A young lady is trying to decide if she should attend university or not.

The young lady's parents say that she must attend university because otherwise all of her hard work studying and attending school during her childhood was a waste.

What's the correct way to classify this item from a capital budgeting perspective when trying to decide whether to attend university?

The hard work studying at school in her childhood should be classified as:

A firm has a debt-to-equity ratio of 60%. What is its debt-to-assets ratio?

In the home loan market, the acronym LVR stands for Loan to Valuation Ratio. If you bought a house worth one million dollars, partly funded by an $800,000 home loan, then your LVR was 80%. The LVR is equivalent to which of the following ratios?

Your friend just bought a house for $1,000,000. He financed it using a $900,000 mortgage loan and a deposit of $100,000.

In the context of residential housing and mortgages, the 'equity' or 'net wealth' tied up in a house is the value of the house less the value of the mortgage loan. Assuming that your friend's only asset is his house, his net wealth is $100,000.

If house prices suddenly fall by 15%, what would be your friend's percentage change in net wealth?

Assume that:

- No income (rent) was received from the house during the short time over which house prices fell.

- Your friend will not declare bankruptcy, he will always pay off his debts.

Use the below information to value a levered company with constant annual perpetual cash flows from assets. The next cash flow will be generated in one year from now, so a perpetuity can be used to value this firm. Both the operating and firm free cash flows are constant (but not equal to each other).

| Data on a Levered Firm with Perpetual Cash Flows | ||

| Item abbreviation | Value | Item full name |

| ##\text{OFCF}## | $48.5m | Operating free cash flow |

| ##\text{FFCF or CFFA}## | $50m | Firm free cash flow or cash flow from assets |

| ##g## | 0% pa | Growth rate of OFCF and FFCF |

| ##\text{WACC}_\text{BeforeTax}## | 10% pa | Weighted average cost of capital before tax |

| ##\text{WACC}_\text{AfterTax}## | 9.7% pa | Weighted average cost of capital after tax |

| ##r_\text{D}## | 5% pa | Cost of debt |

| ##r_\text{EL}## | 11.25% pa | Cost of levered equity |

| ##D/V_L## | 20% pa | Debt to assets ratio, where the asset value includes tax shields |

| ##t_c## | 30% | Corporate tax rate |

What is the value of the levered firm including interest tax shields?

Here are the Net Income (NI) and Cash Flow From Assets (CFFA) equations:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c)###

###CFFA=NI+Depr-CapEx - \varDelta NWC+IntExp###

What is the formula for calculating annual interest expense (IntExp) which is used in the equations above?

Select one of the following answers. Note that D is the value of debt which is constant through time, and ##r_D## is the cost of debt.

A man is thinking about taking a day off from his casual painting job to relax.

He just woke up early in the morning and he's about to call his boss to say that he won't be coming in to work.

But he's thinking about the hours that he could work today (in the future) which are:

A man has taken a day off from his casual painting job to relax.

It's the end of the day and he's thinking about the hours that he could have spent working (in the past) which are now:

Which one of the following will decrease net income (NI) but increase cash flow from assets (CFFA) in this year for a tax-paying firm, all else remaining constant?

Remember:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c )### ###CFFA=NI+Depr-CapEx - ΔNWC+IntExp###One method for calculating a firm's free cash flow (FFCF, or CFFA) is to ignore interest expense. That is, pretend that interest expense ##(IntExp)## is zero:

###\begin{aligned} FFCF &= (Rev - COGS - Depr - FC - IntExp)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp \\ &= (Rev - COGS - Depr - FC - 0)(1-t_c) + Depr - CapEx -\Delta NWC - 0\\ \end{aligned}###

Question 413 CFFA, interest tax shield, depreciation tax shield

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA).

One method is to use the following formulas to transform net income (NI) into FFCF including interest and depreciation tax shields:

###FFCF=NI + Depr - CapEx -ΔNWC + IntExp###

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )###

Another popular method is to use EBITDA rather than net income. EBITDA is defined as:

###EBITDA=Rev - COGS - FC###

One of the below formulas correctly calculates FFCF from EBITDA, including interest and depreciation tax shields, giving an identical answer to that above. Which formula is correct?

Question 658 CFFA, income statement, balance sheet, no explanation

To value a business's assets, the free cash flow of the firm (FCFF, also called CFFA) needs to be calculated. This requires figures from the firm's income statement and balance sheet. For what figures is the income statement needed? Note that the income statement is sometimes also called the profit and loss, P&L, or statement of financial performance.

Total cash flows can be broken into income and capital cash flows. What is the name given to the income cash flow from owning shares?

Which of the following equations is NOT equal to the total return of an asset?

Let ##p_0## be the current price, ##p_1## the expected price in one year and ##c_1## the expected income in one year.

An asset's total expected return over the next year is given by:

###r_\text{total} = \dfrac{c_1+p_1-p_0}{p_0} ###

Where ##p_0## is the current price, ##c_1## is the expected income in one year and ##p_1## is the expected price in one year. The total return can be split into the income return and the capital return.

Which of the following is the expected capital return?

A stock was bought for $8 and paid a dividend of $0.50 one year later (at t=1 year). Just after the dividend was paid, the stock price was $7 (at t=1 year).

What were the total, capital and dividend returns given as effective annual rates? The choices are given in the same order:

##r_\text{total}##, ##r_\text{capital}##, ##r_\text{dividend}##.

A fixed coupon bond was bought for $90 and paid its annual coupon of $3 one year later (at t=1 year). Just after the coupon was paid, the bond price was $92 (at t=1 year). What was the total return, capital return and income return? Calculate your answers as effective annual rates.

The choices are given in the same order: ## r_\text{total},r_\text{capital},r_\text{income} ##.

Question 278 inflation, real and nominal returns and cash flows

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year.

Question 295 inflation, real and nominal returns and cash flows, NPV

When valuing assets using discounted cash flow (net present value) methods, it is important to consider inflation. To properly deal with inflation:

(I) Discount nominal cash flows by nominal discount rates.

(II) Discount nominal cash flows by real discount rates.

(III) Discount real cash flows by nominal discount rates.

(IV) Discount real cash flows by real discount rates.

Which of the above statements is or are correct?

In the 'Austin Powers' series of movies, the character Dr. Evil threatens to destroy the world unless the United Nations pays him a ransom (video 1, video 2). Dr. Evil makes the threat on two separate occasions:

- In 1969 he demands a ransom of $1 million (=10^6), and again;

- In 1997 he demands a ransom of $100 billion (=10^11).

If Dr. Evil's demands are equivalent in real terms, in other words $1 million will buy the same basket of goods in 1969 as $100 billion would in 1997, what was the implied inflation rate over the 28 years from 1969 to 1997?

The answer choices below are given as effective annual rates:

Question 353 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 6% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

Question 363 income and capital returns, inflation, real and nominal returns and cash flows, real estate

A residential investment property has an expected nominal total return of 8% pa and nominal capital return of 3% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What are the property's expected real total, capital and income returns? The answer choices below are given in the same order.

Question 407 income and capital returns, inflation, real and nominal returns and cash flows

A stock has a real expected total return of 7% pa and a real expected capital return of 2% pa.

Inflation is expected to be 2% pa. All rates are given as effective annual rates.

What is the nominal expected total return, capital return and dividend yield? The answers below are given in the same order.

Question 155 inflation, real and nominal returns and cash flows, Loan, effective rate conversion

You are a banker about to grant a 2 year loan to a customer. The loan's principal and interest will be repaid in a single payment at maturity, sometimes called a zero-coupon loan, discount loan or bullet loan.

You require a real return of 6% pa over the two years, given as an effective annual rate. Inflation is expected to be 2% this year and 4% next year, both given as effective annual rates.

You judge that the customer can afford to pay back $1,000,000 in 2 years, given as a nominal cash flow. How much should you lend to her right now?

The below screenshot of Commonwealth Bank of Australia's (CBA) details were taken from the Google Finance website on 7 Nov 2014. Some information has been deliberately blanked out.

What was CBA's market capitalisation of equity?

The below screenshot of Microsoft's (MSFT) details were taken from the Google Finance website on 28 Nov 2014. Some information has been deliberately blanked out.

What was MSFT's market capitalisation of equity?

Which of the following statements about book and market equity is NOT correct?

Question 461 book and market values, ROE, ROA, market efficiency

One year ago a pharmaceutical firm floated by selling its 1 million shares for $100 each. Its book and market values of equity were both $100m. Its debt totalled $50m. The required return on the firm's assets was 15%, equity 20% and debt 5% pa.

In the year since then, the firm:

- Earned net income of $29m.

- Paid dividends totaling $10m.

- Discovered a valuable new drug that will lead to a massive 1,000 times increase in the firm's net income in 10 years after the research is commercialised. News of the discovery was publicly announced. The firm's systematic risk remains unchanged.

Which of the following statements is NOT correct? All statements are about current figures, not figures one year ago.

Hint: Book return on assets (ROA) and book return on equity (ROE) are ratios that accountants like to use to measure a business's past performance.

###\text{ROA}= \dfrac{\text{Net income}}{\text{Book value of assets}}###

###\text{ROE}= \dfrac{\text{Net income}}{\text{Book value of equity}}###

The required return on assets ##r_V## is a return that financiers like to use to estimate a business's future required performance which compensates them for the firm's assets' risks. If the business were to achieve realised historical returns equal to its required returns, then investment into the business's assets would have been a zero-NPV decision, which is neither good nor bad but fair.

###r_\text{V, 0 to 1}= \dfrac{\text{Cash flow from assets}_\text{1}}{\text{Market value of assets}_\text{0}} = \dfrac{CFFA_\text{1}}{V_\text{0}}###

Similarly for equity and debt.

Question 444 investment decision, corporate financial decision theory

The investment decision primarily affects which part of a business?

Question 446 working capital decision, corporate financial decision theory

The working capital decision primarily affects which part of a business?

Question 445 financing decision, corporate financial decision theory

The financing decision primarily affects which part of a business?

Question 447 payout policy, corporate financial decision theory

Payout policy is most closely related to which part of a business?

Question 443 corporate financial decision theory, investment decision, financing decision, working capital decision, payout policy

Business people make lots of important decisions. Which of the following is the most important long term decision?

You're considering making an investment in a particular company. They have preference shares, ordinary shares, senior debt and junior debt.

Which is the safest investment? Which has the highest expected returns?

Which business structure or structures have the advantage of limited liability for equity investors?

Question 452 limited liability, expected and historical returns

What is the lowest and highest expected share price and expected return from owning shares in a company over a finite period of time?

Let the current share price be ##p_0##, the expected future share price be ##p_1##, the expected future dividend be ##d_1## and the expected return be ##r##. Define the expected return as:

##r=\dfrac{p_1-p_0+d_1}{p_0} ##

The answer choices are stated using inequalities. As an example, the first answer choice "(a) ##0≤p<∞## and ##0≤r< 1##", states that the share price must be larger than or equal to zero and less than positive infinity, and that the return must be larger than or equal to zero and less than one.

A share was bought for $30 (at t=0) and paid its annual dividend of $6 one year later (at t=1).

Just after the dividend was paid, the share price fell to $27 (at t=1). What were the total, capital and income returns given as effective annual rates?

The choices are given in the same order:

##r_\text{total}## , ##r_\text{capital}## , ##r_\text{dividend}##.

Question 993 inflation, real and nominal returns and cash flows

In February 2020, the RBA cash rate was 0.75% pa and the Australian CPI inflation rate was 1.8% pa.

You currently have $100 in the bank which pays a 0.75% pa interest rate.

Apples currently cost $1 each at the shop and inflation is 1.8% pa which is the expected growth rate in the apple price.

This information is summarised in the table below, with some parts missing that correspond to the answer options. All rates are given as effective annual rates. Note that when payments are not specified as real, as in this question, they're conventionally assumed to be nominal.

| Wealth in Dollars and Apples | ||||

| Time (year) | Bank account wealth ($) | Apple price ($) | Wealth in apples | |

| 0 | 100 | 1 | 100 | |

| 1 | 100.75 | 1.018 | (a) | |

| 2 | (b) | (c) | (d) | |

Which of the following statements is NOT correct? Your:

Question 525 income and capital returns, real and nominal returns and cash flows, inflation

Which of the following statements about cash in the form of notes and coins is NOT correct? Assume that inflation is positive.

Notes and coins:

Question 526 real and nominal returns and cash flows, inflation, no explanation

How can a nominal cash flow be precisely converted into a real cash flow?

Question 577 inflation, real and nominal returns and cash flows

What is the present value of a real payment of $500 in 2 years? The nominal discount rate is 7% pa and the inflation rate is 4% pa.

Question 554 inflation, real and nominal returns and cash flows

On his 20th birthday, a man makes a resolution. He will put $30 cash under his bed at the end of every month starting from today. His birthday today is the first day of the month. So the first addition to his cash stash will be in one month. He will write in his will that when he dies the cash under the bed should be given to charity.

If the man lives for another 60 years, how much money will be under his bed if he dies just after making his last (720th) addition?

Also, what will be the real value of that cash in today's prices if inflation is expected to 2.5% pa? Assume that the inflation rate is an effective annual rate and is not expected to change.

The answers are given in the same order, the amount of money under his bed in 60 years, and the real value of that money in today's prices.

Question 745 real and nominal returns and cash flows, inflation, income and capital returns

If the nominal gold price is expected to increase at the same rate as inflation which is 3% pa, which of the following statements is NOT correct?

The expression 'you have to spend money to make money' relates to which business decision?

Katya offers to pay you $10 at the end of every year for the next 5 years (t=1,2,3,4,5) if you pay her $50 now (t=0). You can borrow and lend from the bank at an interest rate of 10% pa, given as an effective annual rate. Ignore credit risk.

There are many ways to write the ordinary annuity formula.

Which of the following is NOT equal to the ordinary annuity formula?

This annuity formula ##\dfrac{C_1}{r}\left(1-\dfrac{1}{(1+r)^3} \right)## is equivalent to which of the following formulas? Note the 3.

In the below formulas, ##C_t## is a cash flow at time t. All of the cash flows are equal, but paid at different times.

Your friend overheard that you need some cash and asks if you would like to borrow some money. She can lend you $5,000 now (t=0), and in return she wants you to pay her back $1,000 in two years (t=2) and every year after that for the next 5 years, so there will be 6 payments of $1,000 from t=2 to t=7 inclusive.

What is the net present value (NPV) of borrowing from your friend?

Assume that banks loan funds at interest rates of 10% pa, given as an effective annual rate.

Question 58 NPV, inflation, real and nominal returns and cash flows, Annuity

A project to build a toll bridge will take two years to complete, costing three payments of $100 million at the start of each year for the next three years, that is at t=0, 1 and 2.

After completion, the toll bridge will yield a constant $50 million at the end of each year for the next 10 years. So the first payment will be at t=3 and the last at t=12. After the last payment at t=12, the bridge will be given to the government.

The required return of the project is 21% pa given as an effective annual nominal rate.

All cash flows are real and the expected inflation rate is 10% pa given as an effective annual rate. Ignore taxes.

The Net Present Value is:

Some countries' interest rates are so low that they're zero.

If interest rates are 0% pa and are expected to stay at that level for the foreseeable future, what is the most that you would be prepared to pay a bank now if it offered to pay you $10 at the end of every year for the next 5 years?

In other words, what is the present value of five $10 payments at time 1, 2, 3, 4 and 5 if interest rates are 0% pa?

Total cash flows can be broken into income and capital cash flows.

What is the name given to the cash flow generated from selling shares at a higher price than they were bought?

Discounted cash flow (DCF) valuation prices assets by finding the present value of the asset's future cash flows. The single cash flow, annuity, and perpetuity equations are very useful for this.

Which of the following equations is the 'perpetuity with growth' equation?

The following equation is called the Dividend Discount Model (DDM), Gordon Growth Model or the perpetuity with growth formula: ### P_0 = \frac{ C_1 }{ r - g } ###

What is ##g##? The value ##g## is the long term expected:

The first payment of a constant perpetual annual cash flow is received at time 5. Let this cash flow be ##C_5## and the required return be ##r##.

So there will be equal annual cash flows at time 5, 6, 7 and so on forever, and all of the cash flows will be equal so ##C_5 = C_6 = C_7 = ...##

When the perpetuity formula is used to value this stream of cash flows, it will give a value (V) at time:

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### P_{0} = \frac{C_1}{r_{\text{eff}} - g_{\text{eff}}} ###

What would you call the expression ## C_1/P_0 ##?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###P_0=\frac{d_1}{r-g}###

A stock pays dividends annually. It just paid a dividend, but the next dividend (##d_1##) will be paid in one year.

According to the DDM, what is the correct formula for the expected price of the stock in 2.5 years?

In the dividend discount model:

###P_0 = \dfrac{C_1}{r-g}###

The return ##r## is supposed to be the:

Two years ago Fred bought a house for $300,000.

Now it's worth $500,000, based on recent similar sales in the area.

Fred's residential property has an expected total return of 8% pa.

He rents his house out for $2,000 per month, paid in advance. Every 12 months he plans to increase the rental payments.

The present value of 12 months of rental payments is $23,173.86.

The future value of 12 months of rental payments one year ahead is $25,027.77.

What is the expected annual growth rate of the rental payments? In other words, by what percentage increase will Fred have to raise the monthly rent by each year to sustain the expected annual total return of 8%?

A share just paid its semi-annual dividend of $10. The dividend is expected to grow at 2% every 6 months forever. This 2% growth rate is an effective 6 month rate. Therefore the next dividend will be $10.20 in six months. The required return of the stock 10% pa, given as an effective annual rate.

What is the price of the share now?

A stock pays annual dividends which are expected to continue forever. It just paid a dividend of $10. The growth rate in the dividend is 2% pa. You estimate that the stock's required return is 10% pa. Both the discount rate and growth rate are given as effective annual rates. Using the dividend discount model, what will be the share price?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates. What is the current price of the stock?

A stock is expected to pay the following dividends:

| Cash Flows of a Stock | ||||||

| Time (yrs) | 0 | 1 | 2 | 3 | 4 | ... |

| Dividend ($) | 0.00 | 1.00 | 1.05 | 1.10 | 1.15 | ... |

After year 4, the annual dividend will grow in perpetuity at 5% pa, so;

- the dividend at t=5 will be $1.15(1+0.05),

- the dividend at t=6 will be $1.15(1+0.05)^2, and so on.

The required return on the stock is 10% pa. Both the growth rate and required return are given as effective annual rates.

What will be the price of the stock in three and a half years (t = 3.5)?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

### p_0 = \frac{d_1}{r - g} ###

Which expression is NOT equal to the expected dividend yield?

The following equation is the Dividend Discount Model, also known as the 'Gordon Growth Model' or the 'Perpetuity with growth' equation.

###p_0=\frac{d_1}{r_\text{eff}-g_\text{eff}}###

Which expression is NOT equal to the expected capital return?

A fairly valued share's current price is $4 and it has a total required return of 30%. Dividends are paid annually and next year's dividend is expected to be $1. After that, dividends are expected to grow by 5% pa in perpetuity. All rates are effective annual returns.

What is the expected dividend income paid at the end of the second year (t=2) and what is the expected capital gain from just after the first dividend (t=1) to just after the second dividend (t=2)? The answers are given in the same order, the dividend and then the capital gain.

A stock pays semi-annual dividends. It just paid a dividend of $10. The growth rate in the dividend is 1% every 6 months, given as an effective 6 month rate. You estimate that the stock's required return is 21% pa, as an effective annual rate.

Using the dividend discount model, what will be the share price?

Question 488 income and capital returns, payout policy, payout ratio, DDM

Two companies BigDiv and ZeroDiv are exactly the same except for their dividend payouts.

BigDiv pays large dividends and ZeroDiv doesn't pay any dividends.

Currently the two firms have the same earnings, assets, number of shares, share price, expected total return and risk.

Assume a perfect world with no taxes, no transaction costs, no asymmetric information and that all assets including business projects are fairly priced and therefore zero-NPV.

All things remaining equal, which of the following statements is NOT correct?

The boss of WorkingForTheManCorp has a wicked (and unethical) idea. He plans to pay his poor workers one week late so that he can get more interest on his cash in the bank.

Every week he is supposed to pay his 1,000 employees $1,000 each. So $1 million is paid to employees every week.

The boss was just about to pay his employees today, until he thought of this idea so he will actually pay them one week (7 days) later for the work they did last week and every week in the future, forever.

Bank interest rates are 10% pa, given as a real effective annual rate. So ##r_\text{eff annual, real} = 0.1## and the real effective weekly rate is therefore ##r_\text{eff weekly, real} = (1+0.1)^{1/52}-1 = 0.001834569##

All rates and cash flows are real, the inflation rate is 3% pa and there are 52 weeks per year. The boss will always pay wages one week late. The business will operate forever with constant real wages and the same number of employees.

What is the net present value (NPV) of the boss's decision to pay later?

Question 498 NPV, Annuity, perpetuity with growth, multi stage growth model

A business project is expected to cost $100 now (t=0), then pay $10 at the end of the third (t=3), fourth, fifth and sixth years, and then grow by 5% pa every year forever. So the cash flow will be $10.5 at the end of the seventh year (t=7), then $11.025 at the end of the eighth year (t=8) and so on perpetually. The total required return is 10℅ pa.

Which of the following formulas will NOT give the correct net present value of the project?

Estimate the US bank JP Morgan's share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- The major US banks JP Morgan Chase (JPM), Citi Group (C) and Wells Fargo (WFC) are comparable companies;

- JP Morgan Chase's historical earnings per share (EPS) is $4.37;

- Citi Group's share price is $50.05 and historical EPS is $4.26;

- Wells Fargo's share price is $48.98 and historical EPS is $3.89.

Note: Figures sourced from Google Finance on 24 March 2014.

Estimate the Chinese bank ICBC's share price using a backward-looking price earnings (PE) multiples approach with the following assumptions and figures only. Note that the renminbi (RMB) is the Chinese currency, also known as the yuan (CNY).

- The 4 major Chinese banks ICBC, China Construction Bank (CCB), Bank of China (BOC) and Agricultural Bank of China (ABC) are comparable companies;

- ICBC 's historical earnings per share (EPS) is RMB 0.74;

- CCB's backward-looking PE ratio is 4.59;

- BOC 's backward-looking PE ratio is 4.78;

- ABC's backward-looking PE ratio is also 4.78;

Note: Figures sourced from Google Finance on 25 March 2014. Share prices are from the Shanghai stock exchange.

Estimate Microsoft's (MSFT) share price using a price earnings (PE) multiples approach with the following assumptions and figures only:

- Apple, Google and Microsoft are comparable companies,

- Apple's (AAPL) share price is $526.24 and historical EPS is $40.32.

- Google's (GOOG) share price is $1,215.65 and historical EPS is $36.23.

- Micrsoft's (MSFT) historical earnings per share (EPS) is $2.71.

Source: Google Finance 28 Feb 2014.

Which of the following investable assets are NOT suitable for valuation using PE multiples techniques?

Which firms tend to have low forward-looking price-earnings (PE) ratios?

Only consider firms with positive earnings, disregard firms with negative earnings and therefore negative PE ratios.

Which firms tend to have low forward-looking price-earnings (PE) ratios? Only consider firms with positive PE ratios.

Private equity firms are known to buy medium sized private companies operating in the same industry, merge them together into a larger company, and then sell it off in a public float (initial public offering, IPO).

If medium-sized private companies trade at PE ratios of 5 and larger listed companies trade at PE ratios of 15, what return can be achieved from this strategy?

Assume that:

- The medium-sized companies can be bought, merged and sold in an IPO instantaneously.

- There are no costs of finding, valuing, merging and restructuring the medium sized companies. Also, there is no competition to buy the medium-sized companies from other private equity firms.

- The large merged firm's earnings are the sum of the medium firms' earnings.

- The only reason for the difference in medium and large firm's PE ratios is due to the illiquidity of the medium firms' shares.

- Return is defined as: ##r_{0→1} = (p_1-p_0+c_1)/p_0## , where time zero is just before the merger and time one is just after.

A low-quality second-hand car can be bought now for $1,000 and will last for 1 year before it will be scrapped for nothing.

A high-quality second-hand car can be bought now for $4,900 and it will last for 5 years before it will be scrapped for nothing.

What is the equivalent annual cost of each car? Assume a discount rate of 10% pa, given as an effective annual rate.

The answer choices are given as the equivalent annual cost of the low-quality car and then the high quality car.

Question 180 equivalent annual cash flow, inflation, real and nominal returns and cash flows

Details of two different types of light bulbs are given below:

- Low-energy light bulbs cost $3.50, have a life of nine years, and use about $1.60 of electricity a year, paid at the end of each year.

- Conventional light bulbs cost only $0.50, but last only about a year and use about $6.60 of energy a year, paid at the end of each year.

The real discount rate is 5%, given as an effective annual rate. Assume that all cash flows are real. The inflation rate is 3% given as an effective annual rate.

Find the Equivalent Annual Cost (EAC) of the low-energy and conventional light bulbs. The below choices are listed in that order.

You're advising your superstar client 40-cent who is weighing up buying a private jet or a luxury yacht. 40-cent is just as happy with either, but he wants to go with the more cost-effective option. These are the cash flows of the two options:

- The private jet can be bought for $6m now, which will cost $12,000 per month in fuel, piloting and airport costs, payable at the end of each month. The jet will last for 12 years.

- Or the luxury yacht can be bought for $4m now, which will cost $20,000 per month in fuel, crew and berthing costs, payable at the end of each month. The yacht will last for 20 years.

What's unusual about 40-cent is that he is so famous that he will actually be able to sell his jet or yacht for the same price as it was bought since the next generation of superstar musicians will buy it from him as a status symbol.

Bank interest rates are 10% pa, given as an effective annual rate. You can assume that 40-cent will live for another 60 years and that when the jet or yacht's life is at an end, he will buy a new one with the same details as above.

Would you advise 40-cent to buy the or the ?

Note that the effective monthly rate is ##r_\text{eff monthly}=(1+0.1)^{1/12}-1=0.00797414##

Carlos and Edwin are brothers and they both love Holden Commodore cars.

Carlos likes to buy the latest Holden Commodore car for $40,000 every 4 years as soon as the new model is released. As soon as he buys the new car, he sells the old one on the second hand car market for $20,000. Carlos never has to bother with paying for repairs since his cars are brand new.

Edwin also likes Commodores, but prefers to buy 4-year old cars for $20,000 and keep them for 11 years until the end of their life (new ones last for 15 years in total but the 4-year old ones only last for another 11 years). Then he sells the old car for $2,000 and buys another 4-year old second hand car, and so on.

Every time Edwin buys a second hand 4 year old car he immediately has to spend $1,000 on repairs, and then $1,000 every year after that for the next 10 years. So there are 11 payments in total from when the second hand car is bought at t=0 to the last payment at t=10. One year later (t=11) the old car is at the end of its total 15 year life and can be scrapped for $2,000.

Assuming that Carlos and Edwin maintain their love of Commodores and keep up their habits of buying new ones and second hand ones respectively, how much larger is Carlos' equivalent annual cost of car ownership compared with Edwin's?

The real discount rate is 10% pa. All cash flows are real and are expected to remain constant. Inflation is forecast to be 3% pa. All rates are effective annual. Ignore capital gains tax and tax savings from depreciation since cars are tax-exempt for individuals.

Question 215 equivalent annual cash flow, effective rate conversion

You're about to buy a car. These are the cash flows of the two different cars that you can buy:

- You can buy an old car for $5,000 now, for which you will have to buy $90 of fuel at the end of each week from the date of purchase. The old car will last for 3 years, at which point you will sell the old car for $500.

- Or you can buy a new car for $14,000 now for which you will have to buy $50 of fuel at the end of each week from the date of purchase. The new car will last for 4 years, at which point you will sell the new car for $1,000.

Bank interest rates are 10% pa, given as an effective annual rate. Assume that there are exactly 52 weeks in a year. Ignore taxes and environmental and pollution factors.

Should you buy the or the ?

You own a nice suit which you wear once per week on nights out. You bought it one year ago for $600. In your experience, suits used once per week last for 6 years. So you expect yours to last for another 5 years.

Your younger brother said that retro is back in style so he wants to wants to borrow your suit once a week when he goes out. With the increased use, your suit will only last for another 4 years rather than 5.

What is the present value of the cost of letting your brother use your current suit for the next 4 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new suit when your current one wears out and your brother will not use the new one; your brother will only use your current suit so he will only use it for the next four years; and the price of a new suit never changes.

You own some nice shoes which you use once per week on date nights. You bought them 2 years ago for $500. In your experience, shoes used once per week last for 6 years. So you expect yours to last for another 4 years.

Your younger sister said that she wants to borrow your shoes once per week. With the increased use, your shoes will only last for another 2 years rather than 4.

What is the present value of the cost of letting your sister use your current shoes for the next 2 years?

Assume: that bank interest rates are 10% pa, given as an effective annual rate; you will buy a new pair of shoes when your current pair wears out and your sister will not use the new ones; your sister will only use your current shoes so she will only use it for the next 2 years; and the price of new shoes never changes.

Which of the following statements is NOT equivalent to the yield on debt?

Assume that the debt being referred to is fairly priced, but do not assume that it's priced at par.

Which of the below statements about effective rates and annualised percentage rates (APR's) is NOT correct?

Which of the following statements about effective rates and annualised percentage rates (APR's) is NOT correct?

A credit card offers an interest rate of 18% pa, compounding monthly.

Find the effective monthly rate, effective annual rate and the effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff monthly} , r_\text{eff yearly} , r_\text{eff daily} ###

A European bond paying annual coupons of 6% offers a yield of 10% pa.

Convert the yield into an effective monthly rate, an effective annual rate and an effective daily rate. Assume that there are 365 days in a year.

All answers are given in the same order:

### r_\text{eff, monthly} , r_\text{eff, yearly} , r_\text{eff, daily} ###

Calculate the effective annual rates of the following three APR's:

- A credit card offering an interest rate of 18% pa, compounding monthly.

- A bond offering a yield of 6% pa, compounding semi-annually.

- An annual dividend-paying stock offering a return of 10% pa compounding annually.

All answers are given in the same order:

##r_\text{credit card, eff yrly}##, ##r_\text{bond, eff yrly}##, ##r_\text{stock, eff yrly}##

Question 49 inflation, real and nominal returns and cash flows, APR, effective rate

In Australia, nominal yields on semi-annual coupon paying Government Bonds with 2 years until maturity are currently 2.83% pa.

The inflation rate is currently 2.2% pa, given as an APR compounding per quarter. The inflation rate is not expected to change over the next 2 years.

What is the real yield on these bonds, given as an APR compounding every 6 months?

Question 64 inflation, real and nominal returns and cash flows, APR, effective rate

In Germany, nominal yields on semi-annual coupon paying Government Bonds with 2 years until maturity are currently 0.04% pa.

The inflation rate is currently 1.4% pa, given as an APR compounding per quarter. The inflation rate is not expected to change over the next 2 years.

What is the real yield on these bonds, given as an APR compounding every 6 months?

You want to buy an apartment priced at $300,000. You have saved a deposit of $30,000. The bank has agreed to lend you the $270,000 as a fully amortising loan with a term of 25 years. The interest rate is 12% pa and is not expected to change.

What will be your monthly payments? Remember that mortgage loan payments are paid in arrears (at the end of the month).

You want to buy an apartment worth $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as a fully amortising mortgage loan with a term of 25 years. The interest rate is 6% pa and is not expected to change.

What will be your monthly payments?

You want to buy an apartment worth $400,000. You have saved a deposit of $80,000. The bank has agreed to lend you the $320,000 as a fully amortising mortgage loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

You want to buy an apartment priced at $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as a fully amortising loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $2,000 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 5 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $1,500 per month. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 10 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change.

You just signed up for a 30 year fully amortising mortgage loan with monthly payments of $1,500 per month. The interest rate is 9% pa which is not expected to change.

To your surprise, you can actually afford to pay $2,000 per month and your mortgage allows early repayments without fees. If you maintain these higher monthly payments, how long will it take to pay off your mortgage?

You just agreed to a 30 year fully amortising mortgage loan with monthly payments of $2,500. The interest rate is 9% pa which is not expected to change.

How much did you borrow? After 10 years, how much will be owing on the mortgage? The interest rate is still 9% and is not expected to change. The below choices are given in the same order.

You want to buy a house priced at $400,000. You have saved a deposit of $40,000. The bank has agreed to lend you $360,000 as a fully amortising loan with a term of 30 years. The interest rate is 8% pa payable monthly and is not expected to change.

What will be your monthly payments?

You want to buy an apartment priced at $300,000. You have saved a deposit of $30,000. The bank has agreed to lend you the $270,000 as an interest only loan with a term of 25 years. The interest rate is 12% pa and is not expected to change.

What will be your monthly payments? Remember that mortgage payments are paid in arrears (at the end of the month).

You just signed up for a 30 year interest-only mortgage with monthly payments of $3,000 per month. The interest rate is 6% pa which is not expected to change.

How much did you borrow? After 15 years, just after the 180th payment at that time, how much will be owing on the mortgage? The interest rate is still 6% and is not expected to change. Remember that the mortgage is interest-only and that mortgage payments are paid in arrears (at the end of the month).

You want to buy an apartment worth $300,000. You have saved a deposit of $60,000.

The bank has agreed to lend you $240,000 as an interest only mortgage loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

You want to buy an apartment priced at $500,000. You have saved a deposit of $50,000. The bank has agreed to lend you the $450,000 as an interest only loan with a term of 30 years. The interest rate is 6% pa and is not expected to change. What will be your monthly payments?

Question 239 income and capital returns, inflation, real and nominal returns and cash flows, interest only loan

A bank grants a borrower an interest-only residential mortgage loan with a very large 50% deposit and a nominal interest rate of 6% that is not expected to change. Assume that inflation is expected to be a constant 2% pa over the life of the loan. Ignore credit risk.

From the bank's point of view, what is the long term expected nominal capital return of the loan asset?

A prospective home buyer can afford to pay $2,000 per month in mortgage loan repayments. The central bank recently lowered its policy rate by 0.25%, and residential home lenders cut their mortgage loan rates from 4.74% to 4.49%.

How much more can the prospective home buyer borrow now that interest rates are 4.49% rather than 4.74%? Give your answer as a proportional increase over the original amount he could borrow (##V_\text{before}##), so:

###\text{Proportional increase} = \frac{V_\text{after}-V_\text{before}}{V_\text{before}} ###Assume that:

- Interest rates are expected to be constant over the life of the loan.

- Loans are interest-only and have a life of 30 years.

- Mortgage loan payments are made every month in arrears and all interest rates are given as annualised percentage rates compounding per month.

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid annually. So there's only one coupon per year, paid in arrears every year.

Calculate the price of a newly issued ten year bond with a face value of $100, a yield of 8% pa and a fixed coupon rate of 6% pa, paid semi-annually. So there are two coupons per year, paid in arrears every six months.

For a price of $100, Vera will sell you a 2 year bond paying semi-annual coupons of 10% pa. The face value of the bond is $100. Other bonds with similar risk, maturity and coupon characteristics trade at a yield of 8% pa.

For a price of $95, Nicole will sell you a 10 year bond paying semi-annual coupons of 8% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 8% pa.

Bonds X and Y are issued by the same US company. Both bonds yield 10% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X and Y's coupon rates are 8 and 12% pa respectively. Which of the following statements is true?

A two year Government bond has a face value of $100, a yield of 0.5% and a fixed coupon rate of 0.5%, paid semi-annually. What is its price?

Question 48 IRR, NPV, bond pricing, premium par and discount bonds, market efficiency

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

Question 56 income and capital returns, bond pricing, premium par and discount bonds

Which of the following statements about risk free government bonds is NOT correct?

Hint: Total return can be broken into income and capital returns as follows:

###\begin{aligned} r_\text{total} &= \frac{c_1}{p_0} + \frac{p_1-p_0}{p_0} \\ &= r_\text{income} + r_\text{capital} \end{aligned} ###

The capital return is the growth rate of the price.

The income return is the periodic cash flow. For a bond this is the coupon payment.

The theory of fixed interest bond pricing is an application of the theory of Net Present Value (NPV). Also, a 'fairly priced' asset is not over- or under-priced. Buying or selling a fairly priced asset has an NPV of zero.

Considering this, which of the following statements is NOT correct?

A bond maturing in 10 years has a coupon rate of 4% pa, paid semi-annually. The bond's yield is currently 6% pa. The face value of the bond is $100. What is its price?

Bonds A and B are issued by the same Australian company. Both bonds yield 7% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond A pays coupons of 10% pa and bond B pays coupons of 5% pa. Which of the following statements is true about the bonds' prices?

A three year bond has a fixed coupon rate of 12% pa, paid semi-annually. The bond's yield is currently 6% pa. The face value is $100. What is its price?

Bonds X and Y are issued by different companies, but they both pay a semi-annual coupon of 10% pa and they have the same face value ($100), maturity (3 years) and yield (10%) as each other.

Which of the following statements is true?

A four year bond has a face value of $100, a yield of 6% and a fixed coupon rate of 12%, paid semi-annually. What is its price?

Which one of the following bonds is trading at a discount?

A firm wishes to raise $20 million now. They will issue 8% pa semi-annual coupon bonds that will mature in 5 years and have a face value of $100 each. Bond yields are 6% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

A five year bond has a face value of $100, a yield of 12% and a fixed coupon rate of 6%, paid semi-annually.

What is the bond's price?

Which one of the following bonds is trading at par?

A firm wishes to raise $8 million now. They will issue 7% pa semi-annual coupon bonds that will mature in 10 years and have a face value of $100 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue?

Question 207 income and capital returns, bond pricing, coupon rate, no explanation

For a bond that pays fixed semi-annual coupons, how is the annual coupon rate defined, and how is the bond's annual income yield from time 0 to 1 defined mathematically?

Let: ##P_0## be the bond price now,

##F_T## be the bond's face value,

##T## be the bond's maturity in years,

##r_\text{total}## be the bond's total yield,

##r_\text{income}## be the bond's income yield,

##r_\text{capital}## be the bond's capital yield, and

##C_t## be the bond's coupon at time t in years. So ##C_{0.5}## is the coupon in 6 months, ##C_1## is the coupon in 1 year, and so on.

Which one of the following bonds is trading at a premium?

An investor bought two fixed-coupon bonds issued by the same company, a zero-coupon bond and a 7% pa semi-annual coupon bond. Both bonds have a face value of $1,000, mature in 10 years, and had a yield at the time of purchase of 8% pa.

A few years later, yields fell to 6% pa. Which of the following statements is correct? Note that a capital gain is an increase in price.

A firm wishes to raise $10 million now. They will issue 6% pa semi-annual coupon bonds that will mature in 8 years and have a face value of $1,000 each. Bond yields are 10% pa, given as an APR compounding every 6 months, and the yield curve is flat.

How many bonds should the firm issue? All numbers are rounded up.

A four year bond has a face value of $100, a yield of 9% and a fixed coupon rate of 6%, paid semi-annually. What is its price?

In these tough economic times, central banks around the world have cut interest rates so low that they are practically zero. In some countries, government bond yields are also very close to zero.

A three year government bond with a face value of $100 and a coupon rate of 2% pa paid semi-annually was just issued at a yield of 0%. What is the price of the bond?

A 10 year bond has a face value of $100, a yield of 6% pa and a fixed coupon rate of 8% pa, paid semi-annually. What is its price?

A 30 year Japanese government bond was just issued at par with a yield of 1.7% pa. The fixed coupon payments are semi-annual. The bond has a face value of $100.

Six months later, just after the first coupon is paid, the yield of the bond increases to 2% pa. What is the bond's new price?

A 10 year Australian government bond was just issued at par with a yield of 3.9% pa. The fixed coupon payments are semi-annual. The bond has a face value of $1,000.

Six months later, just after the first coupon is paid, the yield of the bond decreases to 3.65% pa. What is the bond's new price?

Bonds X and Y are issued by the same US company. Both bonds yield 6% pa, and they have the same face value ($100), maturity, seniority, and payment frequency.

The only difference is that bond X pays coupons of 8% pa and bond Y pays coupons of 12% pa. Which of the following statements is true?

Below are some statements about loans and bonds. The first descriptive sentence is correct. But one of the second sentences about the loans' or bonds' prices is not correct. Which statement is NOT correct? Assume that interest rates are positive.

Note that coupons or interest payments are the periodic payments made throughout a bond or loan's life. The face or par value of a bond or loan is the amount paid at the end when the debt matures.

Suppose you had $100 in a savings account and the interest rate was 2% per year.

After 5 years, how much do you think you would have in the account if you left the money to grow?

Jan asks you for a loan. He wants $100 now and offers to pay you back $120 in 1 year. You can borrow and lend from the bank at an interest rate of 10% pa, given as an effective annual rate.

Ignore credit risk. Remember:

### V_0 = \frac{V_t}{(1+r_\text{eff})^t} ###

For a price of $6, Carlos will sell you a share which will pay a dividend of $1 in one year and every year after that forever. The required return of the stock is 10% pa.

For a price of $102, Andrea will sell you a share which just paid a dividend of $10 yesterday, and is expected to pay dividends every year forever, growing at a rate of 5% pa.

So the next dividend will be ##10(1+0.05)^1=$10.50## in one year from now, and the year after it will be ##10(1+0.05)^2=11.025## and so on.

The required return of the stock is 15% pa.

For a price of $10.20 each, Renee will sell you 100 shares. Each share is expected to pay dividends in perpetuity, growing at a rate of 5% pa. The next dividend is one year away (t=1) and is expected to be $1 per share.

The required return of the stock is 15% pa.

Find World Bar's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| World Bar | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 300 | |

| COGS | 150 | |

| Operating expense | 50 | |

| Depreciation | 40 | |

| Interest expense | 10 | |

| Taxable income | 50 | |

| Tax at 30% | 15 | |

| Net income | 35 | |

| World Bar | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 200 | 230 |

| PPE | ||

| Cost | 400 | 400 |

| Accumul. depr. | 75 | 35 |

| Carrying amount | 325 | 365 |

| Total assets | 525 | 595 |

| Liabilities | ||

| Current liabilities | 150 | 205 |

| Non-current liabilities | 235 | 250 |

| Owners' equity | ||

| Retained earnings | 100 | 100 |

| Contributed equity | 40 | 40 |

| Total L and OE | 525 | 595 |

Note: all figures above and below are given in millions of dollars ($m).

For a price of $100, Carol will sell you a 5 year bond paying semi-annual coupons of 16% pa. The face value of the bond is $100. Other bonds with similar risk, maturity and coupon characteristics trade at a yield of 12% pa.

For a price of $100, Rad will sell you a 5 year bond paying semi-annual coupons of 16% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 6% pa.

For a price of $100, Andrea will sell you a 2 year bond paying annual coupons of 10% pa. The face value of the bond is $100. Other bonds with the same risk, maturity and coupon characteristics trade at a yield of 6% pa.

A person is thinking about borrowing $100 from the bank at 7% pa and investing it in shares with an expected return of 10% pa. One year later the person intends to sell the shares and pay back the loan in full. Both the loan and the shares are fairly priced.

What is the Net Present Value (NPV) of this one year investment? Note that you are asked to find the present value (##V_0##), not the value in one year (##V_1##).

A company increases the proportion of debt funding it uses to finance its assets by issuing bonds and using the cash to repurchase stock, leaving assets unchanged.

Ignoring the costs of financial distress, which of the following statements is NOT correct:

Which one of the following will have no effect on net income (NI) but decrease cash flow from assets (CFFA or FFCF) in this year for a tax-paying firm, all else remaining constant?

Remember:

###NI=(Rev-COGS-FC-Depr-IntExp).(1-t_c )### ###CFFA=NI+Depr-CapEx - ΔNWC+IntExp###Over the next year, the management of an unlevered company plans to:

- Make $5m in sales, $1.9m in net income and $2m in equity free cash flow (EFCF).

- Pay dividends of $1m.

- Complete a $1.3m share buy-back.

Assume that:

- All amounts are received and paid at the end of the year so you can ignore the time value of money.

- The firm has sufficient retained profits to legally pay the dividend and complete the buy back.

- The firm plans to run a very tight ship, with no excess cash above operating requirements currently or over the next year.

How much new equity financing will the company need? In other words, what is the value of new shares that will need to be issued?

Read the following financial statements and calculate the firm's free cash flow over the 2014 financial year.

| UBar Corp | ||

| Income Statement for | ||

| year ending 30th June 2014 | ||

| $m | ||

| Sales | 293 | |

| COGS | 200 | |

| Rent expense | 15 | |

| Gas expense | 8 | |

| Depreciation | 10 | |

| EBIT | 60 | |

| Interest expense | 0 | |

| Taxable income | 60 | |

| Taxes | 18 | |

| Net income | 42 | |

| UBar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2014 | 2013 |

| $m | $m | |

| Assets | ||

| Cash | 30 | 29 |

| Accounts receivable | 5 | 7 |

| Pre-paid rent expense | 1 | 0 |

| Inventory | 50 | 46 |

| PPE | 290 | 300 |

| Total assets | 376 | 382 |

| Liabilities | ||

| Trade payables | 20 | 18 |

| Accrued gas expense | 3 | 2 |

| Non-current liabilities | 0 | 0 |

| Contributed equity | 212 | 212 |

| Retained profits | 136 | 150 |

| Asset revaluation reserve | 5 | 0 |

| Total L and OE | 376 | 382 |

Note: all figures are given in millions of dollars ($m).

The firm's free cash flow over the 2014 financial year was:

Find Trademark Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Trademark Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 100 | |

| COGS | 25 | |

| Operating expense | 5 | |

| Depreciation | 20 | |

| Interest expense | 20 | |

| Income before tax | 30 | |

| Tax at 30% | 9 | |

| Net income | 21 | |

| Trademark Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 120 | 80 |

| PPE | ||

| Cost | 150 | 140 |

| Accumul. depr. | 60 | 40 |

| Carrying amount | 90 | 100 |

| Total assets | 210 | 180 |

| Liabilities | ||

| Current liabilities | 75 | 65 |

| Non-current liabilities | 75 | 55 |

| Owners' equity | ||

| Retained earnings | 10 | 10 |

| Contributed equity | 50 | 50 |

| Total L and OE | 210 | 180 |

Note: all figures are given in millions of dollars ($m).

Find UniBar Corp's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| UniBar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 80 | |

| COGS | 40 | |

| Operating expense | 15 | |

| Depreciation | 10 | |

| Interest expense | 5 | |

| Income before tax | 10 | |

| Tax at 30% | 3 | |

| Net income | 7 | |

| UniBar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 120 | 90 |

| PPE | ||

| Cost | 360 | 320 |

| Accumul. depr. | 40 | 30 |

| Carrying amount | 320 | 290 |

| Total assets | 440 | 380 |

| Liabilities | ||

| Current liabilities | 110 | 60 |

| Non-current liabilities | 190 | 180 |

| Owners' equity | ||

| Retained earnings | 95 | 95 |

| Contributed equity | 45 | 45 |

| Total L and OE | 440 | 380 |

Note: all figures are given in millions of dollars ($m).

Find Piano Bar's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Piano Bar | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 310 | |

| COGS | 185 | |

| Operating expense | 20 | |

| Depreciation | 15 | |

| Interest expense | 10 | |

| Income before tax | 80 | |

| Tax at 30% | 24 | |

| Net income | 56 | |

| Piano Bar | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Assets | ||

| Current assets | 240 | 230 |

| PPE | ||

| Cost | 420 | 400 |

| Accumul. depr. | 50 | 35 |

| Carrying amount | 370 | 365 |

| Total assets | 610 | 595 |

| Liabilities | ||

| Current liabilities | 180 | 190 |

| Non-current liabilities | 290 | 265 |

| Owners' equity | ||

| Retained earnings | 90 | 90 |

| Contributed equity | 50 | 50 |

| Total L and OE | 610 | 595 |

Note: all figures are given in millions of dollars ($m).

Find Scubar Corporation's Cash Flow From Assets (CFFA), also known as Free Cash Flow to the Firm (FCFF), over the year ending 30th June 2013.

| Scubar Corp | ||

| Income Statement for | ||

| year ending 30th June 2013 | ||

| $m | ||

| Sales | 200 | |

| COGS | 60 | |

| Depreciation | 20 | |

| Rent expense | 11 | |

| Interest expense | 19 | |

| Taxable Income | 90 | |

| Taxes at 30% | 27 | |

| Net income | 63 | |

| Scubar Corp | ||

| Balance Sheet | ||

| as at 30th June | 2013 | 2012 |

| $m | $m | |

| Inventory | 60 | 50 |

| Trade debtors | 19 | 6 |

| Rent paid in advance | 3 | 2 |

| PPE | 420 | 400 |

| Total assets | 502 | 458 |

| Trade creditors | 10 | 8 |

| Bond liabilities | 200 | 190 |

| Contributed equity | 130 | 130 |

| Retained profits | 162 | 130 |

| Total L and OE | 502 | 458 |

Note: All figures are given in millions of dollars ($m).

The cash flow from assets was:

Find the cash flow from assets (CFFA) of the following project.

| Project Data | ||

| Project life | 2 years | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year for tax purposes | $1m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $3 | |

| Fixed costs per year, paid at the end of each year | $1.5m | |

| Tax rate | 30% | |

Note 1: The equipment will have a book value of $4m at the end of the project for tax purposes. However, the equipment is expected to fetch $0.9 million when it is sold at t=2.

Note 2: Due to the project, the firm will have to purchase $0.8m of inventory initially, which it will sell at t=1. The firm will buy another $0.8m at t=1 and sell it all again at t=2 with zero inventory left. The project will have no effect on the firm's current liabilities.

Find the project's CFFA at time zero, one and two. Answers are given in millions of dollars ($m).

Your friend just bought a house for $400,000. He financed it using a $320,000 mortgage loan and a deposit of $80,000.

In the context of residential housing and mortgages, the 'equity' tied up in the value of a person's house is the value of the house less the value of the mortgage. So the initial equity your friend has in his house is $80,000. Let this amount be E, let the value of the mortgage be D and the value of the house be V. So ##V=D+E##.

If house prices suddenly fall by 10%, what would be your friend's percentage change in equity (E)? Assume that the value of the mortgage is unchanged and that no income (rent) was received from the house during the short time over which house prices fell.

Remember:

### r_{0\rightarrow1}=\frac{p_1-p_0+c_1}{p_0} ###

where ##r_{0-1}## is the return (percentage change) of an asset with price ##p_0## initially, ##p_1## one period later, and paying a cash flow of ##c_1## at time ##t=1##.

Interest expense (IntExp) is an important part of a company's income statement (or 'profit and loss' or 'statement of financial performance').

How does an accountant calculate the annual interest expense of a fixed-coupon bond that has a liquid secondary market? Select the most correct answer:

Annual interest expense is equal to:

A retail furniture company buys furniture wholesale and distributes it through its retail stores. The owner believes that she has some good ideas for making stylish new furniture. She is considering a project to buy a factory and employ workers to manufacture the new furniture she's designed. Furniture manufacturing has more systematic risk than furniture retailing.

Her furniture retailing firm's after-tax WACC is 20%. Furniture manufacturing firms have an after-tax WACC of 30%. Both firms are optimally geared. Assume a classical tax system.

Which method(s) will give the correct valuation of the new furniture-making project? Select the most correct answer.

There are many ways to calculate a firm's free cash flow (FFCF), also called cash flow from assets (CFFA). Some include the annual interest tax shield in the cash flow and some do not.

Which of the below FFCF formulas include the interest tax shield in the cash flow?

###(1) \quad FFCF=NI + Depr - CapEx -ΔNWC + IntExp### ###(2) \quad FFCF=NI + Depr - CapEx -ΔNWC + IntExp.(1-t_c)### ###(3) \quad FFCF=EBIT.(1-t_c )+ Depr- CapEx -ΔNWC+IntExp.t_c### ###(4) \quad FFCF=EBIT.(1-t_c) + Depr- CapEx -ΔNWC### ###(5) \quad FFCF=EBITDA.(1-t_c )+Depr.t_c- CapEx -ΔNWC+IntExp.t_c### ###(6) \quad FFCF=EBITDA.(1-t_c )+Depr.t_c- CapEx -ΔNWC### ###(7) \quad FFCF=EBIT-Tax + Depr - CapEx -ΔNWC### ###(8) \quad FFCF=EBIT-Tax + Depr - CapEx -ΔNWC-IntExp.t_c### ###(9) \quad FFCF=EBITDA-Tax - CapEx -ΔNWC### ###(10) \quad FFCF=EBITDA-Tax - CapEx -ΔNWC-IntExp.t_c###The formulas for net income (NI also called earnings), EBIT and EBITDA are given below. Assume that depreciation and amortisation are both represented by 'Depr' and that 'FC' represents fixed costs such as rent.

###NI=(Rev - COGS - Depr - FC - IntExp).(1-t_c )### ###EBIT=Rev - COGS - FC-Depr### ###EBITDA=Rev - COGS - FC### ###Tax =(Rev - COGS - Depr - FC - IntExp).t_c= \dfrac{NI.t_c}{1-t_c}###One formula for calculating a levered firm's free cash flow (FFCF, or CFFA) is to use earnings before interest and tax (EBIT).

###\begin{aligned} FFCF &= (EBIT)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp.t_c \\ &= (Rev - COGS - Depr - FC)(1-t_c) + Depr - CapEx -\Delta NWC + IntExp.t_c \\ \end{aligned} \\###

One formula for calculating a levered firm's free cash flow (FFCF, or CFFA) is to use net operating profit after tax (NOPAT).

###\begin{aligned} FFCF &= NOPAT + Depr - CapEx -\Delta NWC \\ &= (Rev - COGS - Depr - FC)(1-t_c) + Depr - CapEx -\Delta NWC \\ \end{aligned} \\###

Question 69 interest tax shield, capital structure, leverage, WACC

Which statement about risk, required return and capital structure is the most correct?

A company issues a large amount of bonds to raise money for new projects of similar risk to the company's existing projects. The net present value (NPV) of the new projects is positive but small. Assume a classical tax system. Which statement is NOT correct?

A firm is considering a new project of similar risk to the current risk of the firm. This project will expand its existing business. The cash flows of the project have been calculated assuming that there is no interest expense. In other words, the cash flows assume that the project is all-equity financed.

In fact the firm has a target debt-to-equity ratio of 1, so the project will be financed with 50% debt and 50% equity. To find the levered value of the firm's assets, what discount rate should be applied to the project's unlevered cash flows? Assume a classical tax system.

A firm has a debt-to-assets ratio of 50%. The firm then issues a large amount of equity to raise money for new projects of similar systematic risk to the company's existing projects. Assume a classical tax system. Which statement is correct?

Question 121 capital structure, leverage, financial distress, interest tax shield

Fill in the missing words in the following sentence:

All things remaining equal, as a firm's amount of debt funding falls, benefits of interest tax shields __________ and the costs of financial distress __________.

A firm plans to issue equity and use the cash raised to pay off its debt. No assets will be bought or sold. Ignore the costs of financial distress.

Which of the following statements is NOT correct, all things remaining equal?

Question 337 capital structure, interest tax shield, leverage, real and nominal returns and cash flows, multi stage growth model

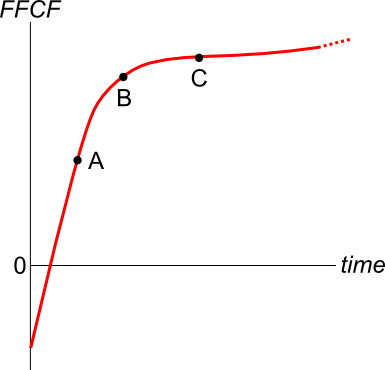

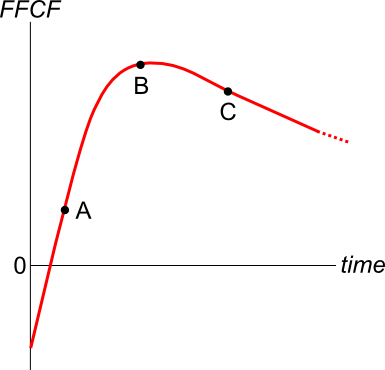

A fast-growing firm is suitable for valuation using a multi-stage growth model.

It's nominal unlevered cash flow from assets (##CFFA_U##) at the end of this year (t=1) is expected to be $1 million. After that it is expected to grow at a rate of:

- 12% pa for the next two years (from t=1 to 3),

- 5% over the fourth year (from t=3 to 4), and

- -1% forever after that (from t=4 onwards). Note that this is a negative one percent growth rate.

Assume that:

- The nominal WACC after tax is 9.5% pa and is not expected to change.

- The nominal WACC before tax is 10% pa and is not expected to change.

- The firm has a target debt-to-equity ratio that it plans to maintain.

- The inflation rate is 3% pa.

- All rates are given as nominal effective annual rates.

What is the levered value of this fast growing firm's assets?

Question 559 variance, standard deviation, covariance, correlation

Which of the following statements about standard statistical mathematics notation is NOT correct?

Diversification in a portfolio of two assets works best when the correlation between their returns is:

All things remaining equal, the variance of a portfolio of two positively-weighted stocks rises as:

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation ##(\rho_{A,B})## | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the standard deviation (not variance) of returns of the above portfolio?

Two risky stocks A and B comprise an equal-weighted portfolio. The correlation between the stocks' returns is 70%.

If the variance of stock A's returns increases but the:

- Prices and expected returns of each stock stays the same,

- Variance of stock B's returns stays the same,

- Correlation of returns between the stocks stays the same.

Which of the following statements is NOT correct?

All things remaining equal, the higher the correlation of returns between two stocks:

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 6% pa.

- Stock A has an expected return of 5% pa.

- Stock B has an expected return of 10% pa.

What portfolio weights should the investor have in stocks A and B respectively?

Question 556 portfolio risk, portfolio return, standard deviation

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 12% pa.

- Stock A has an expected return of 10% pa and a standard deviation of 20% pa.

- Stock B has an expected return of 15% pa and a standard deviation of 30% pa.

The correlation coefficient between stock A and B's expected returns is 70%.

What will be the annual standard deviation of the portfolio with this 12% pa target return?

What is the correlation of a variable X with itself?

The corr(X, X) or ##\rho_{X,X}## equals:

Let the variance of returns for a share per month be ##\sigma_\text{monthly}^2##.

What is the formula for the variance of the share's returns per year ##(\sigma_\text{yearly}^2)##?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

Question 119 market efficiency, fundamental analysis, joint hypothesis problem

Your friend claims that by reading 'The Economist' magazine's economic news articles, she can identify shares that will have positive abnormal expected returns over the next 2 years. Assuming that her claim is true, which statement(s) are correct?

(i) Weak form market efficiency is broken.

(ii) Semi-strong form market efficiency is broken.

(iii) Strong form market efficiency is broken.

(iv) The asset pricing model used to measure the abnormal returns (such as the CAPM) is either wrong (mis-specification error) or is measured using the wrong inputs (data errors) so the returns may not be abnormal but rather fair for the level of risk.

Select the most correct response:

Government bonds currently have a return of 5% pa. A stock has an expected return of 6% pa and the market return is 7% pa. What is the beta of the stock?

Stock A has a beta of 0.5 and stock B has a beta of 1. Which statement is NOT correct?

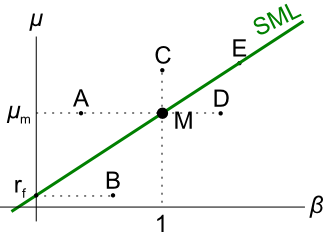

Question 244 CAPM, SML, NPV, risk

Examine the following graph which shows stocks' betas ##(\beta)## and expected returns ##(\mu)##:

Assume that the CAPM holds and that future expectations of stocks' returns and betas are correctly measured. Which statement is NOT correct?

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation | Beta | Dollars invested |

|

| A | 0.2 | 0.4 | 0.12 | 0.5 | 40 | |

| B | 0.3 | 0.8 | 1.5 | 80 | ||

What is the beta of the above portfolio?

Which statement(s) are correct?

(i) All stocks that plot on the Security Market Line (SML) are fairly priced.

(ii) All stocks that plot above the Security Market Line (SML) are overpriced.

(iii) All fairly priced stocks that plot on the Capital Market Line (CML) have zero idiosyncratic risk.

Select the most correct response:

A managed fund charges fees based on the amount of money that you keep with them. The fee is 2% of the end-of-year amount, paid at the end of every year.

This fee is charged regardless of whether the fund makes gains or losses on your money.

The fund offers to invest your money in shares which have an expected return of 10% pa before fees.

You are thinking of investing $100,000 in the fund and keeping it there for 40 years when you plan to retire.

How much money do you expect to have in the fund in 40 years? Also, what is the future value of the fees that the fund expects to earn from you? Give both amounts as future values in 40 years. Assume that:

- The fund has no private information.

- Markets are weak and semi-strong form efficient.

- The fund's transaction costs are negligible.

- The cost and trouble of investing your money in shares by yourself, without the managed fund, is negligible.

- The fund invests its fees in the same companies as it invests your funds in, but with no fees.

The below answer choices list your expected wealth in 40 years, and then the fund's expected wealth in 40 years.

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Assume that there are no dividend payments so the entire 15% total return is all capital return.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% return lasts for the next 100 years (t=0 to 100), then reverts to 10% pa after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant. All returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

The average weekly earnings of an Australian adult worker before tax was $1,542.40 per week in November 2014 according to the Australian Bureau of Statistics. Therefore average annual earnings before tax were $80,204.80 assuming 52 weeks per year. Personal income tax rates published by the Australian Tax Office are reproduced for the 2014-2015 financial year in the table below:

| Taxable income | Tax on this income |

|---|---|

| 0 – $18,200 | Nil |

| $18,201 – $37,000 | 19c for each $1 over $18,200 |

| $37,001 – $80,000 | $3,572 plus 32.5c for each $1 over $37,000 |

| $80,001 – $180,000 | $17,547 plus 37c for each $1 over $80,000 |

| $180,001 and over | $54,547 plus 45c for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2%. Exclude the Medicare levy from your calculations

How much personal income tax would you have to pay per year if you earned $80,204.80 per annum before-tax?