar firms have a PE ratio of 12.

Which of the below statements is NOT correct based on a PE multiples valuation?

Question 990 Multiples valuation, EV to EBITDA ratio, enterprise value

A firm has:

2 million shares;

$200 million EBITDA expected over the next year;

$100 million in cash (not included in EV);

1/3 market debt-to-assets ratio is (market assets = EV + cash);

4% pa expected dividend yield over the next year, paid annually with the next dividend expected in one year;

2% pa expected dividend growth rate;

40% expected payout ratio over the next year;10 times EV/EBITDA ratio.

30% corporate tax rate.

The stock can be valued using the EV/EBITDA multiple, dividend discount model, Gordon growth model or PE multiple. Which of the below statements is NOT correct based on an EV/EBITDA multiple valuation?

Question 1022 inflation linked bond, breakeven inflation rate, inflation, real and nominal returns and cash flows

Below is a graph of 10-year US treasury fixed coupon bond yields (red), inflation-indexed bond yields (green) and the 'breakeven' inflation rate (blue). Note that inflation-indexed bonds are also called treasury inflation protected securities (TIPS) in the US. In other countries they're called inflation-linked bonds (ILB's). For more information, see PIMCO's great article about inflation linked bonds here.

The 10 year breakeven inflation rate (blue) equals the:

PIMCO gives the following example of an Inflation Linked Bond (ILB), called Treasury Inflation Protected Securities (TIPS) in the US.

How do ILBs work?

An ILB’s explicit link to a nationally-recognized inflation measure means that any increase in price levels directly translates into higher principal values. As a hypothetical example, consider a $1,000 20-year U.S. TIPS with a 2.5% coupon (1.25% on semiannual basis), and an inflation rate of 4%. The principal on the TIPS note will adjust upward on a daily basis to account for the 4% inflation rate. At maturity, the principal value will be $2,208 (4% per year, compounded semiannually). Additionally, while the coupon rate remains fixed at 2.5%, the dollar value of each interest payment will rise, as the coupon will be paid on the inflation-adjusted principal value. The first semiannual coupon of 1.25% paid on the inflation-adjusted principal of $1,020 is $12.75, while the final semiannual interest payment will be 1.25% of $2,208, which is $27.60.

Forecast the semi-annual coupon paid in 10 years based on the bond details given above. The 20th semi-annual coupon, paid in 10 years, is expected to be:

Question 1023 monetary policy, inflation, breakeven inflation rate

If the breakeven inflation rate was far above the US Fed's long term 2% average inflation target, the Fed would be expected to:

Former Reserve Bank of Australia (RBA) Governor Phil Lowe says that the RBA cash rate is the interest rate in the Australian:

Former RBA Governor Phil Lowe says that if the economy is growing very strongly, then prices might be growing too:

Former RBA Governor Phil Lowe says that when the RBA raise interest rates, homeowners' mortgage loan interest expense will be:

Question 1018 RBA cash rate, monetary policy, foreign exchange rate

RBA Governor Phil Lowe says that when the RBA raises the cash rate (by surprise), the Australian dollar (AUD) tends to:

Question 1019 RBA cash rate, monetary policy, wealth effect

Former RBA Governor Phil Lowe says that when the RBA raise the cash rate, asset prices tend to:

Question 1020 Federal funds rate, monetary policy, dot plot

US Federal Reserve Chair Jerome Powell showed the 'dot plot' of Federal Open Market Committee (FOMC) members' estimated future Fed fund rates following their quarterly summary of economic projections on 15 Dec 2021. The dot plot shows that committee members intended to make monetary policy more:

Question 1021 Federal funds rate, monetary policy, quantitative easing, tapering

US Fed Chair Jerome Powell held a news conference following the 25-26 January 2022 FOMC meeting.

Nick Timiraos reporting for The Wall Street Journal asked: "Raising rates and reducing the balance sheet both restrain the economy, both tighten monetary policy. How should we think about the relationship between the two? For example, how much passive runoff is equal to every quarter percentage point increase in your benchmark rate?"

Jerome Powell replied: "So, again, we think of the balance sheet as moving in a predictable manner, sort of in the background, and that the active tool meeting to meeting is not -- both of them, it's the federal funds rate. There are rules of thumbs. I'm reluctant to land on one of them that equate this. And there's also an element of uncertainty around the balance sheet. I think we have a much better sense, frankly, of how rate increases affect financial conditions and, hence, economic conditions. Balance sheet is still a relatively new thing for the markets and for us, so we're less certain about that." (US Fed, 2022)

When Nick Timiraos mentioned 'reducing the balance sheet', he's referring to:

Katya offers to pay you $10 at the end of every year for the next 5 years (t=1,2,3,4,5) if you pay her $50 now (t=0). You can borrow and lend from the bank at an interest rate of 10% pa, given as an effective annual rate. Ignore credit risk.

There are many ways to write the ordinary annuity formula.

Which of the following is NOT equal to the ordinary annuity formula?

This annuity formula ##\dfrac{C_1}{r}\left(1-\dfrac{1}{(1+r)^3} \right)## is equivalent to which of the following formulas? Note the 3.

In the below formulas, ##C_t## is a cash flow at time t. All of the cash flows are equal, but paid at different times.

The following cash flows are expected:

- 10 yearly payments of $60, with the first payment in 3 years from now (first payment at t=3 and last at t=12).

- 1 payment of $400 in 5 years and 6 months (t=5.5) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

Your friend overheard that you need some cash and asks if you would like to borrow some money. She can lend you $5,000 now (t=0), and in return she wants you to pay her back $1,000 in two years (t=2) and every year after that for the next 5 years, so there will be 6 payments of $1,000 from t=2 to t=7 inclusive.

What is the net present value (NPV) of borrowing from your friend?

Assume that banks loan funds at interest rates of 10% pa, given as an effective annual rate.

Question 58 NPV, inflation, real and nominal returns and cash flows, Annuity

A project to build a toll bridge will take two years to complete, costing three payments of $100 million at the start of each year for the next three years, that is at t=0, 1 and 2.

After completion, the toll bridge will yield a constant $50 million at the end of each year for the next 10 years. So the first payment will be at t=3 and the last at t=12. After the last payment at t=12, the bridge will be given to the government.

The required return of the project is 21% pa given as an effective annual nominal rate.

All cash flows are real and the expected inflation rate is 10% pa given as an effective annual rate. Ignore taxes.

The Net Present Value is:

Some countries' interest rates are so low that they're zero.

If interest rates are 0% pa and are expected to stay at that level for the foreseeable future, what is the most that you would be prepared to pay a bank now if it offered to pay you $10 at the end of every year for the next 5 years?

In other words, what is the present value of five $10 payments at time 1, 2, 3, 4 and 5 if interest rates are 0% pa?

Discounted cash flow (DCF) valuation prices assets by finding the present value of the asset's future cash flows. The single cash flow, annuity, and perpetuity equations are very useful for this.

Which of the following equations is the 'perpetuity with growth' equation?

The following equation is called the Dividend Discount Model (DDM), Gordon Growth Model or the perpetuity with growth formula: ### P_0 = \frac{ C_1 }{ r - g } ###

What is ##g##? The value ##g## is the long term expected:

For a price of $13, Carla will sell you a share paying a dividend of $1 in one year and every year after that forever. The required return of the stock is 10% pa.

The first payment of a constant perpetual annual cash flow is received at time 5. Let this cash flow be ##C_5## and the required return be ##r##.

So there will be equal annual cash flows at time 5, 6, 7 and so on forever, and all of the cash flows will be equal so ##C_5 = C_6 = C_7 = ...##

When the perpetuity formula is used to value this stream of cash flows, it will give a value (V) at time:

For a price of $1040, Camille will sell you a share which just paid a dividend of $100, and is expected to pay dividends every year forever, growing at a rate of 5% pa.

So the next dividend will be ##100(1+0.05)^1=$105.00##, and the year after it will be ##100(1+0.05)^2=110.25## and so on.

The required return of the stock is 15% pa.

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### P_{0} = \frac{C_1}{r_{\text{eff}} - g_{\text{eff}}} ###

What would you call the expression ## C_1/P_0 ##?

The following is the Dividend Discount Model (DDM) used to price stocks:

###P_0=\dfrac{C_1}{r-g}###

If the assumptions of the DDM hold and the stock is fairly priced, which one of the following statements is NOT correct? The long term expected:

A stock just paid its annual dividend of $9. The share price is $60. The required return of the stock is 10% pa as an effective annual rate.

What is the implied growth rate of the dividend per year?

Question 497 income and capital returns, DDM, ex dividend date

A stock will pay you a dividend of $10 tonight if you buy it today. Thereafter the annual dividend is expected to grow by 5% pa, so the next dividend after the $10 one tonight will be $10.50 in one year, then in two years it will be $11.025 and so on. The stock's required return is 10% pa.

What is the stock price today and what do you expect the stock price to be tomorrow, approximately?

A stock is expected to pay a dividend of $15 in one year (t=1), then $25 for 9 years after that (payments at t=2 ,3,...10), and on the 11th year (t=11) the dividend will be 2% less than at t=10, and will continue to shrink at the same rate every year after that forever. The required return of the stock is 10%. All rates are effective annual rates.

What is the price of the stock now?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###P_0=\frac{d_1}{r-g}###

A stock pays dividends annually. It just paid a dividend, but the next dividend (##d_1##) will be paid in one year.

According to the DDM, what is the correct formula for the expected price of the stock in 2.5 years?

In the dividend discount model:

###P_0 = \dfrac{C_1}{r-g}###

The return ##r## is supposed to be the:

Two years ago Fred bought a house for $300,000.

Now it's worth $500,000, based on recent similar sales in the area.

Fred's residential property has an expected total return of 8% pa.

He rents his house out for $2,000 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $23,173.86.

The future value of 12 months of rental payments one year ahead is $25,027.77.

What is the expected annual growth rate of the rental payments? In other words, by what percentage increase will Fred have to raise the monthly rent by each year to sustain the expected annual total return of 8%?

Question 31 DDM, perpetuity with growth, effective rate conversion

What is the NPV of the following series of cash flows when the discount rate is 5% given as an effective annual rate?

The first payment of $10 is in 4 years, followed by payments every 6 months forever after that which shrink by 2% every 6 months. That is, the growth rate every 6 months is actually negative 2%, given as an effective 6 month rate. So the payment at ## t=4.5 ## years will be ## 10(1-0.02)^1=9.80 ##, and so on.

A share just paid its semi-annual dividend of $10. The dividend is expected to grow at 2% every 6 months forever. This 2% growth rate is an effective 6 month rate. Therefore the next dividend will be $10.20 in six months. The required return of the stock 10% pa, given as an effective annual rate.

What is the price of the share now?

A stock pays annual dividends which are expected to continue forever. It just paid a dividend of $10. The growth rate in the dividend is 2% pa. You estimate that the stock's required return is 10% pa. Both the discount rate and growth rate are given as effective annual rates. Using the dividend discount model, what will be the share price?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates. What is the current price of the stock?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What will be the price of the stock in three and a half years (t = 3.5)?

The following is the Dividend Discount Model (DDM) used to price stocks:

### P_0 = \frac{d_1}{r-g} ###Assume that the assumptions of the DDM hold and that the time period is measured in years.

Which of the following is equal to the expected dividend in 3 years, ## d_3 ##?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### p_0 = \frac{d_1}{r - g} ###

Which expression is NOT equal to the expected dividend yield?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###p_0=\frac{d_1}{r_\text{eff}-g_\text{eff}}###

Which expression is NOT equal to the expected capital return?

A fairly valued share's current price is $4 and it has a total required return of 30%. Dividends are paid annually and next year's dividend is expected to be $1. After that, dividends are expected to grow by 5% pa in perpetuity. All rates are effective annual returns.

What is the expected dividend income paid at the end of the second year (t=2) and what is the expected capital gain from just after the first dividend (t=1) to just after the second dividend (t=2)? The answers are given in the same order, the dividend and then the capital gain.

A stock pays semi-annual dividends. It just paid a dividend of $10. The growth rate in the dividend is 1% every 6 months, given as an effective 6 month rate. You estimate that the stock's required return is 21% pa, as an effective annual rate.

Using the dividend discount model, what will be the share price?

Question 50 DDM, stock pricing, inflation, real and nominal returns and cash flows

Most listed Australian companies pay dividends twice per year, the 'interim' and 'final' dividends, which are roughly 6 months apart.

You are an equities analyst trying to value the company BHP. You decide to use the Dividend Discount Model (DDM) as a starting point, so you study BHP's dividend history and you find that BHP tends to pay the same interim and final dividend each year, and that both grow by the same rate.

You expect BHP will pay a $0.55 interim dividend in six months and a $0.55 final dividend in one year. You expect each to grow by 4% next year and forever, so the interim and final dividends next year will be $0.572 each, and so on in perpetuity.

Assume BHP's cost of equity is 8% pa. All rates are quoted as nominal effective rates. The dividends are nominal cash flows and the inflation rate is 2.5% pa.

What is the current price of a BHP share?

Question 488 income and capital returns, payout policy, payout ratio, DDM

Two companies BigDiv and ZeroDiv are exactly the same except for their dividend payouts.

BigDiv pays large dividends and ZeroDiv doesn't pay any dividends.

Currently the two firms have the same earnings, assets, number of shares, share price, expected total return and risk.

Assume a perfect world with no taxes, no transaction costs, no asymmetric information and that all assets including business projects are fairly priced and therefore zero-NPV.

All things remaining equal, which of the following statements is NOT correct?

The boss of WorkingForTheManCorp has a wicked (and unethical) idea. He plans to pay his poor workers one week late so that he can get more interest on his cash in the bank.

Every week he is supposed to pay his 1,000 employees $1,000 each. So $1 million is paid to employees every week.

The boss was just about to pay his employees today, until he thought of this idea so he will actually pay them one week (7 days) later for the work they did last week and every week in the future, forever.

Bank interest rates are 10% pa, given as a real effective annual rate. So ##r_\text{eff annual, real} = 0.1## and the real effective weekly rate is therefore ##r_\text{eff weekly, real} = (1+0.1)^{1/52}-1 = 0.001834569##

All rates and cash flows are real, the inflation rate is 3% pa and there are 52 weeks per year. The boss will always pay wages one week late. The business will operate forever with constant real wages and the same number of employees.

What is the net present value (NPV) of the boss's decision to pay later?

You own an apartment which you rent out as an investment property.

What is the price of the apartment using discounted cash flow (DCF, same as NPV) valuation?

Assume that:

- You just signed a contract to rent the apartment out to a tenant for the next 12 months at $2,000 per month, payable in advance (at the start of the month, t=0). The tenant is just about to pay you the first $2,000 payment.

- The contract states that monthly rental payments are fixed for 12 months. After the contract ends, you plan to sign another contract but with rental payment increases of 3%. You intend to do this every year.

So rental payments will increase at the start of the 13th month (t=12) to be $2,060 (=2,000(1+0.03)), and then they will be constant for the next 12 months.

Rental payments will increase again at the start of the 25th month (t=24) to be $2,121.80 (=2,000(1+0.03)2), and then they will be constant for the next 12 months until the next year, and so on. - The required return of the apartment is 8.732% pa, given as an effective annual rate.

- Ignore all taxes, maintenance, real estate agent, council and strata fees, periods of vacancy and other costs. Assume that the apartment will last forever and so will the rental payments.

Question 498 NPV, Annuity, perpetuity with growth, multi stage growth model

A business project is expected to cost $100 now (t=0), then pay $10 at the end of the third (t=3), fourth, fifth and sixth years, and then grow by 5% pa every year forever. So the cash flow will be $10.5 at the end of the seventh year (t=7), then $11.025 at the end of the eighth year (t=8) and so on perpetually. The total required return is 10℅ pa.

Which of the following formulas will NOT give the correct net present value of the project?

Estimate Microsoft's (MSFT) share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- Apple, Google and Microsoft are comparable companies,

- Apple's (AAPL) share price is $526.24 and historical EPS is $40.32.

- Google's (GOOG) share price is $1,215.65 and historical EPS is $36.23.

- Micrsoft's (MSFT) historical earnings per share (EPS) is $2.71.

Source: Google Finance 28 Feb 2014.

Which of the following investable assets are NOT suitable for valuation using PE multiples techniques?

A low-quality second-hand car can be bought now for $1,000 and will last for 1 year before it will be scrapped for nothing.

A high-quality second-hand car can be bought now for $4,900 and it will last for 5 years before it will be scrapped for nothing.

What is the equivalent annual cost of each car? Assume a discount rate of 10% pa, given as an effective annual rate.

The answer choices are given as the equivalent annual cost of the low-quality car and then the high quality car.

Question 180 equivalent annual cash flow, inflation, real and nominal returns and cash flows

Details of two different types of light bulbs are given below:

- Low-energy light bulbs cost $3.50, have a life of nine years, and use about $1.60 of electricity a year, paid at the end of each year.

- Conventional light bulbs cost only $0.50, but last only about a year and use about $6.60 of energy a year, paid at the end of each year.

The real discount rate is 5%, given as an effective annual rate. Assume that all cash flows are real. The inflation rate is 3% given as an effective annual rate.

Find the Equivalent Annual Cost (EAC) of the low-energy and conventional light bulbs. The below choices are listed in that order.

You're advising your superstar client 40-cent who is weighing up buying a private jet or a luxury yacht. 40-cent is just as happy with either, but he wants to go with the more cost-effective option. These are the cash flows of the two options:

- The private jet can be bought for $6m now, which will cost $12,000 per month in fuel, piloting and airport costs, payable at the end of each month. The jet will last for 12 years.

- Or the luxury yacht can be bought for $4m now, which will cost $20,000 per month in fuel, crew and berthing costs, payable at the end of each month. The yacht will last for 20 years.

What's unusual about 40-cent is that he is so famous that he will actually be able to sell his jet or yacht for the same price as it was bought since the next generation of superstar musicians will buy it from him as a status symbol.

Bank interest rates are 10% pa, given as an effective annual rate. You can assume that 40-cent will live for another 60 years and that when the jet or yacht's life is at an end, he will buy a new one with the same details as above.

Would you advise 40-cent to buy the or the ?

Note that the effective monthly rate is ##r_\text{eff monthly}=(1+0.1)^{1/12}-1=0.00797414##

Question 215 equivalent annual cash flow, effective rate conversion

You're about to buy a car. These are the cash flows of the two different cars that you can buy:

- You can buy an old car for $5,000 now, for which you will have to buy $90 of fuel at the end of each week from the date of purchase. The old car will last for 3 years, at which point you will sell the old car for $500.

- Or you can buy a new car for $14,000 now for which you will have to buy $50 of fuel at the end of each week from the date of purchase. The new car will last for 4 years, at which point you will sell the new car for $1,000.

Bank interest rates are 10% pa, given as an effective annual rate. Assume that there are exactly 52 weeks in a year. Ignore taxes and environmental and pollution factors.

Should you buy the or the ?

An industrial chicken farmer grows chickens for their meat. Chickens:

- Cost $0.50 each to buy as chicks. They are bought on the day they’re born, at t=0.

- Grow at a rate of $0.70 worth of meat per chicken per week for the first 6 weeks (t=0 to t=6).

- Grow at a rate of $0.40 worth of meat per chicken per week for the next 4 weeks (t=6 to t=10) since they’re older and grow more slowly.

- Feed costs are $0.30 per chicken per week for their whole life. Chicken feed is bought and fed to the chickens once per week at the beginning of the week. So the first amount of feed bought for a chicken at t=0 costs $0.30, and so on.

- Can be slaughtered (killed for their meat) and sold at no cost at the end of the week. The price received for the chicken is their total value of meat (note that the chicken grows fast then slow, see above).

The required return of the chicken farm is 0.5% given as an effective weekly rate.

Ignore taxes and the fixed costs of the factory. Ignore the chicken’s welfare and other environmental and ethical concerns.

Find the equivalent weekly cash flow of slaughtering a chicken at 6 weeks and at 10 weeks so the farmer can figure out the best time to slaughter his chickens. The choices below are given in the same order, 6 and 10 weeks.

You own some nice shoes which you use once per week on date nights. You bought them 2 years ago for $500. In your experience, shoes used once per week last for 6 years. So you expect yours to last for another 4 years.

Your younger sister said that she wants to borrow your shoes once per week. With the increased use, your shoes will only last for another 2 years rather than 4.

What is the present value of the cost of letting your sister use your current shoes for the next 2 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new pair of shoes when your current pair wears out and your sister will not use the new ones; your sister will only use your current shoes so she will only use it for the next 2 years; and the price of new shoes never changes.

You own a nice suit which you wear once per week on nights out. You bought it one year ago for $600. In your experience, suits used once per week last for 6 years. So you expect yours to last for another 5 years.

Your younger brother said that retro is back in style so he wants to wants to borrow your suit once a week when he goes out. With the increased use, your suit will only last for another 4 years rather than 5.

What is the present value of the cost of letting your brother use your current suit for the next 4 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new suit when your current one wears out and your brother will not use the new one; your brother will only use your current suit so he will only use it for the next four years; and the price of a new suit never changes.

You just bought a nice dress which you plan to wear once per month on nights out. You bought it a moment ago for $600 (at t=0). In your experience, dresses used once per month last for 6 years.

Your younger sister is a student with no money and wants to borrow your dress once a month when she hits the town. With the increased use, your dress will only last for another 3 years rather than 6.

What is the present value of the cost of letting your sister use your current dress for the next 3 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new dress when your current one wears out; your sister will only use the current dress, not the next one that you will buy; and the price of a new dress never changes.

Question 249 equivalent annual cash flow, effective rate conversion

Details of two different types of desserts or edible treats are given below:

- High-sugar treats like candy, chocolate and ice cream make a person very happy. High sugar treats are cheap at only $2 per day.

- Low-sugar treats like nuts, cheese and fruit make a person equally happy if these foods are of high quality. Low sugar treats are more expensive at $4 per day.

The advantage of low-sugar treats is that a person only needs to pay the dentist $2,000 for fillings and root canal therapy once every 15 years. Whereas with high-sugar treats, that treatment needs to be done every 5 years.

The real discount rate is 10%, given as an effective annual rate. Assume that there are 365 days in every year and that all cash flows are real. The inflation rate is 3% given as an effective annual rate.

Find the equivalent annual cash flow (EAC) of the high-sugar treats and low-sugar treats, including dental costs. The below choices are listed in that order.

Ignore the pain of dental therapy, personal preferences and other factors.

Carlos and Edwin are brothers and they both love Holden Commodore cars.

Carlos likes to buy the latest Holden Commodore car for $40,000 every 4 years as soon as the new model is released. As soon as he buys the new car, he sells the old one on the second hand car market for $20,000. Carlos never has to bother with paying for repairs since his cars are brand new.

Edwin also likes Commodores, but prefers to buy 4-year old cars for $20,000 and keep them for 11 years until the end of their life (new ones last for 15 years in total but the 4-year old ones only last for another 11 years). Then he sells the old car for $2,000 and buys another 4-year old second hand car, and so on.

Every time Edwin buys a second hand 4 year old car he immediately has to spend $1,000 on repairs, and then $1,000 every year after that for the next 10 years. So there are 11 payments in total from when the second hand car is bought at t=0 to the last payment at t=10. One year later (t=11) the old car is at the end of its total 15 year life and can be scrapped for $2,000.

Assuming that Carlos and Edwin maintain their love of Commodores and keep up their habits of buying new ones and second hand ones respectively, how much larger is Carlos' equivalent annual cost of car ownership compared with Edwin's?

The real discount rate is 10% pa. All cash flows are real and are expected to remain constant. Inflation is forecast to be 3% pa. All rates are effective annual. Ignore capital gains tax and tax savings from depreciation since cars are tax-exempt for individuals.

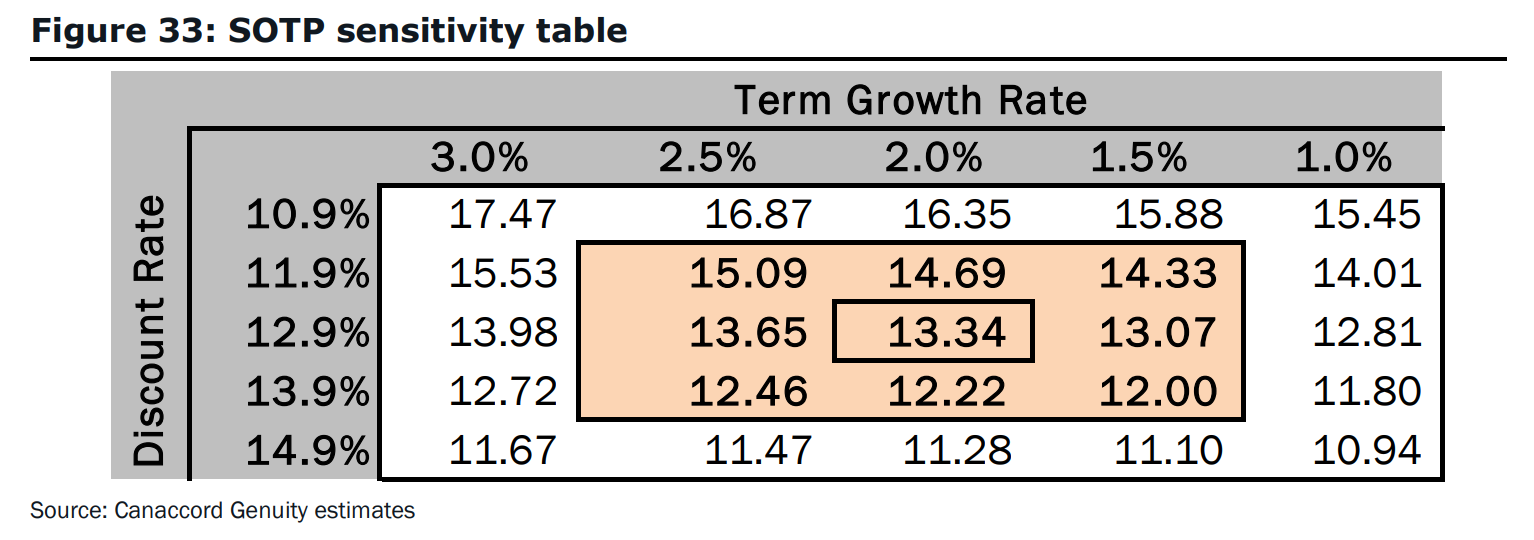

Investment bank Canaccord's Think Childcare (TNK) initiation of coverage states: "What's the Differentiator? TNK are operators, not consolidators - Other listed childcare companies have led highly successful consolidation strategies involving multiple arbitrage combined with scale benefits and operating efficiencies. TNK’s focus is on operating the centres to the best of their individual potentials..." (Canaccord, 2016). Multiples arbitrage involves:

Question 1029 Buffett ratio

Tesla CEO Elon Musk asked a question to ARK Invest CEO Cathie Wood on 6 April 2021: "What do you think of the unusually high ratio of the S&P market cap to GDP?", to which Cathie Wood replied.

What are the units of this S&P500 market cap to GDP ratio, commonly known as the Buffett ratio?

What proportion of managers are evaluating projects correctly, based on table 8 from Meier and Tarhan's (2006) survey of corporate managers?

| Table 8: Consistency of nominal or real hurdle rates and cash flows | |||

| Hurdle rate | Cash flows | Total | |

|---|---|---|---|

| Nominal | Real | ||

| Nominal | 29.8% | 11.6% | 41.3% |

| Real | 19.8% | 38.4% | 58.7% |

| Total | 49.6% | 50.4% | 100.0% |

Table 8 footnote: The rows in this cross-tabulation show whether the firm uses a nominal or real hurdle rate, the columns indicate whether cash flows are calculated in nominal or real terms. The fractions denote the number of firms for each combination relative to the total of 123 respondents that responded to both separate survey questions.

What proportion of managers are evaluating projects correctly?

Meier and Tarhan (2006) conducted an interesting survey of corporate managers. The results are copied in Table 7 below. What proportion of managers are evaluating levered projects correctly?

| Table 7: Consistency between hurdle rate and the calculation of cash flows | |||||||

| Hurdle rate | Cash flow calculation (see below notes) | ||||||

|---|---|---|---|---|---|---|---|

| (i) | (ii) | (iii) | (iv) | (v) | Other | Total | |

| WACC | 11.3% | 34.8% | 1.7% | 3.5% | 18.3% | 1.7% | 71.3% |

| Equity levered | 0.0% | 2.6% | 0.9% | 0.0% | 0.9% | 0.9% | 6.1% |

| Equity unlevered | 1.7% | 1.7% | 0.9% | 0.9% | 1.7% | 0.9% | 7.8% |

| Other | 2.6% | 5.2% | 1.7% | 0.9% | 3.5% | 0.9% | 14.8% |

| Total | 16.5% | 44.4% | 5.2% | 5.2% | 24.4% | 4.4% | 100.0% |

The rows of the cross-tabulation indicate what the self-reported hurdle rate represents and the columns denote five different ways to calculate cash flows, (i) to (v), plus the “other” category. Each cell then displays the fraction of all 113 respondents for a given combination of what the hurdle rate represents and how the firm calculates its cash flows when evaluating a project.

The definitions of the cash flow calculations (i)-(v) are as follows:

(i) Earnings before interest and after taxes (EBIAT) + depreciation

(ii) Earnings before interest and after taxes (EBIAT) + depreciation – capital expenditures – net change in working capital

(iii) Earnings

(iv) Earnings + depreciation

(v) Earnings + depreciation – capital expenditures – net change in working capital

Assume that the WACC is after tax, the required return on unlevered equity is the WACC before tax, all projects are levered, the benefit of interest tax shields should be included in the valuation, earnings = net profit after tax (NPAT) and EBIAT = EBIT*(1-tc) which is often also called net operating profit after tax (NOPAT).

What proportion of managers are evaluating levered projects correctly?

Question 905 market capitalisation of equity, PE ratio, payout ratio

The below graph shows the computer software company Microsoft's stock price (MSFT) at the market close on the NASDAQ on Friday 1 June 2018.

Based on the screenshot above, which of the following statements about MSFT is NOT correct? MSFT's:

An analyst is valuing a levered company whose owners insist on keeping a constant market debt to assets ratio into the future.

The analyst is wondering how asset values and other things in her model will change when she changes the forecast sales growth rate.

Which of the below values will increase as the forecast growth rate of sales increases, with the debt to assets ratio remaining constant?

Assume that the cost of debt (yield) remains constant and the company’s asset beta will also remain constant since any expansion (or downsize) will involve buying (or selling) more of the same assets.

The analyst should expect which value or ratio to increase when the forecast growth rate of sales increases and the debt to assets ratio remains unchanged? In other words, which of the following values will NOT remain constant?

An analyst is valuing a levered company whose owners insist on keeping the dollar amount of debt funding fixed. So the company cannot issue or repay its debt, its dollar value must remain constant. Any funding gaps will be met with equity.

The analyst is wondering, as he changes inputs into his valuation, such as the forecast growth rate of sales, then asset values and other things will change. This makes it hard to figure out which values can be held constant and would therefore make good model inputs, rather than outputs which vary depending on the inputs. Assume that the cost of debt (yield) remains constant and the company’s asset beta will also remain constant since any expansion (or downsize) will involve buying (or selling) more of the same assets.

Which of the following values can be assumed to stay constant when projected sales growth increases?

Question 1032 inflation, percent of sales forecasting, no explanation

Investment bank Canaccord's Think Childcare (TNK) initiation of coverage states: "Building lease costs – Rent expense is the second largest cost and TNK reported rent/sales of 12.1%, within the industry range that we typically see as 12-14% of sales. TNK lease all their properties and do not intend to own property. Leases are generally long term with 10-15 year terms and additional options. Although terms vary across properties and landlords, rental increases are generally tied to the consumer price index (CPI)" (Canaccord, 2016).

Assuming that sales grow faster than the CPI, when Canaccord forecast TNK's building lease costs using the 'percent of sales' method, that proportion should:

Read these quotes from Adir Shiffman's 26 July 2021 article in the AFR 'Roll up, roll up and make a mint off Amazon sellers'.

"Amazon sellers outsource their warehousing and logistics to the tech giant in a model known as “fulfilled by Amazon”, or FBA. Joining FBA provides access to one of the world’s largest global warehousing operations and even a fleet of Boeing 747 cargo jets. Just as significantly, FBA sellers can much more easily qualify for Amazon’s Prime program, which guarantees free and fast shipping to members."

"Companies want to acquire and integrate a selection, or in business parlance, do a 'roll-up'."

"More than 100 companies are now racing to roll-up FBA sellers, and almost all have launched since 2017. At least a dozen of these boast war chests of more than $US100 million. The largest, Thrasio, was founded in 2018 and has raised more than $US1.7 billion. Thrasio targets businesses with high quality and differentiated products that generate $US1 to $US100 million in revenue annually" (Shiffman, 2021).

If Thrasio's total funds available to spend on the roll up is $1.7 billion, and it's buying targets at price-to-revenue multiples of 2, what's the largest number of firms with $50 million of annual revenue that it could buy?

Your friend just bought a house for $1,000,000. He financed it using a $900,000 mortgage loan and a deposit of $100,000.

In the context of residential housing and mortgages, the 'equity' or 'net wealth' tied up in a house is the value of the house less the value of the mortgage loan. Assuming that your friend's only asset is his house, his net wealth is $100,000.

If house prices suddenly fall by 15%, what would be your friend's percentage change in net wealth?

Assume that:

- No income (rent) was received from the house during the short time over which house prices fell.

- Your friend will not declare bankruptcy, he will always pay off his debts.

One year ago you bought $100,000 of shares partly funded using a margin loan. The margin loan size was $70,000 and the other $30,000 was your own wealth or 'equity' in the share assets.

The interest rate on the margin loan was 7.84% pa.

Over the year, the shares produced a dividend yield of 4% pa and a capital gain of 5% pa.

What was the total return on your wealth? Ignore taxes, assume that all cash flows (interest payments and dividends) were paid and received at the end of the year, and all rates above are effective annual rates.

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

Question 408 leverage, portfolio beta, portfolio risk, real estate, CAPM

You just bought a house worth $1,000,000. You financed it with an $800,000 mortgage loan and a deposit of $200,000.

You estimate that:

- The house has a beta of 1;

- The mortgage loan has a beta of 0.2.

What is the beta of the equity (the $200,000 deposit) that you have in your house?

Also, if the risk free rate is 5% pa and the market portfolio's return is 10% pa, what is the expected return on equity in your house? Ignore taxes, assume that all cash flows (interest payments and rent) were paid and received at the end of the year, and all rates are effective annual rates.

Question 800 leverage, portfolio return, risk, portfolio risk, capital structure, no explanation

Which of the following assets would you expect to have the highest required rate of return? All values are current market values.

Four retail business people compete in the same city. They are all exactly the same except that they have different ways of funding or leasing the shop real estate needed to run their retail business.

The two main assets that retail stores need are:

- Inventory typically worth $1 million which has a beta of 2, and;

- Shopfront real estate worth $1 million which has a beta of 1. Shops can be bought or leased.

Lease contract prices are fixed for the term of the lease and based on expectations of the future state of the economy. When leases end, a new lease contract is negotiated and the lease cost may be higher or lower depending on the state of the economy and demand and supply if the economy is:

- Booming, shop real estate is worth more and lease costs are higher.

- In recession, shop real estate is worth less and lease costs are low.

Which retail business person will have the LOWEST beta of equity (or net wealth)?

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $100m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $112m | Firm free cash flow or cash flow from assets (includes interest tax shields) |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 7% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 6.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 9% pa | Cost of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $48.5m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $50m | Firm free cash flow or cash flow from assets |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 10% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 9.7% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 11.25% pa | Cost of levered equity |

| ##D/V_L## | 20% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

Use the below information to value a levered company with annual perpetual cash flows from assets that grow. The next cash flow will be generated in one year from now. Note that ‘k’ means kilo or 1,000. So the $30k is $30,000.

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $30k | Operating free cash flow |

| ##g## | 1.5% pa | Growth rate of OFCF |

| ##r_\text{D}## | 4% pa | Cost of debt |

| ##r_\text{EL}## | 16.3% pa | Cost of levered equity |

| ##D/V_L## | 80% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

| ##n_\text{shares}## | 100k | Number of shares |

Which of the following statements is NOT correct?

Use the below information to value a mature levered company with growing annual perpetual cash flows and a constant debt-to-assets ratio. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. The firm's debt funding comprises annual fixed coupon bonds that all have the same seniority and coupon rate. When these bonds mature, new bonds will be re-issued, and so on in perpetuity. The yield curve is flat.

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}_1## | $12.5m | Operating free cash flow at time 1 |

| ##\text{FFCF}_1 \text{ or }\text{CFFA}_1## | $14m | Firm free cash flow or cash flow from assets at time 1 |

| ##\text{EFCF}_1## | $11m | Equity free cash flow at time 1 |

| ##\text{BondCoupons}_1## | $1.2m | Bond coupons paid to debt holders at time 1 |

| ##g## | 2% pa | Growth rate of OFCF, FFCF, EFCF and Debt cash flow |

| ##\text{WACC}_\text{BeforeTax}## | 9% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 8.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Bond yield |

| ##r_\text{EL}## | 13% pa | Cost or required return of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##n_\text{shares}## | 1m | Number of shares |

| ##t_c## | 30% | Corporate tax rate |

Which of the following statements is NOT correct?

Question 69 interest tax shield, capital structure, leverage, WACC

Which statement about risk, required return and capital structure is the most correct?

Your friend just bought a house for $400,000. He financed it using a $320,000 mortgage loan and a deposit of $80,000.

In the context of residential housing and mortgages, the 'equity' tied up in the value of a person's house is the value of the house less the value of the mortgage. So the initial equity your friend has in his house is $80,000. Let this amount be E, let the value of the mortgage be D and the value of the house be V. So ##V=D+E##.

If house prices suddenly fall by 10%, what would be your friend's percentage change in equity (E)? Assume that the value of the mortgage is unchanged and that no income (rent) was received from the house during the short time over which house prices fell.

Remember:

### r_{0\rightarrow1}=\frac{p_1-p_0+c_1}{p_0} ###

where ##r_{0-1}## is the return (percentage change) of an asset with price ##p_0## initially, ##p_1## one period later, and paying a cash flow of ##c_1## at time ##t=1##.

A firm has a debt-to-assets ratio of 50%. The firm then issues a large amount of debt to raise money for new projects of similar market risk to the company's existing projects. Assume a classical tax system. Which statement is correct?

Question 121 capital structure, leverage, financial distress, interest tax shield

Fill in the missing words in the following sentence:

All things remaining equal, as a firm's amount of debt funding falls, benefits of interest tax shields __________ and the costs of financial distress __________.

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

Question 241 Miller and Modigliani, leverage, payout policy, diversification, NPV

One of Miller and Modigliani's (M&M's) important insights is that a firm's managers should not try to achieve a particular level of leverage in a world with zero taxes and perfect information since investors can make their own leverage. Therefore corporate capital structure policy is irrelevant since investors can achieve their own desired leverage at the personal level by borrowing or lending on their own.

This principal of 'home-made' or 'do-it-yourself' leverage can also be applied to other topics. Read the following statements to decide which are true:

(I) Payout policy: a firm's managers should not try to achieve a particular pattern of equity payout.

(II) Agency costs: a firm's managers should not try to minimise agency costs.

(III) Diversification: a firm's managers should not try to diversify across industries.

(IV) Shareholder wealth: a firm's managers should not try to maximise shareholders' wealth.

Which of the above statement(s) are true?

Question 337 capital structure, interest tax shield, leverage, real and nominal returns and cash flows, multi stage growth model

A fast-growing firm is suitable for valuation using a multi-stage growth model.

It's nominal unlevered cash flow from assets (##CFFA_U##) at the end of this year (t=1) is expected to be $1 million. After that it is expected to grow at a rate of:

- 12% pa for the next two years (from t=1 to 3),

- 5% over the fourth year (from t=3 to 4), and

- -1% forever after that (from t=4 onwards). Note that this is a negative one percent growth rate.

Assume that:

- The nominal WACC after tax is 9.5% pa and is not expected to change.

- The nominal WACC before tax is 10% pa and is not expected to change.

- The firm has a target debt-to-equity ratio that it plans to maintain.

- The inflation rate is 3% pa.

- All rates are given as nominal effective annual rates.

What is the levered value of this fast growing firm's assets?

A firm has a debt-to-equity ratio of 25%. What is its debt-to-assets ratio?

A firm has a debt-to-equity ratio of 60%. What is its debt-to-assets ratio?

Question 536 idiom, bond pricing, capital structure, leverage

The expression 'my word is my bond' is often used in everyday language to make a serious promise.

Why do you think this expression uses the metaphor of a bond rather than a share?

A firm has a debt-to-assets ratio of 20%. What is its debt-to-equity ratio?

Question 772 interest tax shield, capital structure, leverage

A firm issues debt and uses the funds to buy back equity. Assume that there are no costs of financial distress or transactions costs. Which of the following statements about interest tax shields is NOT correct?

One year ago you bought a $1,000,000 house partly funded using a mortgage loan. The loan size was $800,000 and the other $200,000 was your wealth or 'equity' in the house asset.

The interest rate on the home loan was 4% pa.

Over the year, the house produced a net rental yield of 2% pa and a capital gain of 2.5% pa.

Assuming that all cash flows (interest payments and net rental payments) were paid and received at the end of the year, and all rates are given as effective annual rates, what was the total return on your wealth over the past year?

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

In the home loan market, the acronym LVR stands for Loan to Valuation Ratio. If you bought a house worth one million dollars, partly funded by an $800,000 home loan, then your LVR was 80%. The LVR is equivalent to which of the following ratios?

The following steps outline the process of ‘negative gearing’ an investment property in Australia. Which of these steps or statements is NOT correct? To successfully achieve negative gearing on an investment property:

Question 802 negative gearing, leverage, capital structure, no explanation