The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Profitability Index (PI) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 200 |

| 2 | 250 |

What is the Profitability Index (PI) of the project? Assume that the cash flows shown in the table are paid all at once at the given point in time. The required return is 10% pa, given as an effective annual rate.

A project's Profitability Index (PI) is less than 1. Select the most correct statement:

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -90 |

| 1 | 30 |

| 2 | 105 |

The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Profitability Index (PI) of the project?

The required return of a project is 10%, given as an effective annual rate. Assume that the cash flows shown in the table are paid all at once at the given point in time.

What is the Net Present Value (NPV) of the project?

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

What is the Internal Rate of Return (IRR) of the project detailed in the table below?

Assume that the cash flows shown in the table are paid all at once at the given point in time. All answers are given as effective annual rates.

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |

If a project's net present value (NPV) is zero, then its internal rate of return (IRR) will be:

The required return of a project is 10%, given as an effective annual rate.

What is the payback period of the project in years?

Assume that the cash flows shown in the table are received smoothly over the year. So the $121 at time 2 is actually earned smoothly from t=1 to t=2.

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 11 |

| 2 | 121 |

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 0 |

| 2 | 500 |

What is the payback period of the project in years?

Normally cash flows are assumed to happen at the given time. But here, assume that the cash flows are received smoothly over the year. So the $500 at time 2 is actually earned smoothly from t=1 to t=2.

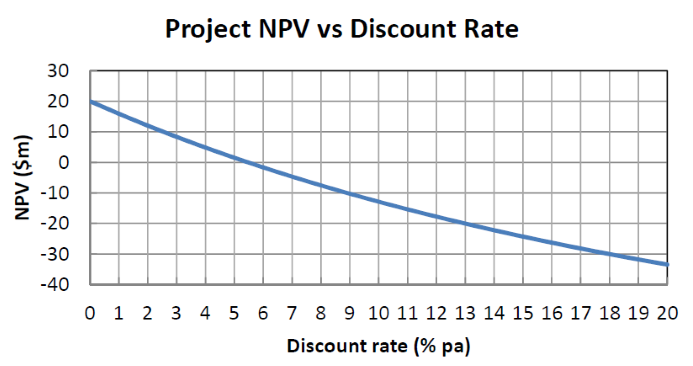

The below graph shows a project's net present value (NPV) against its annual discount rate.

For what discount rate or range of discount rates would you accept and commence the project?

All answer choices are given as approximations from reading off the graph.

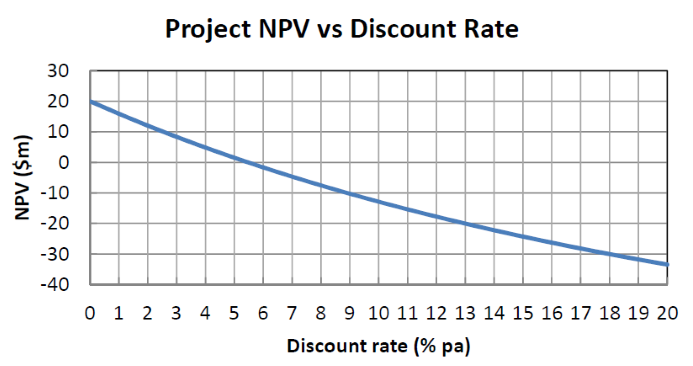

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

You have $100,000 in the bank. The bank pays interest at 10% pa, given as an effective annual rate.

You wish to consume an equal amount now (t=0) and in one year (t=1) and have nothing left in the bank at the end (t=1).

How much can you consume at each time?

An investor owns an empty block of land that has local government approval to be developed into a petrol station, car wash or car park. The council will only allow a single development so the projects are mutually exclusive.

All of the development projects have the same risk and the required return of each is 10% pa. Each project has an immediate cost and once construction is finished in one year the land and development will be sold. The table below shows the estimated costs payable now, expected sale prices in one year and the internal rates of returns (IRR's).

| Mutually Exclusive Projects | |||

| Project | Cost now ($) |

Sale price in one year ($) |

IRR (% pa) |

| Petrol station | 9,000,000 | 11,000,000 | 22.22 |

| Car wash | 800,000 | 1,100,000 | 37.50 |

| Car park | 70,000 | 110,000 | 57.14 |

Which project should the investor accept?

An investor owns a whole level of an old office building which is currently worth $1 million. There are three mutually exclusive projects that can be started by the investor. The office building level can be:

- Rented out to a tenant for one year at $0.1m paid immediately, and then sold for $0.99m in one year.

- Refurbished into more modern commercial office rooms at a cost of $1m now, and then sold for $2.4m when the refurbishment is finished in one year.

- Converted into residential apartments at a cost of $2m now, and then sold for $3.4m when the conversion is finished in one year.

All of the development projects have the same risk so the required return of each is 10% pa. The table below shows the estimated cash flows and internal rates of returns (IRR's).

| Mutually Exclusive Projects | |||

| Project | Cash flow now ($) |

Cash flow in one year ($) |

IRR (% pa) |

| Rent then sell as is | -900,000 | 990,000 | 10 |

| Refurbishment into modern offices | -2,000,000 | 2,400,000 | 20 |

| Conversion into residential apartments | -3,000,000 | 3,400,000 | 13.33 |

Which project should the investor accept?

Question 579 price gains and returns over time, time calculation, effective rate

How many years will it take for an asset's price to double if the price grows by 10% pa?

Question 580 price gains and returns over time, time calculation, effective rate

How many years will it take for an asset's price to quadruple (be four times as big, say from $1 to $4) if the price grows by 15% pa?

The saying "buy low, sell high" suggests that investors should make a:

Total cash flows can be broken into income and capital cash flows. What is the name given to the income cash flow from owning shares?

An asset's total expected return over the next year is given by:

###r_\text{total} = \dfrac{c_1+p_1-p_0}{p_0} ###

Where ##p_0## is the current price, ##c_1## is the expected income in one year and ##p_1## is the expected price in one year. The total return can be split into the income return and the capital return.

Which of the following is the expected capital return?

A share was bought for $30 (at t=0) and paid its annual dividend of $6 one year later (at t=1).

Just after the dividend was paid, the share price fell to $27 (at t=1). What were the total, capital and income returns given as effective annual rates?

The choices are given in the same order:

##r_\text{total}## , ##r_\text{capital}## , ##r_\text{dividend}##.

Question 278 inflation, real and nominal returns and cash flows

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year.

Question 542 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to double every 10 years, what must be the expected future capital return, given as an effective annual rate?

Question 993 inflation, real and nominal returns and cash flows

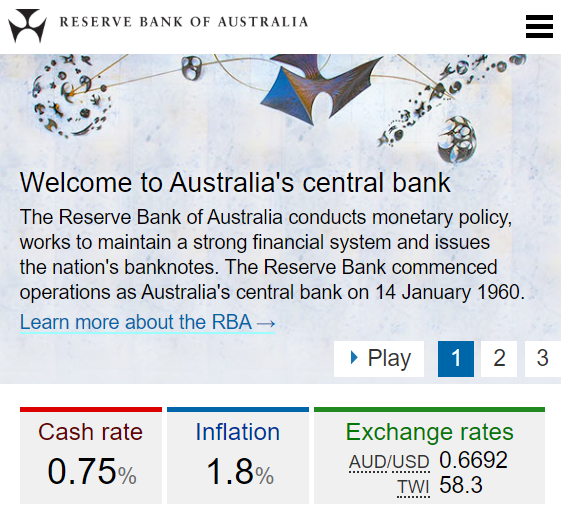

In February 2020, the RBA cash rate was 0.75% pa and the Australian CPI inflation rate was 1.8% pa.

You currently have $100 in the bank which pays a 0.75% pa interest rate.

Apples currently cost $1 each at the shop and inflation is 1.8% pa which is the expected growth rate in the apple price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Apples | ||||

| Time (year) | Bank account wealth ($) | Apple price ($) | Wealth in apples | |

| 0 | 100 | 1 | 100 | |

| 1 | 100.75 | 1.018 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your:

Which of the following equations is NOT equal to the total return of an asset?

Let ##p_0## be the current price, ##p_1## the expected price in one year and ##c_1## the expected income in one year.

Total cash flows can be broken into income and capital cash flows.

What is the name given to the cash flow generated from selling shares at a higher price than they were bought?

Question 543 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to triple every 5 years, what must be the expected future capital return, given as an effective annual rate?

A newly floated farming company is financed with senior bonds, junior bonds, cumulative non-voting preferred stock and common stock. The new company has no retained profits and due to floods it was unable to record any revenues this year, leading to a loss. The firm is not bankrupt yet since it still has substantial contributed equity (same as paid-up capital).

On which securities must it pay interest or dividend payments in this terrible financial year?

Question 452 limited liability, expected and historical returns

What is the lowest and highest expected share price and expected return from owning shares in a company over a finite period of time?

Let the current share price be ##p_0##, the expected future share price be ##p_1##, the expected future dividend be ##d_1## and the expected return be ##r##. Define the expected return as:

##r=\dfrac{p_1-p_0+d_1}{p_0} ##

The answer choices are stated using inequalities. As an example, the first answer choice "(a) ##0≤p<∞## and ##0≤r< 1##", states that the share price must be larger than or equal to zero and less than positive infinity, and that the return must be larger than or equal to zero and less than one.

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's market capitalisation of equity?

Question 524 risk, expected and historical returns, bankruptcy or insolvency, capital structure, corporate financial decision theory, limited liability

Which of the following statements is NOT correct?

Question 992 inflation, real and nominal returns and cash flows

You currently have $100 in the bank which pays a 10% pa interest rate.

Oranges currently cost $1 each at the shop and inflation is 5% pa which is the expected growth rate in the orange price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Oranges | ||||

| Time (year) | Bank account wealth ($) | Orange price ($) | Wealth in oranges | |

| 0 | 100 | 1 | 100 | |

| 1 | 110 | 1.05 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your:

Question 578 inflation, real and nominal returns and cash flows

Which of the following statements about inflation is NOT correct?

Question 522 income and capital returns, real and nominal returns and cash flows, inflation, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 2.5% pa. Inflation is expected to be 2.5% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the property's expected real total, capital and income returns?

The answer choices below are given in the same order.

Question 523 income and capital returns, real and nominal returns and cash flows, inflation

A low-growth mature stock has an expected nominal total return of 6% pa and nominal capital return of 2% pa. Inflation is expected to be 3% pa.

All of the above are effective nominal rates and investors believe that they will stay the same in perpetuity.

What are the stock's expected real total, capital and income returns?

The answer choices below are given in the same order.

Question 727 inflation, real and nominal returns and cash flows

The Australian Federal Government lends money to domestic students to pay for their university education. This is known as the Higher Education Contribution Scheme (HECS). The nominal interest rate on the HECS loan is set equal to the consumer price index (CPI) inflation rate. The interest is capitalised every year, which means that the interest is added to the principal. The interest and principal does not need to be repaid by students until they finish study and begin working.

Which of the following statements about HECS loans is NOT correct?

Question 407 income and capital returns, inflation, real and nominal returns and cash flows

A stock has a real expected total return of 7% pa and a real expected capital return of 2% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What is the nominal expected total return, capital return and dividend yield? The answers below are given in the same order.

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

Question 554 inflation, real and nominal returns and cash flows

On his 20th birthday, a man makes a resolution. He will put $30 cash under his bed at the end of every month starting from today. His birthday today is the first day of the month. So the first addition to his cash stash will be in one month. He will write in his will that when he dies the cash under the bed should be given to charity.

If the man lives for another 60 years, how much money will be under his bed if he dies just after making his last (720th) addition?

Also, what will be the real value of that cash in today's prices if inflation is expected to 2.5% pa? Assume that the inflation rate is an effective annual rate and is not expected to change.

The answers are given in the same order, the amount of money under his bed in 60 years, and the real value of that money in today's prices.

Question 745 real and nominal returns and cash flows, inflation, income and capital returns

If the nominal gold price is expected to increase at the same rate as inflation which is 3% pa, which of the following statements is NOT correct?

Question 732 real and nominal returns and cash flows, inflation, income and capital returns

An investor bought a bond for $100 (at t=0) and one year later it paid its annual coupon of $1 (at t=1). Just after the coupon was paid, the bond price was $100.50 (at t=1). Inflation over the past year (from t=0 to t=1) was 3% pa, given as an effective annual rate.

Which of the following statements is NOT correct? The bond investment produced a:

You're considering making an investment in a particular company. They have preference shares, ordinary shares, senior debt and junior debt.

Which is the safest investment? Which has the highest expected returns?

Which business structure or structures have the advantage of limited liability for equity investors?

Question 531 bankruptcy or insolvency, capital structure, risk, limited liability

Who is most in danger of being personally bankrupt? Assume that all of their businesses' assets are highly liquid and can therefore be sold immediately.

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's market capitalisation of equity?

Question 445 financing decision, corporate financial decision theory

The financing decision primarily affects which part of a business?

Question 443 corporate financial decision theory, investment decision, financing decision, working capital decision, payout policy

Business people make lots of important decisions. Which of the following is the most important long term decision?

Katya offers to pay you $10 at the end of every year for the next 5 years (t=1,2,3,4,5) if you pay her $50 now (t=0). You can borrow and lend from the bank at an interest rate of 10% pa, given as an effective annual rate. Ignore credit risk.

Your friend overheard that you need some cash and asks if you would like to borrow some money. She can lend you $5,000 now (t=0), and in return she wants you to pay her back $1,000 in two years (t=2) and every year after that for the next 5 years, so there will be 6 payments of $1,000 from t=2 to t=7 inclusive.

What is the net present value (NPV) of borrowing from your friend?

Assume that banks loan funds at interest rates of 10% pa, given as an effective annual rate.

Some countries' interest rates are so low that they're zero.

If interest rates are 0% pa and are expected to stay at that level for the foreseeable future, what is the most that you would be prepared to pay a bank now if it offered to pay you $10 at the end of every year for the next 5 years?

In other words, what is the present value of five $10 payments at time 1, 2, 3, 4 and 5 if interest rates are 0% pa?

Discounted cash flow (DCF) valuation prices assets by finding the present value of the asset's future cash flows. The single cash flow, annuity, and perpetuity equations are very useful for this.

Which of the following equations is the 'perpetuity with growth' equation?

A stock is expected to pay its next dividend of $1 in one year. Future annual dividends are expected to grow by 2% pa. So the first dividend of $1 will be in one year, the year after that $1.02 (=1*(1+0.02)^1), and a year later $1.0404 (=1*(1+0.02)^2) and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

A stock just paid a dividend of $1. Future annual dividends are expected to grow by 2% pa. The next dividend of $1.02 (=1*(1+0.02)^1) will be in one year, and the year after that the dividend will be $1.0404 (=1*(1+0.02)^2), and so on forever.

Its required total return is 10% pa. The total required return and growth rate of dividends are given as effective annual rates.

Calculate the current stock price.

For a price of $13, Carla will sell you a share paying a dividend of $1 in one year and every year after that forever. The required return of the stock is 10% pa.

For a price of $1040, Camille will sell you a share which just paid a dividend of $100, and is expected to pay dividends every year forever, growing at a rate of 5% pa.

So the next dividend will be ##100(1+0.05)^1=$105.00##, and the year after it will be ##100(1+0.05)^2=110.25## and so on.

The required return of the stock is 15% pa.

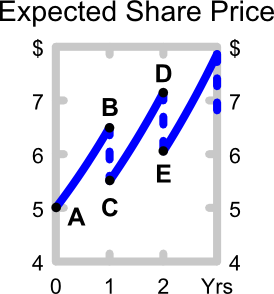

The perpetuity with growth formula, also known as the dividend discount model (DDM) or Gordon growth model, is appropriate for valuing a company's shares. ##P_0## is the current share price, ##C_1## is next year's expected dividend, ##r## is the total required return and ##g## is the expected growth rate of the dividend.

###P_0=\dfrac{C_1}{r-g}###

The below graph shows the expected future price path of the company's shares. Which of the following statements about the graph is NOT correct?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###P_0=\frac{d_1}{r-g}###

A stock pays dividends annually. It just paid a dividend, but the next dividend (##d_1##) will be paid in one year.

According to the DDM, what is the correct formula for the expected price of the stock in 2.5 years?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### P_{0} = \frac{C_1}{r_{\text{eff}} - g_{\text{eff}}} ###

What would you call the expression ## C_1/P_0 ##?

Question 497 income and capital returns, DDM, ex dividend date

A stock will pay you a dividend of $10 tonight if you buy it today. Thereafter the annual dividend is expected to grow by 5% pa, so the next dividend after the $10 one tonight will be $10.50 in one year, then in two years it will be $11.025 and so on. The stock's required return is 10% pa.

What is the stock price today and what do you expect the stock price to be tomorrow, approximately?

In the dividend discount model:

###P_0 = \dfrac{C_1}{r-g}###

The return ##r## is supposed to be the:

A stock pays annual dividends which are expected to continue forever. It just paid a dividend of $10. The growth rate in the dividend is 2% pa. You estimate that the stock's required return is 10% pa. Both the discount rate and growth rate are given as effective annual rates. Using the dividend discount model, what will be the share price?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What will be the price of the stock in three and a half years (t = 3.5)?

Question 535 DDM, real and nominal returns and cash flows, stock pricing

You are an equities analyst trying to value the equity of the Australian telecoms company Telstra, with ticker TLS. In Australia, listed companies like Telstra tend to pay dividends every 6 months. The payment around August is called the final dividend and the payment around February is called the interim dividend. Both occur annually.

- Today is mid-March 2015.

- TLS's last interim dividend of $0.15 was one month ago in mid-February 2015.

- TLS's last final dividend of $0.15 was seven months ago in mid-August 2014.

Judging by TLS's dividend history and prospects, you estimate that the nominal dividend growth rate will be 1% pa. Assume that TLS's total nominal cost of equity is 6% pa. The dividends are nominal cash flows and the inflation rate is 2.5% pa. All rates are quoted as nominal effective annual rates. Assume that each month is exactly one twelfth (1/12) of a year, so you can ignore the number of days in each month.

Calculate the current TLS share price.

A stock is expected to pay a dividend of $15 in one year (t=1), then $25 for 9 years after that (payments at t=2 ,3,...10), and on the 11th year (t=11) the dividend will be 2% less than at t=10, and will continue to shrink at the same rate every year after that forever. The required return of the stock is 10%. All rates are effective annual rates.

What is the price of the stock now?

Estimate the US bank JP Morgan's share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- The major US banks JP Morgan Chase (JPM), Citi Group (C) and Wells Fargo (WFC) are comparable companies;

- JP Morgan Chase's historical earnings per share (EPS) is $4.37;

- Citi Group's share price is $50.05 and historical EPS is $4.26;

- Wells Fargo's share price is $48.98 and historical EPS is $3.89.

Note: Figures sourced from Google Finance on 24 March 2014.

Estimate Microsoft's (MSFT) share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- Apple, Google and Microsoft are comparable companies,

- Apple's (AAPL) share price is $526.24 and historical EPS is $40.32.

- Google's (GOOG) share price is $1,215.65 and historical EPS is $36.23.

- Micrsoft's (MSFT) historical earnings per share (EPS) is $2.71.

Source: Google Finance 28 Feb 2014.

Carlos and Edwin are brothers and they both love Holden Commodore cars.

Carlos likes to buy the latest Holden Commodore car for $40,000 every 4 years as soon as the new model is released. As soon as he buys the new car, he sells the old one on the second hand car market for $20,000. Carlos never has to bother with paying for repairs since his cars are brand new.

Edwin also likes Commodores, but prefers to buy 4-year old cars for $20,000 and keep them for 11 years until the end of their life (new ones last for 15 years in total but the 4-year old ones only last for another 11 years). Then he sells the old car for $2,000 and buys another 4-year old second hand car, and so on.

Every time Edwin buys a second hand 4 year old car he immediately has to spend $1,000 on repairs, and then $1,000 every year after that for the next 10 years. So there are 11 payments in total from when the second hand car is bought at t=0 to the last payment at t=10. One year later (t=11) the old car is at the end of its total 15 year life and can be scrapped for $2,000.

Assuming that Carlos and Edwin maintain their love of Commodores and keep up their habits of buying new ones and second hand ones respectively, how much larger is Carlos' equivalent annual cost of car ownership compared with Edwin's?

The real discount rate is 10% pa. All cash flows are real and are expected to remain constant. Inflation is forecast to be 3% pa. All rates are effective annual. Ignore capital gains tax and tax savings from depreciation since cars are tax-exempt for individuals.

There are many ways to write the ordinary annuity formula.

Which of the following is NOT equal to the ordinary annuity formula?

The following cash flows are expected:

- 10 yearly payments of $60, with the first payment in 3 years from now (first payment at t=3 and last at t=12).

- 1 payment of $400 in 5 years and 6 months (t=5.5) from now.

What is the NPV of the cash flows if the discount rate is 10% given as an effective annual rate?

Question 58 NPV, inflation, real and nominal returns and cash flows, Annuity

A project to build a toll bridge will take two years to complete, costing three payments of $100 million at the start of each year for the next three years, that is at t=0, 1 and 2.

After completion, the toll bridge will yield a constant $50 million at the end of each year for the next 10 years. So the first payment will be at t=3 and the last at t=12. After the last payment at t=12, the bridge will be given to the government.

The required return of the project is 21% pa given as an effective annual nominal rate.

All cash flows are real and the expected inflation rate is 10% pa given as an effective annual rate. Ignore taxes.

The Net Present Value is:

The first payment of a constant perpetual annual cash flow is received at time 5. Let this cash flow be ##C_5## and the required return be ##r##.

So there will be equal annual cash flows at time 5, 6, 7 and so on forever, and all of the cash flows will be equal so ##C_5 = C_6 = C_7 = ...##

When the perpetuity formula is used to value this stream of cash flows, it will give a value (V) at time:

A stock just paid its annual dividend of $9. The share price is $60. The required return of the stock is 10% pa as an effective annual rate.

What is the implied growth rate of the dividend per year?

Two years ago Fred bought a house for $300,000.

Now it's worth $500,000, based on recent similar sales in the area.

Fred's residential property has an expected total return of 8% pa.

He rents his house out for $2,000 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $23,173.86.

The future value of 12 months of rental payments one year ahead is $25,027.77.

What is the expected annual growth rate of the rental payments? In other words, by what percentage increase will Fred have to raise the monthly rent by each year to sustain the expected annual total return of 8%?

The following is the Dividend Discount Model (DDM) used to price stocks:

### P_0 = \frac{d_1}{r-g} ###Assume that the assumptions of the DDM hold and that the time period is measured in years.

Which of the following is equal to the expected dividend in 3 years, ## d_3 ##?

Question 498 NPV, Annuity, perpetuity with growth, multi stage growth model

A business project is expected to cost $100 now (t=0), then pay $10 at the end of the third (t=3), fourth, fifth and sixth years, and then grow by 5% pa every year forever. So the cash flow will be $10.5 at the end of the seventh year (t=7), then $11.025 at the end of the eighth year (t=8) and so on perpetually. The total required return is 10℅ pa.

Which of the following formulas will NOT give the correct net present value of the project?

Estimate the Chinese bank ICBC's share price using a backward-looking price earnings (PE) multiples approach with the following assumptions and figures only. Note that the renminbi (RMB) is the Chinese currency, also known as the yuan (CNY).

- The 4 major Chinese banks ICBC, China Construction Bank (CCB), Bank of China (BOC) and Agricultural Bank of China (ABC) are comparable companies;

- ICBC 's historical earnings per share (EPS) is RMB 0.74;

- CCB's backward-looking PE ratio is 4.59;

- BOC 's backward-looking PE ratio is 4.78;

- ABC's backward-looking PE ratio is also 4.78;

Note: Figures sourced from Google Finance on 25 March 2014. Share prices are from the Shanghai stock exchange.

A low-quality second-hand car can be bought now for $1,000 and will last for 1 year before it will be scrapped for nothing.

A high-quality second-hand car can be bought now for $4,900 and it will last for 5 years before it will be scrapped for nothing.

What is the equivalent annual cost of each car? Assume a discount rate of 10% pa, given as an effective annual rate.

The answer choices are given as the equivalent annual cost of the low-quality car and then the high quality car.

When using the dividend discount model, care must be taken to avoid using a nominal dividend growth rate that exceeds the country's nominal GDP growth rate. Otherwise the firm is forecast to take over the country since it grows faster than the average business forever.

Suppose a firm's nominal dividend grows at 10% pa forever, and nominal GDP growth is 5% pa forever. The firm's total dividends are currently $1 billion (t=0). The country's GDP is currently $1,000 billion (t=0).

In approximately how many years will the company's total dividends be as large as the country's GDP?

Private equity firms are known to buy medium sized private companies operating in the same industry, merge them together into a larger company, and then sell it off in a public float (initial public offering, IPO).

If medium-sized private companies trade at PE ratios of 5 and larger listed companies trade at PE ratios of 15, what return can be achieved from this strategy?

Assume that:

- The medium-sized companies can be bought, merged and sold in an IPO instantaneously.

- There are no costs of finding, valuing, merging and restructuring the medium sized companies. Also, there is no competition to buy the medium-sized companies from other private equity firms.

- The large merged firm's earnings are the sum of the medium firms' earnings.

- The only reason for the difference in medium and large firm's PE ratios is due to the illiquidity of the medium firms' shares.

- Return is defined as: ##r_{0→1} = (p_1-p_0+c_1)/p_0## , where time zero is just before the merger and time one is just after.

You just bought a nice dress which you plan to wear once per month on nights out. You bought it a moment ago for $600 (at t=0). In your experience, dresses used once per month last for 6 years.

Your younger sister is a student with no money and wants to borrow your dress once a month when she hits the town. With the increased use, your dress will only last for another 3 years rather than 6.

What is the present value of the cost of letting your sister use your current dress for the next 3 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new dress when your current one wears out; your sister will only use the current dress, not the next one that you will buy; and the price of a new dress never changes.

Which of the following statements is NOT equivalent to the yield on debt?

Assume that the debt being referred to is fairly priced, but do not assume that it's priced at par.

Which of the below statements about effective rates and annualised percentage rates (APR's) is NOT correct?

A credit card offers an interest rate of 18% pa, compounding monthly.

Find the effective monthly rate, effective annual rate and the effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff monthly} , r_\text{eff yearly} , r_\text{eff daily} ###

A European bond paying annual coupons of 6% offers a yield of 10% pa.

Convert the yield into an effective monthly rate, an effective annual rate and an effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff, monthly} , r_\text{eff, yearly} , r_\text{eff, daily} ###

Calculate the effective annual rates of the following three APR's:

- A credit card offering an interest rate of 18% pa, compounding monthly.

- A bond offering a yield of 6% pa, compounding semi-annually.

- An annual dividend-paying stock offering a return of 10% pa compounding annually.

All answers are given in the same order:

##r_\text{credit card, eff yrly}##, ##r_\text{bond, eff yrly}##, ##r_\text{stock, eff yrly}##

You want to buy an apartment priced at $300,000. You have saved a deposit of $30,000. The bank has agreed to lend you the $270,000 as a fully amortising loan with a term of 25 years. The interest rate is 12% pa and is not expected to change.

What will be your monthly payments? Remember that mortgage loan payments are paid in arrears (at the end of the month).

You want to buy an apartment worth $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as a fully amortising mortgage loan with a term of 25 years. The interest rate is 6% pa and is not expected to change.

What will be your monthly payments?

You want to buy an apartment worth $400,000. You have saved a deposit of $80,000. The bank has agreed to lend you the $320,000 as a fully amortising mortgage loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

You want to buy an apartment priced at $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as a fully amortising loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $2,000 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 5 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

You just signed up for a 30 year fully amortising mortgage with monthly payments of $1,000 per month. The interest rate is 6% pa which is not expected to change.

How much did you borrow? After 20 years, how much will be owing on the mortgage? The interest rate is still 6% and is not expected to change.

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $1,500 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 10 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

You just agreed to a 30 year fully amortising mortgage loan with monthly payments of $2,500. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 10 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change. The below choices are given in the same order.

You want to buy a house priced at $400,000. You have saved a deposit of $40,000. The bank has agreed to lend you $360,000 as a fully amortising loan with a term of 30 years. The interest rate is 8% pa payable monthly and is not expected to change.

What will be your monthly payments?

You want to buy an apartment priced at $300,000. You have saved a deposit of $30,000. The bank has agreed to lend you the $270,000 as an interest only loan with a term of 25 years. The interest rate is 12% pa and is not expected to change.

What will be your monthly payments? Remember that mortgage payments are paid in arrears (at the end of the month).

You want to buy an apartment worth $300,000. You have saved a deposit of $60,000.

The bank has agreed to lend you $240,000 as an interest only mortgage loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

You want to buy an apartment priced at $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as an interest only loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

In Australia in the 1980's, inflation was around 8% pa, and residential mortgage loan interest rates were around 14%.

In 2013, inflation was around 2.5% pa, and residential mortgage loan interest rates were around 4.5%.

If a person can afford constant mortgage loan payments of $2,000 per month, how much more can they borrow when interest rates are 4.5% pa compared with 14.0% pa?

Give your answer as a proportional increase over the amount you could borrow when interest rates were high ##(V_\text{high rates})##, so:

###\text{Proportional increase} = \dfrac{V_\text{low rates}-V_\text{high rates}}{V_\text{high rates}} ###

Assume that:

- Interest rates are expected to be constant over the life of the loan.

- Loans are interest-only and have a life of 30 years.

- Mortgage loan payments are made every month in arrears and all interest rates are given as annualised percentage rates (APR's) compounding per month.

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid annually. So there's only one coupon per year, paid in arrears every year.

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid semi-annually. So there are two coupons per year, paid in arrears every six months.

For a price of $100, Vera will sell you a 2 year bond paying semi-annual coupons of 10% pa. The face value of the bond is $100. Other bonds with similar risk, maturity and coupon characteristics trade at a yield of 8% pa.

Bonds X and Y are issued by the same US company. Both bonds yield 10% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X and Y's coupon rates are 8 and 12% pa respectively. Which of the following statements is true?

Bonds A and B are issued by the same company. They have the same face value, maturity, seniority and coupon payment frequency. The only difference is that bond A has a 5% coupon rate, while bond B has a 10% coupon rate. The yield curve is flat, which means that yields are expected to stay the same.

Which bond would have the higher current price?

A two year Government bond has a face value of $100, a yield of 0.5% and a fixed coupon rate of 0.5%, paid semi-annually. What is its price?

Question 48 IRR, NPV, bond pricing, premium par and discount bonds, market efficiency

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

A two year Government bond has a face value of $100, a yield of 2.5% pa and a fixed coupon rate of 0.5% pa, paid semi-annually. What is its price?

Question 56 income and capital returns, bond pricing, premium par and discount bonds

Which of the following statements about risk free government bonds is NOT correct?

Hint: Total return can be broken into income and capital returns as follows:

###\begin{aligned} r_\text{total} &= \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0} \\ &= r_\text{income} + r_\text{capital} \end{aligned} ###

The capital return is the growth rate of the price.

The income return is the periodic cash flow. For a bond this is the coupon payment.

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

A bond maturing in 10 years has a coupon rate of 4% pa, paid semi-annually. The bond's yield is currently 6% pa. The face value of the bond is $100. What is its price?

Bonds A and B are issued by the same Australian company. Both bonds yield 7% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond A pays coupons of 10% pa and bond B pays coupons of 5% pa. Which of the following statements is true about the bonds' prices?

A three year bond has a fixed coupon rate of 12% pa, paid semi-annually. The bond's yield is currently 6% pa. The face value is $100. What is its price?

Bonds X and Y are issued by different companies, but they both pay a semi-annual coupon of 10% pa and they have the same face value ($100), maturity (3 years) and yield (10%) as each other.

Which of the following statements is true?

A four year bond has a face value of $100, a yield of 6% and a fixed coupon rate of 12%, paid semi-annually. What is its price?

Which one of the following bonds is trading at a discount?

A firm wishes to raise $20 million now. They will issue 8% pa semi-annual coupon bonds that will mature in 5 years and have a face value of $100 each. Bond yields are 6% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

A five year bond has a face value of $100, a yield of 12% and a fixed coupon rate of 6%, paid semi-annually.

What is the bond's price?

Which one of the following bonds is trading at par?

A firm wishes to raise $8 million now. They will issue 7% pa semi-annual coupon bonds that will mature in 10 years and have a face value of $100 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

Which one of the following bonds is trading at a premium?

A firm wishes to raise $10 million now. They will issue 6% pa semi-annual coupon bonds that will mature in 8 years and have a face value of $1,000 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue? All numbers are rounded up.

A four year bond has a face value of $100, a yield of 9% and a fixed coupon rate of 6%, paid semi-annually. What is its price?

In these tough economic times, central banks around the world have cut interest rates so low that they are practically zero. In some countries, government bond yields are also very close to zero.

A three year government bond with a face value of $100 and a coupon rate of 2% pa paid semi-annually was just issued at a yield of 0%. What is the price of the bond?

A 10 year bond has a face value of $100, a yield of 6% pa and a fixed coupon rate of 8% pa, paid semi-annually. What is its price?

A 30 year Japanese government bond was just issued at par with a yield of 1.7% pa. The fixed coupon payments are semi-annual. The bond has a face value of $100.

Six months later, just after the first coupon is paid, the yield of the bond increases to 2% pa. What is the bond's new price?

A 10 year Australian government bond was just issued at par with a yield of 3.9% pa. The fixed coupon payments are semi-annual. The bond has a face value of $1,000.

Six months later, just after the first coupon is paid, the yield of the bond decreases to 3.65% pa. What is the bond's new price?

Bonds X and Y are issued by the same US company. Both bonds yield 6% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X pays coupons of 8% pa and bond Y pays coupons of 12% pa. Which of the following statements is true?

Below are some statements about loans and bonds. The first descriptive sentence is correct. But one of the second sentences about the loans' or bonds' prices is not correct. Which statement is NOT correct? Assume that interest rates are positive.

Note that coupons or interest payments are the periodic payments made throughout a bond or loan's life. The face or par value of a bond or loan is the amount paid at the end when the debt matures.

A credit card company advertises an interest rate of 18% pa, payable monthly. Which of the following statements about the interest rate is NOT correct? All rates are given to four decimal places.

Question 25 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

A European company just issued two bonds, a

- 2 year zero coupon bond at a yield of 8% pa, and a

- 3 year zero coupon bond at a yield of 10% pa.

What is the company's forward rate over the third year (from t=2 to t=3)? Give your answer as an effective annual rate, which is how the above bond yields are quoted.

A home loan company advertises an interest rate of 6% pa, payable monthly. Which of the following statements about the interest rate is NOT correct? All rates are given to four decimal places.

A semi-annual coupon bond has a yield of 3% pa. Which of the following statements about the yield is NOT correct? All rates are given to four decimal places.

"Buy low, sell high" is a phrase commonly heard in financial markets. It states that traders should try to buy assets at low prices and sell at high prices.

Traders in the fixed-coupon bond markets often quote promised bond yields rather than prices. Fixed-coupon bond traders should try to:

Let the 'income return' of a bond be the coupon at the end of the period divided by the market price now at the start of the period ##(C_1/P_0)##. The expected income return of a premium fixed coupon bond is:

Question 35 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

A European company just issued two bonds, a

- 1 year zero coupon bond at a yield of 8% pa, and a

- 2 year zero coupon bond at a yield of 10% pa.

What is the company's forward rate over the second year (from t=1 to t=2)? Give your answer as an effective annual rate, which is how the above bond yields are quoted.

Question 96 bond pricing, zero coupon bond, term structure of interest rates, forward interest rate

An Australian company just issued two bonds paying semi-annual coupons:

- 1 year zero coupon bond at a yield of 8% pa, and a

- 2 year zero coupon bond at a yield of 10% pa.

What is the forward rate on the company's debt from years 1 to 2? Give your answer as an APR compounding every 6 months, which is how the above bond yields are quoted.

You really want to go on a back packing trip to Europe when you finish university. Currently you have $1,500 in the bank. Bank interest rates are 8% pa, given as an APR compounding per month. If the holiday will cost $2,000, how long will it take for your bank account to reach that amount?

A young lady is trying to decide if she should attend university or not.

The young lady's parents say that she must attend university because otherwise all of her hard work studying and attending school during her childhood was a waste.

What's the correct way to classify this item from a capital budgeting perspective when trying to decide whether to attend university?

The hard work studying at school in her childhood should be classified as:

A man has taken a day off from his casual painting job to relax.

It's the end of the day and he's thinking about the hours that he could have spent working (in the past) which are now:

Why is Capital Expenditure (CapEx) subtracted in the Cash Flow From Assets (CFFA) formula?

###CFFA=NI+Depr-CapEx - \Delta NWC+IntExp###

A firm has forecast its Cash Flow From Assets (CFFA) for this year and management is worried that it is too low. Which one of the following actions will lead to a higher CFFA for this year (t=0 to 1)? Only consider cash flows this year. Do not consider cash flows after one year, or the change in the NPV of the firm. Consider each action in isolation.

Which one of the following will decrease net income (NI) but increase cash flow from assets (CFFA) in this year for a tax-paying firm, all else remaining constant?

Remember:

###NI = (Rev-COGS-FC-Depr-IntExp).(1-t_c )### ###CFFA=NI+Depr-CapEx - \Delta NWC+IntExp###Over the next year, the management of an unlevered company plans to:

- Make $5m in sales, $1.9m in net income and $2m in equity free cash flow (EFCF).

- Pay dividends of $1m.

- Complete a $1.3m share buy-back.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to legally pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

Read the following financial statements and calculate the firm's free cash flow over the 2014 financial year.

| UBar Corp | ||

| Income Statement for | ||

| year ending 30th June 2014 | ||

| $m | ||

| Sales | 293 | |

| COGS | 200 | |

| Rent expense | 15 | |

| Gas expense | 8 | |

| Depreciation | 10 | |

| EBIT | 60 | |

| Interest expense | 0 | |

| Taxable income | 60 | |

| Taxes | 18 | |

| Net income | 42 | |

| UBar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2014 | 2013 |

| $m | $m | |

| Assets | ||

| Cash | 30 | 29 |

| Accounts receivable | 5 | 7 |

| Pre-paid rent expense | 1 | 0 |

| Inventory | 50 | 46 |

| PPE | 290 | 300 |

| Total assets | 376 | 382 |

| Liabilities | ||

| Trade payables | 20 | 18 |

| Accrued gas expense | 3 | 2 |

| Non-current liabilities | 0 | 0 |

| Contributed equity | 212 | 212 |

| Retained profits | 136 | 150 |

| Asset revaluation reserve | 5 | 0 |

| Total L and OE | 376 | 382 |

Note: all figures are given in millions of dollars ($m).

The firm's free cash flow over the 2014 financial year was:

Find Trademark Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Trademark Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 100 | |

| COGS | 25 | |

| Operating expense | 5 | |

| Depreciation | 20 | |

| Interest expense | 20 | |

| Income before tax | 30 | |

| Tax at 30% | 9 | |

| Net income | 21 | |

| Trademark Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 120 | 80 |

| PPE | ||

| Cost | 150 | 140 |

| Accumul. depr. | 60 | 40 |

| Carrying amount | 90 | 100 |

| Total assets | 210 | 180 |

| Liabilities | ||

| Current liabilities | 75 | 65 |

| Non-current liabilities | 75 | 55 |

| Owners' equity | ||

| Retained earnings | 10 | 10 |

| Contributed equity | 50 | 50 |

| Total L and OE | 210 | 180 |

Note: all figures are given in millions of dollars ($m).

Find UniBar Corp's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| UniBar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 80 | |

| COGS | 40 | |

| Operating expense | 15 | |

| Depreciation | 10 | |

| Interest expense | 5 | |

| Income before tax | 10 | |

| Tax at 30% | 3 | |

| Net income | 7 | |

| UniBar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 120 | 90 |

| PPE | ||

| Cost | 360 | 320 |

| Accumul. depr. | 40 | 30 |

| Carrying amount | 320 | 290 |

| Total assets | 440 | 380 |

| Liabilities | ||

| Current liabilities | 110 | 60 |

| Non-current liabilities | 190 | 180 |

| Owners' equity | ||

| Retained earnings | 95 | 95 |

| Contributed equity | 45 | 45 |

| Total L and OE | 440 | 380 |

Note: all figures are given in millions of dollars ($m).

Find Scubar Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Scubar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 60 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 90 | |

| Taxes at 30% | 27 | |

| Net income | 63 | |

| Scubar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 60 | 50 |

| Trade debtors | 19 | 6 |

| Rent paid in advance | 3 | 2 |

| PPE | 420 | 400 |

| Total assets | 502 | 458 |

| Trade creditors | 10 | 8 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 130 | 130 |

| Retained profits | 162 | 130 |

| Total L and OE | 502 | 458 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

Value the following business project to manufacture a new product.

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year | $3m | |

| Expected sale price of equipment at end of project | $0.6m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $5 | |

| Fixed costs per year, paid at the end of each year | $1m | |

| Interest expense per year | 0 | |

| Tax rate | 30% | |

| Weighted average cost of capital after tax per annum | 10% | |

Notes

- The firm's current assets and current liabilities are $3m and $2m respectively right now. This net working capital will not be used in this project, it will be used in other unrelated projects.

Due to the project, current assets (mostly inventory) will grow by $2m initially (at t = 0), and then by $0.2m at the end of the first year (t=1).

Current liabilities (mostly trade creditors) will increase by $0.1m at the end of the first year (t=1).

At the end of the project, the net working capital accumulated due to the project can be sold for the same price that it was bought. - The project cost $0.5m to research which was incurred one year ago.

Assumptions

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 3% pa.

- All rates are given as effective annual rates.

- The business considering the project is run as a 'sole tradership' (run by an individual without a company) and is therefore eligible for a 50% capital gains tax discount when the equipment is sold, as permitted by the Australian Tax Office.

What is the expected net present value (NPV) of the project?

To value a business's assets, the free cash flow of the firm (FCFF, also called CFFA) needs to be calculated. This requires figures from the firm's income statement and balance sheet. For what figures is the balance sheet needed? Note that the balance sheet is sometimes also called the statement of financial position.

Your friend just bought a house for $400,000. He financed it using a $320,000 mortgage loan and a deposit of $80,000.

In the context of residential housing and mortgages, the 'equity' tied up in the value of a person's house is the value of the house less the value of the mortgage. So the initial equity your friend has in his house is $80,000. Let this amount be E, let the value of the mortgage be D and the value of the house be V. So ##V=D+E##.

If house prices suddenly fall by 10%, what would be your friend's percentage change in equity (E)? Assume that the value of the mortgage is unchanged and that no income (rent) was received from the house during the short time over which house prices fell.

Remember:

### r_{0\rightarrow1}=\frac{p_1-p_0+c_1}{p_0} ###

where ##r_{0-1}## is the return (percentage change) of an asset with price ##p_0## initially, ##p_1## one period later, and paying a cash flow of ##c_1## at time ##t=1##.

Your friend just bought a house for $1,000,000. He financed it using a $900,000 mortgage loan and a deposit of $100,000.

In the context of residential housing and mortgages, the 'equity' or 'net wealth' tied up in a house is the value of the house less the value of the mortgage loan. Assuming that your friend's only asset is his house, his net wealth is $100,000.

If house prices suddenly fall by 15%, what would be your friend's percentage change in net wealth?

Assume that:

- No income (rent) was received from the house during the short time over which house prices fell.

- Your friend will not declare bankruptcy, he will always pay off his debts.

Here are the Net Income (NI) and Cash Flow From Assets (CFFA) equations:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c)###

###CFFA=NI+Depr-CapEx - \varDelta NWC+IntExp###

What is the formula for calculating annual interest expense (IntExp) which is used in the equations above?

Select one of the following answers. Note that D is the value of debt which is constant through time, and ##r_D## is the cost of debt.

Which one of the following will increase the Cash Flow From Assets in this year for a tax-paying firm, all else remaining constant?

Which one of the following will decrease net income (NI) but increase cash flow from assets (CFFA) in this year for a tax-paying firm, all else remaining constant?

Remember:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c )### ###CFFA=NI+Depr-CapEx - ΔNWC+IntExp###The US firm Google operates in the online advertising business. In 2011 Google bought Motorola Mobility which manufactures mobile phones.

Assume the following:

- Google had a 10% after-tax weighted average cost of capital (WACC) before it bought Motorola.

- Motorola had a 20% after-tax WACC before it merged with Google.

- Google and Motorola have the same level of gearing.

- Both companies operate in a classical tax system.

You are a manager at Motorola. You must value a project for making mobile phones. Which method(s) will give the correct valuation of the mobile phone manufacturing project? Select the most correct answer.

The mobile phone manufacturing project's:

A method commonly seen in textbooks for calculating a levered firm's free cash flow (FFCF, or CFFA) is the following:

###\begin{aligned} FFCF &= (Rev - COGS - Depr - FC - IntExp)(1-t_c) + \\ &\space\space\space+ Depr - CapEx -\Delta NWC + IntExp(1-t_c) \\ \end{aligned}###

One formula for calculating a levered firm's free cash flow (FFCF, or CFFA) is to use earnings before interest and tax (EBIT).

###\begin{aligned} FFCF &= (EBIT)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp.t_c \\ &= (Rev - COGS - Depr - FC)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp.t_c \\ \end{aligned} \\###

One method for calculating a firm's free cash flow (FFCF, or CFFA) is to ignore interest expense. That is, pretend that interest expense ##(IntExp)## is zero:

###\begin{aligned} FFCF &= (Rev - COGS - Depr - FC - IntExp)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp \\ &= (Rev - COGS - Depr - FC - 0)(1-t_c) + Depr - CapEx -\Delta NWC - 0\\ \end{aligned}###

One formula for calculating a levered firm's free cash flow (FFCF, or CFFA) is to use net operating profit after tax (NOPAT).

###\begin{aligned} FFCF &= NOPAT + Depr - CapEx -\Delta NWC \\ &= (Rev - COGS - Depr - FC)(1-t_c) + Depr - CapEx -\Delta NWC \\ \end{aligned} \\###

Question 413 CFFA, interest tax shield, depreciation tax shield

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA).

One method is to use the following formulas to transform net income (NI) into FFCF including interest and depreciation tax shields:

###FFCF=NI + Depr - CapEx -ΔNWC + IntExp###

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )###

Another popular method is to use EBITDA rather than net income. EBITDA is defined as:

###EBITDA=Rev - COGS - FC###

One of the below formulas correctly calculates FFCF from EBITDA, including interest and depreciation tax shields, giving an identical answer to that above. Which formula is correct?

Question 370 capital budgeting, NPV, interest tax shield, WACC, CFFA

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $600k | |

| Depreciation of equipment per year | $250k | |

| Expected sale price of equipment at end of project | $200k | |

| Revenue per job | $12k | |

| Variable cost per job | $4k | |

| Quantity of jobs per year | 120 | |

| Fixed costs per year, paid at the end of each year | $100k | |

| Interest expense in first year (at t=1) | $16.091k | |

| Interest expense in second year (at t=2) | $9.711k | |

| Tax rate | 30% | |

| Government treasury bond yield | 5% | |

| Bank loan debt yield | 6% | |

| Levered cost of equity | 12.5% | |

| Market portfolio return | 10% | |

| Beta of assets | 1.24 | |

| Beta of levered equity | 1.5 | |

| Firm's and project's debt-to-equity ratio | 25% | |

Notes

- The project will require an immediate purchase of $50k of inventory, which will all be sold at cost when the project ends. Current liabilities are negligible so they can be ignored.

Assumptions

- The debt-to-equity ratio will be kept constant throughout the life of the project. The amount of interest expense at the end of each period has been correctly calculated to maintain this constant debt-to-equity ratio. Note that interest expense is different in each year.

- Thousands are represented by 'k' (kilo).

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are nominal. The inflation rate is 2% pa.

- All rates are given as effective annual rates.

- The 50% capital gains tax discount is not available since the project is undertaken by a firm, not an individual.

What is the net present value (NPV) of the project?

A firm has a debt-to-assets ratio of 50%. The firm then issues a large amount of debt to raise money for new projects of similar market risk to the company's existing projects. Assume a classical tax system. Which statement is correct?

Question 121 capital structure, leverage, financial distress, interest tax shield

Fill in the missing words in the following sentence:

All things remaining equal, as a firm's amount of debt funding falls, benefits of interest tax shields __________ and the costs of financial distress __________.

A firm plans to issue equity and use the cash raised to pay off its debt. No assets will be bought or sold. Ignore the costs of financial distress.

Which of the following statements is NOT correct, all things remaining equal?

A firm has a debt-to-equity ratio of 60%. What is its debt-to-assets ratio?

In the home loan market, the acronym LVR stands for Loan to Valuation Ratio. If you bought a house worth one million dollars, partly funded by an $800,000 home loan, then your LVR was 80%. The LVR is equivalent to which of the following ratios?

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $48.5m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $50m | Firm free cash flow or cash flow from assets |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 10% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 9.7% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 11.25% pa | Cost of levered equity |

| ##D/V_L## | 20% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

Question 658 CFFA, income statement, balance sheet, no explanation

To value a business's assets, the free cash flow of the firm (FCFF, also called CFFA) needs to be calculated. This requires figures from the firm's income statement and balance sheet. For what figures is the income statement needed? Note that the income statement is sometimes also called the profit and loss, P&L, or statement of financial performance.

Question 241 Miller and Modigliani, leverage, payout policy, diversification, NPV

One of Miller and Modigliani's (M&M's) important insights is that a firm's managers should not try to achieve a particular level of leverage in a world with zero taxes and perfect information since investors can make their own leverage. Therefore corporate capital structure policy is irrelevant since investors can achieve their own desired leverage at the personal level by borrowing or lending on their own.

This principal of 'home-made' or 'do-it-yourself' leverage can also be applied to other topics. Read the following statements to decide which are true:

(I) Payout policy: a firm's managers should not try to achieve a particular pattern of equity payout.

(II) Agency costs: a firm's managers should not try to minimise agency costs.

(III) Diversification: a firm's managers should not try to diversify across industries.

(IV) Shareholder wealth: a firm's managers should not try to maximise shareholders' wealth.

Which of the above statement(s) are true?

A firm has a debt-to-equity ratio of 25%. What is its debt-to-assets ratio?

A firm has a debt-to-assets ratio of 20%. What is its debt-to-equity ratio?

One year ago you bought a $1,000,000 house partly funded using a mortgage loan. The loan size was $800,000 and the other $200,000 was your wealth or 'equity' in the house asset.

The interest rate on the home loan was 4% pa.

Over the year, the house produced a net rental yield of 2% pa and a capital gain of 2.5% pa.

Assuming that all cash flows (interest payments and net rental payments) were paid and received at the end of the year, and all rates are given as effective annual rates, what was the total return on your wealth over the past year?

Hint: Remember that wealth in this context is your equity (E) in the house asset (V = D+E) which is funded by the loan (D) and your deposit or equity (E).

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $100m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $112m | Firm free cash flow or cash flow from assets (includes interest tax shields) |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 7% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 6.25% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 9% pa | Cost of levered equity |

| ##D/V_L## | 50% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

Use the below information to value a levered company with annual perpetual cash flows from assets that grow. The next cash flow will be generated in one year from now. Note that ‘k’ means kilo or 1,000. So the $30k is $30,000.

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $30k | Operating free cash flow |

| ##g## | 1.5% pa | Growth rate of OFCF |

| ##r_\text{D}## | 4% pa | Cost of debt |

| ##r_\text{EL}## | 16.3% pa | Cost of levered equity |

| ##D/V_L## | 80% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

| ##n_\text{shares}## | 100k | Number of shares |

Which of the following statements is NOT correct?

Question 772 interest tax shield, capital structure, leverage

A firm issues debt and uses the funds to buy back equity. Assume that there are no costs of financial distress or transactions costs. Which of the following statements about interest tax shields is NOT correct?

There are many different ways to value a firm's assets. Which of the following will NOT give the correct market value of a levered firm's assets ##(V_L)##? Assume that:

- The firm is financed by listed common stock and vanilla annual fixed coupon bonds, which are both traded in a liquid market.

- The bonds' yield is equal to the coupon rate, so the bonds are issued at par. The yield curve is flat and yields are not expected to change. When bonds mature they will be rolled over by issuing the same number of new bonds with the same expected yield and coupon rate, and so on forever.

- Tax rates on the dividends and capital gains received by investors are equal, and capital gains tax is paid every year, even on unrealised gains regardless of when the asset is sold.

- There is no re-investment of the firm's cash back into the business. All of the firm's excess cash flow is paid out as dividends so real growth is zero.

- The firm operates in a mature industry with zero real growth.

- All cash flows and rates in the below equations are real (not nominal) and are expected to be stable forever. Therefore the perpetuity equation with no growth is suitable for valuation.

Where:

###r_\text{WACC before tax} = r_D.\frac{D}{V_L} + r_{EL}.\frac{E_L}{V_L} = \text{Weighted average cost of capital before tax}### ###r_\text{WACC after tax} = r_D.(1-t_c).\frac{D}{V_L} + r_{EL}.\frac{E_L}{V_L} = \text{Weighted average cost of capital after tax}### ###NI_L=(Rev-COGS-FC-Depr-\mathbf{IntExp}).(1-t_c) = \text{Net Income Levered}### ###CFFA_L=NI_L+Depr-CapEx - \varDelta NWC+\mathbf{IntExp} = \text{Cash Flow From Assets Levered}### ###NI_U=(Rev-COGS-FC-Depr).(1-t_c) = \text{Net Income Unlevered}### ###CFFA_U=NI_U+Depr-CapEx - \varDelta NWC= \text{Cash Flow From Assets Unlevered}###Question 559 variance, standard deviation, covariance, correlation

Which of the following statements about standard statistical mathematics notation is NOT correct?

Diversification in a portfolio of two assets works best when the correlation between their returns is:

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation ##(\rho_{A,B})## | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the standard deviation (not variance) of returns of the above portfolio?

Two risky stocks A and B comprise an equal-weighted portfolio. The correlation between the stocks' returns is 70%.

If the variance of stock A's returns increases but the:

- Prices and expected returns of each stock stays the same,

- Variance of stock B's returns stays the same,

- Correlation of returns between the stocks stays the same.

Which of the following statements is NOT correct?

All things remaining equal, the higher the correlation of returns between two stocks:

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 6% pa.

- Stock A has an expected return of 5% pa.

- Stock B has an expected return of 10% pa.

What portfolio weights should the investor have in stocks A and B respectively?

Question 556 portfolio risk, portfolio return, standard deviation

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 12% pa.

- Stock A has an expected return of 10% pa and a standard deviation of 20% pa.

- Stock B has an expected return of 15% pa and a standard deviation of 30% pa.

The correlation coefficient between stock A and B's expected returns is 70%.

What will be the annual standard deviation of the portfolio with this 12% pa target return?

What is the correlation of a variable X with itself?

The corr(X, X) or ##\rho_{X,X}## equals:

What is the correlation of a variable X with a constant C?

The corr(X, C) or ##\rho_{X,C}## equals:

The covariance and correlation of two stocks X and Y's annual returns are calculated over a number of years. The units of the returns are in percent per annum ##(\% pa)##.

What are the units of the covariance ##(\sigma_{X,Y})## and correlation ##(\rho_{X,Y})## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the expected return of the above portfolio?

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Covariance ##(\sigma_{A,B})## | Beta | Dollars invested |

|

| A | 0.2 | 0.4 | 0.12 | 0.5 | 40 | |

| B | 0.3 | 0.8 | 1.5 | 80 | ||

What is the standard deviation (not variance) of the above portfolio? Note that the stocks' covariance is given, not correlation.

Which of the following statements about short-selling is NOT true?

Question 558 portfolio weights, portfolio return, short selling

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 16% pa.

- Stock A has an expected return of 8% pa.

- Stock B has an expected return of 12% pa.

What portfolio weights should the investor have in stocks A and B respectively?

What is the covariance of a variable X with itself?

The cov(X, X) or ##\sigma_{X,X}## equals:

The standard deviation and variance of a stock's annual returns are calculated over a number of years. The units of the returns are percent per annum ##(\% pa)##.

What are the units of the standard deviation ##(\sigma)## and variance ##(\sigma^2)## of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points ##(\text{pp})## and percent ##(\%)##.

Let the variance of returns for a share per month be ##\sigma_\text{monthly}^2##.

What is the formula for the variance of the share's returns per year ##(\sigma_\text{yearly}^2)##?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

Diversification is achieved by investing in a large amount of stocks. What type of risk is reduced by diversification?